Vehicle systems manufacturer Commercial Vehicle Group (NASDAQ: CVGI) reported Q4 CY2024 results exceeding the market’s revenue expectations, but sales fell by 26.8% year on year to $163.3 million. The company expects the full year’s revenue to be around $690 million, close to analysts’ estimates. Its non-GAAP loss of $0.15 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Commercial Vehicle Group? Find out by accessing our full research report, it’s free.

Commercial Vehicle Group (CVGI) Q4 CY2024 Highlights:

- Revenue: $163.3 million vs analyst estimates of $158.4 million (26.8% year-on-year decline, 3.1% beat)

- Adjusted EPS: -$0.15 vs analyst estimates of -$0.08 (significant miss)

- Adjusted EBITDA: $900,000 vs analyst estimates of $660,000 (0.6% margin, relatively in line)

- Management’s revenue guidance for the upcoming financial year 2025 is $690 million at the midpoint, in line with analyst expectations and implying -13.4% growth (vs -16.5% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $27.5 million at the midpoint, above analyst estimates of $26.01 million

- Operating Margin: -3.2%, down from 2.5% in the same quarter last year

- Free Cash Flow was -$21.2 million, down from $3.79 million in the same quarter last year

- Market Capitalization: $65.67 million

James Ray, President and Chief Executive Officer, said, “2024 was a year of meaningful change for CVG. Over the course of the year, we undertook immediate and decisive actions, including the divestitures of non-strategic assets and businesses, and improvement initiatives that we believe position us for future accretive growth. Even in the face of continued external market headwinds, we believe the improvement initiatives executed in 2024 will unlock significant operational efficiencies that we have already started to benefit from in 2025. Additionally, we were pleased to open our new Morocco facility and we continue to ramp up our facility in Aldama, Mexico.”

Company Overview

Formed from a partnership between two distinct companies, CVG (NASDAQ: CVGI) offers various components used in vehicles and systems used in warehouses.

