As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the video conferencing industry, including RingCentral (NYSE: RNG) and its peers.

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

The 4 video conferencing stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 0.8% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

RingCentral (NYSE: RNG)

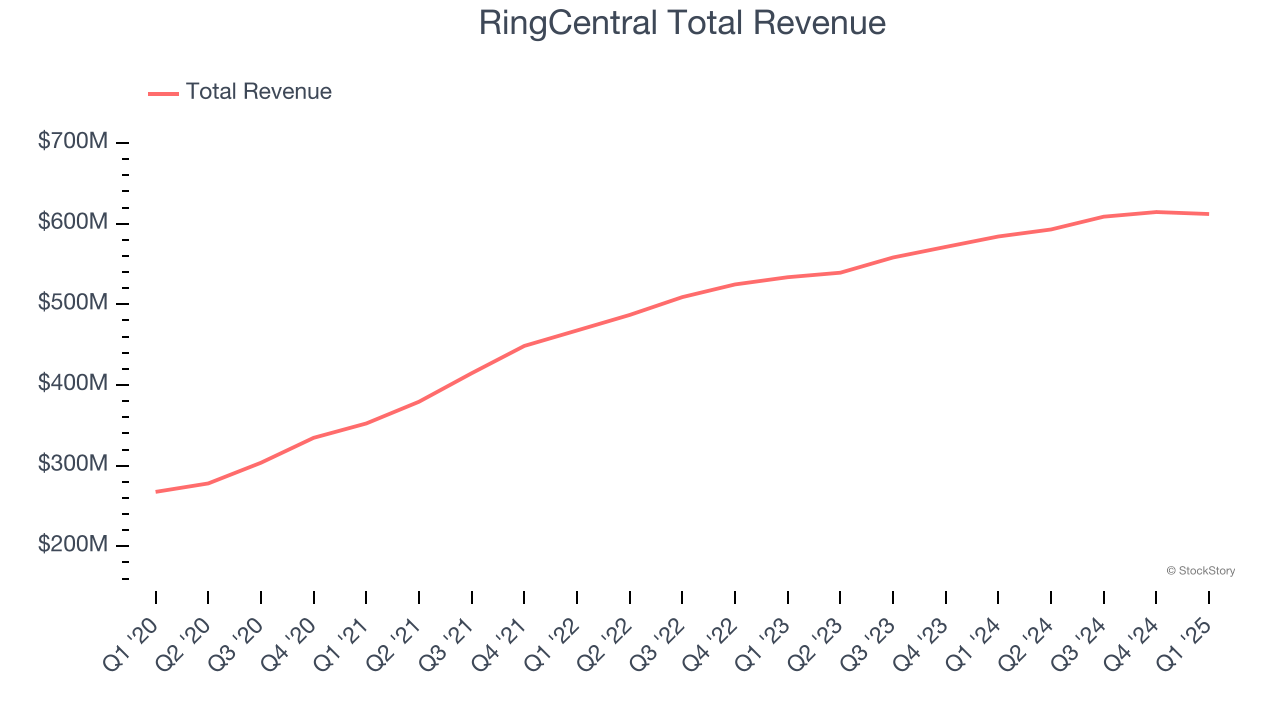

Founded in 1999 during the dot-com era, RingCentral (NYSE: RNG) provides software as a service that unifies phone, text, fax, video calls and chat in one platform.

RingCentral reported revenues of $612.1 million, up 4.8% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a decent beat of analysts’ EBITDA estimates but a miss of analysts’ billings estimates.

“Our continued leadership in UCaaS, combined with strong early momentum in CCaaS and accelerated adoption of our AI-powered solutions, drove solid Q1 results, with ARR surpassing $2.5 billion ,” said Vlad Shmunis, RingCentral’s Founder, Chairman, and CEO.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $26.70.

Read our full report on RingCentral here, it’s free.

