Luxury ski resort company Vail Resorts (NYSE: MTN) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 5.5% year on year to $1.14 billion. Its GAAP profit of $6.56 per share was 3.8% above analysts’ consensus estimates.

Is now the time to buy Vail Resorts? Find out by accessing our full research report, it’s free.

Vail Resorts (MTN) Q4 CY2024 Highlights:

- Revenue: $1.14 billion vs analyst estimates of $1.13 billion (5.5% year-on-year growth, in line)

- EPS (GAAP): $6.56 vs analyst estimates of $6.32 (3.8% beat)

- Adjusted EBITDA: $458.1 million vs analyst estimates of $448.7 million (40.3% margin, 2.1% beat)

- EBITDA guidance for the full year is $875 million at the midpoint, in line with analyst expectations

- Operating Margin: 33.8%, up from 32.5% in the same quarter last year

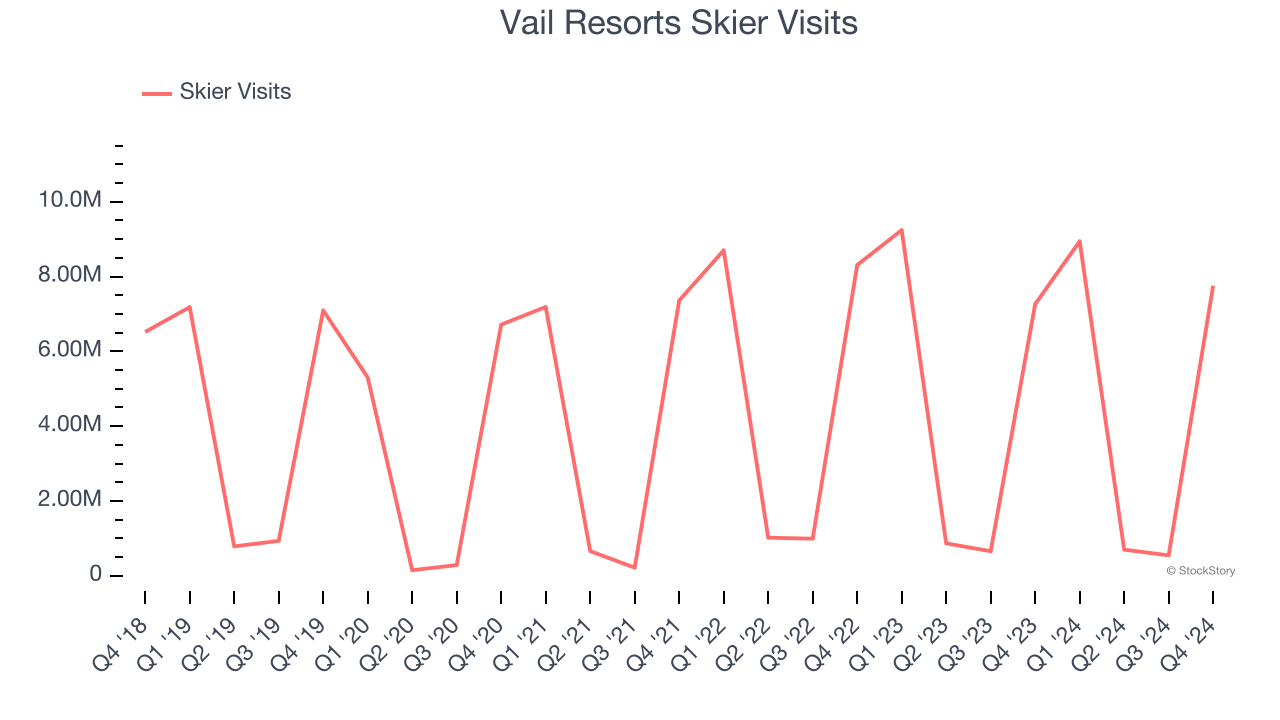

- Skier Visits: 7.76 million, up 491,000 year on year

- Market Capitalization: $5.9 billion

Commenting on the Company's fiscal 2025 second quarter results, Kirsten Lynch, Chief Executive Officer, said, "We are pleased with our overall results for the quarter, with 8% growth in Resort Reported EBITDA compared to the prior year. Our results reflect the stability provided by our season pass program, our investments in the guest experience, and the strong execution of our teams across all of our mountain resorts. Second quarter visitation at our North American resorts was slightly above prior year levels with the benefit of improved conditions, partially offset by the expected continued industry demand normalization and the shift in destination guest visitation to the spring. Destination guest visitation at our western North American mountain resorts was below prior year levels, which we believe was driven by the continued shift in historical visitation patterns across the ski industry to later in the ski season, which increased after challenging early season conditions in the prior year. Local guest visitation was in line with expectations as conditions across our North American resorts improved from the prior year and returned to more typical conditions.

