Video game publisher Take Two (NASDAQ: TTWO) reported Q1 CY2025 results beating Wall Street’s revenue expectations, with sales up 13.1% year on year to $1.58 billion. The company expects next quarter’s revenue to be around $1.38 billion, coming in 4.7% above analysts’ estimates. Its GAAP loss of $21.08 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Take-Two? Find out by accessing our full research report, it’s free.

Take-Two (TTWO) Q1 CY2025 Highlights:

- Revenue: $1.58 billion vs analyst estimates of $1.57 billion (13.1% year-on-year growth, 0.9% beat)

- EPS (GAAP): -$21.08 vs analyst estimates of -$0.05 (significant miss)

- Management’s revenue guidance for the upcoming financial year 2026 is $6 billion at the midpoint, missing analyst estimates by 23.1% and implying 6.5% growth (vs 5.2% in FY2025)

- EPS (GAAP) guidance for the upcoming financial year 2026 is $0.17 at the midpoint, missing analyst estimates by 82.3%

- EBITDA guidance for the upcoming financial year 2026 is $535 million at the midpoint, below analyst estimates of $1.97 billion

- Operating Margin: -239%, down from -194% in the same quarter last year

- Free Cash Flow was $224.9 million, up from -$48.2 million in the previous quarter

- Market Capitalization: $40.51 billion

Company Overview

Best known for its Grand Theft Auto and NBA 2K franchises, Take Two (NASDAQ: TTWO) is one of the world’s largest video game publishers.

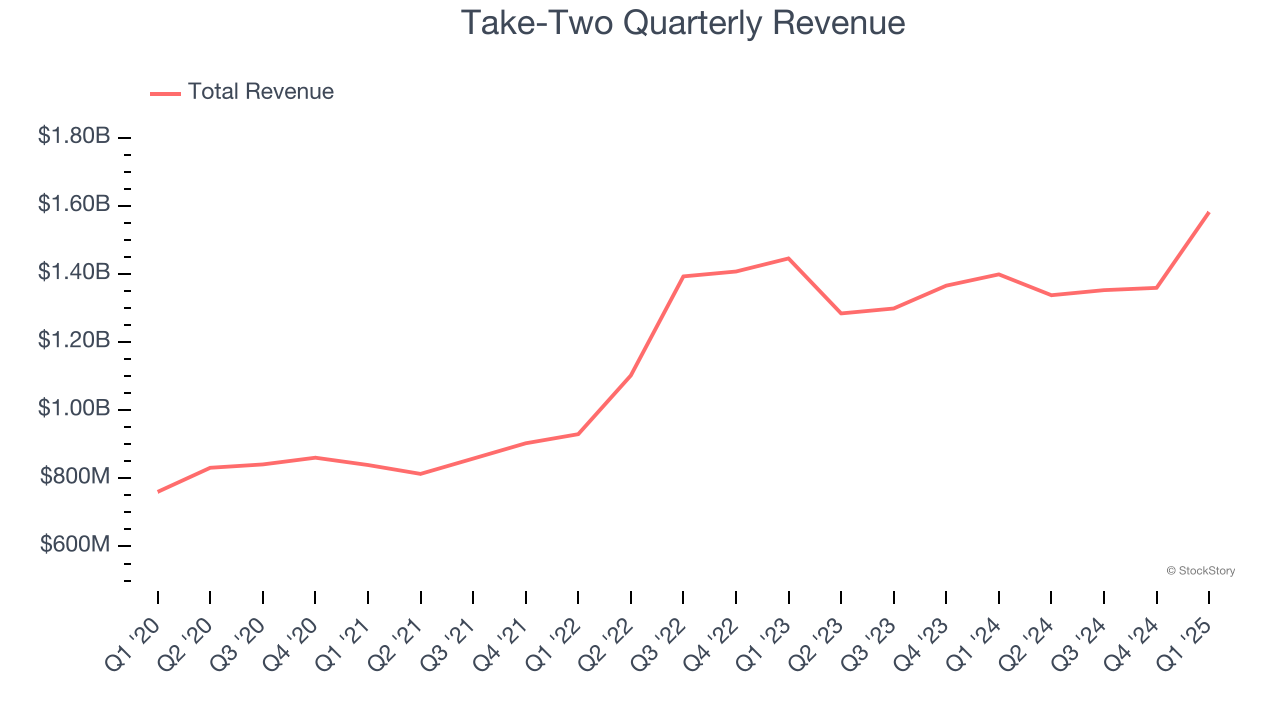

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, Take-Two grew its sales at a solid 17.1% compounded annual growth rate. Its growth beat the average consumer internet company and shows its offerings resonate with customers.

