Pharmaceutical company Amneal Pharmaceuticals (NASDAQ: AMRX) reported Q4 CY2024 results beating Wall Street’s revenue expectations, with sales up 18.4% year on year to $730.5 million. The company’s full-year revenue guidance of $3.05 billion at the midpoint came in 4.5% above analysts’ estimates. Its non-GAAP profit of $0.12 per share was 21.1% below analysts’ consensus estimates.

Is now the time to buy Amneal? Find out by accessing our full research report, it’s free.

Amneal (AMRX) Q4 CY2024 Highlights:

- Revenue: $730.5 million vs analyst estimates of $706.6 million (18.4% year-on-year growth, 3.4% beat)

- Adjusted EPS: $0.12 vs analyst expectations of $0.15 (21.1% miss)

- Adjusted EBITDA: $155.3 million vs analyst estimates of $154.6 million (21.3% margin, in line)

- Management’s revenue guidance for the upcoming financial year 2025 is $3.05 billion at the midpoint, beating analyst estimates by 4.5% and implying 9.2% growth (vs 16.8% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $0.68 at the midpoint, missing analyst estimates by 5.1%

- EBITDA guidance for the upcoming financial year 2025 is $662.5 million at the midpoint, above analyst estimates of $654.5 million

- Operating Margin: 10.4%, up from 2.3% in the same quarter last year

- Free Cash Flow Margin: 14.1%, down from 20.4% in the same quarter last year

- Market Capitalization: $2.60 billion

Company Overview

Founded in 2002, Amneal Pharmaceuticals (NASDAQ: AMRX) develops, manufactures, and distributes a diverse portfolio of pharmaceuticals.

Generic Pharmaceuticals

The generic pharmaceutical industry operates on a volume-driven, low-cost business model, producing bioequivalent versions of branded drugs once their patents expire. These companies benefit from consistent demand for affordable medications, as they are critical to reducing healthcare costs. Generics typically face lower R&D expenses and shorter regulatory approval timelines compared to branded drug makers, enabling cost efficiencies. However, the industry is highly competitive, with intense pricing pressures, thin margins, and frequent legal challenges from branded pharmaceutical companies over patent disputes. Looking ahead, the industry is supported by tailwinds such as the role of AI in streamlining drug development (reverse engineering complex formulations) and manufacturing efficiency (optimize processes and remove inefficiencies). Governments and insurers' focus on reducing drug costs can also boost generics' adoption. However, headwinds include escalating pricing pressure from large buyers like pharmacy chains and healthcare distributors as well as evolving regulatory hurdles.

