What a time it’s been for Upland. In the past six months alone, the company’s stock price has increased by a massive 53.1%, reaching $3.23 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Upland, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

We’re happy investors have made money, but we're swiping left on Upland for now. Here are three reasons why we avoid UPLD and a stock we'd rather own.

Why Is Upland Not Exciting?

Founder Jack McDonald’s second software rollup, Upland Software (NASDAQ: UPLD) is a one stop shop for sales and marketing software, project management, HR, and contact center services for small and medium sized businesses.

1. Revenue Spiraling Downwards

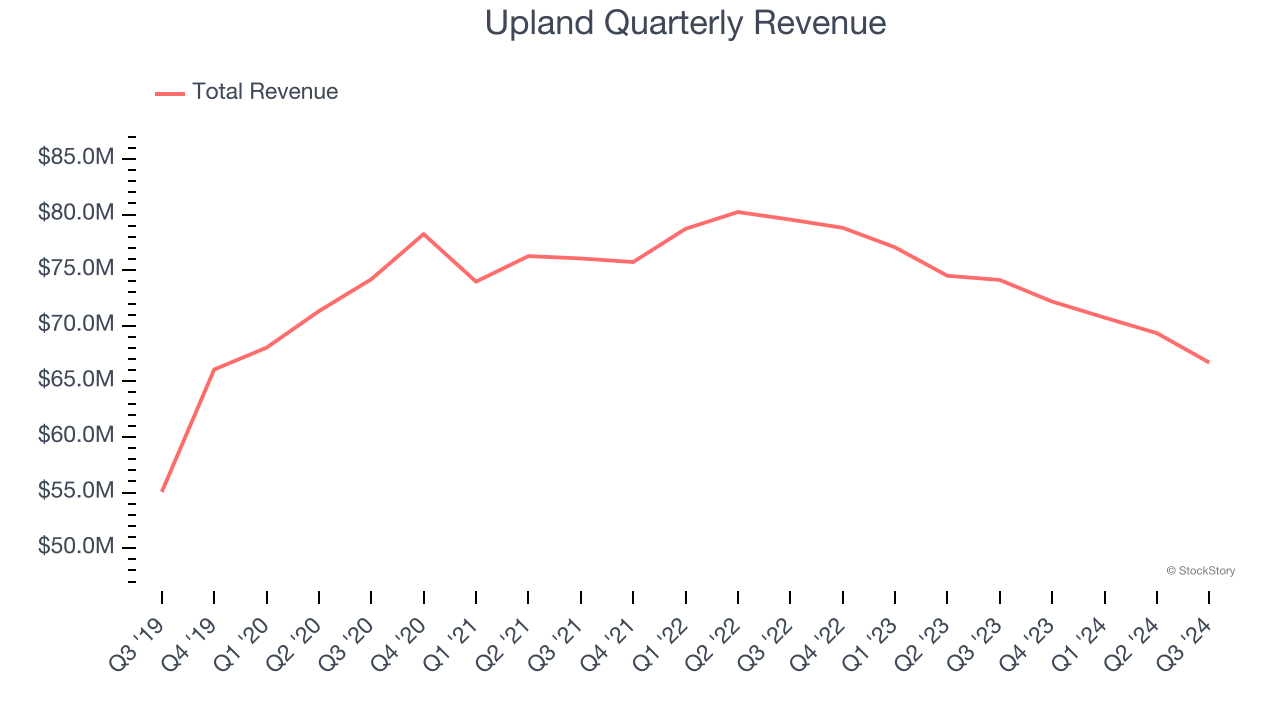

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Upland’s demand was weak over the last three years as its sales fell at a 2.9% annual rate. This was below our standards and is a sign of lacking business quality.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Upland’s revenue to drop by 3.8%, close to its 2.9% annualized declines for the past three years. This projection is underwhelming and implies its newer products and services will not catalyze better top-line performance yet.

Final Judgment

Upland isn’t a terrible business, but it doesn’t pass our quality test. After the recent surge, the stock trades at 0.3× forward price-to-sales (or $3.23 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Upland

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.