Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Pediatrix Medical Group (NYSE: MD) and its peers.

The healthcare providers and services sector, from insurers to hospitals, benefits from consistent demand, generating stable revenue through premiums and patient services. However, it faces challenges from high operational and labor costs, reimbursement pressures that squeeze margins, and regulatory uncertainty. Looking ahead, an aging population with more chronic diseases and a shift toward value-based care create tailwinds. Digitization via telehealth, data analytics, and personalized medicine offers new revenue streams. Nonetheless, headwinds persist, including clinical labor shortages, ongoing reimbursement cuts, and regulatory scrutiny over pricing and quality.

The 40 healthcare providers & services stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 4.5% on average since the latest earnings results.

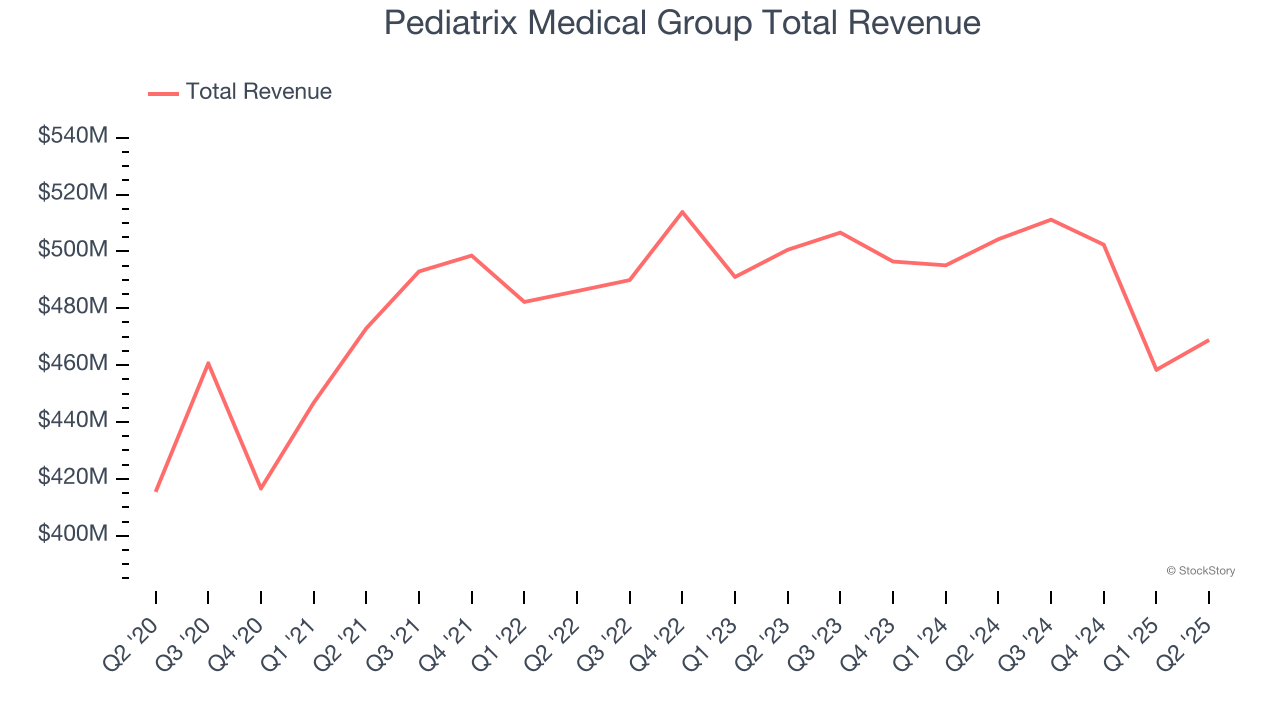

Pediatrix Medical Group (NYSE: MD)

With a network of approximately 2,620 affiliated physicians caring for some of the most vulnerable patients, Pediatrix Medical Group (NYSE: MD) provides specialized physician services focused on neonatal, maternal-fetal, pediatric cardiology and other pediatric subspecialty care across 37 states.

Pediatrix Medical Group reported revenues of $468.8 million, down 7% year on year. This print exceeded analysts’ expectations by 1%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ same-store sales estimates and a beat of analysts’ EPS estimates.

Interestingly, the stock is up 26% since reporting and currently trades at $15.50.

Is now the time to buy Pediatrix Medical Group? Access our full analysis of the earnings results here, it’s free.

