Building systems company Limbach (NASDAQ: LMB) fell short of the market’s revenue expectations in Q4 CY2024, with sales flat year on year at $143.7 million. On the other hand, the company’s full-year revenue guidance of $620 million at the midpoint came in 3.8% above analysts’ estimates. Its non-GAAP profit of $1.15 per share was 49.4% above analysts’ consensus estimates.

Is now the time to buy Limbach? Find out by accessing our full research report, it’s free.

Limbach (LMB) Q4 CY2024 Highlights:

- Revenue: $143.7 million vs analyst estimates of $149.4 million (flat year on year, 3.8% miss)

- Adjusted EPS: $1.15 vs analyst estimates of $0.77 (49.4% beat)

- Adjusted EBITDA: $20.82 million vs analyst estimates of $18.01 million (14.5% margin, 15.6% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $620 million at the midpoint, beating analyst estimates by 3.8% and implying 19.5% growth (vs 0.4% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $80 million at the midpoint, above analyst estimates of $73.17 million

- Operating Margin: 9.1%, up from 6.5% in the same quarter last year

- Free Cash Flow Margin: 12.5%, up from 9.4% in the same quarter last year

- Market Capitalization: $819.4 million

“In 2024, we produced record gross profit, record net income and record adjusted EBITDA by expanding and strengthening customer relationships in six verticals – healthcare, industrial and manufacturing, data centers, life science, higher education and cultural and entertainment,” Michael McCann, President and Chief Executive Officer of Limbach Holdings, said.

Company Overview

Established in 1901, Limbach (NASDAQ: LMB) provides integrated building systems solutions, including mechanical, electrical, and plumbing services.

Construction and Maintenance Services

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years–. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