Heavy Transportation Equipment

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

Sales Growth

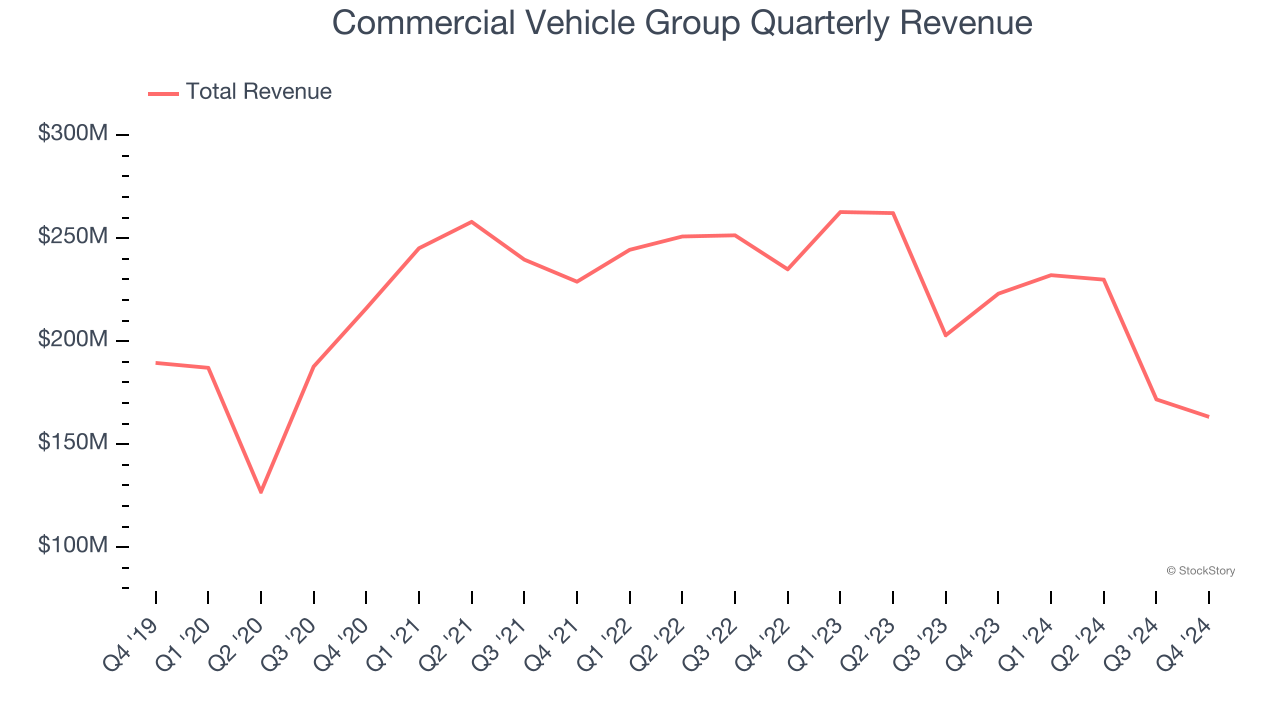

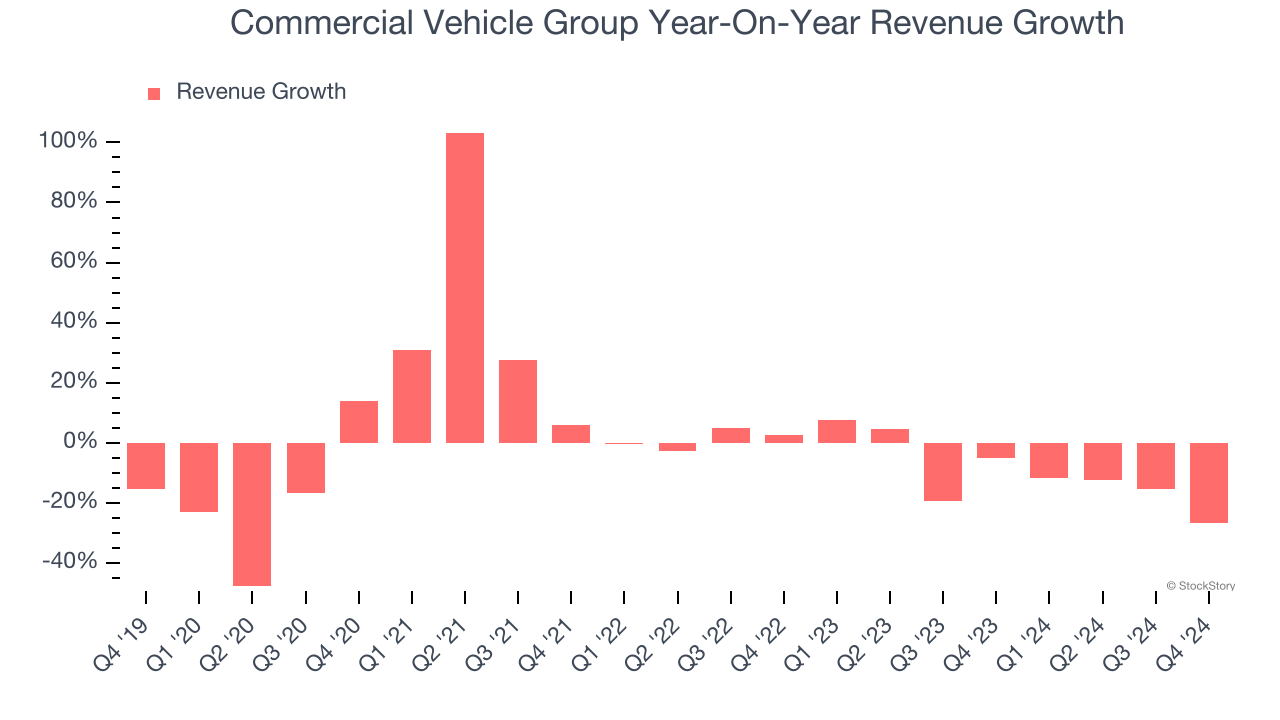

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Commercial Vehicle Group struggled to consistently generate demand over the last five years as its sales dropped at a 2.4% annual rate. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Commercial Vehicle Group’s recent history shows its demand remained suppressed as its revenue has declined by 9.9% annually over the last two years.

This quarter, Commercial Vehicle Group’s revenue fell by 26.8% year on year to $163.3 million but beat Wall Street’s estimates by 3.1%.

Looking ahead, sell-side analysts expect revenue to decline by 14.6% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