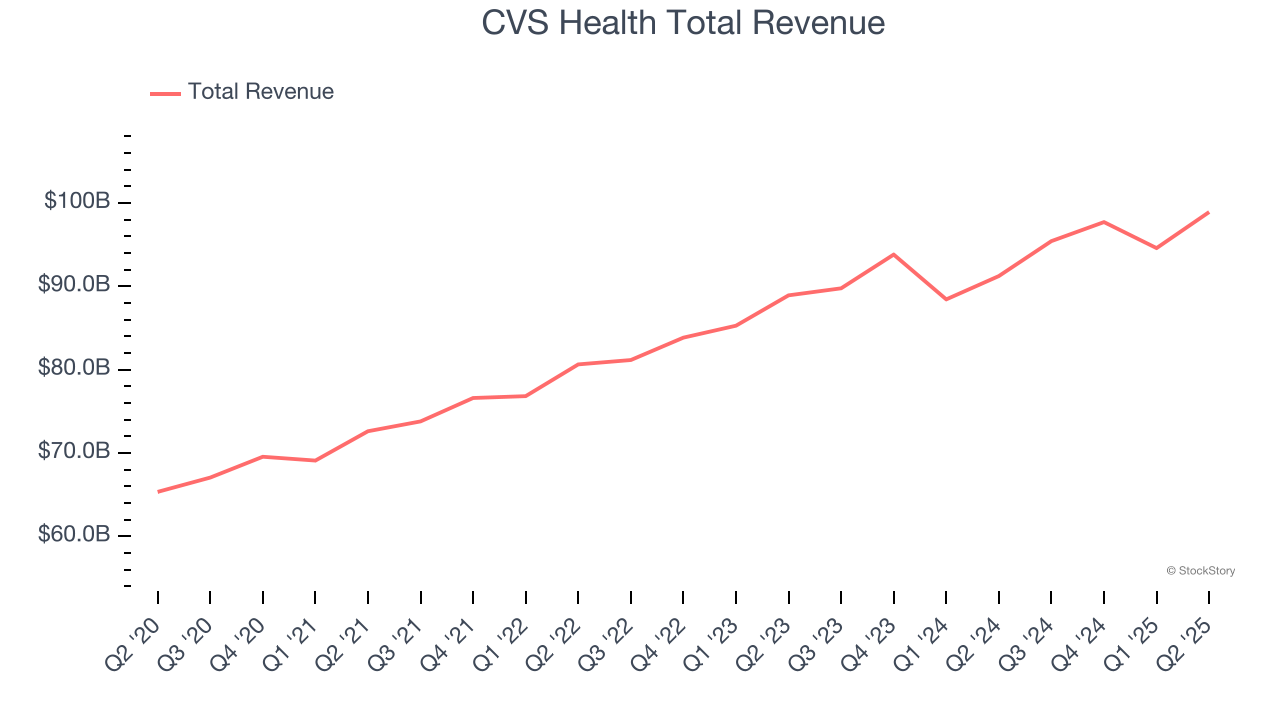

Best Q2: CVS Health (NYSE: CVS)

With over 9,000 retail pharmacy locations serving as neighborhood health destinations across America, CVS Health (NYSE: CVS) operates retail pharmacies, provides pharmacy benefit management services, and offers health insurance through its Aetna subsidiary.

CVS Health reported revenues of $98.92 billion, up 8.4% year on year, outperforming analysts’ expectations by 5.1%. The business had a stunning quarter with a solid beat of analysts’ same-store sales estimates and a beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 5.7% since reporting. It currently trades at $65.90.

Is now the time to buy CVS Health? Access our full analysis of the earnings results here, it’s free.

Oscar Health (NYSE: OSCR)

Founded in 2012 to simplify the notoriously complex American healthcare system, Oscar Health (NYSE: OSCR) is a technology-focused health insurance company that offers individual and small group health plans through its cloud-native platform.

Oscar Health reported revenues of $2.86 billion, up 29% year on year, falling short of analysts’ expectations by 3.5%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 8.4% since the results and currently trades at $14.98.

Read our full analysis of Oscar Health’s results here.

LifeStance Health Group (NASDAQ: LFST)

With over 6,600 licensed mental health professionals treating more than 880,000 patients annually, LifeStance Health (NASDAQ: LFST) provides outpatient mental health services through a network of clinicians offering psychiatric evaluations, psychological testing, and therapy across 33 states.

LifeStance Health Group reported revenues of $345.3 million, up 10.6% year on year. This print met analysts’ expectations. Taking a step back, it was a mixed quarter as it also recorded full-year EBITDA guidance topping analysts’ expectations but EPS in line with analysts’ estimates.

The stock is up 32.1% since reporting and currently trades at $5.16.

Read our full, actionable report on LifeStance Health Group here, it’s free.

HCA Healthcare (NYSE: HCA)

With roots dating back to 1968 and a network spanning 20 states, HCA Healthcare (NYSE: HCA) operates a network of 190 hospitals and 150+ outpatient facilities providing a full range of medical services across the US and England.

HCA Healthcare reported revenues of $18.61 billion, up 6.4% year on year. This number beat analysts’ expectations by 0.7%. Aside from that, it was a satisfactory quarter as it also logged a solid beat of analysts’ full-year EPS guidance estimates but a slight miss of analysts’ same-store sales estimates.

The stock is up 14.4% since reporting and currently trades at $390.46.

Read our full, actionable report on HCA Healthcare here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.