Manufacturing services provider Proto Labs (NYSE: PRLB) reported Q4 CY2024 results beating Wall Street’s revenue expectations, but sales fell by 2.6% year on year to $121.8 million. On the other hand, next quarter’s revenue guidance of $124 million was less impressive, coming in 1.1% below analysts’ estimates. Its non-GAAP profit of $0.38 per share was 18.8% above analysts’ consensus estimates.

Is now the time to buy Proto Labs? Find out by accessing our full research report, it’s free.

Proto Labs (PRLB) Q4 CY2024 Highlights:

- Revenue: $121.8 million vs analyst estimates of $120.3 million (2.6% year-on-year decline, 1.2% beat)

- Adjusted EPS: $0.38 vs analyst estimates of $0.32 (18.8% beat)

- Adjusted EBITDA: $16.86 million vs analyst estimates of $16.86 million (13.8% margin, in line)

- Revenue Guidance for Q1 CY2025 is $124 million at the midpoint, below analyst estimates of $125.4 million

- Adjusted EPS guidance for Q1 CY2025 is $0.30 at the midpoint, below analyst estimates of $0.34

- Operating Margin: -1.2%, down from 6.7% in the same quarter last year

- Free Cash Flow was $16.46 million, up from -$947,000 in the same quarter last year

- Market Capitalization: $1.09 billion

“2024 was a transformational year for Protolabs, and we delivered strong financial results, including expanded gross margins, increased earnings per share, and grew our industry-leading cash flow,” said Rob Bodor, President and Chief Executive Officer.

Company Overview

Pioneering the concept of online quoting and manufacturing for custom prototypes and low-volume production parts, Proto Labs (NYSE: PRLB) offers injection molding, 3D printing, and sheet metal fabrication for manufacturers in various industries.

Custom Parts Manufacturing

Onshoring and inventory management–themes that grew in focus after COVID wreaked havoc on global supply chains–are tailwinds for companies that combine economies of scale with reliable service. Many in the space have adopted 3D printing to efficiently address the need for bespoke parts and components, but all companies are still at the whim of economic cycles. For example, consumer spending and interest rates can greatly impact the industrial production that drives demand for these companies’ offerings.