Company Overview

Founded by two Aspen, Colorado ski patrol guides, Vail Resorts (NYSE: MTN) is a mountain resort company offering luxury experiences in over 30 locations across the globe.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

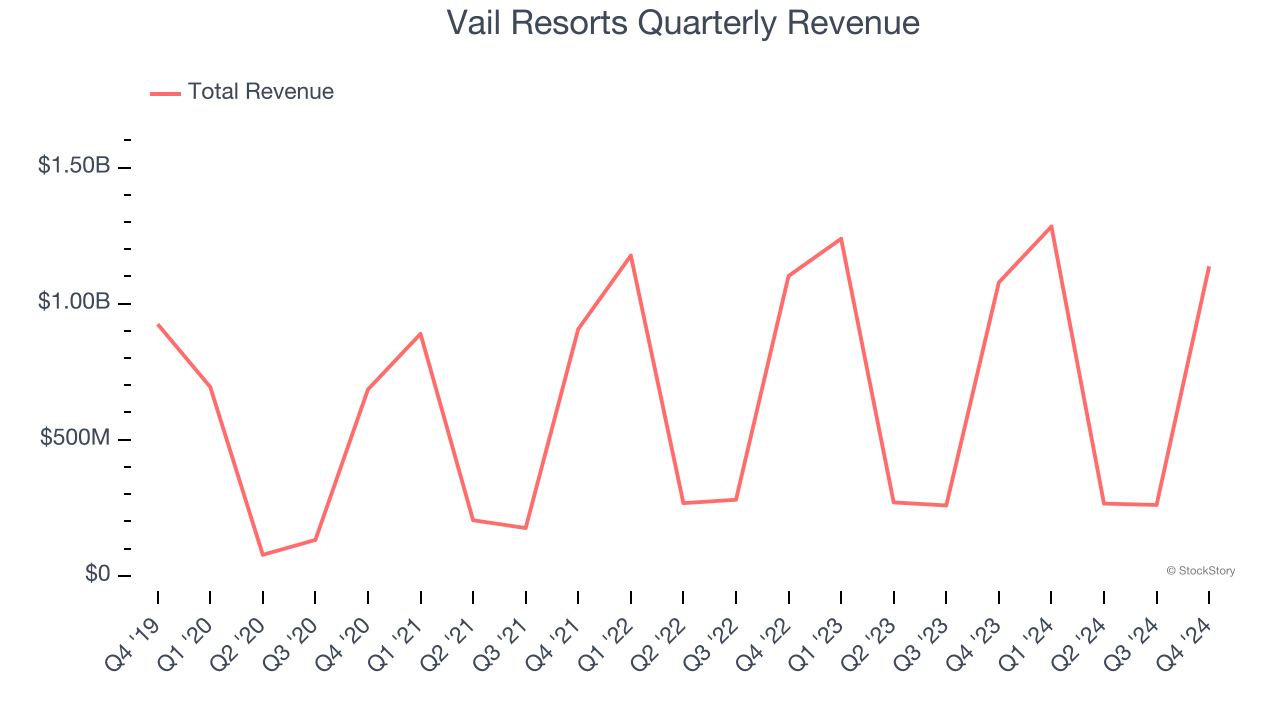

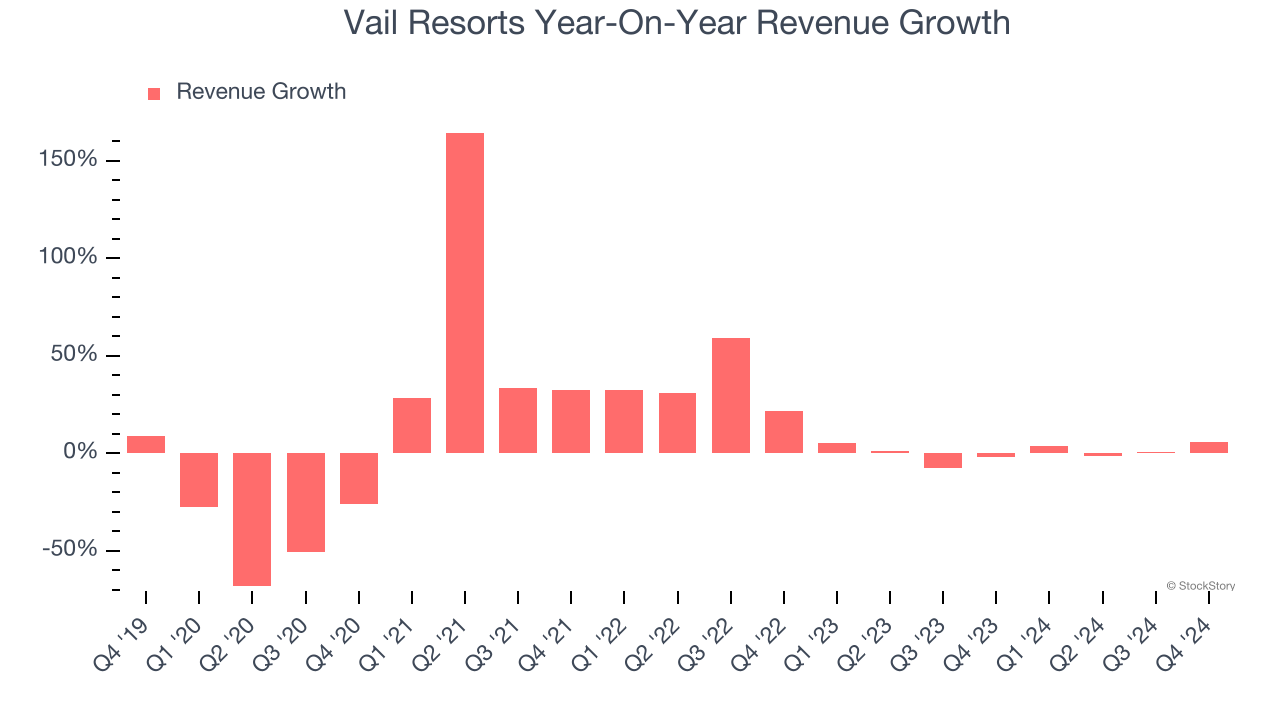

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Vail Resorts’s sales grew at a sluggish 4.2% compounded annual growth rate over the last five years. This was below our standard for the consumer discretionary sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Vail Resorts’s recent history shows its demand has slowed as its annualized revenue growth of 2.1% over the last two years was below its five-year trend. Note that COVID hurt Vail Resorts’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

Vail Resorts also discloses its number of skier visits, which reached 7.76 million in the latest quarter. Over the last two years, Vail Resorts’s skier visits averaged 10.9% year-on-year declines. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Vail Resorts grew its revenue by 5.5% year on year, and its $1.14 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