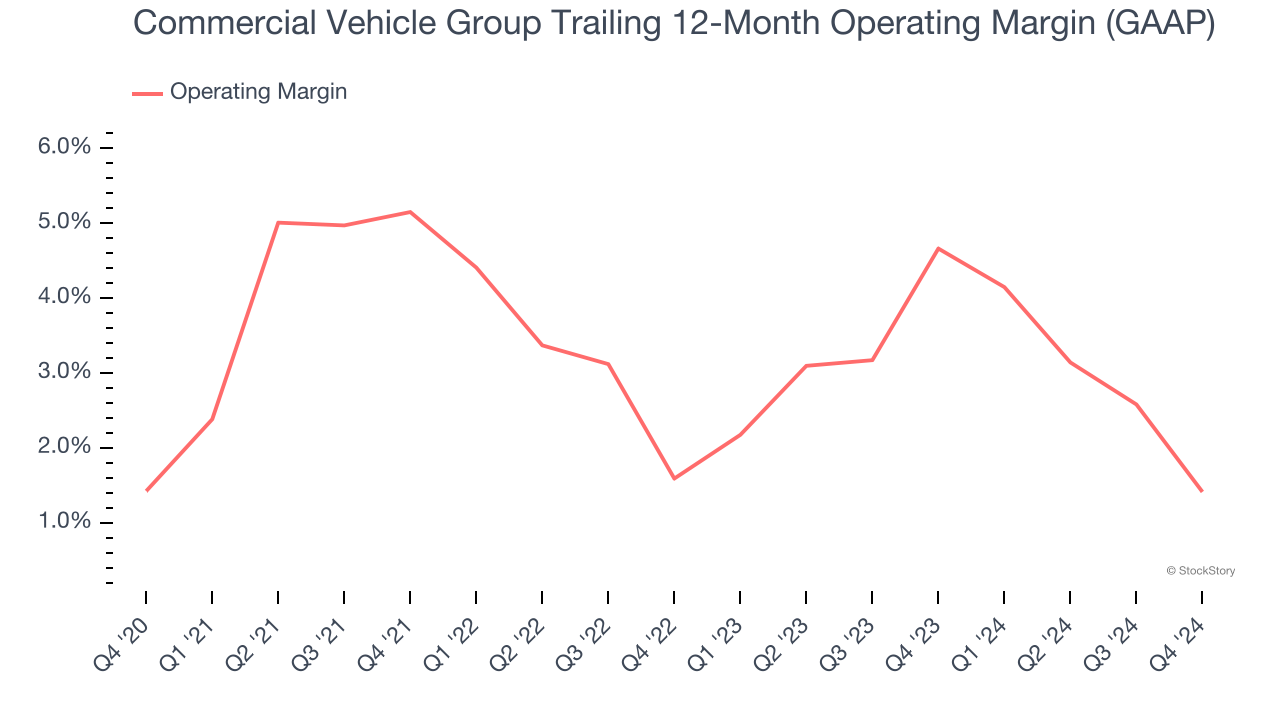

Commercial Vehicle Group was profitable over the last five years but held back by its large cost base. Its average operating margin of 3% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Commercial Vehicle Group’s operating margin might fluctuated slightly but has generally stayed the same over the last five years, meaning it will take a fundamental shift in the business model to change.

In Q4, Commercial Vehicle Group generated an operating profit margin of negative 3.2%, down 5.7 percentage points year on year. Since Commercial Vehicle Group’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