Best Q1: Five9 (NASDAQ: FIVN)

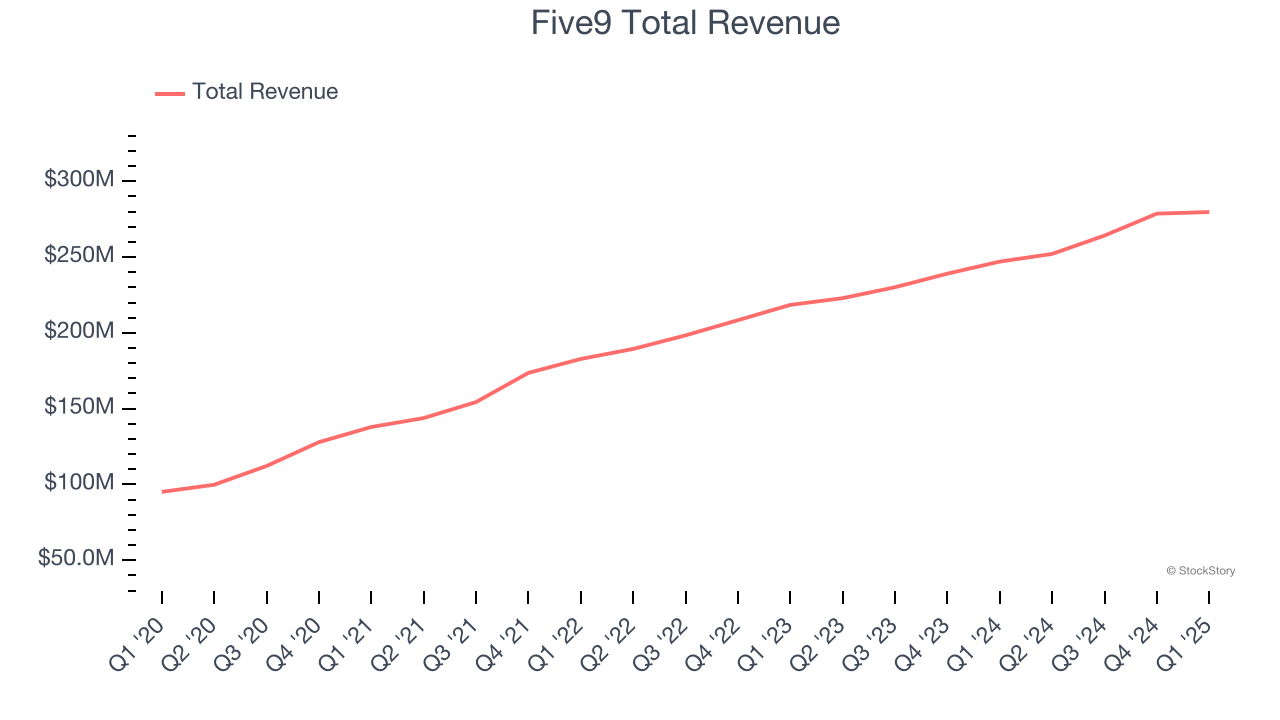

Started in 2001, Five9 (NASDAQ: FIVN) offers software-as-a-service that makes it easier for companies to set up and efficiently run call centers to offer more tailored customer support.

Five9 reported revenues of $279.7 million, up 13.2% year on year, outperforming analysts’ expectations by 2.6%. The business had a very strong quarter with EPS guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

Five9 delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 8.8% since reporting. It currently trades at $27.30.

Is now the time to buy Five9? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: 8x8 (NASDAQ: EGHT)

Founded in 1987, 8x8 (NYSE: EGHT) provides software for organizations to efficiently communicate and collaborate with their customers, employees, and partners.

8x8 reported revenues of $177 million, down 1.3% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a slight miss of analysts’ EBITDA estimates and billings in line with analysts’ estimates.

8x8 delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update in the group. As expected, the stock is down 6.7% since the results and currently trades at $1.67.

Read our full analysis of 8x8’s results here.

Zoom (NASDAQ: ZM)

Started by Eric Yuan who once ran engineering for Cisco’s video conferencing business, Zoom (NASDAQ: ZM) offers an easy to use, cloud-based platform for video conferencing, audio conferencing and screen sharing.

Zoom reported revenues of $1.17 billion, up 2.9% year on year. This result surpassed analysts’ expectations by 0.8%. Overall, it was a strong quarter as it also produced full-year EPS guidance exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

Zoom delivered the highest full-year guidance raise among its peers. The company added 104 enterprise customers paying more than $100,000 annually to reach a total of 4,192. The stock is up 1.1% since reporting and currently trades at $82.95.

Read our full, actionable report on Zoom here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.