Aerospace and defense company Cadre (NYSE: CDRE) reported Q4 CY2024 results beating Wall Street’s revenue expectations, with sales up 41.3% year on year to $176 million. On the other hand, the company’s full-year revenue guidance of $586.5 million at the midpoint came in 5.1% below analysts’ estimates. Its GAAP profit of $0.32 per share was 28.3% below analysts’ consensus estimates.

Is now the time to buy Cadre? Find out by accessing our full research report, it’s free.

Cadre (CDRE) Q4 CY2024 Highlights:

- Revenue: $176 million vs analyst estimates of $171.7 million (41.3% year-on-year growth, 2.5% beat)

- EPS (GAAP): $0.32 vs analyst expectations of $0.45 (28.3% miss)

- Adjusted EBITDA: $38.51 million vs analyst estimates of $36.87 million (21.9% margin, 4.4% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $586.5 million at the midpoint, missing analyst estimates by 5.1% and implying 3.3% growth (vs 17.8% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $110 million at the midpoint, below analyst estimates of $116.2 million

- Operating Margin: 16.7%, up from 10.2% in the same quarter last year

- Free Cash Flow Margin: 12.7%, down from 19.6% in the same quarter last year

- Market Capitalization: $1.37 billion

“2024 was another record year, as our teams continued to leverage the Cadre operating model and capitalize on positive demand trends for our best-in-class, mission-critical safety equipment,” said Warren Kanders, CEO and Chairman.

Company Overview

Originally known as Safariland, Cadre (NYSE: CDRE) specializes in manufacturing and distributing safety and survivability equipment for first responders.

Law Enforcement Suppliers

Many law enforcement suppliers companies require licensing and clearance to manufacture products such as firearms. These companies can enjoy long-term contracts with law enforcement and corrections bodies, leading to more predictable revenue. It is still unclear how the recent focus on excessive force and police accountability will impact longer-term demand. On the one hand, lethal force products could become less popular. On the other hand, products such as body cams that aid in the transparency of policing could become standard. Generally, the sector’s fate will also ebb and flow with state or local budgets, and there is high reputational risk, as one mishap or bad headline can change a company’s fortunes.