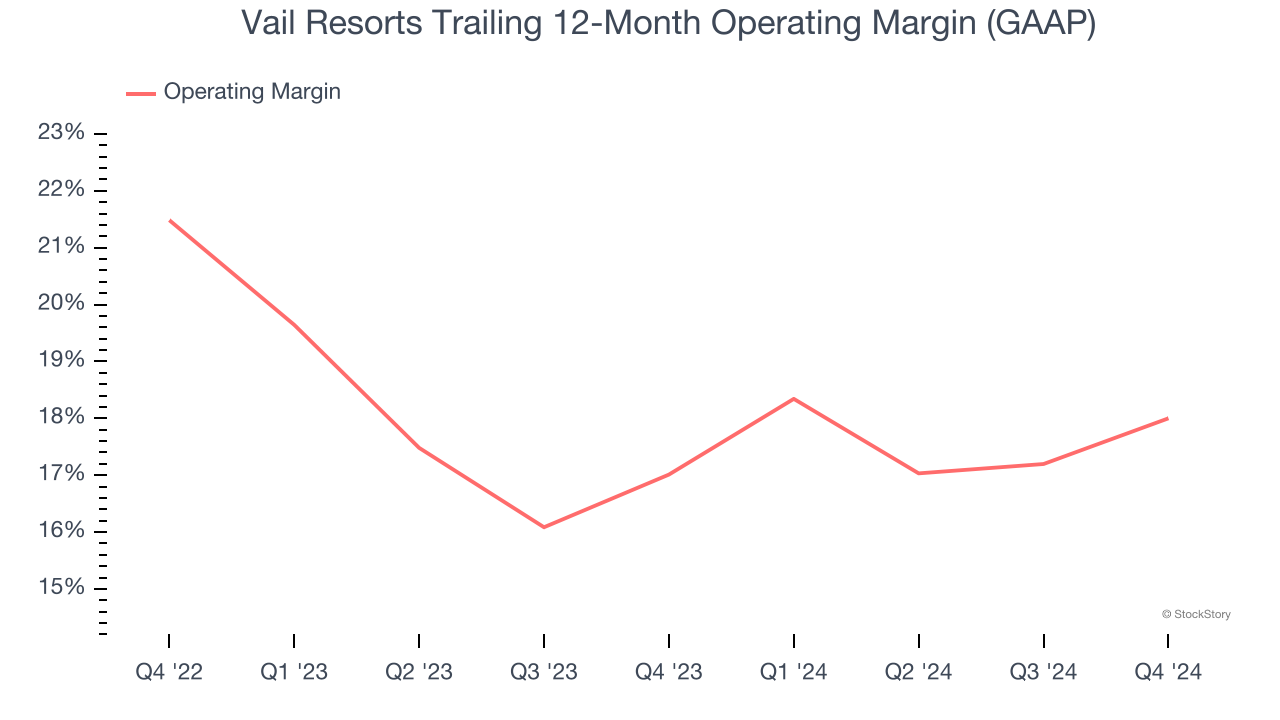

Operating Margin

Vail Resorts’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 17.5% over the last two years. This profitability was top-notch for a consumer discretionary business, showing it’s an well-run company with an efficient cost structure.

In Q4, Vail Resorts generated an operating profit margin of 33.8%, up 1.3 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

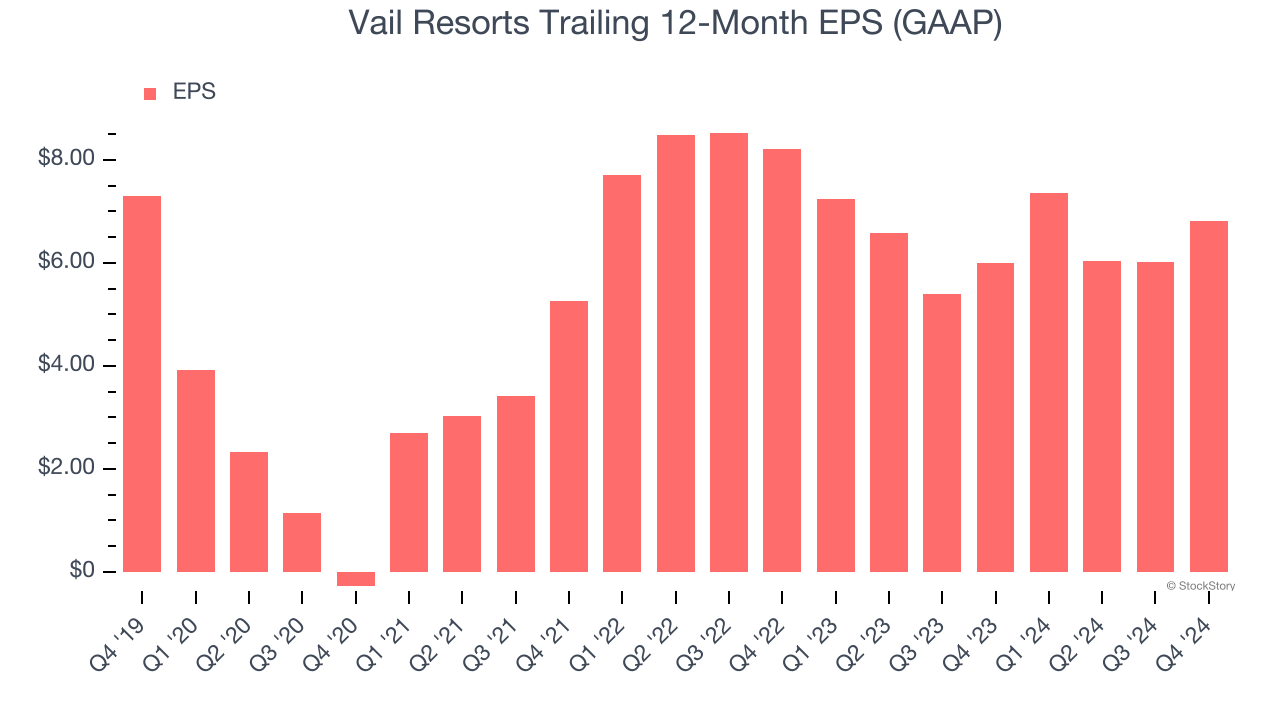

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Vail Resorts, its EPS declined by 1.4% annually over the last five years while its revenue grew by 4.2%. However, its operating margin didn’t change during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

In Q4, Vail Resorts reported EPS at $6.56, up from $5.76 in the same quarter last year. This print beat analysts’ estimates by 3.8%. Over the next 12 months, Wall Street expects Vail Resorts’s full-year EPS of $6.82 to grow 19.2%.

Key Takeaways from Vail Resorts’s Q4 Results

It encouraging to see Vail Resorts narrowly top analysts’ skier visits expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a decent quarter featuring some areas of strength. The stock traded up 3.9% to $159.62 immediately following the results.

So do we think Vail Resorts is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.