Even during a down period for the markets, RTX has gone against the grain, climbing to $132.82. Its shares have yielded a 9.6% return over the last six months, beating the S&P 500 by 11%. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in RTX, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Despite the momentum, we don't have much confidence in RTX. Here are three reasons why RTX doesn't excite us and a stock we'd rather own.

Why Is RTX Not Exciting?

Originally focused on refrigeration technology, Raytheon (NSYE:RTX) provides a a variety of products and services to the aerospace and defense industries.

1. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect RTX’s revenue to rise by 4.6%, a deceleration versus its 9.7% annualized growth for the past two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

2. EPS Trending Down

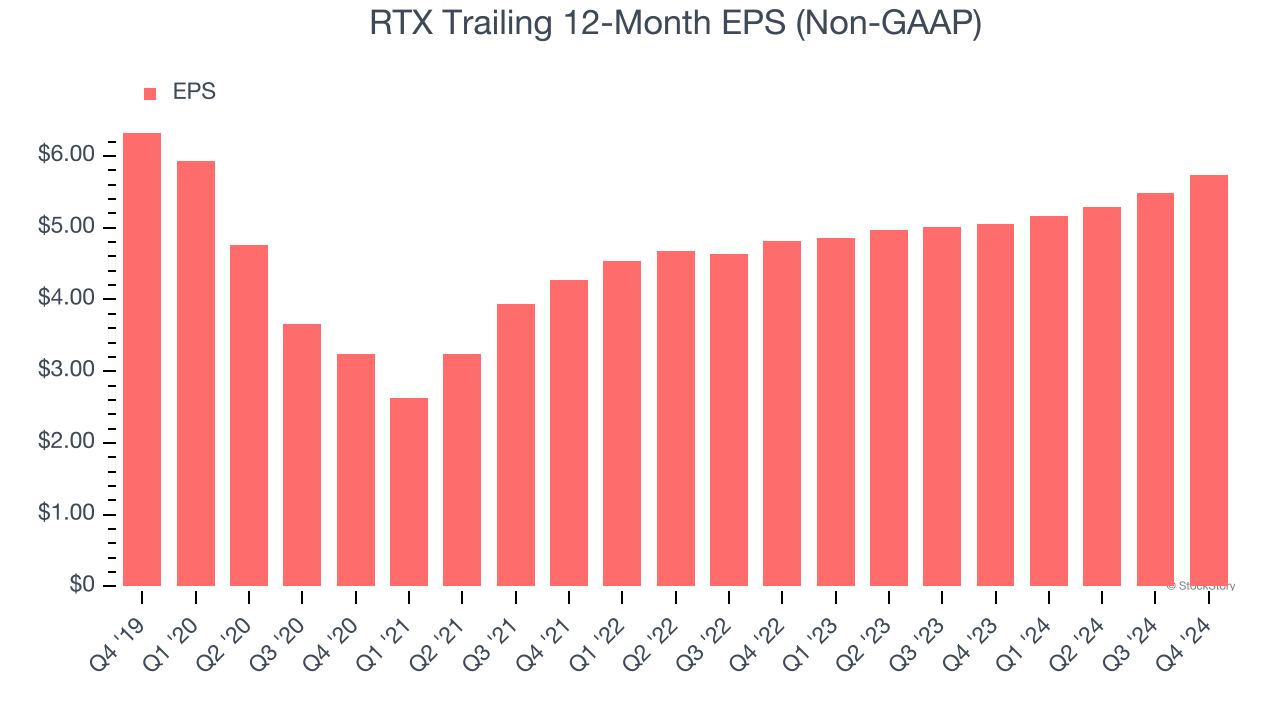

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for RTX, its EPS declined by 1.9% annually over the last five years while its revenue grew by 9.2%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Previous Growth Initiatives Haven’t Impressed

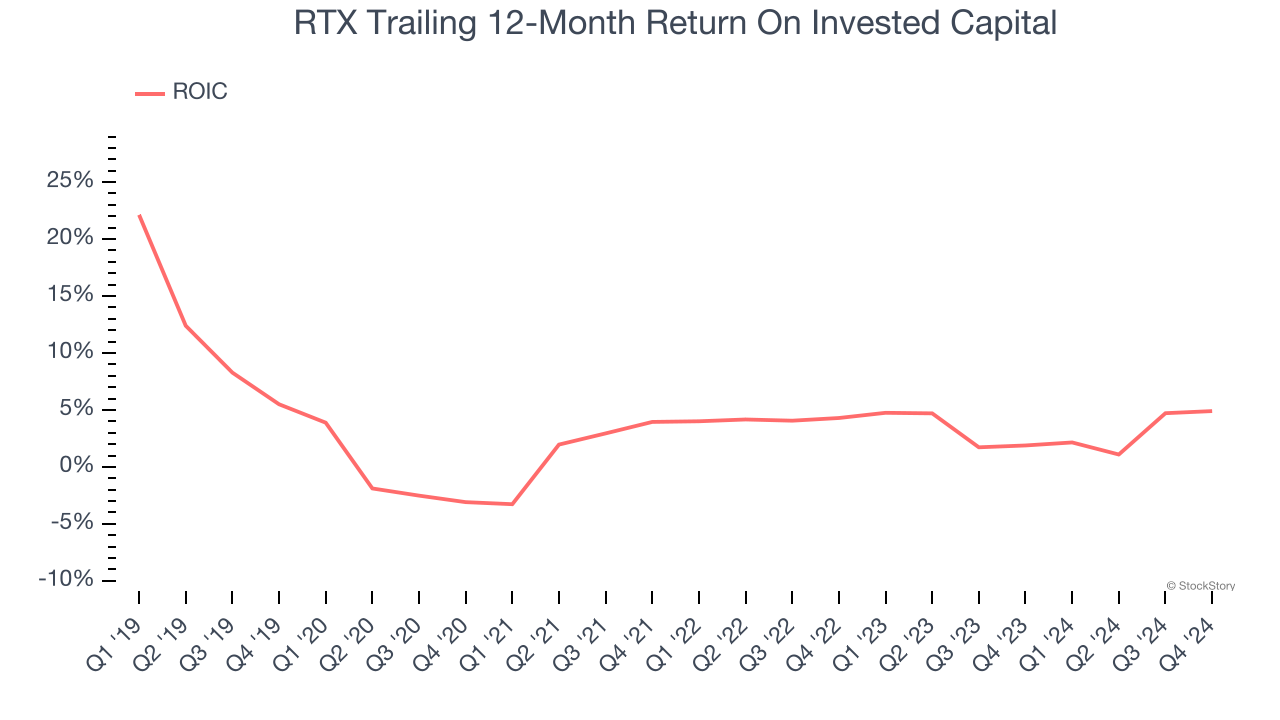

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

RTX historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.4%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

Final Judgment

RTX isn’t a terrible business, but it isn’t one of our picks. With its shares outperforming the market lately, the stock trades at 21.8× forward price-to-earnings (or $132.82 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. We’d suggest looking at our favorite semiconductor picks and shovels play.

Stocks We Would Buy Instead of RTX

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.