As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at vehicle retailer stocks, starting with Lithia (NYSE: LAD).

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

The 4 vehicle retailer stocks we track reported a very strong Q1. As a group, revenues beat analysts’ consensus estimates by 1.1%.

Thankfully, share prices of the companies have been resilient as they are up 9.5% on average since the latest earnings results.

Weakest Q1: Lithia (NYSE: LAD)

With a strong presence in the Western US, Lithia Motors (NYSE: LAD) sells a wide range of vehicles, including new and used cars, trucks, SUVs, and luxury vehicles from various manufacturers.

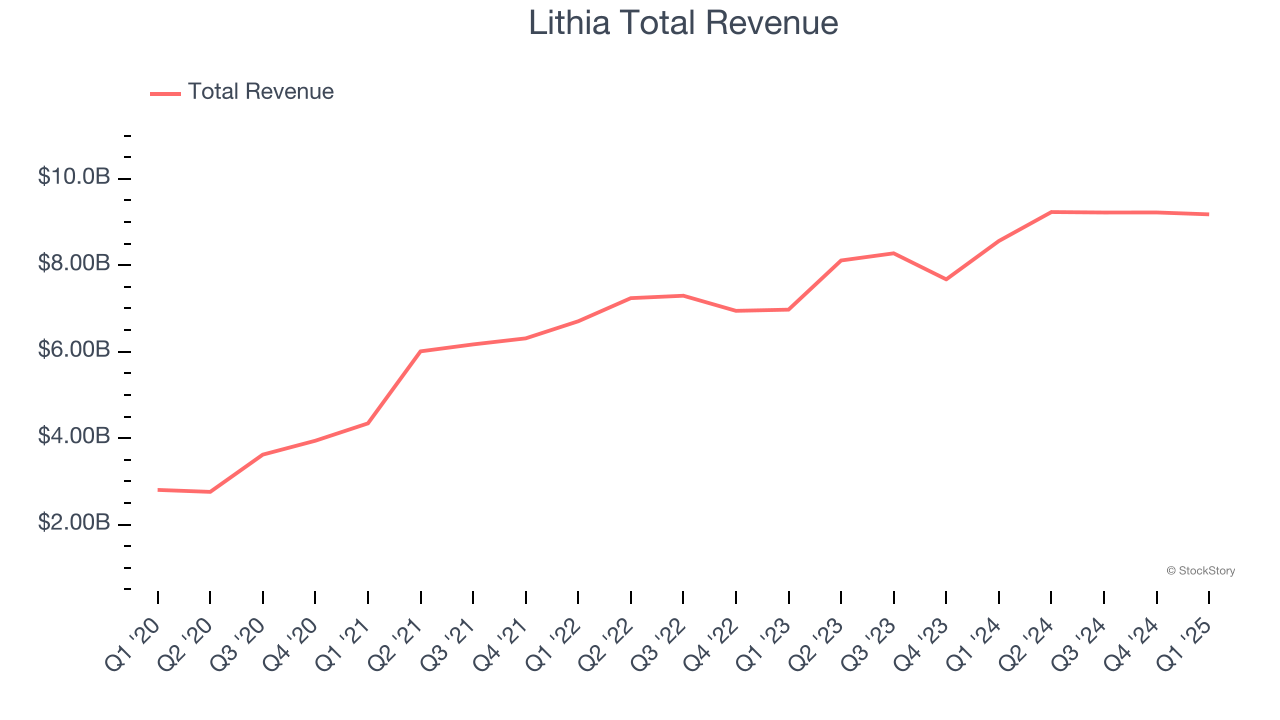

Lithia reported revenues of $9.18 billion, up 7.2% year on year. This print fell short of analysts’ expectations by 2.1%. It was a mixed quarter with an impressive beat of analysts’ EBITDA estimates but a miss of analysts’ EPS estimates.

"Our strong first quarter performance reflects the power of our integrated ecosystem and the disciplined execution of the Lithia & Driveway strategy by our teams," said Bryan DeBoer, President and CEO.

Lithia pulled off the fastest revenue growth but had the weakest performance against analyst estimates of the whole group. The stock is up 13.2% since reporting and currently trades at $335.73.

Is now the time to buy Lithia? Access our full analysis of the earnings results here, it’s free.

Best Q1: America's Car-Mart (NASDAQ: CRMT)

With a strong presence in the Southern and Central US, America’s Car-Mart (NASDAQ: CRMT) sells used cars to budget-conscious consumers.

