Marqeta has gotten torched over the last six months - since July 2025, its stock price has dropped 20.9% to $4.70 per share. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Marqeta, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is Marqeta Not Exciting?

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why MQ doesn't excite us and a stock we'd rather own.

1. Revenue Tumbling Downwards

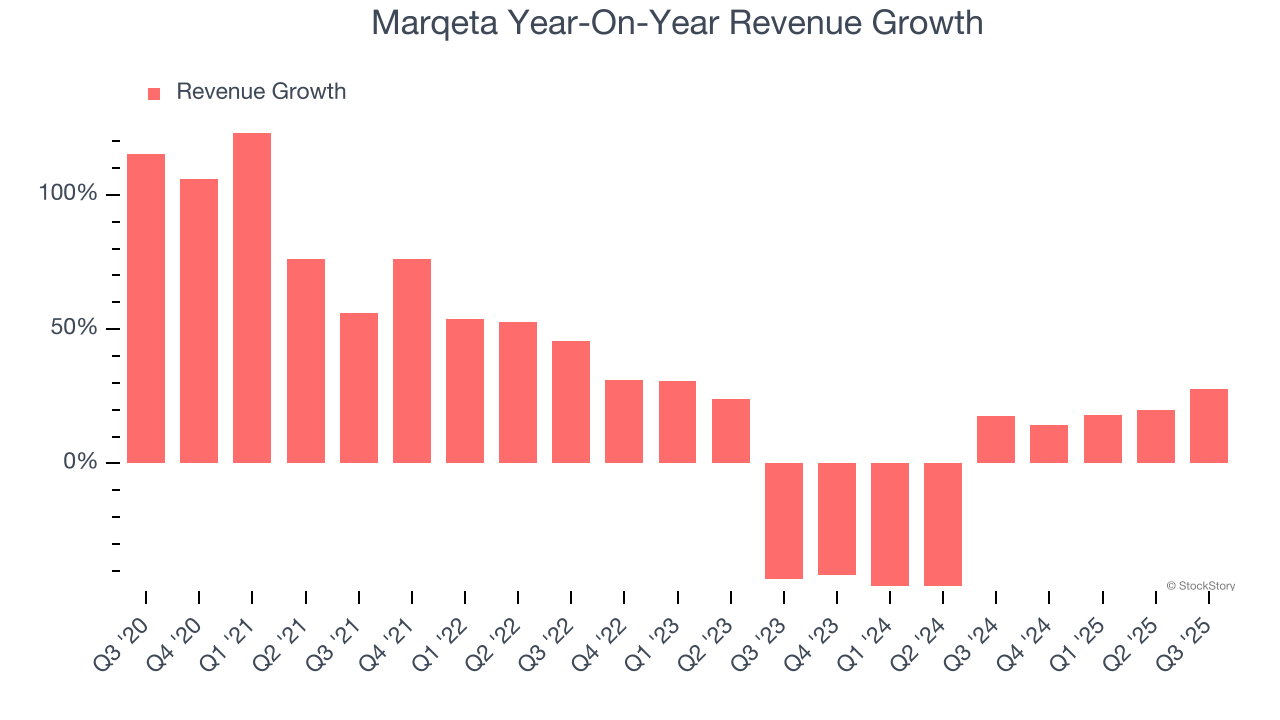

Long-term growth is the most important, but within software, a stretched historical view may miss new innovations or demand cycles. Marqeta’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 12.1% over the last two years.

2. Low Gross Margin Hinders Flexibility

For software companies like Marqeta, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