Sales Growth

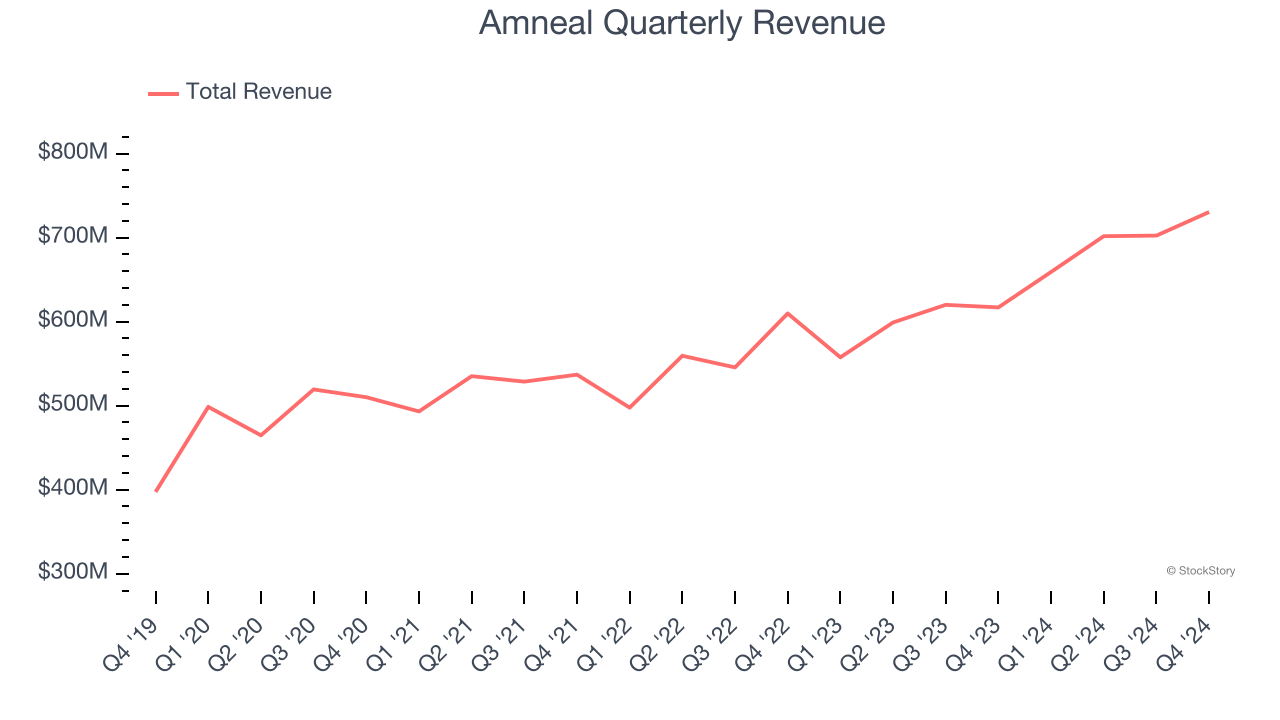

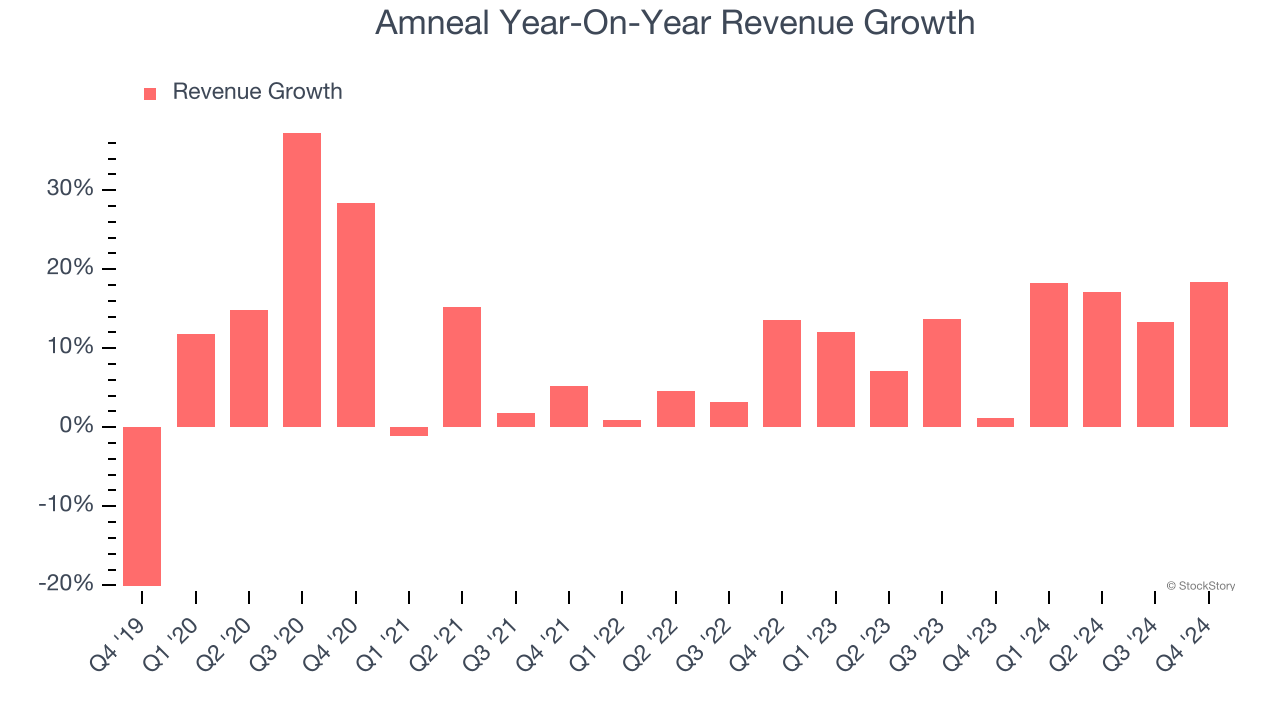

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Thankfully, Amneal’s 11.4% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Amneal’s annualized revenue growth of 12.4% over the last two years aligns with its five-year trend, suggesting its demand was stable.

