Commerce Bancshares currently trades at $61.81 per share and has shown little upside over the past six months, posting a small loss of 3.6%. The stock also fell short of the S&P 500’s 6.4% gain during that period.

Given the weaker price action, is now a good time to buy CBSH? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Does Commerce Bancshares Spark Debate?

Founded in 1865 during the post-Civil War economic boom, Commerce Bancshares (NASDAQGS:CBSH) is a Midwest-focused bank holding company that provides retail, commercial, and wealth management services to individuals and businesses.

Two Positive Attributes:

1. Increasing Net Interest Margin Juices Financials

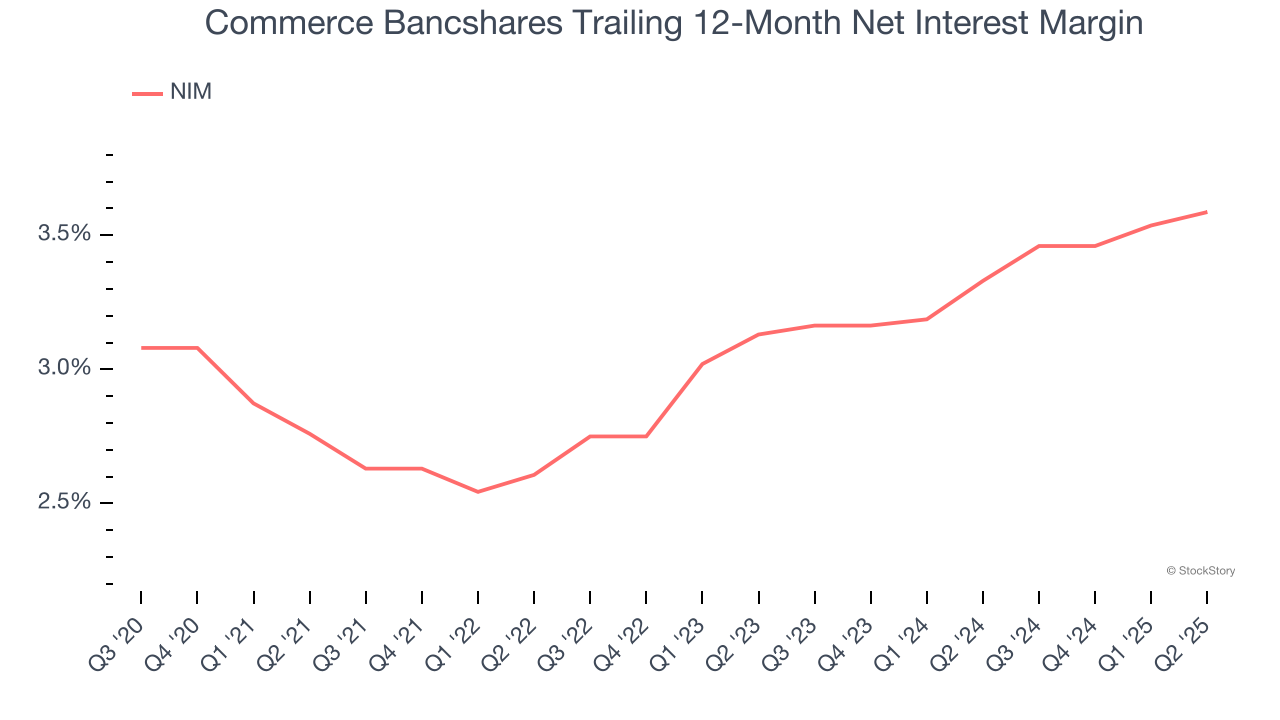

Net interest margin (NIM) serves as a critical gauge of a bank's fundamental profitability by showing the spread between interest income and interest expenses. It's essential for understanding whether a firm can sustainably generate returns from its lending operations.

Over the past two years, Commerce Bancshares’s net interest margin averaged 3.5%. On the bright side, it climbed by 45.7 basis points (100 basis points = 1 percentage point) over that period.

This expansion was a tailwind for its net interest income, and while prevailing interest rates matter the most for industry net interest margins, banks that consistently increase this figure generally boast higher-earning loan books (all else equal such as the risk of those loans) or provide differentiated services that give them the ability to charge higher rates (pricing power).