Sales Growth

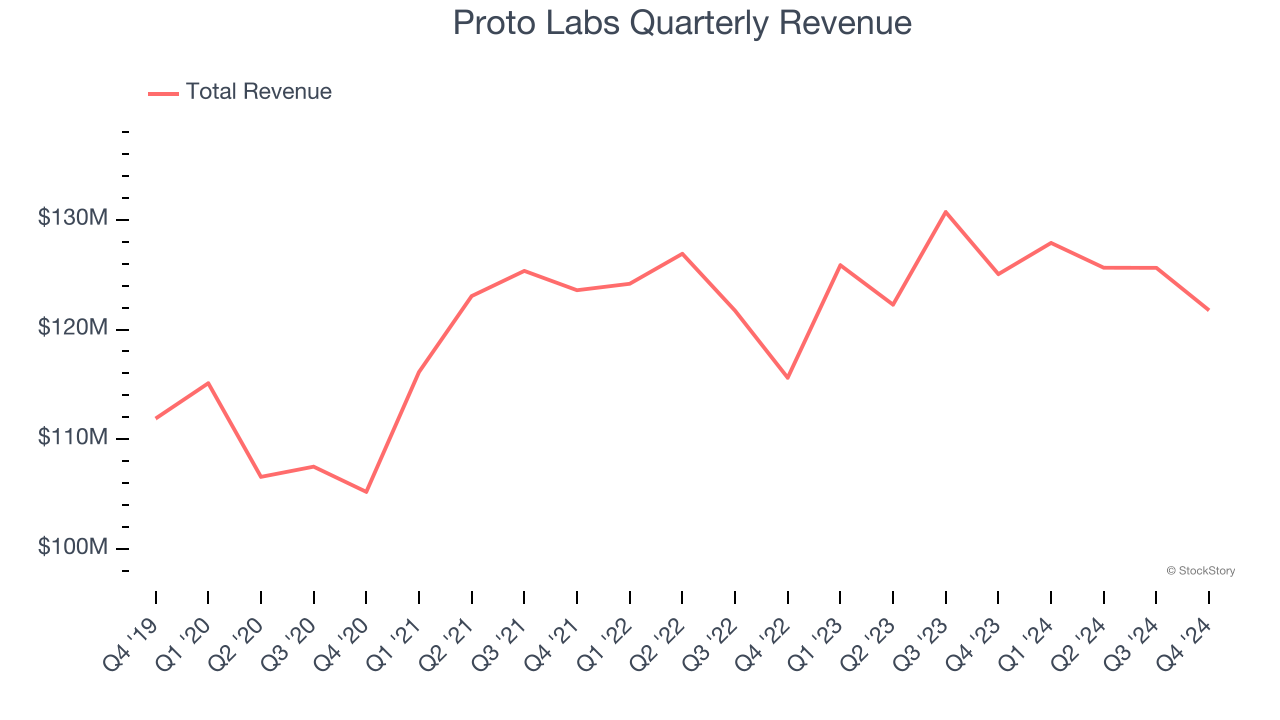

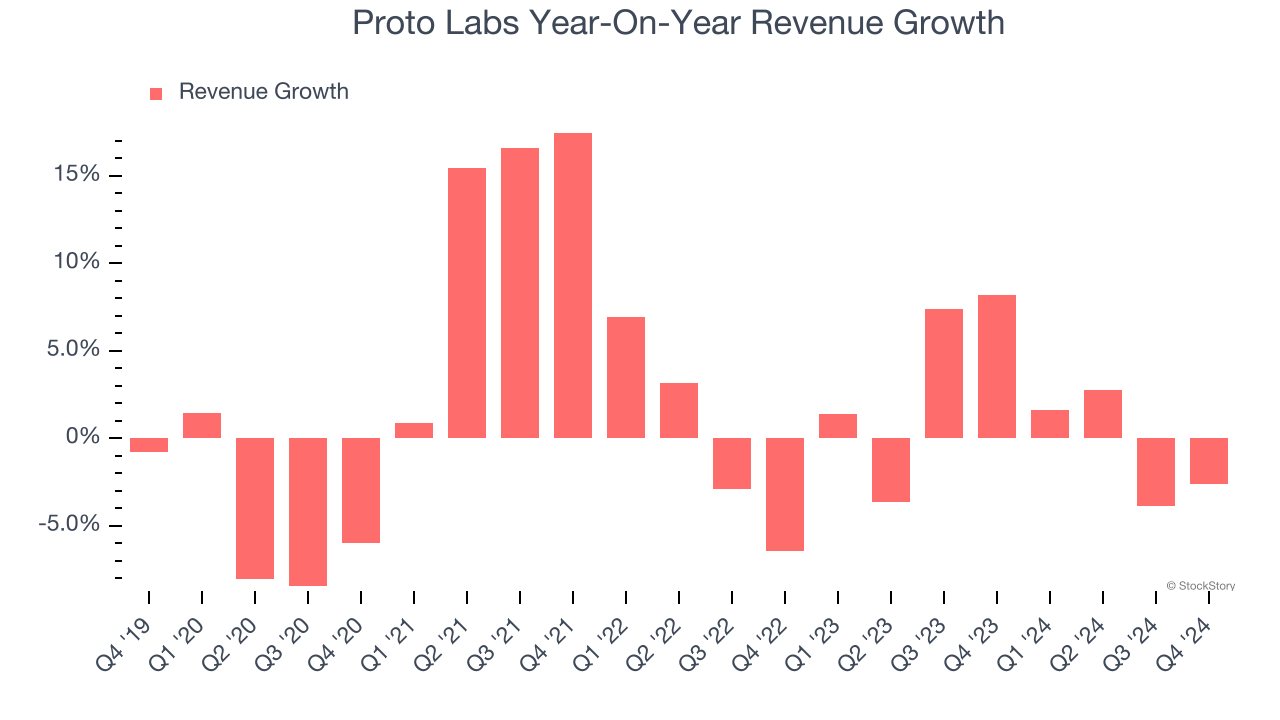

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Proto Labs’s sales grew at a sluggish 1.8% compounded annual growth rate over the last five years. This fell short of our benchmarks and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Proto Labs’s annualized revenue growth of 1.3% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

