Looking back on semiconductor manufacturing stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including FormFactor (NASDAQ: FORM) and its peers.

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

The 14 semiconductor manufacturing stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 1.7% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 26% since the latest earnings results.

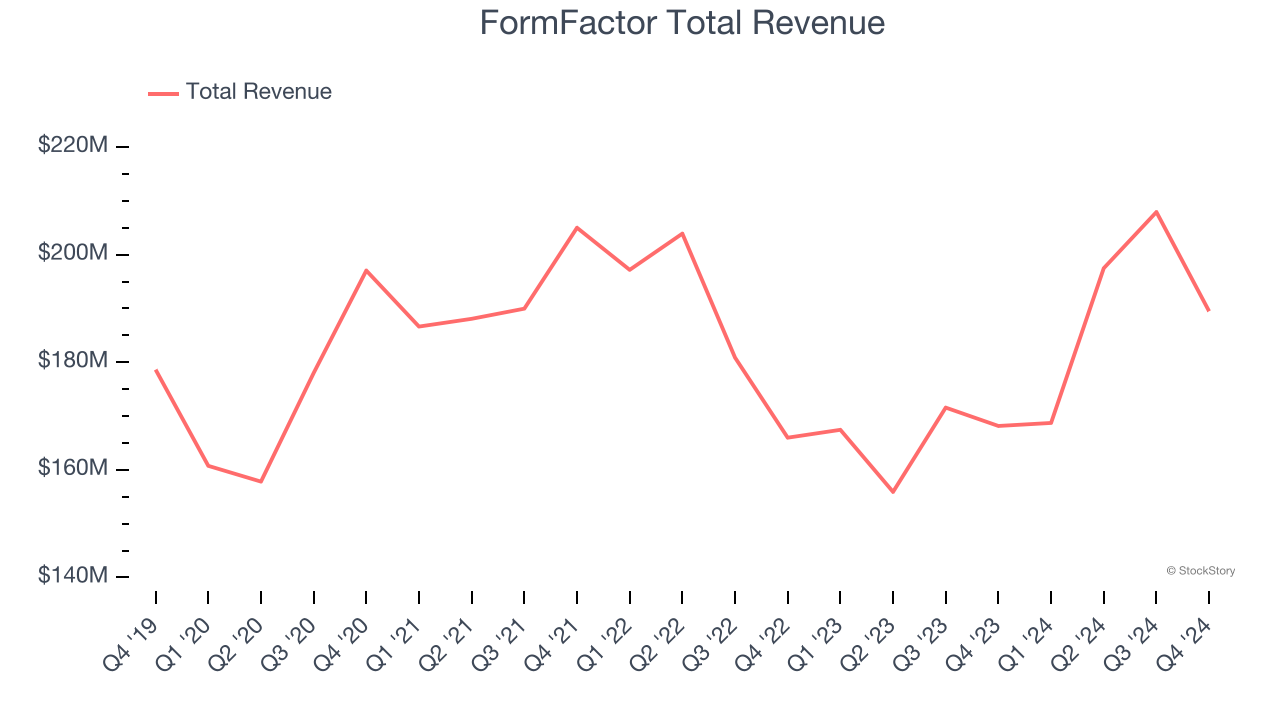

Weakest Q4: FormFactor (NASDAQ: FORM)

With customers across the foundry and fabless markets, FormFactor (NASDAQ: FORM) is a US-based provider of test and measurement technologies for semiconductors.

FormFactor reported revenues of $189.5 million, up 12.7% year on year. This print was in line with analysts’ expectations, but overall, it was a softer quarter for the company with a significant miss of analysts’ adjusted operating income and EPS estimates.

“As expected, FormFactor reported sequentially lower fourth-quarter revenue, gross margin, and non-GAAP earnings per share, driven by the forecasted reduction in Foundry & Logic probe-card revenue,” said Mike Slessor, CEO of FormFactor,

Unsurprisingly, the stock is down 39.8% since reporting and currently trades at $24.78.

Read our full report on FormFactor here, it’s free.