Sales Growth

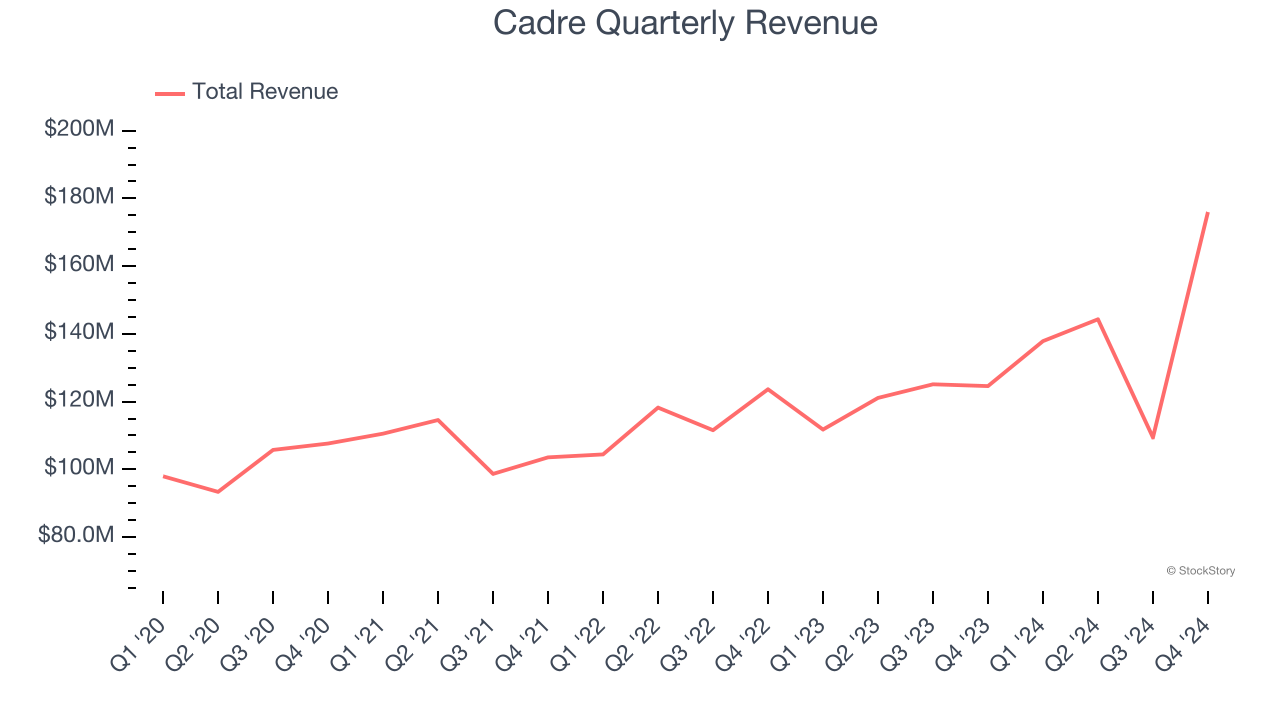

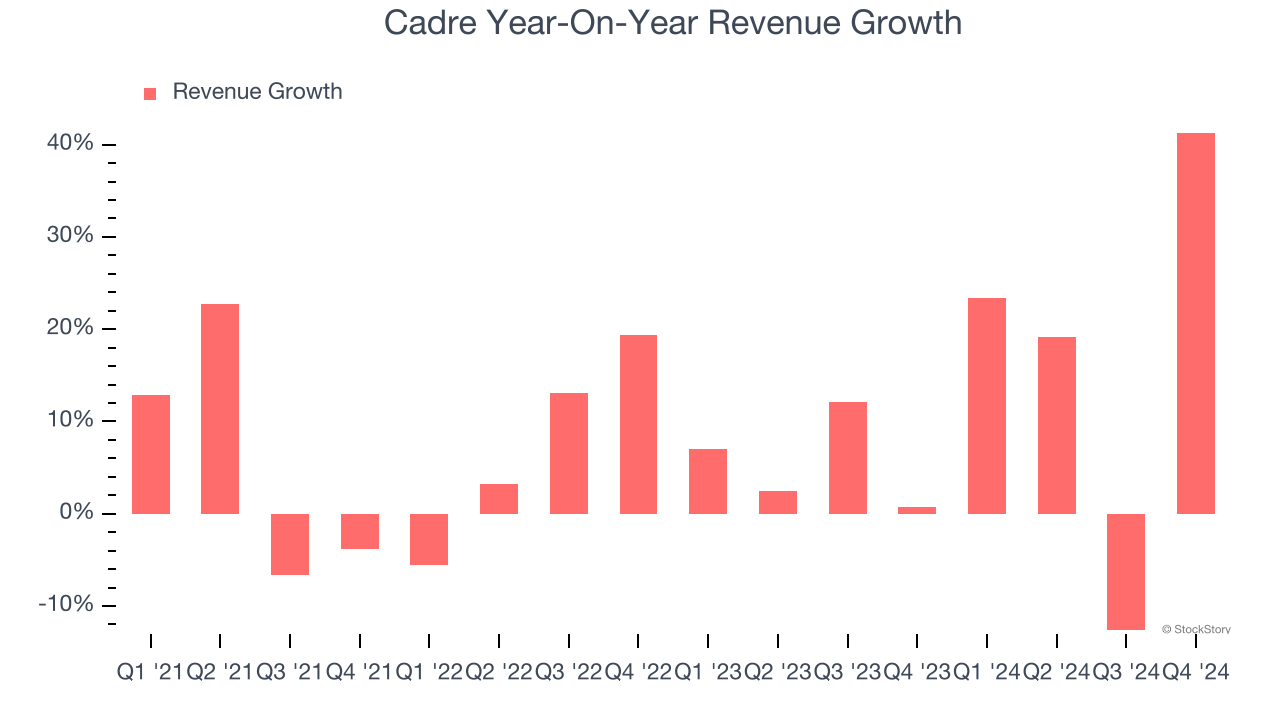

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last four years, Cadre grew its sales at a decent 8.8% compounded annual growth rate. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Cadre’s annualized revenue growth of 11.3% over the last two years is above its four-year trend, suggesting its demand recently accelerated.

