Healthcare solutions company Evolent Health (NYSE: EVH) fell short of the market’s revenue expectations in Q4 CY2024, but sales rose 16.3% year on year to $646.5 million. Next quarter’s revenue guidance of $455 million underwhelmed, coming in 22.7% below analysts’ estimates. Its non-GAAP loss of $0.02 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Evolent Health? Find out by accessing our full research report, it’s free.

Evolent Health (EVH) Q4 CY2024 Highlights:

- Revenue: $646.5 million vs analyst estimates of $650.8 million (16.3% year-on-year growth, 0.7% miss)

- Adjusted EPS: -$0.02 vs analyst estimates of $0.01 (significant miss)

- Adjusted EBITDA: $22.61 million vs analyst estimates of $24.41 million (3.5% margin, 7.4% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $2.09 billion at the midpoint, missing analyst estimates by 14% and implying -18.4% growth (vs 31.3% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $150 million at the midpoint, below analyst estimates of $161.7 million

- Operating Margin: -2.9%, in line with the same quarter last year

- Free Cash Flow was -$32.38 million, down from $83.33 million in the same quarter last year

- Sales Volumes fell 99.9% year on year (380% in the same quarter last year)

- Market Capitalization: $1.21 billion

Seth Blackley, Co-Founder and Chief Executive Officer of Evolent stated, "Evolent delivered fourth quarter and 2024 full-year results within the outlook range we provided in November, despite continued elevated oncology costs during the quarter. We also ended the year with 100% retention across our top customers which together represent over 90% of our 2024 revenue. Looking ahead, the recent changes we made in certain of our Performance Suite contracts as well as our assumptions for medical cost inflation make us feel confident in our financial outlook. Finally, we believe Evolent remains an incredibly unique asset; We have a strong team, a product that our customers value and a clinical approach that both manages healthcare affordability while also enabling the kind of care we would want for our family members."

Company Overview

Founded in 2011, Evolent Health (NYSE: EVH) provides services to health systems (e.g. hospitals) and payers (e.g. insurance companies, government programs such as Medicare) focusing on improving care delivery and cost efficiency.

Healthcare Technology for Providers

The healthcare technology industry focuses on delivering software, data analytics, and workflow solutions to hospitals, clinics, and other care facilities. These companies enable providers to streamline operations, optimize patient outcomes, and transition to value-based care models. They boast subscription-based revenues or long-term contracts, providing financial stability and growth potential. However, they face challenges such as lengthy sales cycles, significant upfront investment in technology development, and reliance on providers’ adoption of new tools, which can be hindered by budget constraints or resistance to change. Over the next few years, the sector is poised for growth as providers increasingly prioritize digital transformation and efficiency in response to rising healthcare costs and patient demand for seamless care. Tailwinds include the growing adoption of AI-driven tools for patient engagement and operational improvements, government incentives for digitization, and the expansion of telehealth and remote patient monitoring. However, headwinds such as tightening hospital budgets, cybersecurity threats, and the fragmented nature of healthcare systems could slow adoption.

