Photo from Unsplash

Photo from Unsplash

Originally Posted On: https://delphiadvisers.com/politics-vs-portfolios-decoding-the-2024-election-impact/

Politics vs. Portfolios: Decoding the 2024 Election Impact

Well, it’s election season, our favorite quadrennial event here at Delphi Advisers. Just in case the written word did not convey the sentiment properly, that was sarcasm. None the less, it is time to analyze the 2024 election impact on markets.

The 2024 presidential election is upon us along with a slew of misinformation and misunderstanding about how presidential elections affect markets and investment portfolios. As I was preparing to write this article, I revisited the piece I wrote four years ago on this exact same topic called “Elections and Markets: Half the Country Will Be Disappointed……..Count on It!”, and, ironically, it doesn’t seem like much has really changed. In fact, I don’t think I even need to rewrite the introduction, so I will just use the one from four years ago:

“We are living in one of the most divisive times I can ever remember when it comes to politics. It seems that, no matter what happens, people are going to be angry and frustrated and there is really nothing that can be done about it. These are just the times we live in. Fear and fervor are magnified by social media and the financial entertainment industry (the so-called news industry). Headlines, ratings, and fake news dominate our daily lives, and it is very difficult to separate fact from fiction with any degree of accuracy.”

The truth is, ideology and principles are a big part of the human condition. These things shape our identity, so it is no wonder that politics is such an emotional topic for so many of us, and there is nothing wrong with that. However, when it comes to investing, this emotional attachment to an ideology or political party can cloud our judgment and ultimately be harmful to our financial future.

In order to navigate the tumultuous waters of this presidential election we need to detach ourselves from our political identity and perform an objective analysis of not only the candidates, but also of history. Many folks may read that last sentence and think that history is not applicable because “it is different this time”, and there is some truth to that sentiment. The candidates are different, their proposals are different, and their rhetoric is different. However, the structure of our government is basically the same as it has been for the last 100 years, and human behavior is the same as it has been since the Stone Age. It is these consistencies that drive markets, not the slight differences.

Before we take a deep dive into history, it is important to note something that everyone is going to hate me for, which likely means it is true. The Constitution of United States of America was written by our founding fathers to ensure that no single person or set of people can structurally affect our country in a material way. It is specifically designed to protect us, the citizens, from the government. Put more simply, our government is designed to accomplish nothing unless everyone agrees it should be done. This means that no matter how someone may feel about Kamala Harris or Donald Trump, neither of them are capable of being a true threat to our country, our democracy, or us as citizens. Our country has survived bad presidents, and it will do so again.

Are Republicans or Democrats better for investors?

In order to get a handle on what to expect from either a Harris or Trump presidency, we need to understand what has happened in the past and how party affiliation and ideology has affected markets. There is a general “feeling” among investors that Republicans are better for markets and the economy than Democrats. This stems from the idea that Republicans are more free market oriented and generally push for lower taxes and a more business-friendly environment. The words that Republicans use on the campaign trail do tend to align with this sentiment; however, in practice, they have not governed much differently than Democrats. Given the policy shifts we have seen from both Harris and Trump in recent weeks, I don’t expect to see any sort of change to the norm this time around. Harkening back to the previous section, it is not different this time.

