Over the past six months, Progressive’s stock price fell to $249.03. Shareholders have lost 10.6% of their capital, which is disappointing considering the S&P 500 has climbed by 8.6%. This may have investors wondering how to approach the situation.

Given the weaker price action, is now a good time to buy PGR? Find out in our full research report, it’s free.

Why Is PGR a Good Business?

Starting as a small auto insurance company in 1937 with a pioneering focus on high-risk drivers, Progressive (NYSE: PGR) is a major auto, property, and commercial insurance provider that offers policies through independent agents, online platforms, and over the phone.

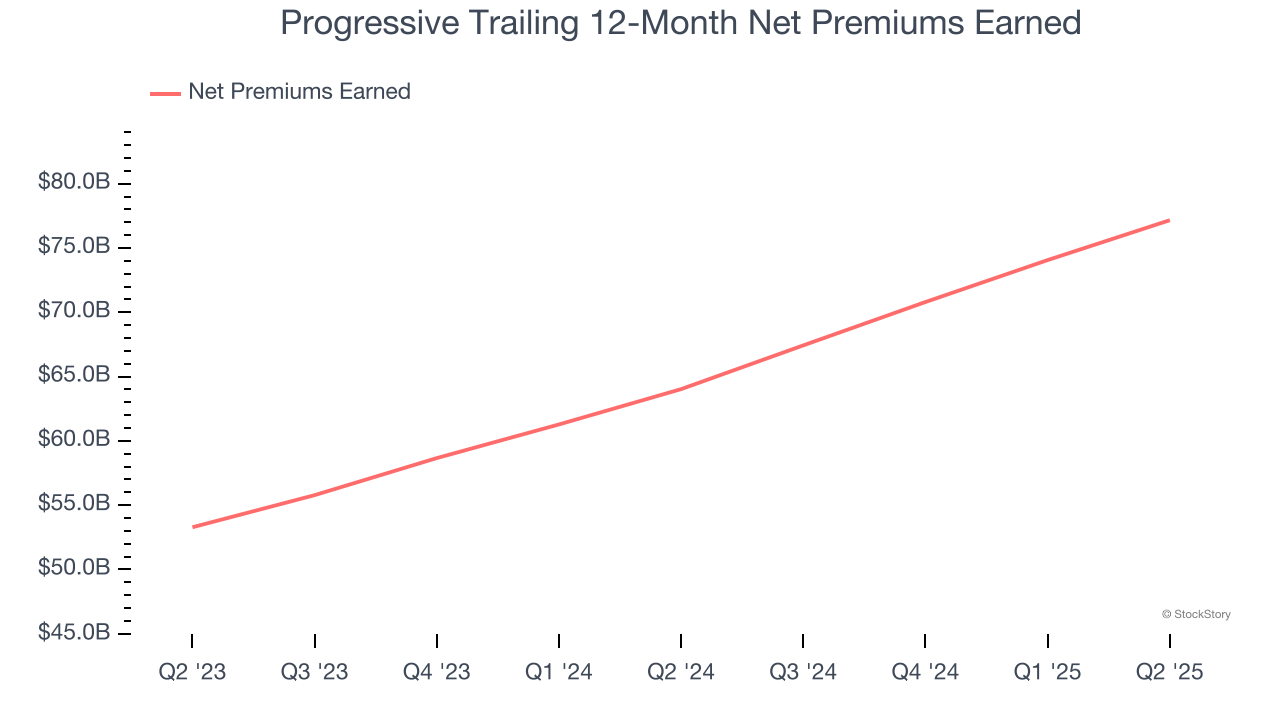

1. Net Premiums Earned Skyrocket, Fueling Growth Opportunities

Net premiums earned are net of what’s paid to reinsurers (insurance for insurance companies), which are used by insurers to protect themselves from large losses.

Progressive’s net premiums earned has grown at a 20.3% annualized rate over the last two years, much better than the broader insurance industry.