Sales Growth

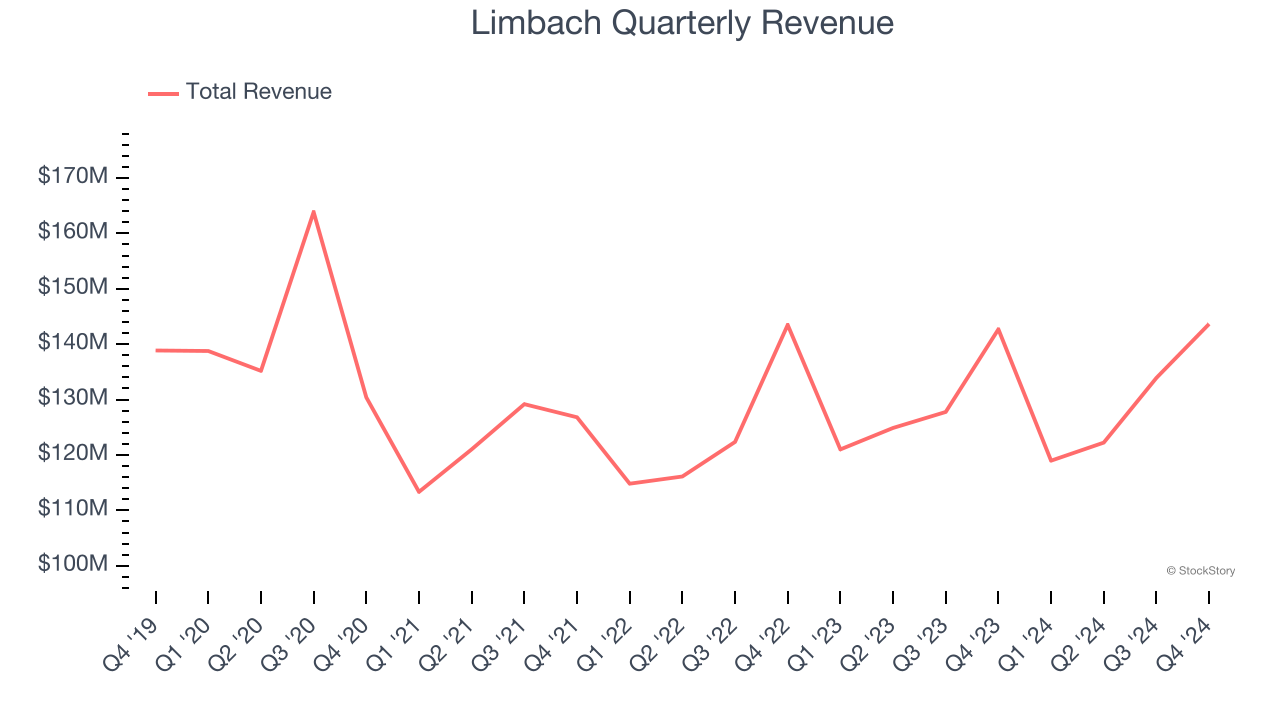

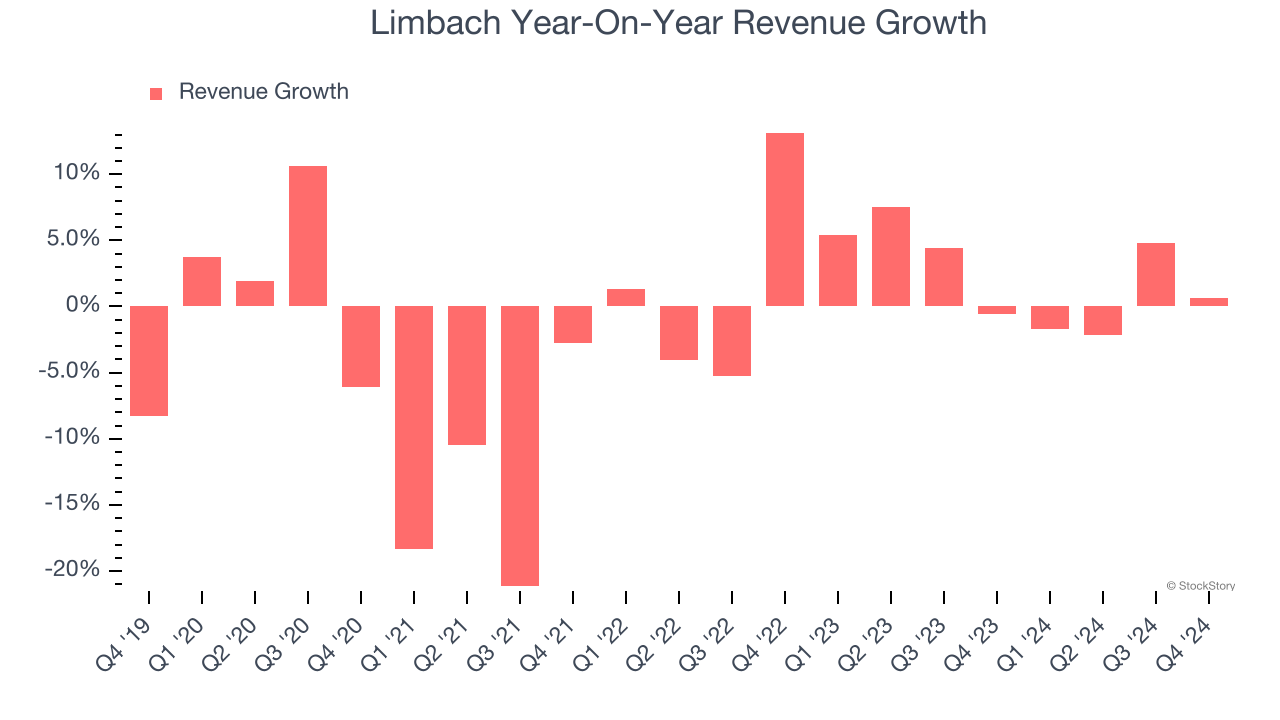

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Limbach struggled to consistently generate demand over the last five years as its sales dropped at a 1.3% annual rate. This was below our standards and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Limbach’s annualized revenue growth of 2.2% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Limbach’s $143.7 million of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 13.6% over the next 12 months, an improvement versus the last two years. This projection is healthy and suggests its newer products and services will catalyze better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

