What a time it’s been for SoFi. In the past six months alone, the company’s stock price has increased by a massive 113%, reaching $29.16 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Following the strength, is SOFI a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Is SOFI a Good Business?

Starting as a student loan refinancing company founded by Stanford business school students in 2011, SoFi Technologies (NASDAQ: SOFI) operates a digital financial platform offering lending, banking, investing, and other financial services to help members borrow, save, spend, invest, and protect their money.

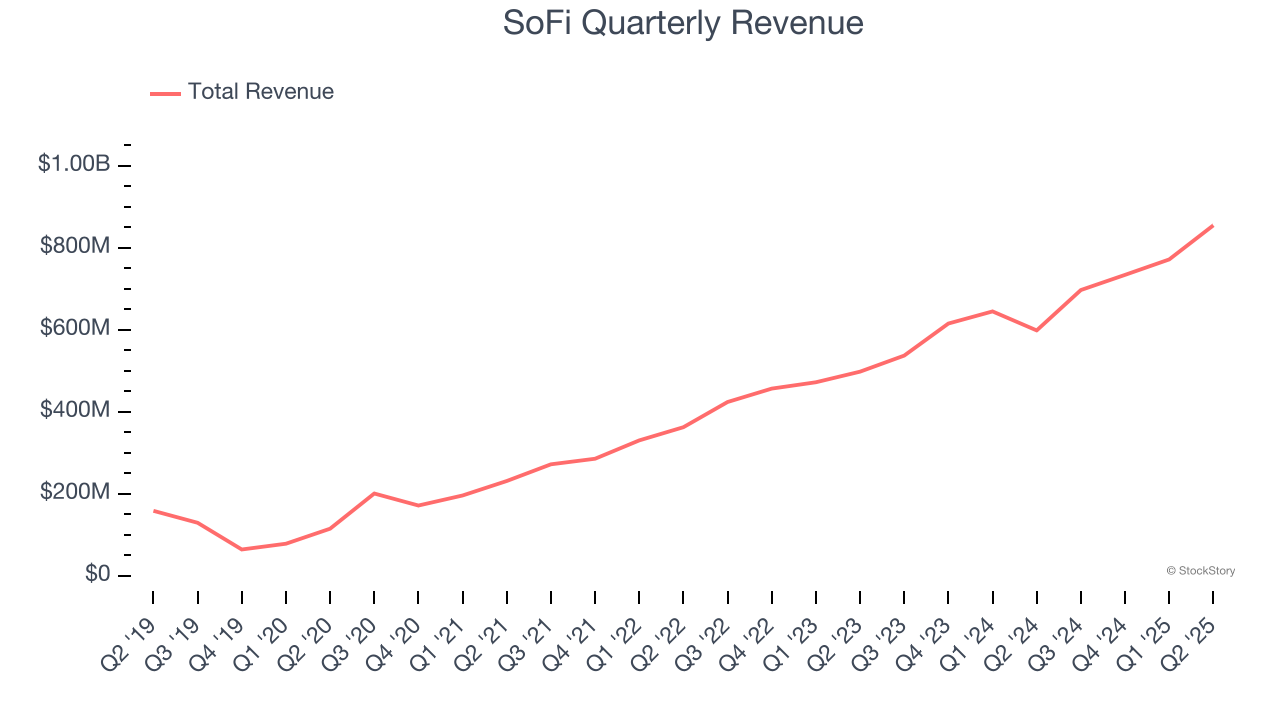

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

Luckily, SoFi’s revenue grew at an incredible 51.2% compounded annual growth rate over the last five years. Its growth surpassed the average financials company and shows its offerings resonate with customers.

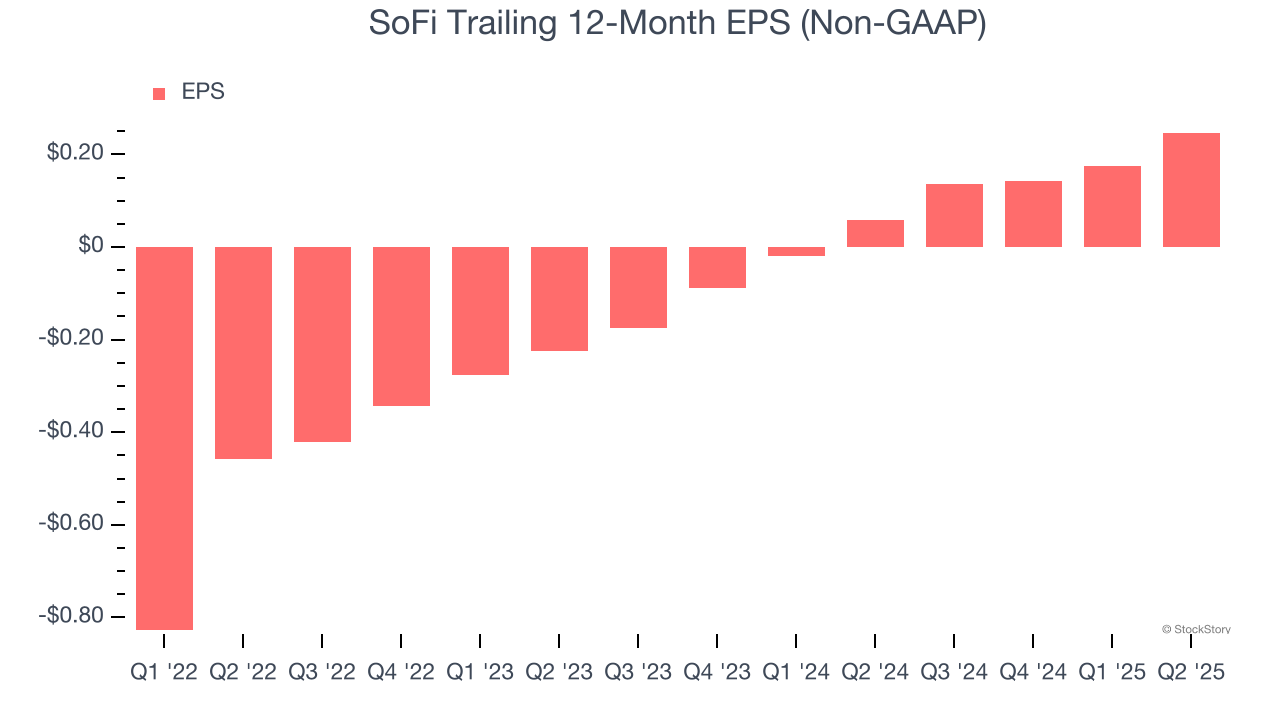

2. Outstanding Long-Term EPS Growth

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

SoFi’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

Final Judgment

These are just a few reasons SoFi is a high-quality business worth owning, and with the recent rally, the stock trades at 78.3× forward P/E (or $29.16 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.