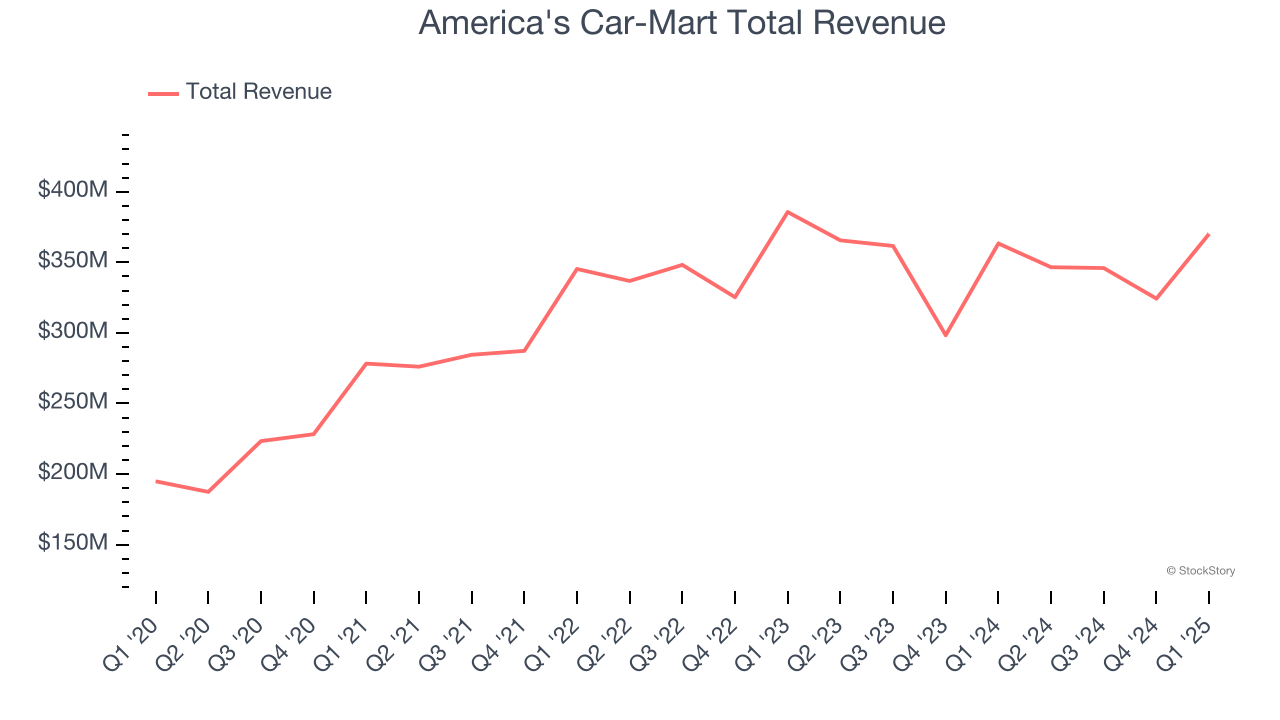

America's Car-Mart reported revenues of $370.2 million, up 1.9% year on year, outperforming analysts’ expectations by 7.8%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

America's Car-Mart pulled off the biggest analyst estimates beat among its peers. The stock is down 10.5% since reporting. It currently trades at $51.69.

Is now the time to buy America's Car-Mart? Access our full analysis of the earnings results here, it’s free.

CarMax (NYSE: KMX)

Known for its transparent, customer-centric approach and wide selection of vehicles, Carmax (NYSE: KMX) is the largest automotive retailer in the United States.

CarMax reported revenues of $7.55 billion, up 6.1% year on year, in line with analysts’ expectations. Still, its results were good as it locked in an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ gross margin estimates.

Interestingly, the stock is up 4.6% since the results and currently trades at $67.28.

Read our full analysis of CarMax’s results here.

Camping World (NYSE: CWH)

Founded in 1966 as a single recreational vehicle (RV) dealership, Camping World (NYSE: CWH) still sells RVs along with boats and general merchandise for outdoor activities.

Camping World reported revenues of $1.41 billion, up 3.6% year on year. This result missed analysts’ expectations by 1%. Taking a step back, it was still a very strong quarter as it recorded a solid beat of analysts’ EBITDA and EPS estimates.

The stock is up 30.5% since reporting and currently trades at $18.40.

Read our full, actionable report on Camping World here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.