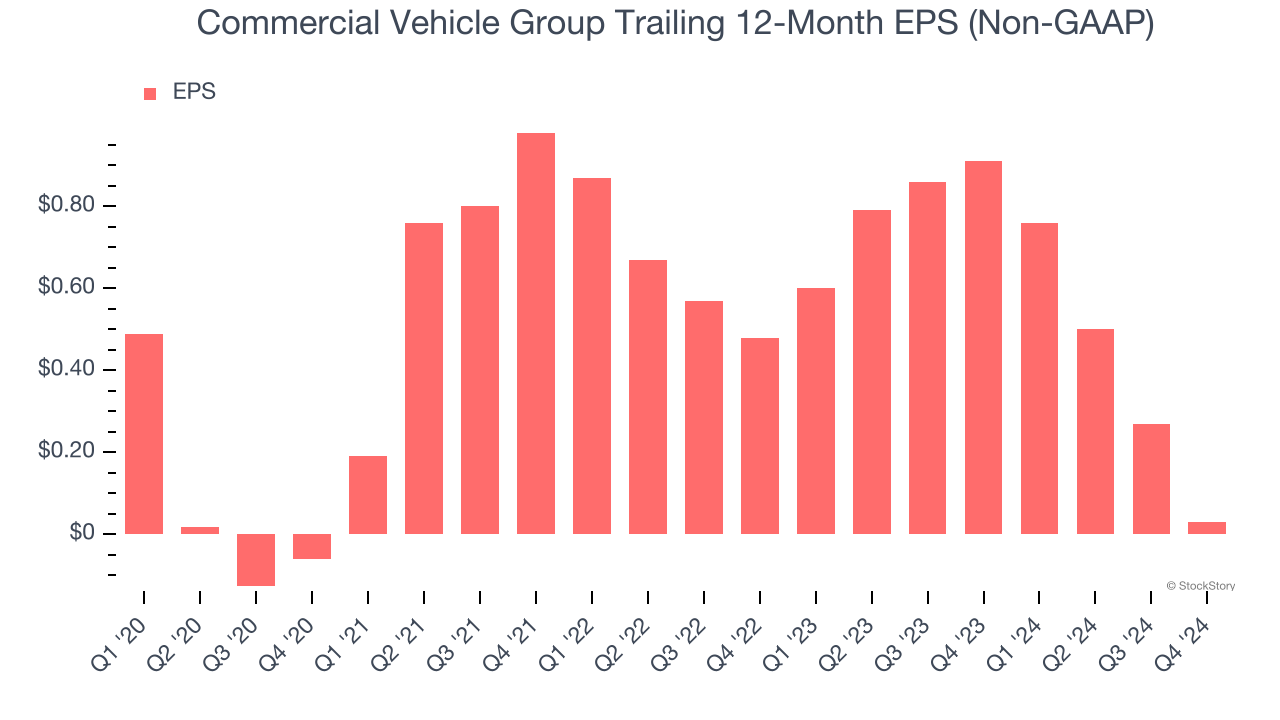

Sadly for Commercial Vehicle Group, its EPS declined by 17.2% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

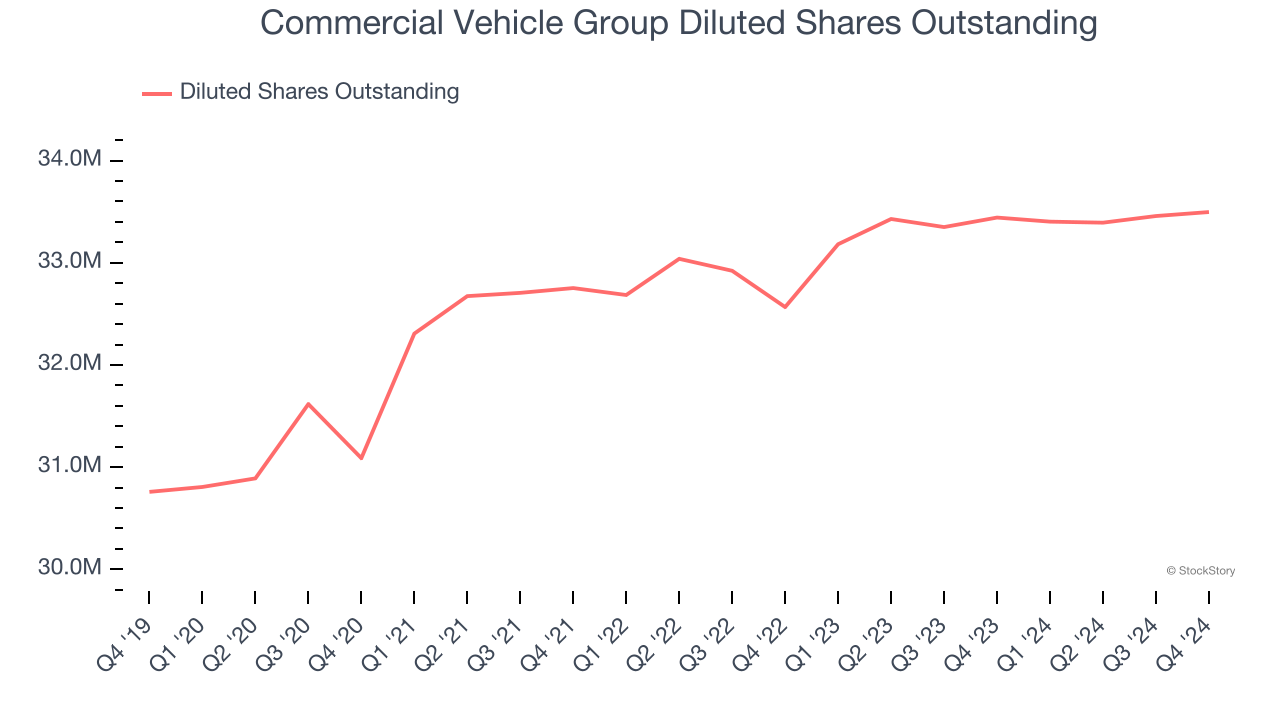

We can take a deeper look into Commercial Vehicle Group’s earnings to better understand the drivers of its performance. A five-year view shows Commercial Vehicle Group has diluted its shareholders, growing its share count by 8.9%. This has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Commercial Vehicle Group, its two-year annual EPS declines of 75% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Commercial Vehicle Group reported EPS at negative $0.15, down from $0.09 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Commercial Vehicle Group to perform poorly. Analysts forecast its full-year EPS of $0.03 will hit $0.09.

Key Takeaways from Commercial Vehicle Group’s Q4 Results

We were impressed by how significantly Commercial Vehicle Group blew past analysts’ revenue and EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance trumped Wall Street’s estimates. On the other hand, its EPS missed significantly. Still, we think this was still a solid quarter with some key areas of upside. The stock remained flat at $1.87 immediately following the results.

So should you invest in Commercial Vehicle Group right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.