We can dig further into the company’s revenue dynamics by analyzing its most important segment, Products. Over the last two years, Cadre’s Products revenue (body armor, corrections tools, sensors) averaged 14.3% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, Cadre reported magnificent year-on-year revenue growth of 41.3%, and its $176 million of revenue beat Wall Street’s estimates by 2.5%.

Looking ahead, sell-side analysts expect revenue to grow 9.6% over the next 12 months, a slight deceleration versus the last two years. Still, this projection is commendable and implies the market is baking in success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

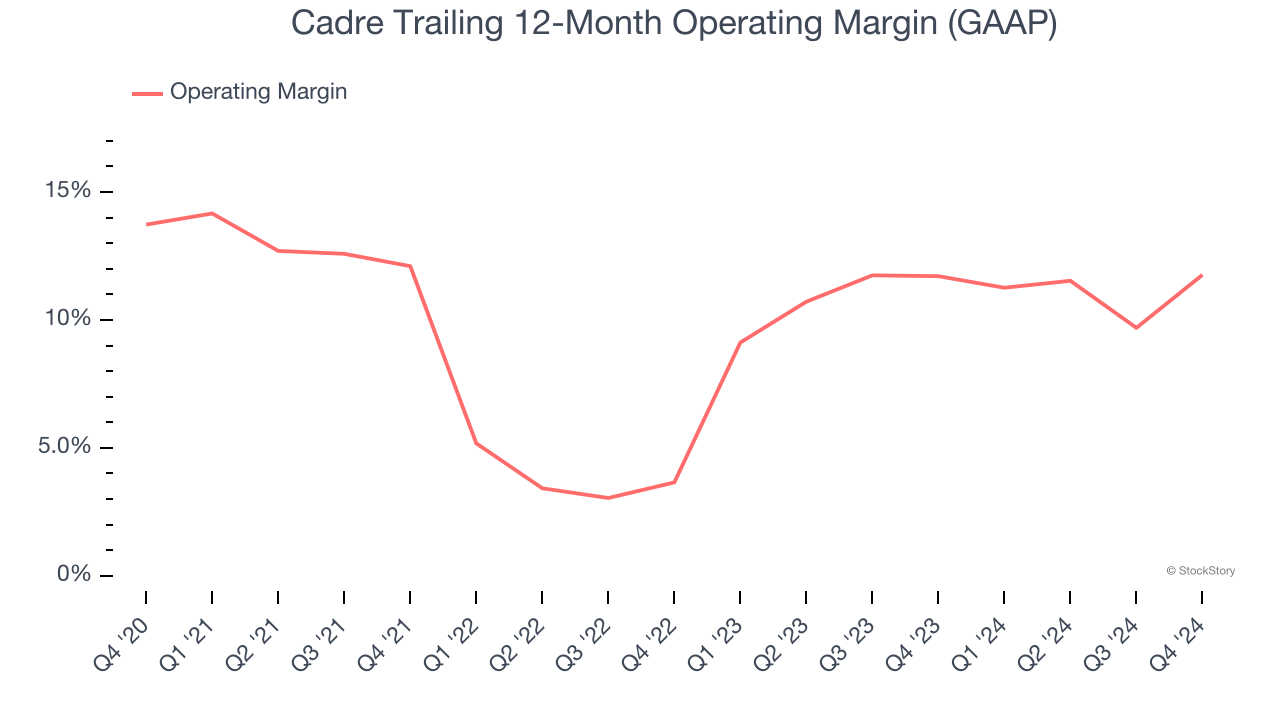

Cadre has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.6%.