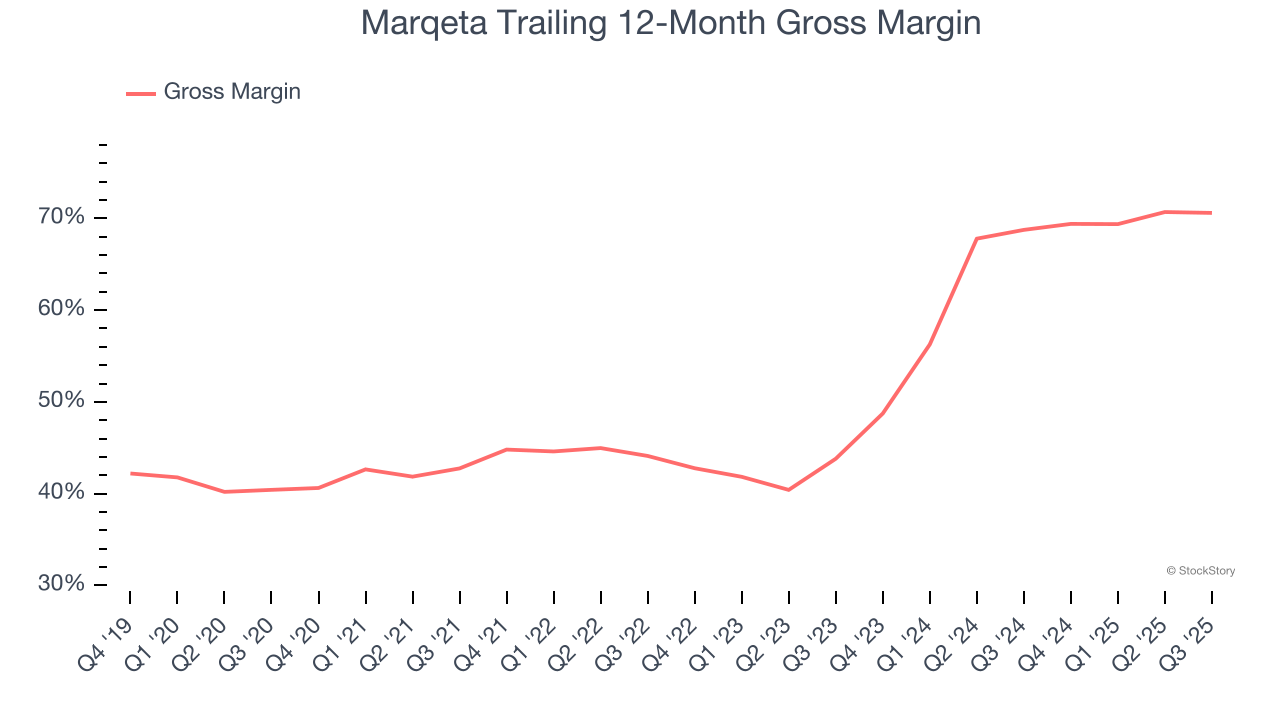

Marqeta’s gross margin is slightly below the average software company, giving it less room than its competitors to invest in areas such as product and sales. As you can see below, it averaged a 70.6% gross margin over the last year. That means Marqeta paid its providers a lot of money ($29.40 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Marqeta has seen gross margins improve by 26.8 percentage points over the last 2 year, which is elite in the software space.

3. Shrinking Operating Margin

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

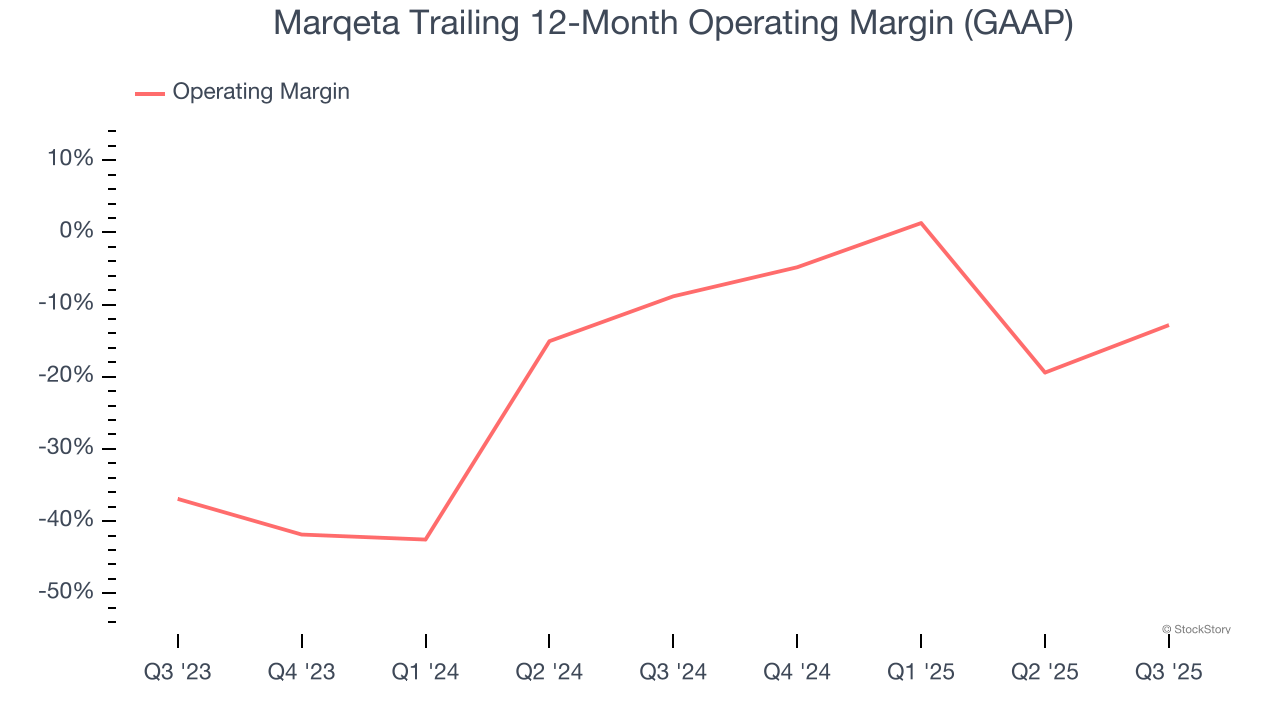

Analyzing the trend in its profitability, Marqeta’s operating margin decreased by 4 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Marqeta’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its operating margin for the trailing 12 months was negative 12.8%.

Final Judgment

Marqeta isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 3× forward price-to-sales (or $4.70 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now. Let us point you toward an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of Marqeta

Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.