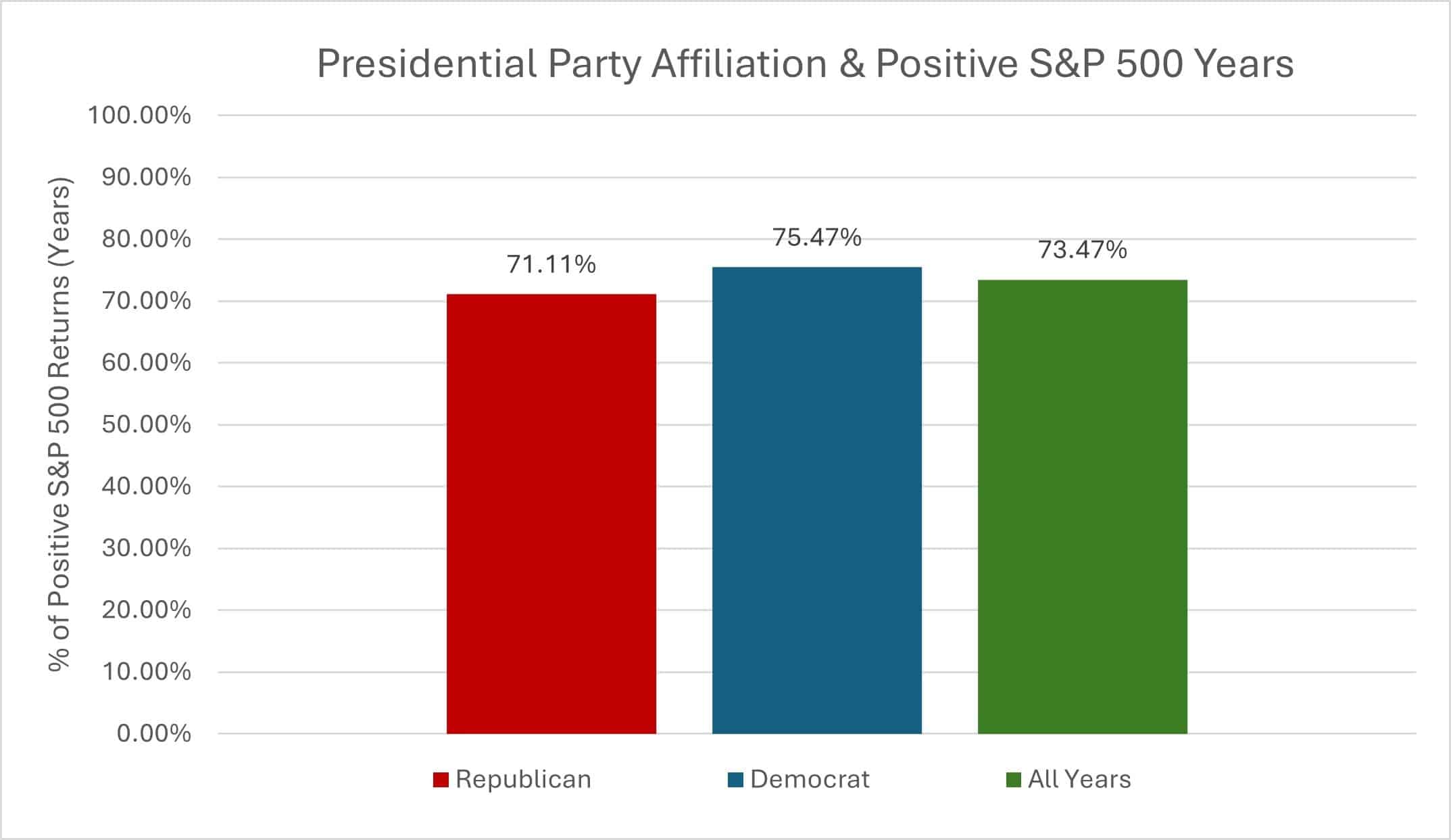

We have really good data for S&P 500 returns going back to 1926, which gives us about 98 years of data to analyze. In that 98 year period, Republicans have controlled the executive office for 45 years, and Democrats for 53 years.1 The S&P 500 tallied positive returns in 72 of the 98 years, 32 of the 45 Republican years, and 40 of the 53 Democratic years.2 Which means, since 1926 the S&P 500 has had a positive return in 73.47% of all years (71.11% during Republican presidency years and 75.47% during Democratic presidency years), see Figure 1 below.

Figure 1: Positive S&P 500 Returns and Presidential Party Affiliation

From a statistical analysis standpoint, the difference between market returns under a Republican versus a Democrat is within the statistical margin of error and can be considered “equal”. Especially considering the relatively low number of datapoints.

Good news! No matter who gets elected, there is a 70%+ chance markets will be positive in about three of the next four years.

Defining Political Market Risk

Even though the S&P 500 has produced positive returns for both Democrats and Republicans at a fairly equal rate, this does not mean that there is no political risk when it comes to the markets. In fact, there are some pretty big risk factors that need to be considered, but the risks are not about political party affiliation, they are about government structure and control.