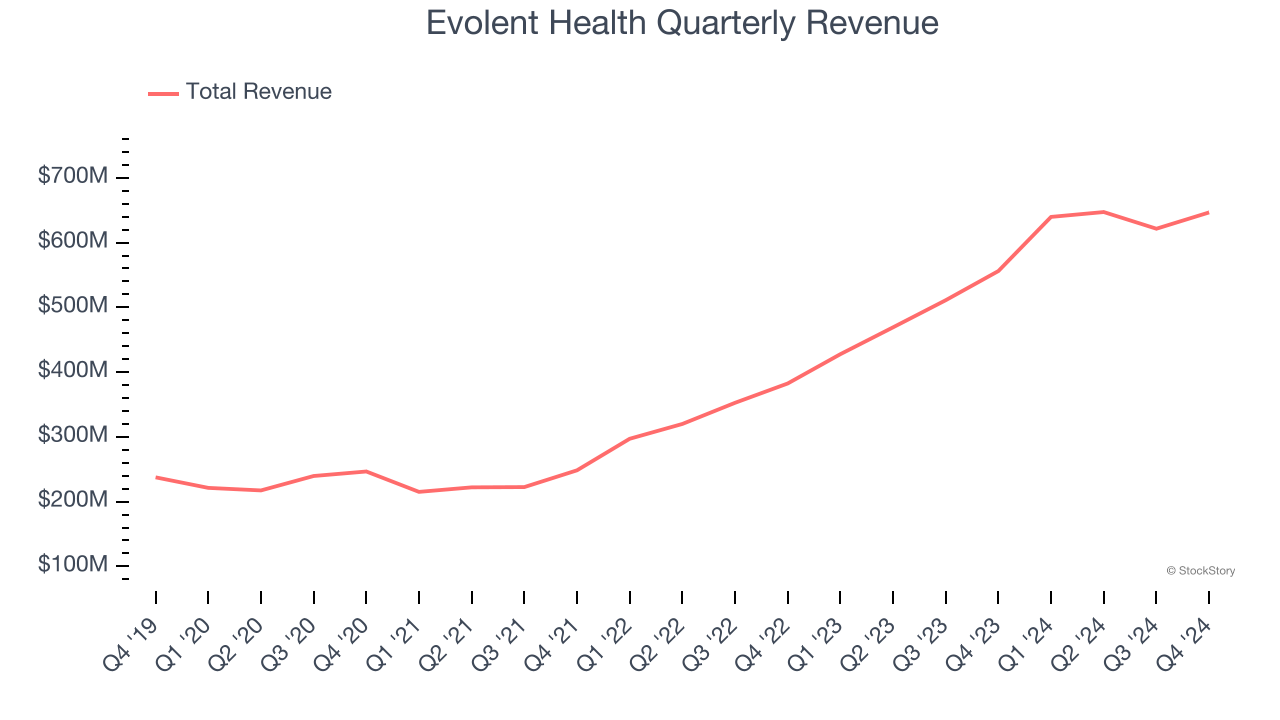

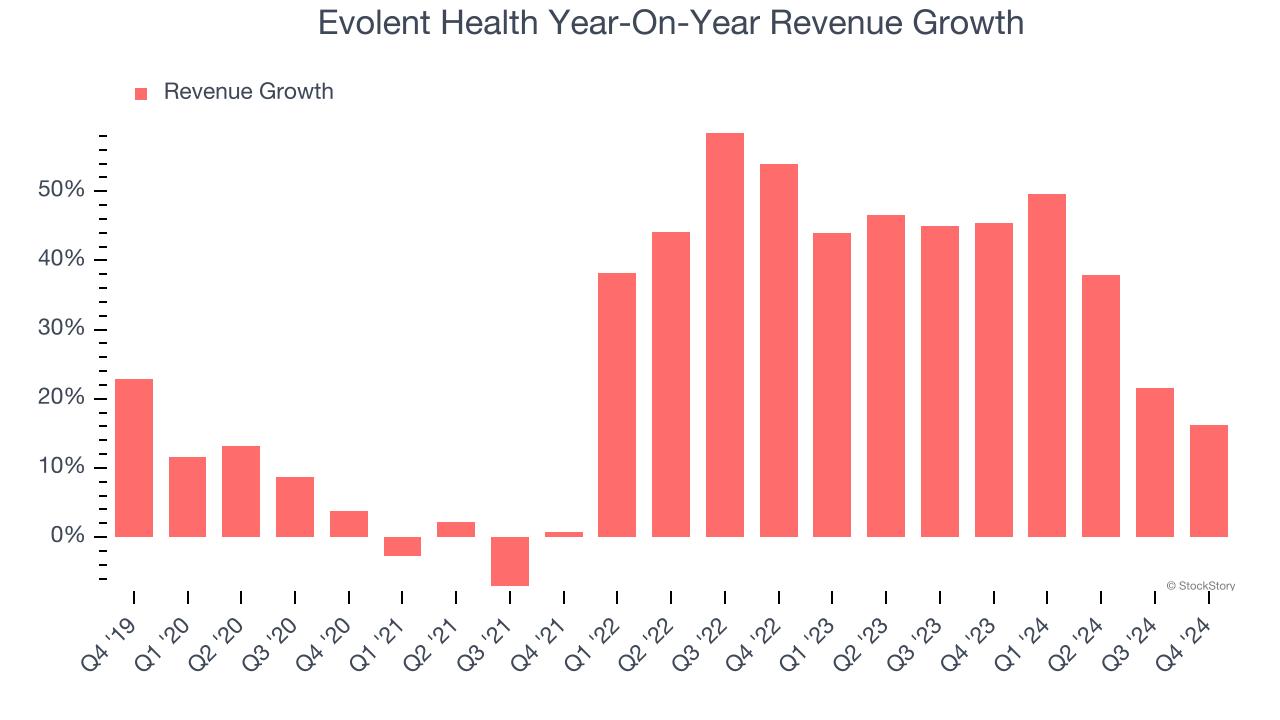

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Thankfully, Evolent Health’s 24.7% annualized revenue growth over the last five years was excellent. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Evolent Health’s annualized revenue growth of 37.5% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