2. Outstanding Long-Term EPS Growth

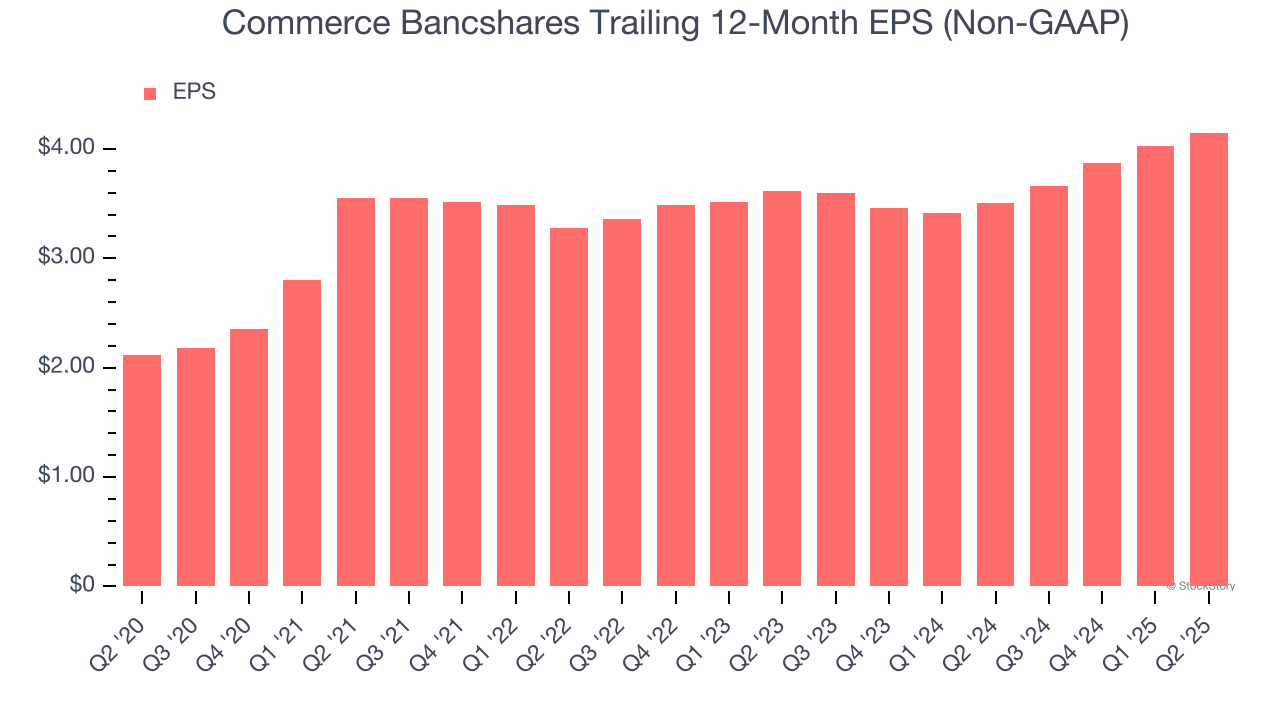

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Commerce Bancshares’s EPS grew at an astounding 14.4% compounded annual growth rate over the last five years, higher than its 5.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Net Interest Income Points to Soft Demand

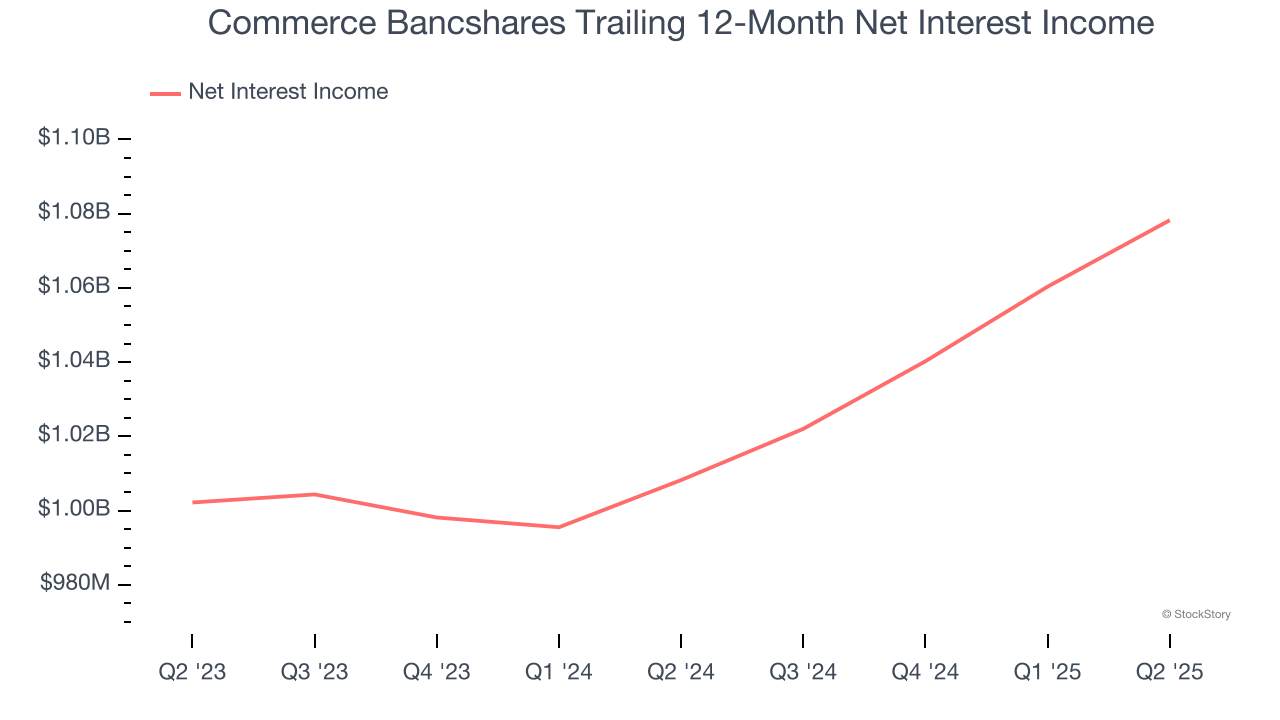

While bank generate revenue from multiple sources, investors view net interest income as a cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of one-time fees.

Commerce Bancshares’s net interest income has grown at a 6.3% annualized rate over the last five years, slightly worse than the broader banking industry and in line with its total revenue.

Final Judgment

Commerce Bancshares has huge potential even though it has some open questions. With its shares trailing the market in recent months, the stock trades at 2.2× forward P/B (or $61.81 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Commerce Bancshares

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.