We can better understand the company’s revenue dynamics by analyzing its three most important segments: Injection Molding , CNC Machining , and 3D Printing, which are 37.5%, 43%, and 16% of revenue. Over the last two years, Proto Labs’s Injection Molding revenue (injection molds and parts) averaged 1.2% year-on-year declines, but its CNC Machining (custom CNC-machined parts) and 3D Printing (custom 3D-printed parts) revenues averaged 4.8% and 3% growth.

This quarter, Proto Labs’s revenue fell by 2.6% year on year to $121.8 million but beat Wall Street’s estimates by 1.2%. Company management is currently guiding for a 3% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.6% over the next 12 months, similar to its two-year rate. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

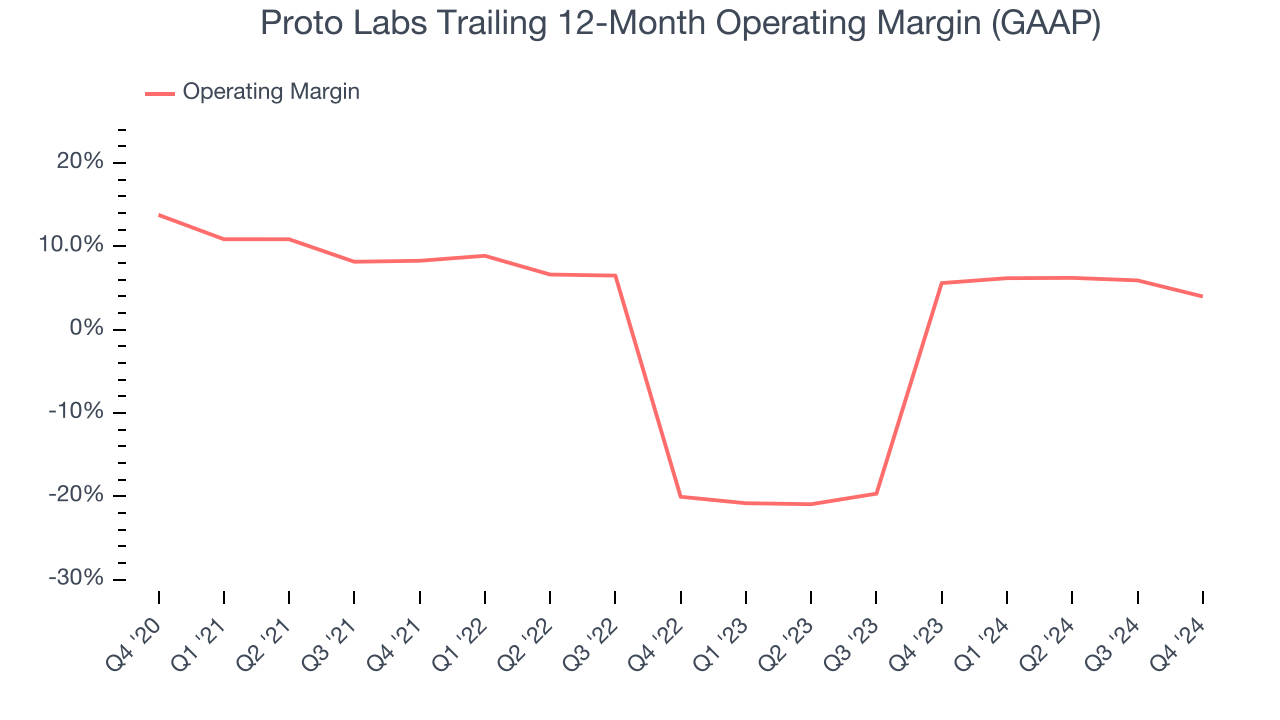

Proto Labs was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.1% was weak for an industrials business. This result is surprising given its high gross margin as a starting point.