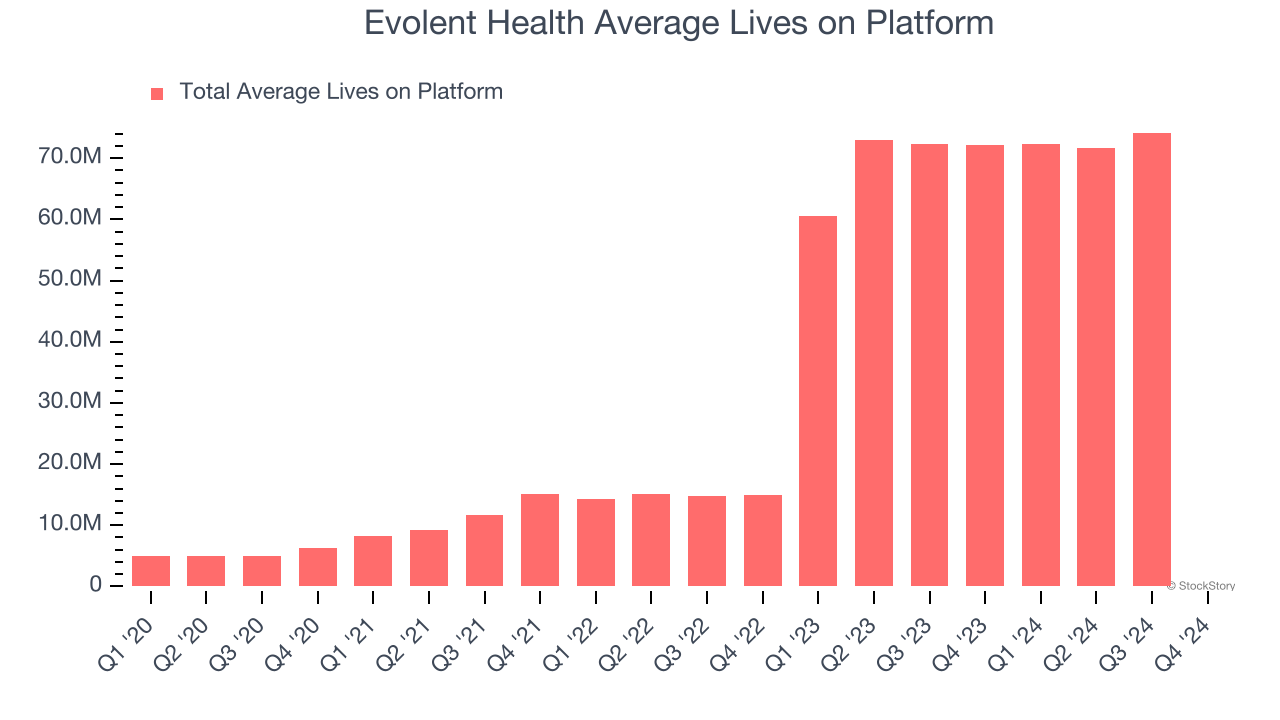

Evolent Health also reports its number of average lives on platform, which reached 75,161 in the latest quarter. Over the last two years, Evolent Health’s average lives on platform averaged 174% year-on-year growth. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, Evolent Health’s revenue grew by 16.3% year on year to $646.5 million but fell short of Wall Street’s estimates. Company management is currently guiding for a 28.9% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 6.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