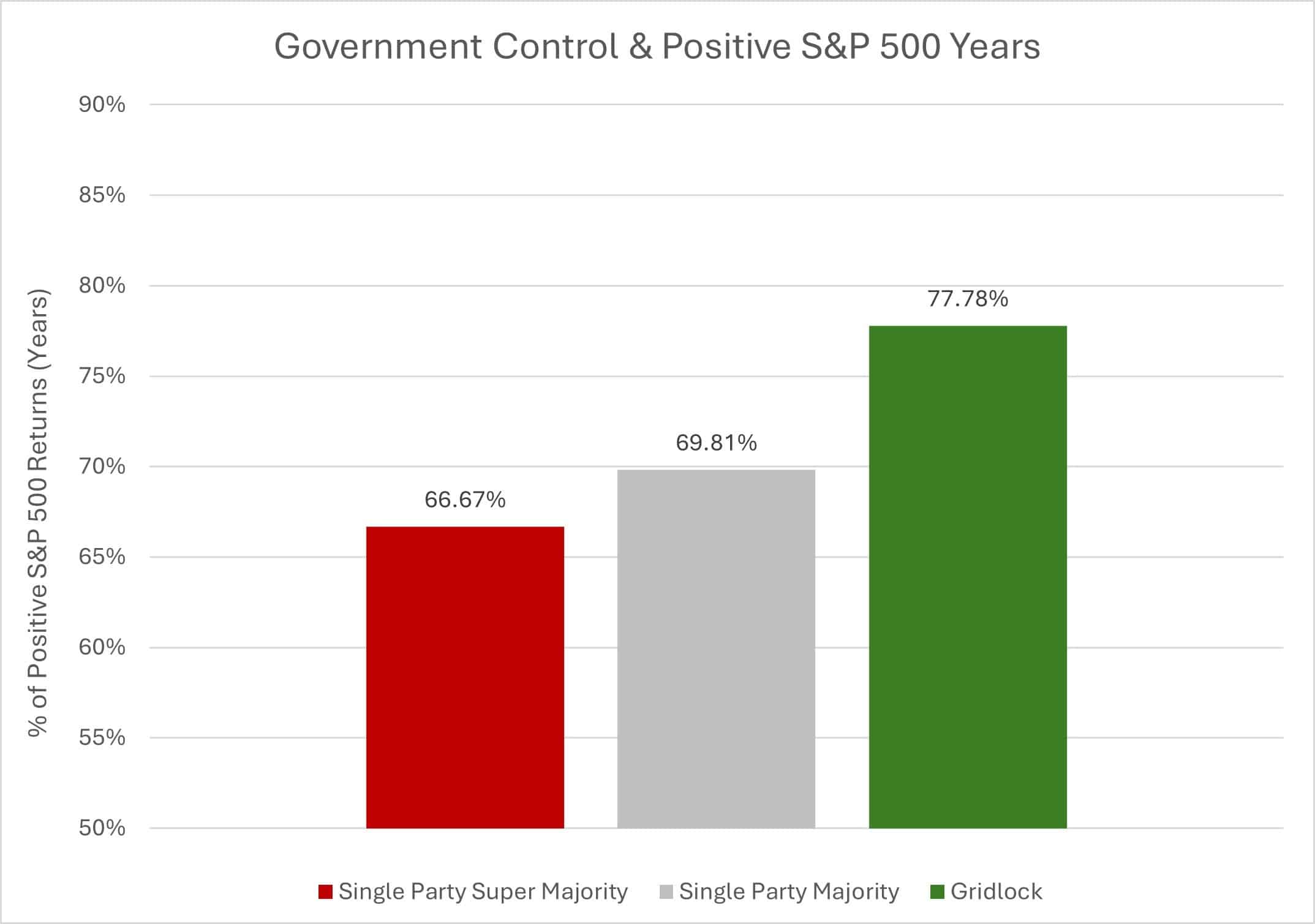

Stock markets, businesses, and economies thrive when the rules of the game are clear and uncertainty is low. Whether or not the rules are favorable or fair is much less important than if the rules are known, clear, and navigable. In the United States of America, we have a system that is designed to be gridlocked and unable to pass meaningful legislation without near unanimous support. This characteristic of the US government ensures that businesses rarely have to worry about drastic changes to the rules and regulations that they operate under.

