As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at personal care stocks, starting with Medifast (NYSE: MED).

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

The 13 personal care stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 3.7% while next quarter’s revenue guidance was 7% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 18.2% since the latest earnings results.

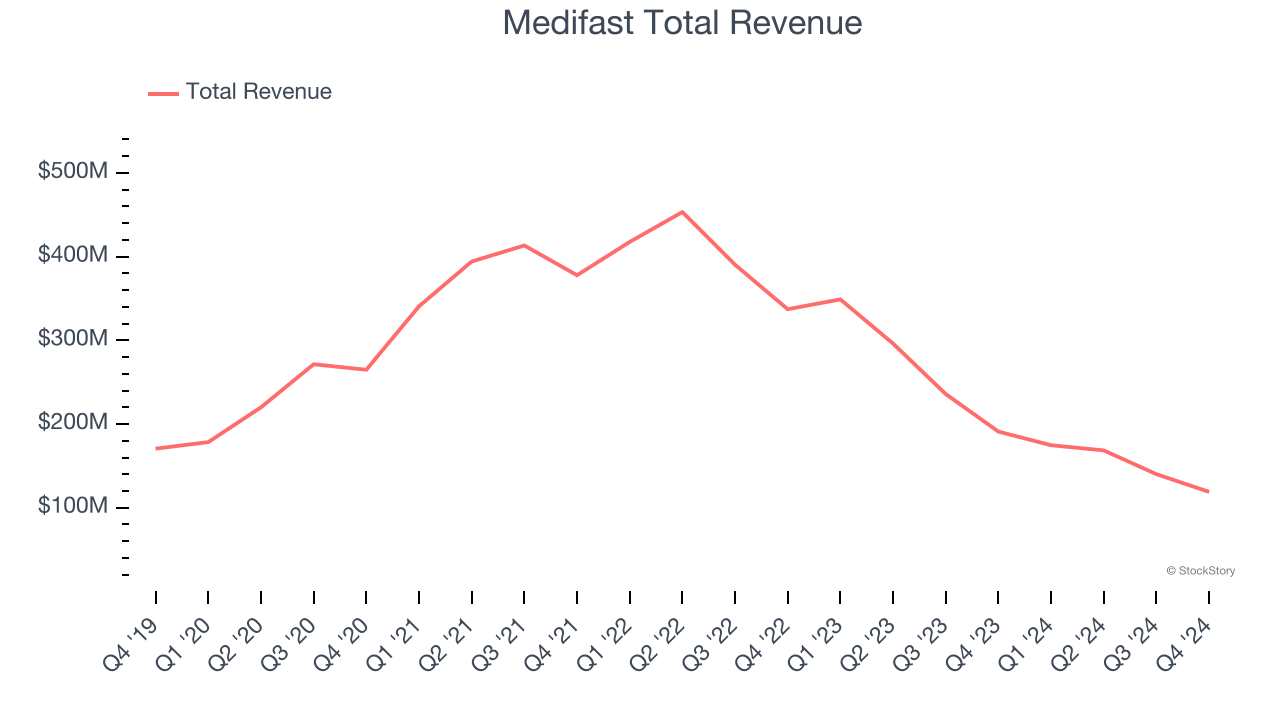

Medifast (NYSE: MED)

Known for its Optavia program that combines portion-controlled meal replacements with coaching, Medifast (NYSE: MED) has a broad product portfolio of bars, snacks, drinks, and desserts for those looking to lose weight or consume healthier foods.

Medifast reported revenues of $119 million, down 37.7% year on year. This print exceeded analysts’ expectations by 4.2%. Despite the top-line beat, it was still a slower quarter for the company with revenue guidance for next quarter missing analysts’ expectations and a significant miss of analysts’ EBITDA estimates.

“This past year was a pivotal year for Medifast, as we continued to transform our business to meet the changing nature of a health and wellness market that has been revolutionized by the rising acceptance of GLP-1 medications,” said Dan Chard, Chairman & CEO.

Medifast delivered the slowest revenue growth of the whole group. The stock is down 24.3% since reporting and currently trades at $12.21.

Read our full report on Medifast here, it’s free.