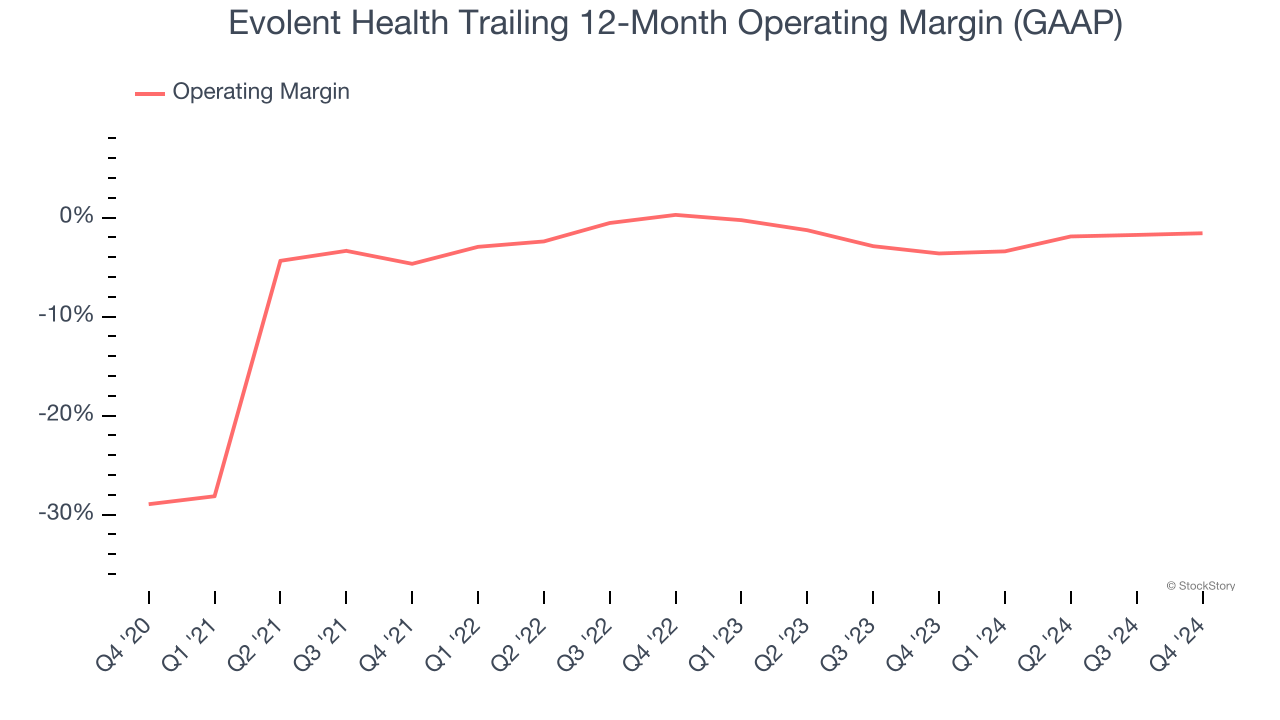

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Evolent Health’s high expenses have contributed to an average operating margin of negative 5.4% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Evolent Health’s operating margin rose by 27.4 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming into its more recent performance, however, we can see the company’s margin has decreased by 1.9 percentage points on a two-year basis. If Evolent Health wants to pass our bar, it must prove it can expand its profitability consistently.

