The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how professional staffing & hr solutions stocks fared in Q3, starting with ManpowerGroup (NYSE: MAN).

The Professional Staffing & HR Solutions subsector within Business Services is set to benefit from evolving workforce trends, including the rise of remote work and the gig economy. With companies casting a wider net to find talent due to remote work, the expertise of staffing and recruiting companies is even more valuable. For those who invest wisely, the use of predictive AI in recruitment and screening as well as automation in HR workflows can enhance efficiency and scalability. On the other hand, digitization means that talent discovery is less of a manual process, opening the door for tech-first platforms. Additionally, regulatory scrutiny around data privacy in HR is evolving and may require companies in this sector to change their go-to-market strategies over time.

The 8 professional staffing & HR solutions stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.5% while next quarter’s revenue guidance was 1.1% below.

While some professional staffing & hr solutions stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4% since the latest earnings results.

ManpowerGroup (NYSE: MAN)

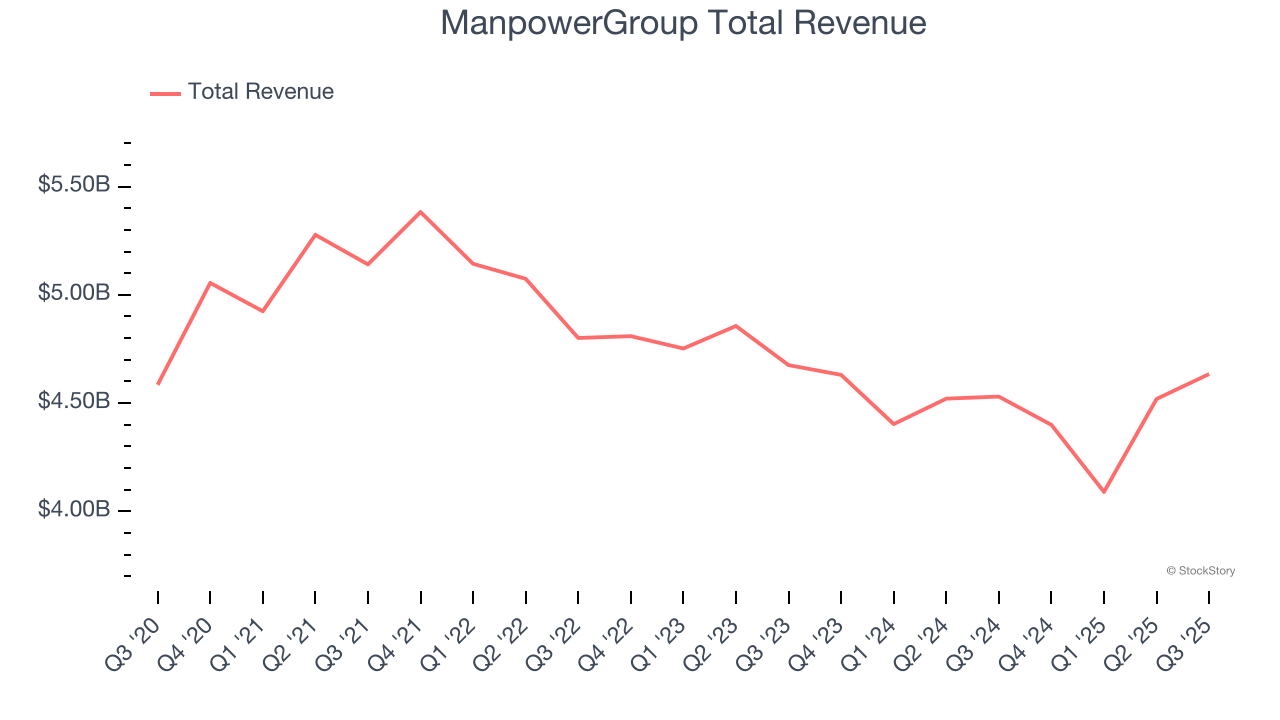

Founded during the post-World War II economic boom when businesses needed temporary workers, ManpowerGroup (NYSE: MAN) connects millions of people to employment opportunities through its global network of staffing, recruitment, and workforce management services.

ManpowerGroup reported revenues of $4.63 billion, up 2.3% year on year. This print exceeded analysts’ expectations by 0.7%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ EPS guidance for next quarter estimates but a significant miss of analysts’ EPS estimates.

Jonas Prising, ManpowerGroup Chair & CEO, said "After 11 consecutive quarters of organic constant currency revenue declines, we crossed back over to growth during the third quarter. The stabilization of demand in recent quarters in North America and Europe, despite ongoing tariff uncertainty, has been a key factor in the revenue trend improvement. Currently our entire organization has a relentless focus on two main outcomes - Winning In The Market to increase our market share and the acceleration of initiatives to remove structural costs from the organization to drive a more efficient ManpowerGroup for the future. We are pleased with our progress in both and confident in our ability to deliver long-term value to all of our stakeholders.

The stock is down 23% since reporting and currently trades at $29.28.

Is now the time to buy ManpowerGroup? Access our full analysis of the earnings results here, it’s free.

