Leidos trades at $152.40 per share and has stayed right on track with the overall market, losing 7.1% over the last six months while the S&P 500 is down 3.3%. This might have investors contemplating their next move.

Is now the time to buy Leidos, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Leidos Not Exciting?

Even with the cheaper entry price, we're swiping left on Leidos for now. Here are two reasons why we avoid LDOS and a stock we'd rather own.

1. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Leidos’s revenue to rise by 2.5%, a deceleration versus its 7.7% annualized growth for the past two years. This projection doesn't excite us and implies its products and services will face some demand challenges.

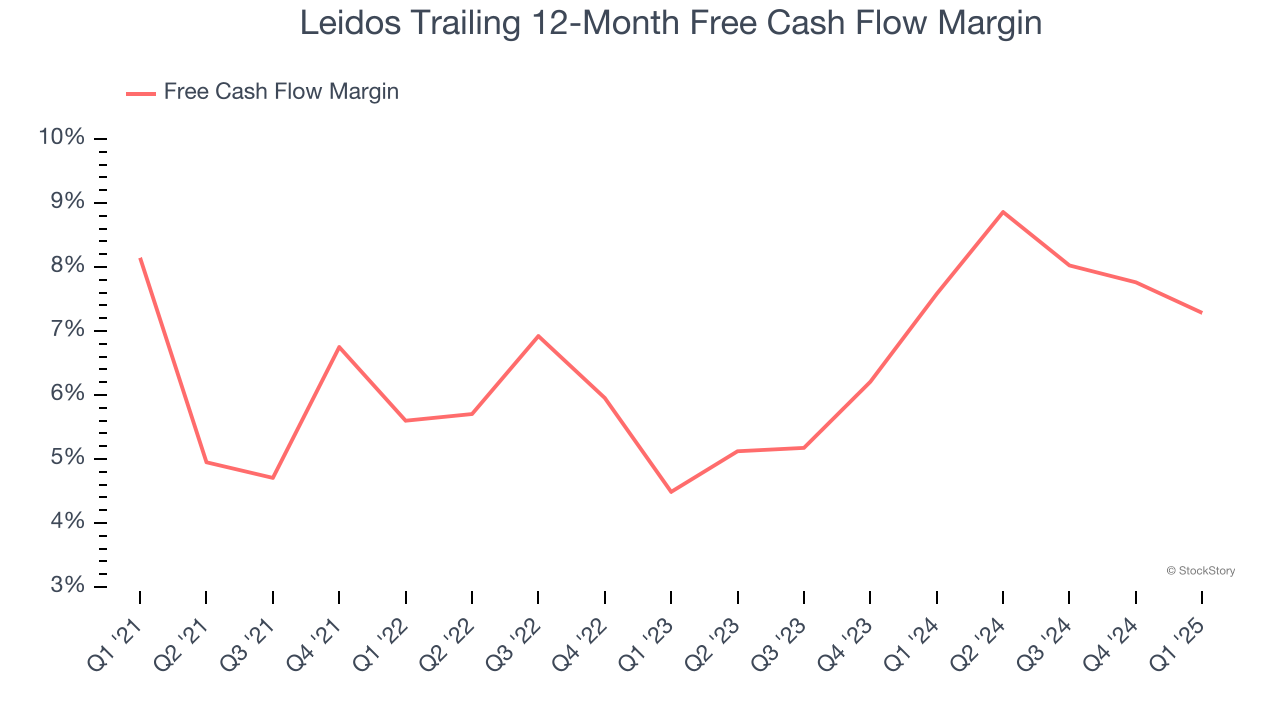

2. Free Cash Flow Margin Stuck in Neutral

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Leidos’s margin was unchanged over the last five years, showing it couldn’t improve. Its free cash flow margin for the trailing 12 months was 7.3%.

Final Judgment

Leidos isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 13.9× forward P/E (or $152.40 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at one of our top digital advertising picks.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.