In Q4, Evolent Health generated a negative 2.9% operating margin. The company's consistent lack of profits raise a flag.

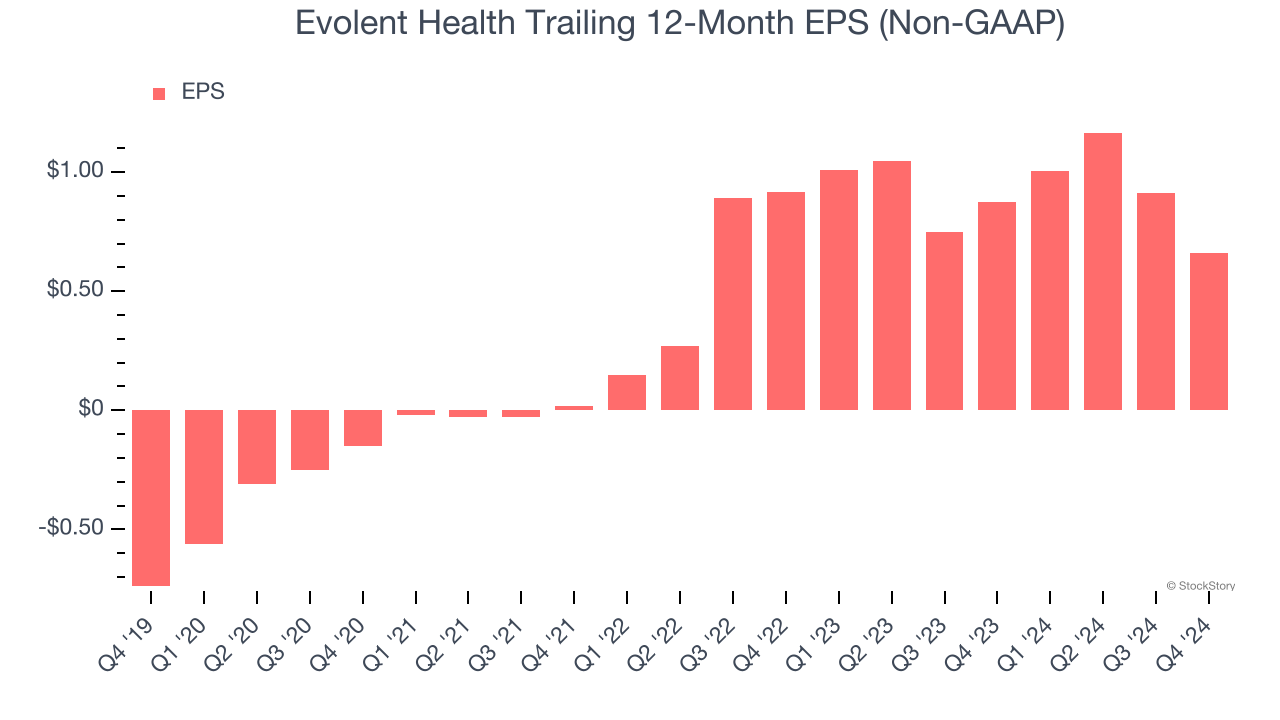

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Evolent Health’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Evolent Health reported EPS at negative $0.02, down from $0.23 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Evolent Health’s full-year EPS of $0.66 to stay about the same.

Key Takeaways from Evolent Health’s Q4 Results

We struggled to find many positives in these results as the company missed across all key metrics. Its full-year revenue and EBITDA guidance also fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 3.1% to $10.40 immediately following the results.

Evolent Health may have had a tough quarter, but does that actually create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.