Looking at the trend in its profitability, Cadre’s operating margin decreased by 2 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Cadre generated an operating profit margin of 16.7%, up 6.5 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

Earnings Per Share

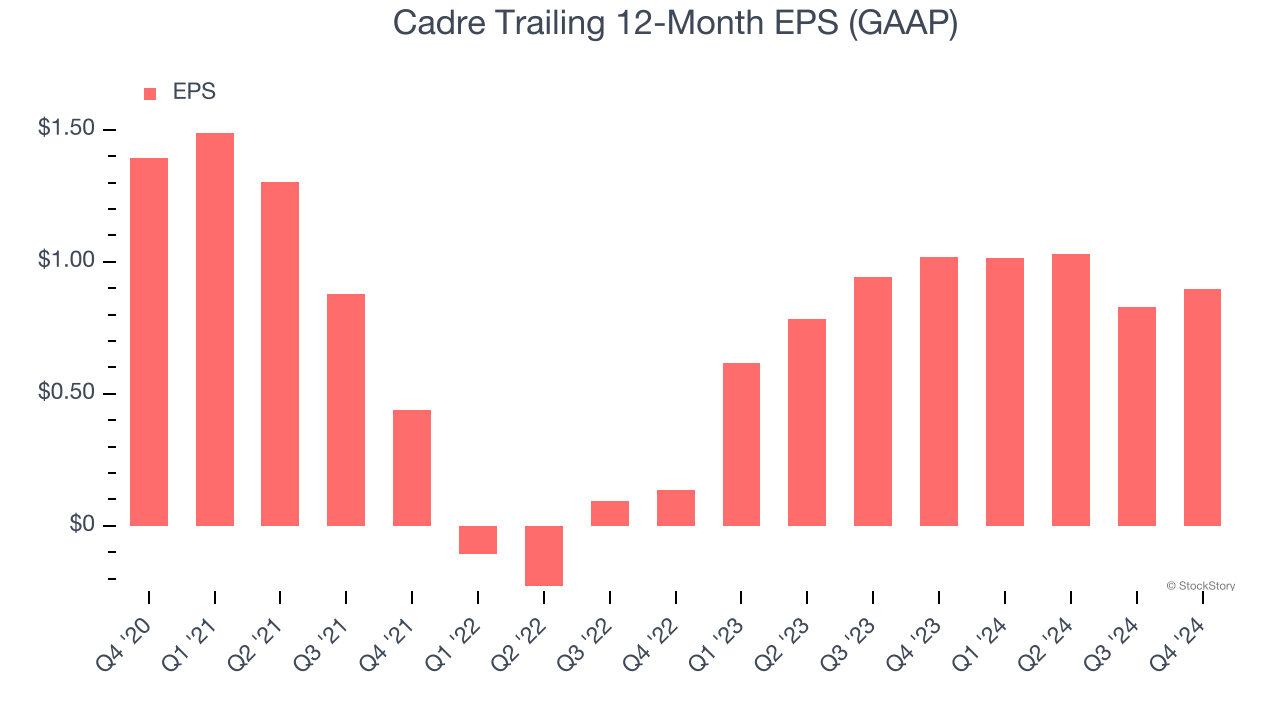

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Cadre, its EPS declined by 10.4% annually over the last four years while its revenue grew by 8.8%. This tells us the company became less profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Cadre, its two-year annual EPS growth of 158% was higher than its four-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q4, Cadre reported EPS at $0.32, up from $0.25 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Cadre’s full-year EPS of $0.90 to grow 57.1%.

Key Takeaways from Cadre’s Q4 Results

We enjoyed seeing Cadre exceed analysts’ Products revenue and EBITDA expectations this quarter. On the other hand, its full-year revenue and EBITDA guidance fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.6% to $32.65 immediately following the results.

Cadre’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.