What markets, businesses, and economies hate is uncertainty. From a political perspective, uncertainty is created from single party control. If the presidency, Senate, and House of Representatives are all controlled by a single party, it increases the risk of massive legislation being passed that changes the rules of the game and may affect things like property rights or the re-distribution of wealth. There is, however, a procedural rule embedded in how our government operates that keeps political risk to a minimum. This rule is called “Cloture”, or more commonly referred to as the filibuster. Without going into tedious detail, the filibuster is a way to block legislation from being voted on and the only way to overrule the filibuster is with 60 votes in the Senate.3 Explained a bit more simply, unless a single party has 60 or more of the 100 seats in the Senate, or they are able to rally bipartisan support, they cannot get any massive legislation passed into law. Additionally, a constitutional amendment requires a two-thirds majority in both the House and Senate to be passed. This is otherwise known as a supermajority.4

Given the bureaucratic nature of our government, the real risk to markets is not any one party itself, but rather a supermajority of a single party that can amend the Constitution or obtain control of all three bodies while securing 60 Senate seats to bypass a filibuster. A true supermajority has been very rare in modern history, only occurring during six of the last 98 years. As depicted in Figure 2 below, you can see that the more gridlocked our government is, the more likely the S&P 500 is to produce positive returns.

Figure 2: Positive S&P 500 Returns during Gridlock and Supermajorities

Not to take issue with the late Franklin Delano Roosevelt, but from an investor perspective, the only thing to fear is not fear itself, but rather single party control of government. Ironically, four of those six supermajority years took place under FDR.

Evaluating the Candidates

There are a number of reasons as to why the process of evaluating these candidates’ individual policy proposals to determine the potential market and economic effects is incredibly difficult. First, what they are saying now is not likely what they believe personally, but rather what they believe will get them elected. Historically, a very small percentage of what a presidential candidate “pitches” to the public ever even gets proposed and voted on. Surprise, surprise, politicians are self-interested. They do and say whatever they think will lead to their personal success, which means getting elected. This political characteristic is party agnostic.

Second, what tiny bits of proposed legislation ever make it to the President’s desk to be signed are likely to be very watered down due to the legislative process. As a result, the ideas will become shadows of what they once were. This makes it nearly impossible to asses potential market and economic impacts.

Lastly, as unlikely as a supermajority traditionally is, this cycle, it is even more unlikely. The current composition of the Senate is 47 Democrats, 49 Republicans, and 4 Independents. Those Independents can be considered, for all intents and purposes, Democrats, which means the Democrats currently hold a 51 to 49 majority. There are 34 Senate seats up for re-election in this cycle, 19 of which are held by Democrats, 11 by Republicans, and 4 by Independents. For Democrats, obtaining that 67 seat supermajority is an impossibility in this election. Even if they win every seat that is up for grabs, that will only put them at a total of 62 seats. For Republicans, it is possible, but incredibly improbable. They would need to retain all 11 of their seats and acquire 17 of the remaining 23 seats up for grabs.5 The House of Representatives, on the other hand, is always a variable because all 435 seats are up for re-election every two years. Given the massive divide in our country at the moment, it seems unlikely that either party will be able to reach the 290-seat mark necessary to achieve a two-thirds majority. The last time either party had this many seats was in 1978.6

There is a path for either party to get to 60 seats in the Senate and control of the House, which would give that party increased legislative power, but they would still be unable to pass constitutional amendments. Structurally, the Republicans have an easier path to get to 60 Senate seats, as they would only need to pick up 11 of the 23 seats they don’t already hold. Democrats would need to pick up 10 of the 11 seats they don’t already hold, which is a much more difficult task. However, getting to 60 seats in the Senate does not guarantee anything. There is a tremendous amount of intraparty disagreement in both parties and neither party can assume that all of their colleagues will vote down the party line.

The high likelihood of a gridlocked government means that the risk of massive, damaging legislation being passed under either Harris or Trump is almost zero. From a market perspective, the winning candidate will matter very little for at least the next two years.