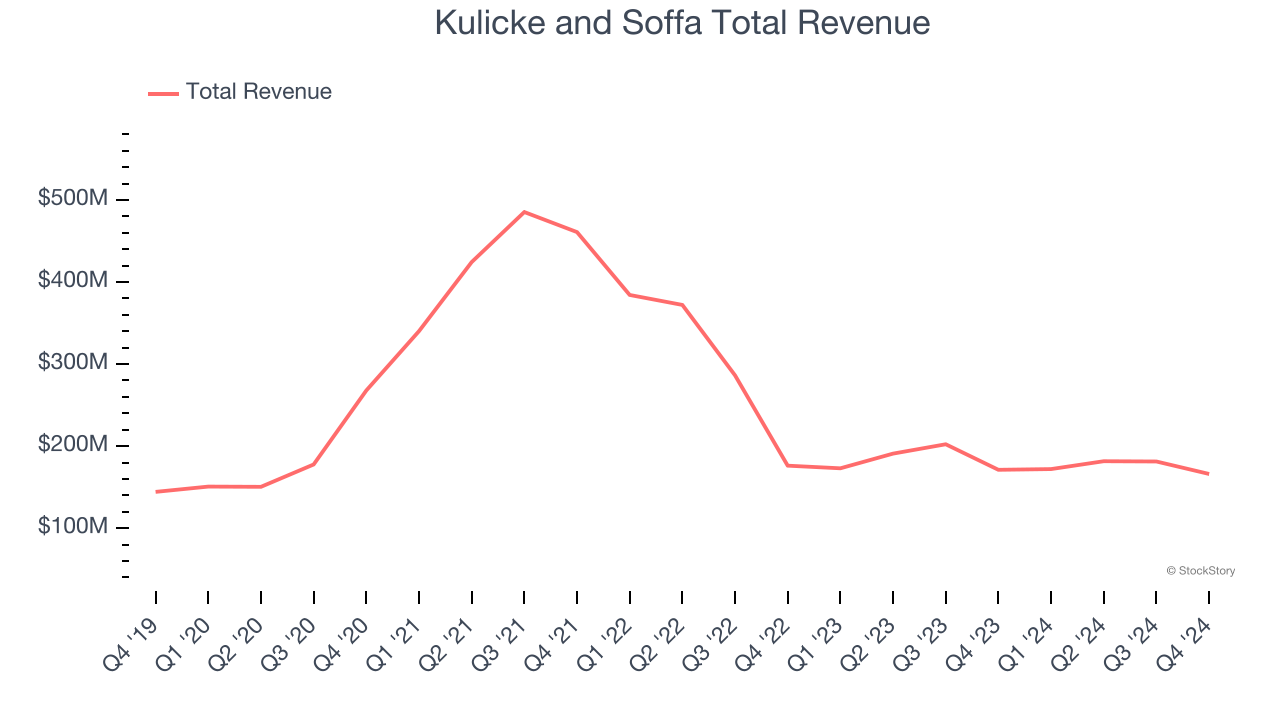

Best Q4: Kulicke and Soffa (NASDAQ: KLIC)

Headquartered in Singapore, Kulicke & Soffa (NASDAQ: KLIC) is a provider of production equipment and tools used to assemble semiconductor devices

Kulicke and Soffa reported revenues of $166.1 million, down 3% year on year, outperforming analysts’ expectations by 0.7%. The business had a very strong quarter with a significant improvement in its inventory levels and an impressive beat of analysts’ EPS estimates.

The stock is down 24% since reporting. It currently trades at $32.99.

Is now the time to buy Kulicke and Soffa? Access our full analysis of the earnings results here, it’s free.

Marvell Technology (NASDAQ: MRVL)

Moving away from a low margin storage device management chips in one of the biggest semiconductor business model pivots of the past decade, Marvell Technology (NASDAQ: MRVL) is a fabless designer of special purpose data processing and networking chips used by data centers, communications carriers, enterprises, and autos.

Marvell Technology reported revenues of $1.82 billion, up 27.4% year on year, exceeding analysts’ expectations by 1.2%. Still, it was a slower quarter as it posted revenue guidance for next quarter slightly missing analysts’ expectations and an increase in its inventory levels.

As expected, the stock is down 41.4% since the results and currently trades at $52.85.

Read our full analysis of Marvell Technology’s results here.

Entegris (NASDAQ: ENTG)

With fabs representing the company’s largest customer type, Entegris (NASDAQ: ENTG) supplies products that purify, protect, and generally ensure the integrity of raw materials needed for advanced semiconductor manufacturing.

Entegris reported revenues of $849.8 million, up 4.6% year on year. This number topped analysts’ expectations by 3.3%. It was a strong quarter as it also logged a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is down 34.8% since reporting and currently trades at $67.83.

Read our full, actionable report on Entegris here, it’s free.

Semtech (NASDAQ: SMTC)

A public company since the late 1960s, Semtech (NASDAQ: SMTC) is a provider of analog and mixed-signal semiconductors used for Internet of Things systems and cloud connectivity.

Semtech reported revenues of $251 million, up 30.1% year on year. This print met analysts’ expectations. Overall, it was a strong quarter as it also recorded an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is down 11% since reporting and currently trades at $29.05.

Read our full, actionable report on Semtech here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.