Analyzing the trend in its profitability, Proto Labs’s operating margin decreased by 9.8 percentage points over the last five years. The company’s performance was poor no matter how you look at it - it shows operating expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Proto Labs generated an operating profit margin of negative 1.2%, down 7.9 percentage points year on year. Since Proto Labs’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

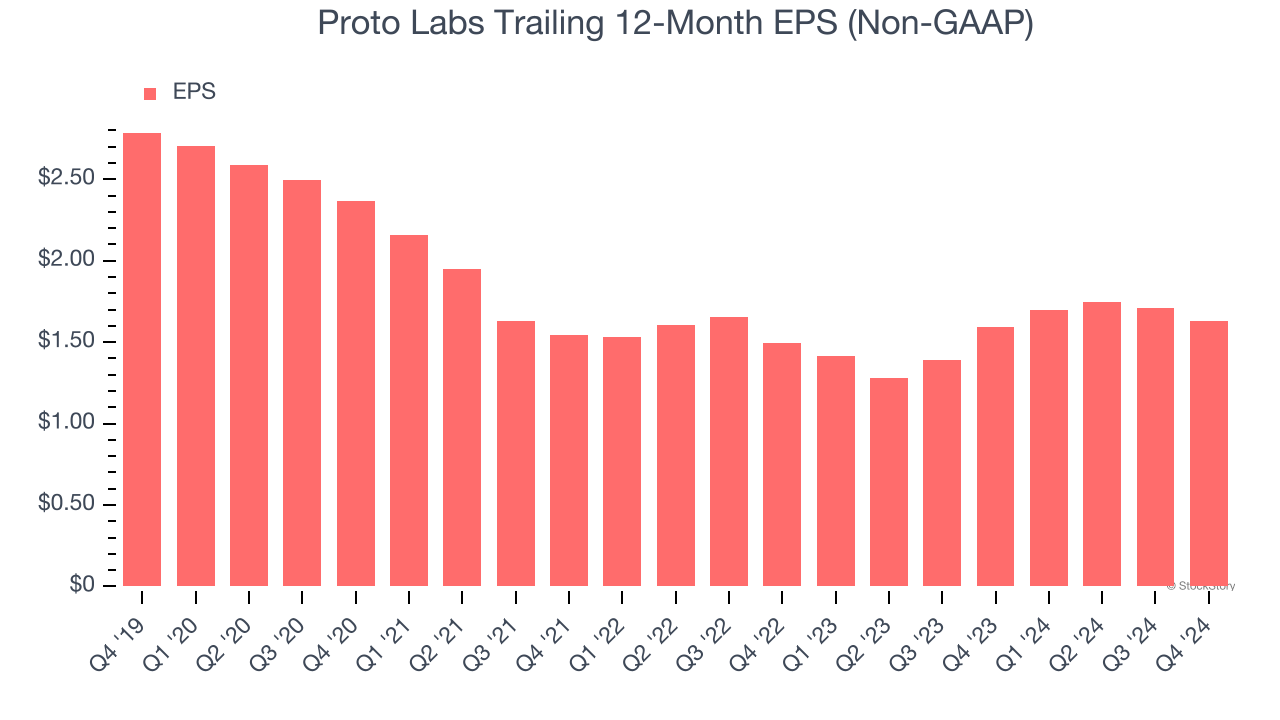

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Proto Labs, its EPS declined by 10.2% annually over the last five years while its revenue grew by 1.8%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of Proto Labs’s earnings can give us a better understanding of its performance. As we mentioned earlier, Proto Labs’s operating margin declined by 9.8 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Proto Labs, its two-year annual EPS growth of 4.4% was higher than its five-year trend. Accelerating earnings growth is almost always an encouraging data point.

In Q4, Proto Labs reported EPS at $0.38, down from $0.46 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Proto Labs’s full-year EPS of $1.63 to shrink by 7.9%.

Key Takeaways from Proto Labs’s Q4 Results

We enjoyed seeing Proto Labs exceed analysts’ revenue and EPS expectations this quarter. On the other hand, its quarterly guidance for both metrics fell short of Wall Street’s estimates. Overall, this quarter was mixed. The areas below expectations seem to be driving the move, and the stock traded down 5.2% to $42 immediately following the results.

Is Proto Labs an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.