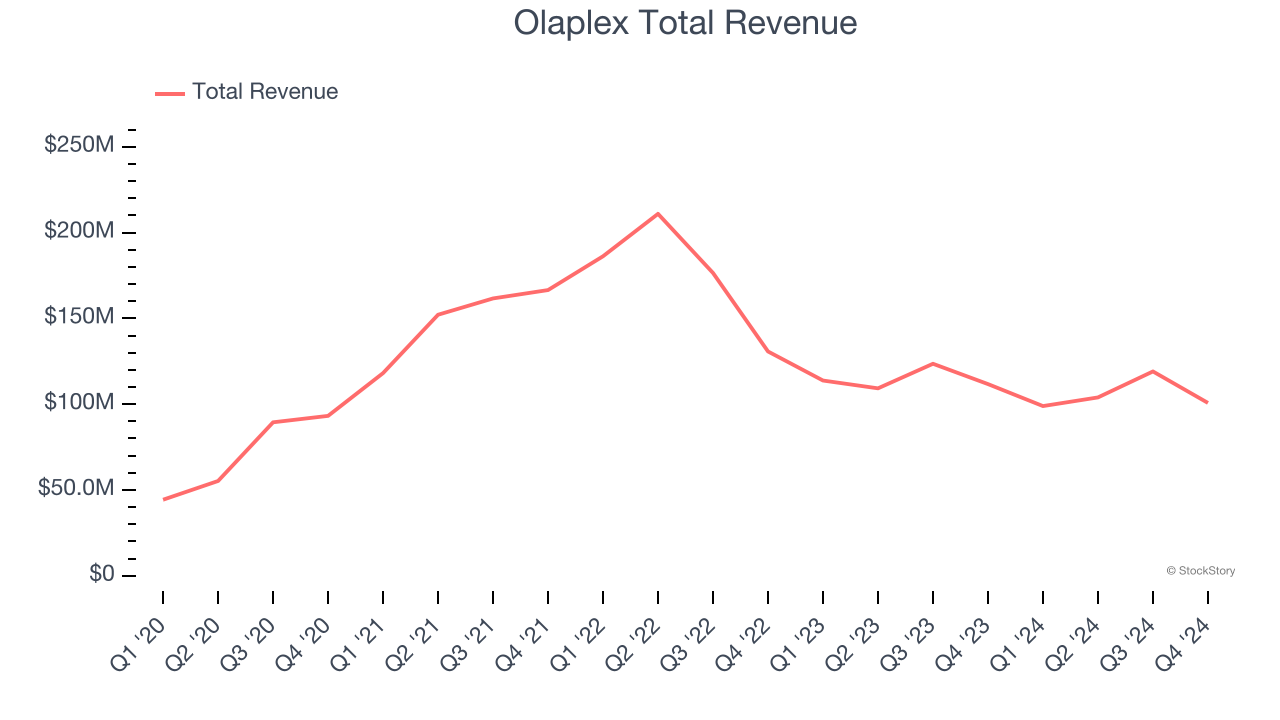

Best Q4: Olaplex (NASDAQ: OLPX)

Rising to fame on TikTok because of its “bond building" hair products, Olaplex (NASDAQ: OLPX) offers products and treatments that repair the damage caused by traditional heat and chemical-based styling goods.

Olaplex reported revenues of $100.7 million, down 9.8% year on year, outperforming analysts’ expectations by 14.4%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Olaplex pulled off the biggest analyst estimates beat and highest full-year guidance raise among its peers. The market seems unhappy with the results as the stock is down 24.1% since reporting. It currently trades at $1.04.

Is now the time to buy Olaplex? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Coty (NYSE: COTY)

With a portfolio boasting many household brands, Coty (NYSE: COTY) is a beauty products powerhouse spanning cosmetics, fragrances, and skincare.

Coty reported revenues of $1.67 billion, down 3.3% year on year, falling short of analysts’ expectations by 3.1%. It was a softer quarter as it posted a significant miss of analysts’ EPS estimates and a miss of analysts’ organic revenue estimates.

Coty delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 22.5% since the results and currently trades at $5.25.

Read our full analysis of Coty’s results here.

The Honest Company (NASDAQ: HNST)

Co-founded by actress Jessica Alba, The Honest Company (NASDAQ: HNST) sells diapers and wipes, skin care products, and household cleaning products.

The Honest Company reported revenues of $99.84 million, up 10.6% year on year. This number beat analysts’ expectations by 3.1%. It was a stunning quarter as it also logged an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The stock is down 18.4% since reporting and currently trades at $4.64.

Read our full, actionable report on The Honest Company here, it’s free.

Nature's Sunshine (NASDAQ: NATR)

Started on a kitchen table in Utah, Nature’s Sunshine (NASDAQ: NATR) manufactures and sells nutritional and personal care products.

Nature's Sunshine reported revenues of $118.2 million, up 8.5% year on year. This result surpassed analysts’ expectations by 8.1%. Zooming out, it was a slower quarter as it produced a significant miss of analysts’ EBITDA and EPS estimates.

The stock is down 23.6% since reporting and currently trades at $11.17.

Read our full, actionable report on Nature's Sunshine here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.