Best Q3: Kforce (NYSE: KFRC)

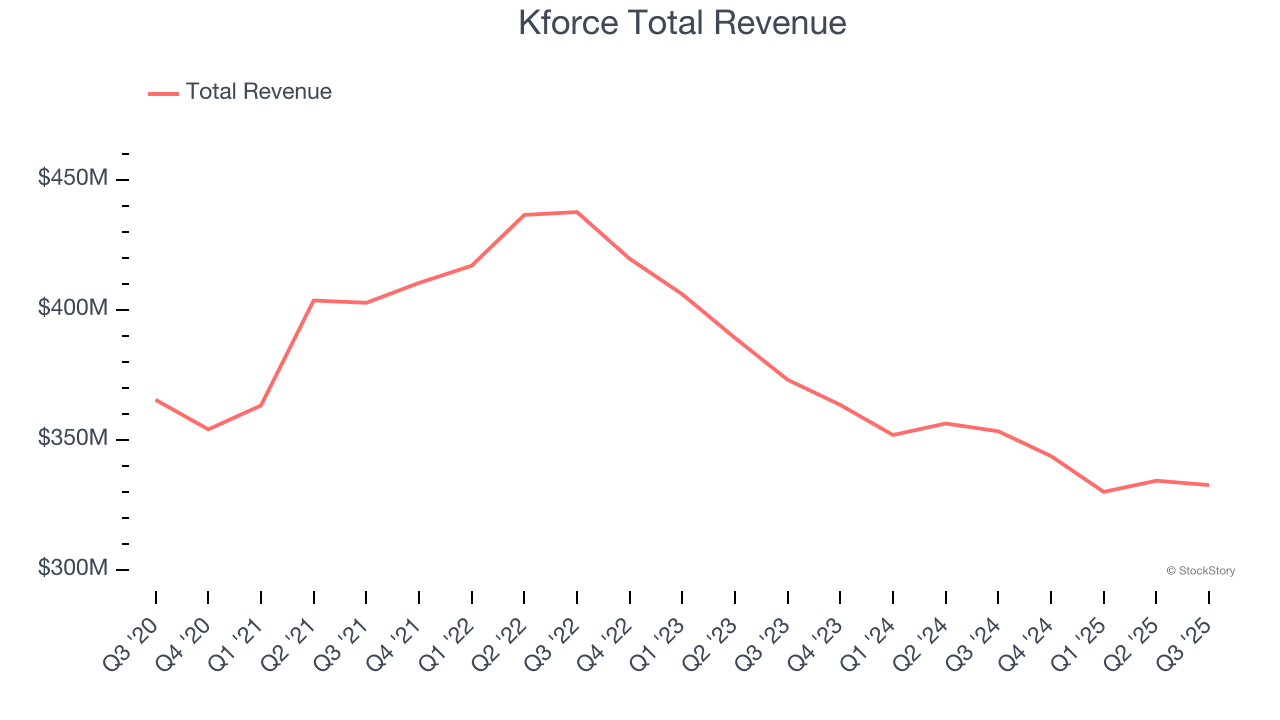

With nearly 60 years of matching skilled professionals with the right opportunities, Kforce (NYSE: KFRC) is a professional staffing company that specializes in placing technology and finance experts with businesses on both temporary and permanent bases.

Kforce reported revenues of $332.6 million, down 5.9% year on year, outperforming analysts’ expectations by 1.5%. The business had an exceptional quarter with revenue guidance for next quarter exceeding analysts’ expectations and a beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 36.5% since reporting. It currently trades at $33.51.

Is now the time to buy Kforce? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Insperity (NYSE: NSP)

Pioneering the professional employer organization (PEO) industry it helped establish, Insperity (NYSE: NSP) provides human resources outsourcing services to small and medium-sized businesses, handling payroll, benefits, compliance, and HR administration.

Insperity reported revenues of $1.62 billion, up 4% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates and a significant miss of analysts’ EPS guidance for next quarter estimates.

The stock is flat since the results and currently trades at $45.36.

Read our full analysis of Insperity’s results here.

Barrett (NASDAQ: BBSI)

Operating as a professional employer organization (PEO) that serves over 8,000 companies with more than 120,000 worksite employees, Barrett Business Services (NASDAQ: BBSI) provides management solutions that help small and mid-sized businesses handle human resources, payroll, workers' compensation, and other administrative functions.

Barrett reported revenues of $318.9 million, up 8.4% year on year. This print met analysts’ expectations. Taking a step back, it was a slower quarter as it recorded a miss of analysts’ EPS estimates and revenue in line with analysts’ estimates.

The stock is down 7.1% since reporting and currently trades at $37.84.

Read our full, actionable report on Barrett here, it’s free.

Korn Ferry (NYSE: KFY)

With clients including 97% of the S&P 100 and operations in 103 offices across 51 countries, Korn Ferry (NYSE: KFY) is a global consulting firm that helps organizations design optimal structures, recruit talent, develop leaders, and create effective compensation strategies.

Korn Ferry reported revenues of $729.8 million, up 7% year on year. This result topped analysts’ expectations by 1.7%. Zooming out, it was a slower quarter as it produced revenue guidance for next quarter slightly missing analysts’ expectations and a slight miss of analysts’ EPS guidance for next quarter estimates.

Korn Ferry achieved the biggest analyst estimates beat among its peers. The stock is up 2.3% since reporting and currently trades at $66.47.

Read our full, actionable report on Korn Ferry here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.