This quarter, Take-Two reported year-on-year revenue growth of 13.1%, and its $1.58 billion of revenue exceeded Wall Street’s estimates by 0.9%. Company management is currently guiding for a 2.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 37.1% over the next 12 months, an acceleration versus the last three years. This projection is eye-popping and suggests its newer products and services will catalyze better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

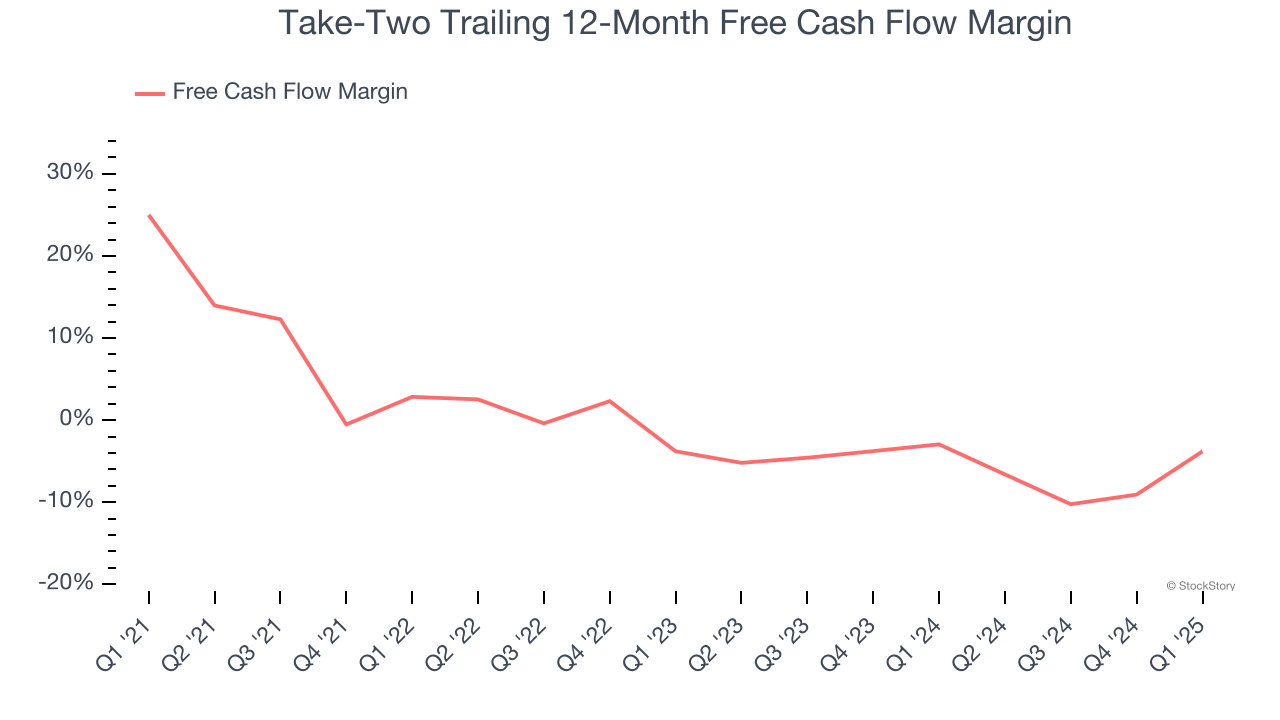

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While Take-Two posted positive free cash flow this quarter, the broader story hasn’t been so clean. Take-Two’s demanding reinvestments have consumed many resources over the last two years, contributing to an average free cash flow margin of negative 3.4%. This means it lit $3.39 of cash on fire for every $100 in revenue. This is a stark contrast from its EBITDA margin, and its investments (i.e., stocking inventory, building new facilities) are the primary culprit.

Taking a step back, we can see that Take-Two’s margin dropped by 6.6 percentage points over the last few years. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s in the middle of a big investment cycle.

Take-Two’s free cash flow clocked in at $224.9 million in Q1, equivalent to a 14.2% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Key Takeaways from Take-Two’s Q1 Results

We struggled to find many positives in these results as its EPS missed and its full-year guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 1.7% to $228.50 immediately following the results.

Take-Two underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.