This quarter, Amneal reported year-on-year revenue growth of 18.4%, and its $730.5 million of revenue exceeded Wall Street’s estimates by 3.4%.

Looking ahead, sell-side analysts expect revenue to grow 2.3% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

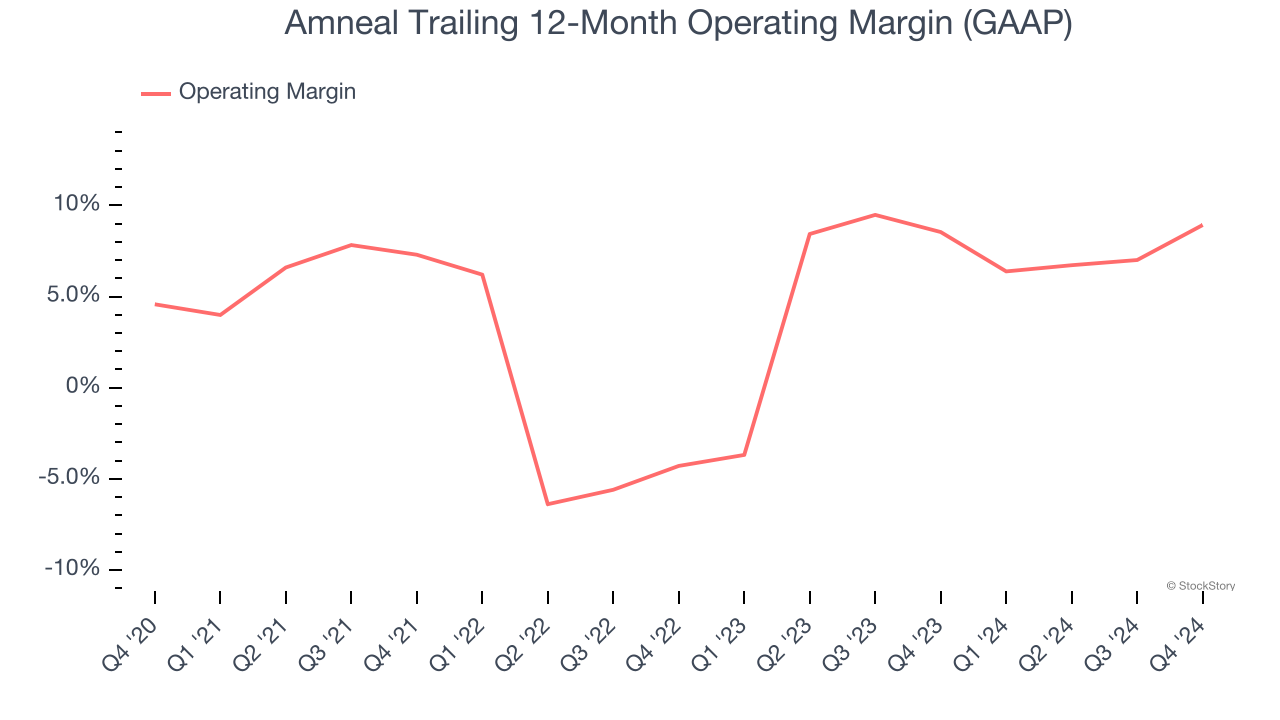

Amneal was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.2% was weak for a healthcare business.