Policy Platform Risks

If we take the policy proposals at face value and do not discount the fact that neither of these candidates will be able to pass much meaningful legislation, we can accomplish some evaluation of the policy platform. From our perspective, both platforms have very little upside, so we are really looking for who will do the least damage.

On the Trump side of the equation, the biggest risk is what he will do with tariffs. The President does have some power granted to him/her by Congress to enact tariffs, but there are limitations. If Trump is able to get massive blanket tariffs in place, it could have short-term detrimental effects on the economy until businesses adjust accordingly. Traditionally, tariffs cause short-term disruptions until the country they are imposed on figures out a way around them. For example, the tariffs levied against China by the Trump administration ,and kept in place by the Biden administration, forced China to rethink its export logistics. Ultimately, they ended up exporting through intermediaries like Vietnam to avoid the tariffs altogether. The effected products are still a bit more expensive for American consumers, but much less so than they would be without this logistical change. The real risk of enacting tariffs is that doing so could spark a trade war, which currently seems unlikely.

The risks associated with the Harris platform carry more potential weight, but are less likely to be enacted. Primarily, her “anti-price-gouging” policies are of particular concern. Essentially, this equates to price fixing, which does not end well for those familiar with economic history. The free market pricing mechanism is what drives suppliers to produce goods and services. If prices are capped, it will limit supply and cause shortages, which, in turn, will drive up prices when the price caps are removed. However, Harris is not likely to get this sort of legislation through a gridlocked Congress. The other dangerous Harris proposal is the tax on unrealized capital gains. Taxing a theoretical appreciation of value of certain investments will disrupt the efficient flow of capital to investments while choosing winners and losers, thus causing massive price disruptions and market distortions. Overall, this would be very bad for the economy and specifically damaging to low- and middle-income families. Again, however, this is very unlikely to make it through the legislature and Harris has recently distanced herself from this idea. Other policy proposals by the Harris campaign are much more mundane and will have little broad impact. Things like down payment assistance could help a small group of people who initially receive the assistance, but then home prices will simply adjust accordingly and make housing slightly more expensive for everyone. The broad market and economic impact will be minimal even if this unlikely piece of legislation makes it to her desk.

Both parties have fallen in love with the idea of no taxes on tips, but it seems unlikely that there is really any impact on broad markets here. Even if this proposal finds its way into the tax code, it will be incredibly difficult to administer. What is a tip? Will we start seeing other industries adopt a “mandatory” tip structure? Perhaps Delphi Advisers will only charge $1 a year for our services and have a mandatory tip for the remainder of our fee. If we don’t have to pay taxes on that tip, then our services would be cheaper for our clients. Can you imagine the amount of work the IRS will have on its hands? In general, we believe this is more of a gimmick to buy votes than it is a serious policy proposal. If it does become law, it will look very different than it does today.

Overall, from a market perspective, we don’t think it matters who gets elected as long as no single party gains meaningful control of Congress.

Advice for Investors

As we approach November 5th, the political rhetoric will no doubt become more egregious and inflamed. Now is not the time to allow our political attachments to drive our financial decisions. If you have a well thought out investment strategy and financial plan, then stick to it. What was right in 2024 will still be right in 2025,as long as it is right for the investors themselves. Times like this call for a cool head, discipline, and an unwavering will. If you are worried about having the right investment strategy and financial plan, get in touch with us. We can perform an evaluation for you and help ensure that you are on the right path.

1https://en.wikipedia.org/wiki/Party_divisions_of_United_States_Congresses

2https://www.slickcharts.com/sp500/returns

3https://www.senate.gov/about/powers-procedures/filibusters-cloture/overview.htm

4https://www.whitehouse.gov/about-the-white-house/our-government/the-constitution/

5https://www.270towin.com/2024-senate-election/

6https://en.wikipedia.org/wiki/Party_divisions_of_United_States_Congresses

This content is developed from sources believed to be providing accurate information but Delphi Advisers, LLC does not warrant that this information will be free from error. This information should not be considered legal, tax, or financial advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security, investment, tax, or legal advice. Delphi Advisers, LLC is registered as an investment adviser in the state of Washington and is licensed to do business in any state where registered or otherwise exempt from registration