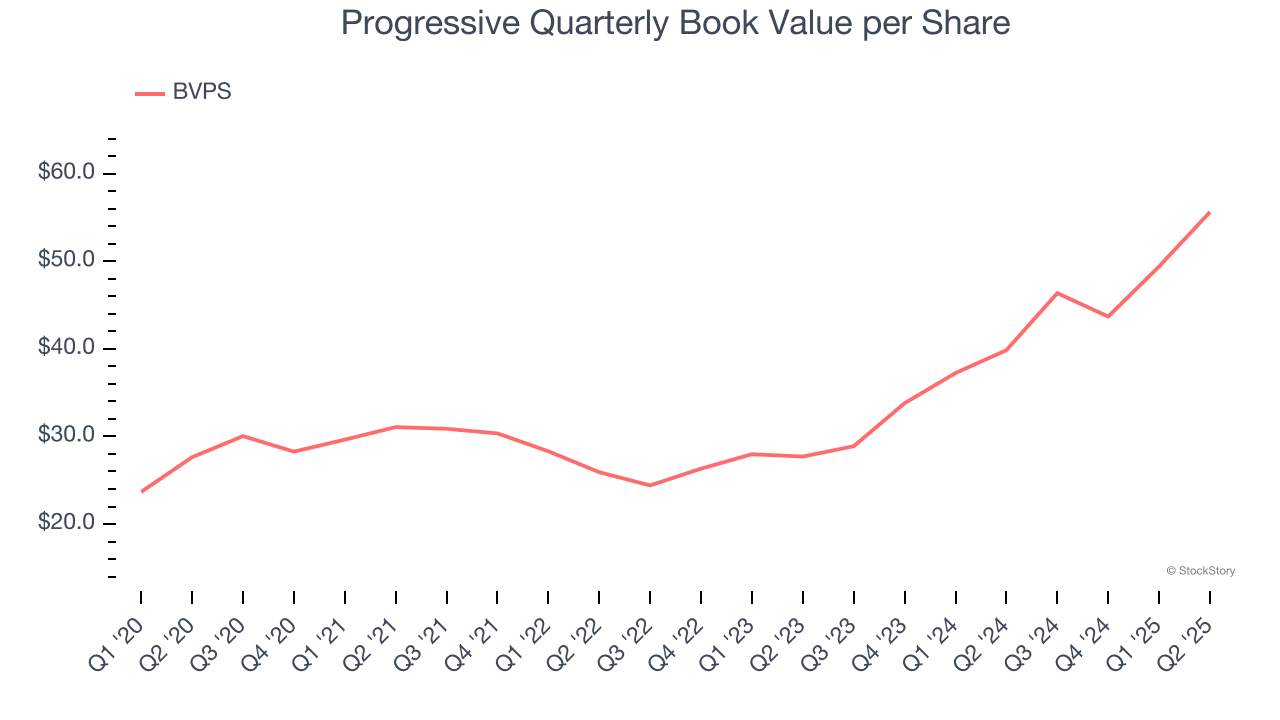

2. Growing BVPS Reflects Strong Asset Base

For insurers, book value per share (BVPS) is a vital measure of financial health, representing the total assets available to shareholders after accounting for all liabilities, including policyholder reserves and claims obligations.

Progressive’s BVPS increased by 15% annually over the last five years, and growth has recently accelerated as BVPS grew at an incredible 41.7% annual clip over the past two years (from $27.71 to $55.62 per share).

3. Projected BVPS Growth Is Remarkable

Book value per share (BVPS) growth comes from an insurer’s ability to price risk appropriately and invest premiums profitably.

Over the next 12 months, Consensus estimates call for Progressive’s BVPS to grow by 24.9% to $54.33, elite growth rate.

Final Judgment

These are just a few reasons why Progressive is one of the best insurance companies out there. After the recent drawdown, the stock trades at 4.2× forward P/B (or $249.03 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.