On the plus side, Amneal’s operating margin rose by 4.3 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 13.2 percentage points on a two-year basis.

In Q4, Amneal generated an operating profit margin of 10.4%, up 8.1 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

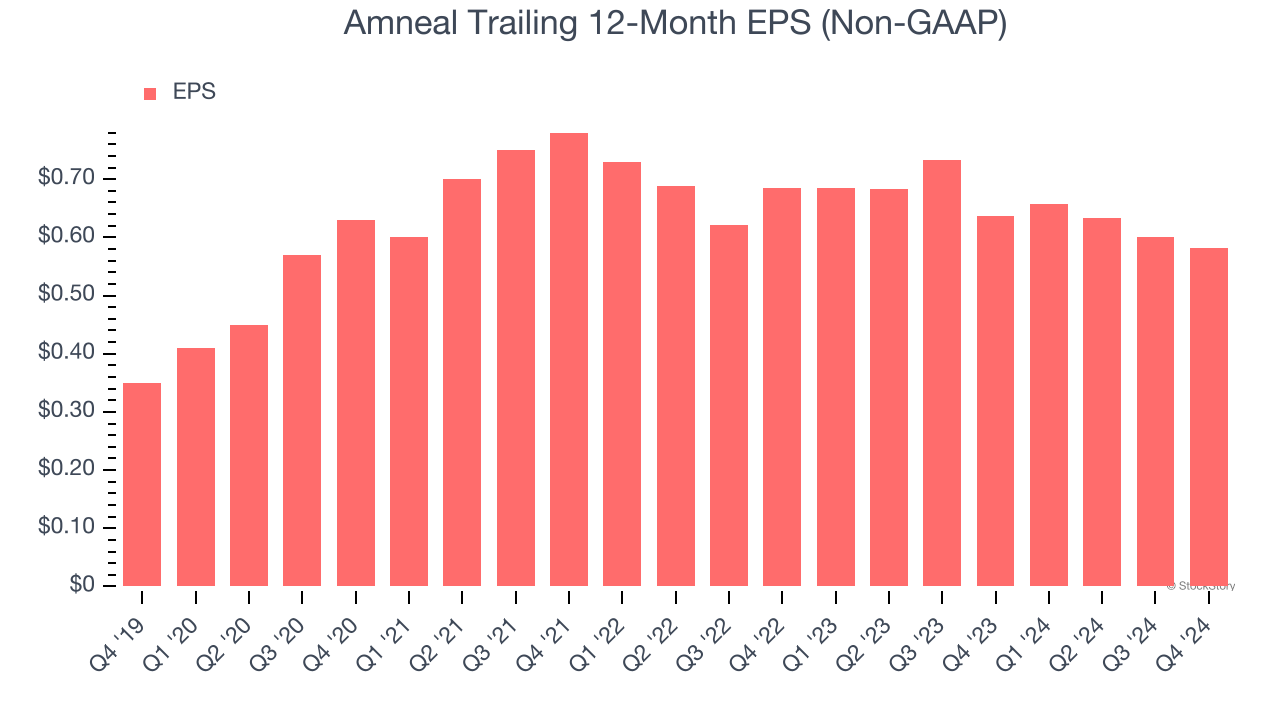

Amneal’s remarkable 10.7% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

In Q4, Amneal reported EPS at $0.12, down from $0.14 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Amneal’s full-year EPS of $0.58 to grow 19.5%.

Key Takeaways from Amneal’s Q4 Results

We were impressed by Amneal’s optimistic full-year revenue guidance, which blew past analysts’ expectations. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed significantly and its EPS fell short of Wall Street’s estimates. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock traded up 3.3% to $8.65 immediately following the results.

So do we think Amneal is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.