Atlantic Union Bankshares currently trades at $35.68 per share and has shown little upside over the past six months, posting a middling return of 1.3%. The stock also fell short of the S&P 500’s 8.6% gain during that period.

Is there a buying opportunity in Atlantic Union Bankshares, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Atlantic Union Bankshares Not Exciting?

We're sitting this one out for now. Here are three reasons you should be careful with AUB and a stock we'd rather own.

1. Low Net Interest Margin Hinders Flexibility

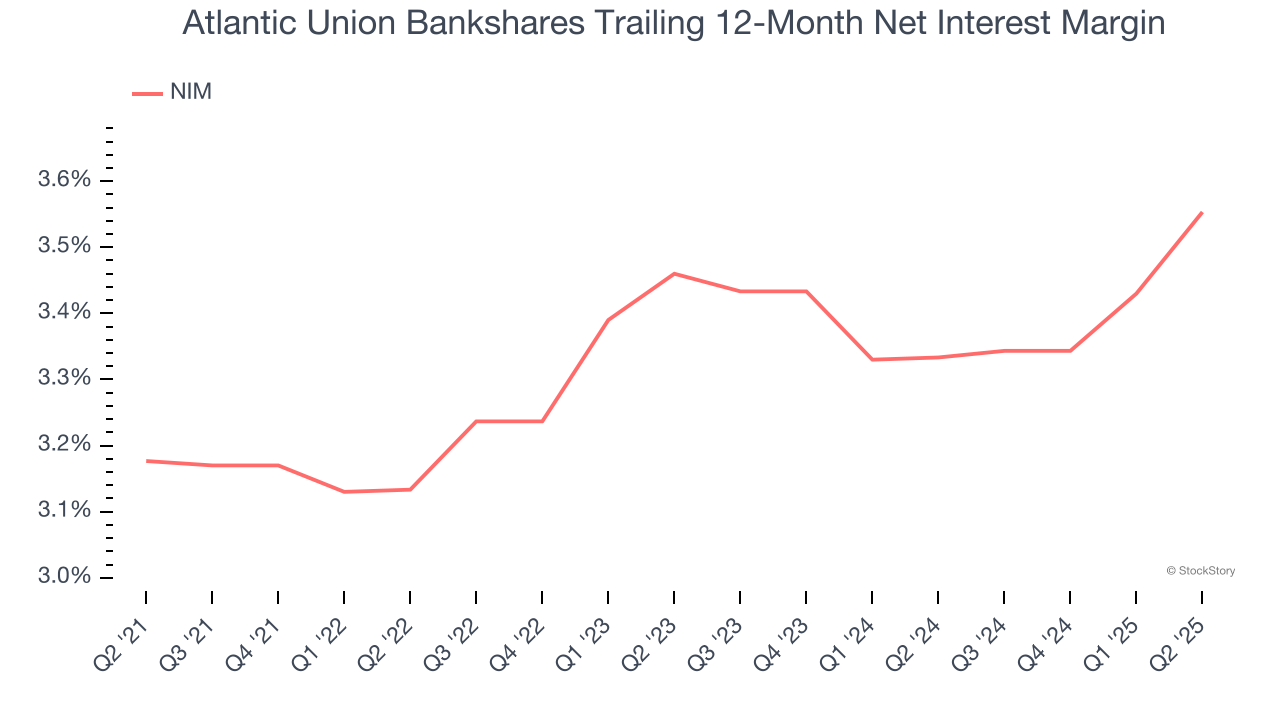

Net interest margin (NIM) represents the unit economics of a bank by measuring the profitability of its interest-bearing assets relative to its interest-bearing liabilities. It's a fundamental metric that investors use to assess lending premiums and returns.

Over the past two years, we can see that Atlantic Union Bankshares’s net interest margin averaged a subpar 3.4%, indicating the company has weak loan book economics.