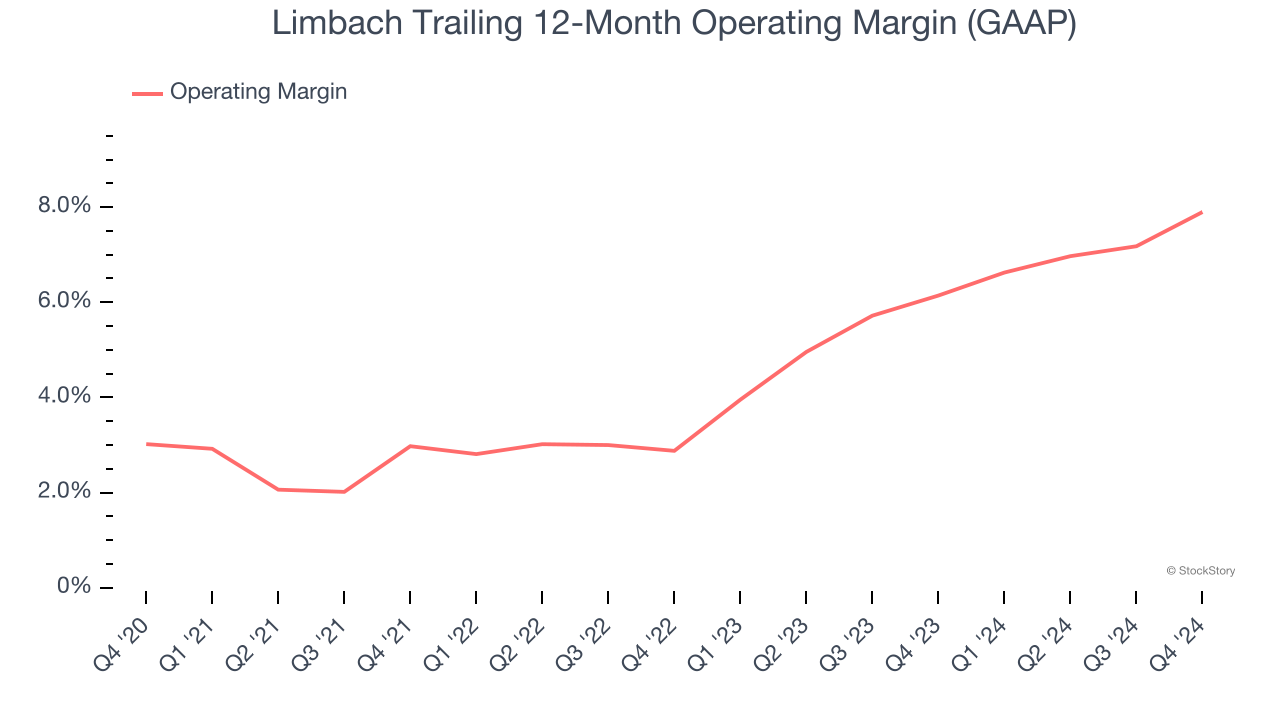

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Limbach was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.6% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Limbach’s operating margin rose by 4.9 percentage points over the last five years.

This quarter, Limbach generated an operating profit margin of 9.1%, up 2.6 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Earnings Per Share

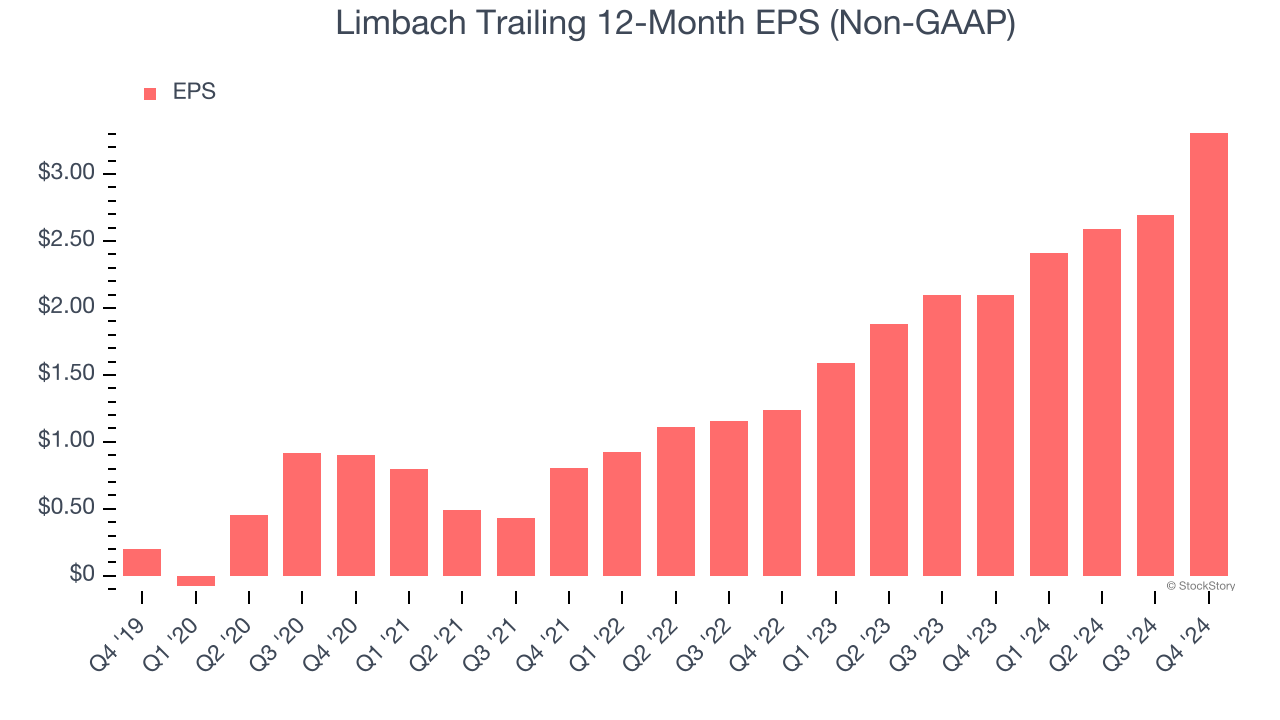

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Limbach’s EPS grew at an astounding 74.9% compounded annual growth rate over the last five years, higher than its 1.3% annualized revenue declines. This tells us management adapted its cost structure in response to a challenging demand environment.

We can take a deeper look into Limbach’s earnings to better understand the drivers of its performance. As we mentioned earlier, Limbach’s operating margin expanded by 4.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Limbach, its two-year annual EPS growth of 63.5% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, Limbach reported EPS at $1.15, up from $0.54 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Limbach’s full-year EPS of $3.31 to shrink by 6.3%.

Key Takeaways from Limbach’s Q4 Results

Revenue missed but EBITDA beat. Looking ahead, full-year revenue and EBITDA guidance were both ahead. It wasn't a perfect quarter, but it was a solid one. The stock remained flat at $68.92 immediately after reporting.

Sure, Limbach had a solid quarter, but if we look at the bigger picture, is this stock a buy? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.