2. TBVPS Has Plateaued, Reflecting Stagnating Assets

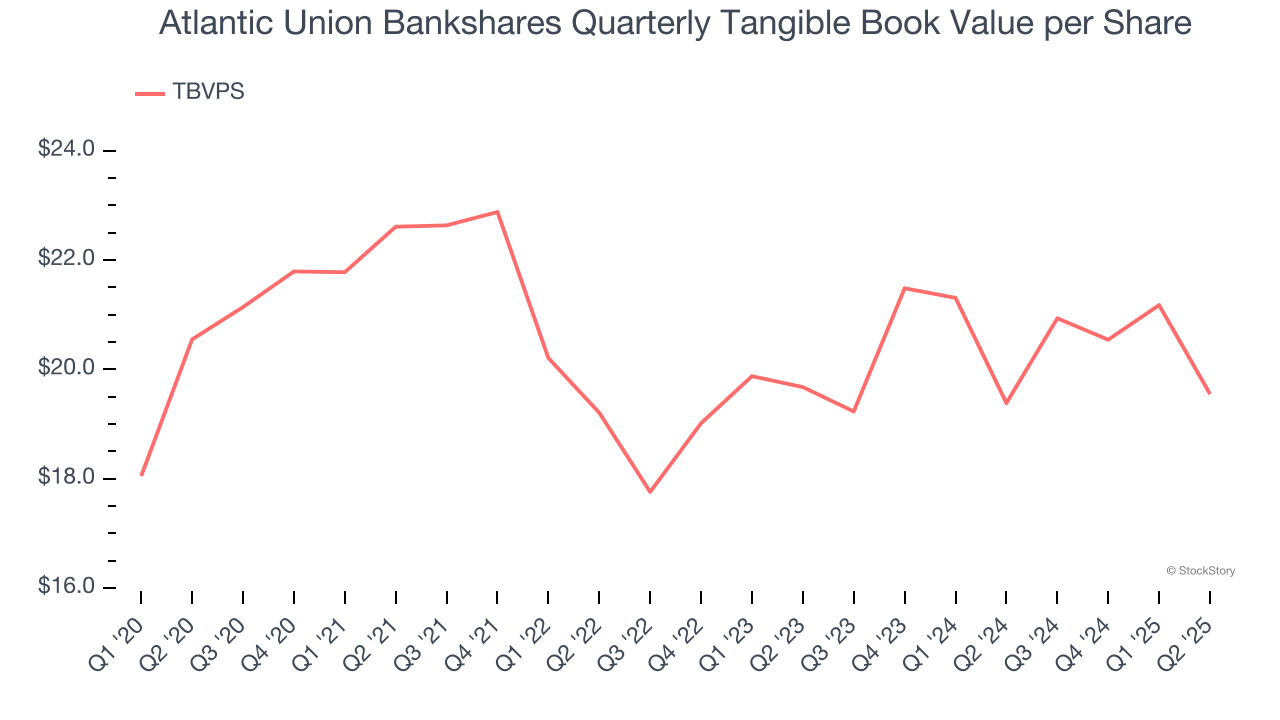

In the banking industry, tangible book value per share (TBVPS) provides the clearest picture of shareholder value, as it focuses on concrete assets while excluding intangible items that may not hold value during challenging times.

To the detriment of investors, Atlantic Union Bankshares’s TBVPS was flat over the last two years.

3. Projected TBVPS Growth Is Slim

Tangible book value per share (TBVPS) growth comes from a bank’s ability to profitably lend while maintaining prudent risk management and efficient operations.

Over the next 12 months, Consensus estimates call for Atlantic Union Bankshares’s TBVPS to grow by 6.5% to $20.82, mediocre growth rate.

Final Judgment

Atlantic Union Bankshares isn’t a terrible business, but it doesn’t pass our quality test. With its shares lagging the market recently, the stock trades at 1× forward P/B (or $35.68 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d recommend looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Atlantic Union Bankshares

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.