Racing, gaming, and entertainment company Churchill Downs (NASDAQ: CHDN) reported Q4 CY2024 results beating Wall Street’s revenue expectations, with sales up 11.2% year on year to $624.2 million. Its non-GAAP profit of $0.92 per share was 4.3% below analysts’ consensus estimates.

Is now the time to buy Churchill Downs? Find out by accessing our full research report, it’s free.

Churchill Downs (CHDN) Q4 CY2024 Highlights:

- Revenue: $624.2 million vs analyst estimates of $618.9 million (11.2% year-on-year growth, 0.9% beat)

- Adjusted EPS: $0.92 vs analyst expectations of $0.96 (4.3% miss)

- Adjusted EBITDA: $236.6 million vs analyst estimates of $233.3 million (37.9% margin, 1.4% beat)

- Operating Margin: 20.3%, up from 18.9% in the same quarter last year

- Free Cash Flow was -$367 million compared to -$71.9 million in the same quarter last year

- Market Capitalization: $8.89 billion

Company Overview

Famous for hosting the Kentucky Derby, Churchill Downs (NASDAQ: CHDN) operates a horse racing, online wagering, and gaming entertainment business in the United States.

Gaming Solutions

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

Sales Growth

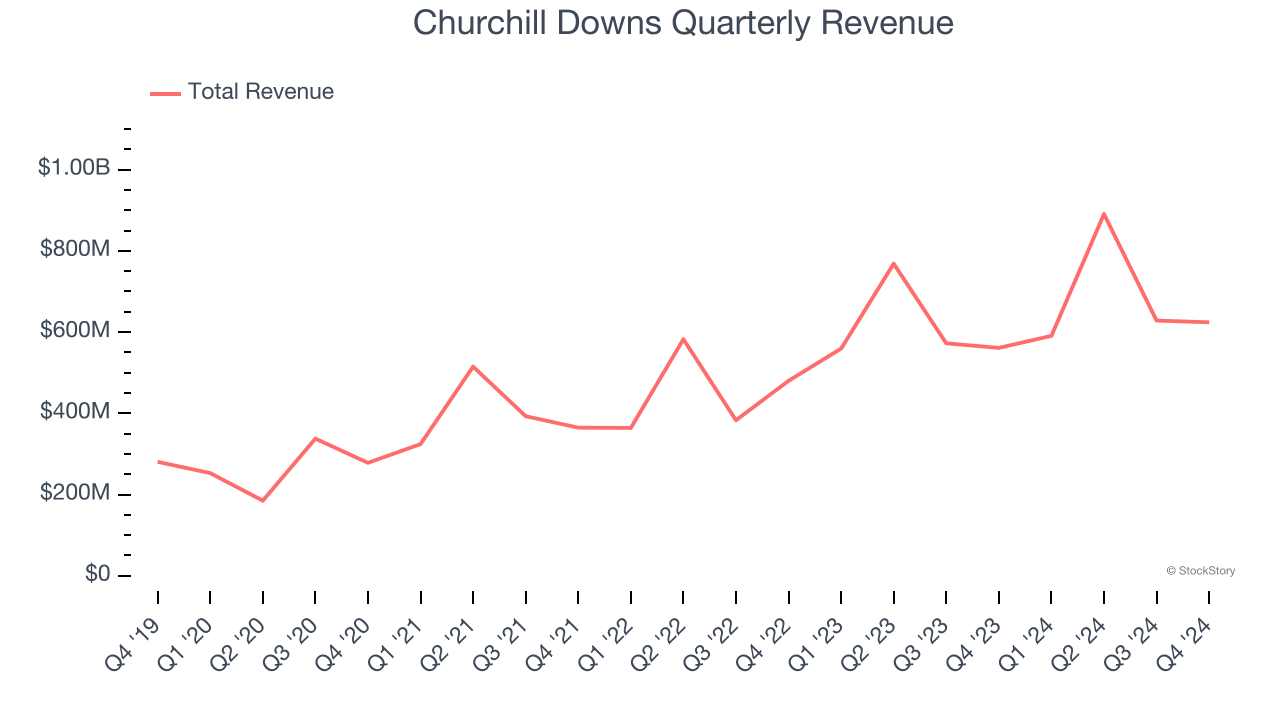

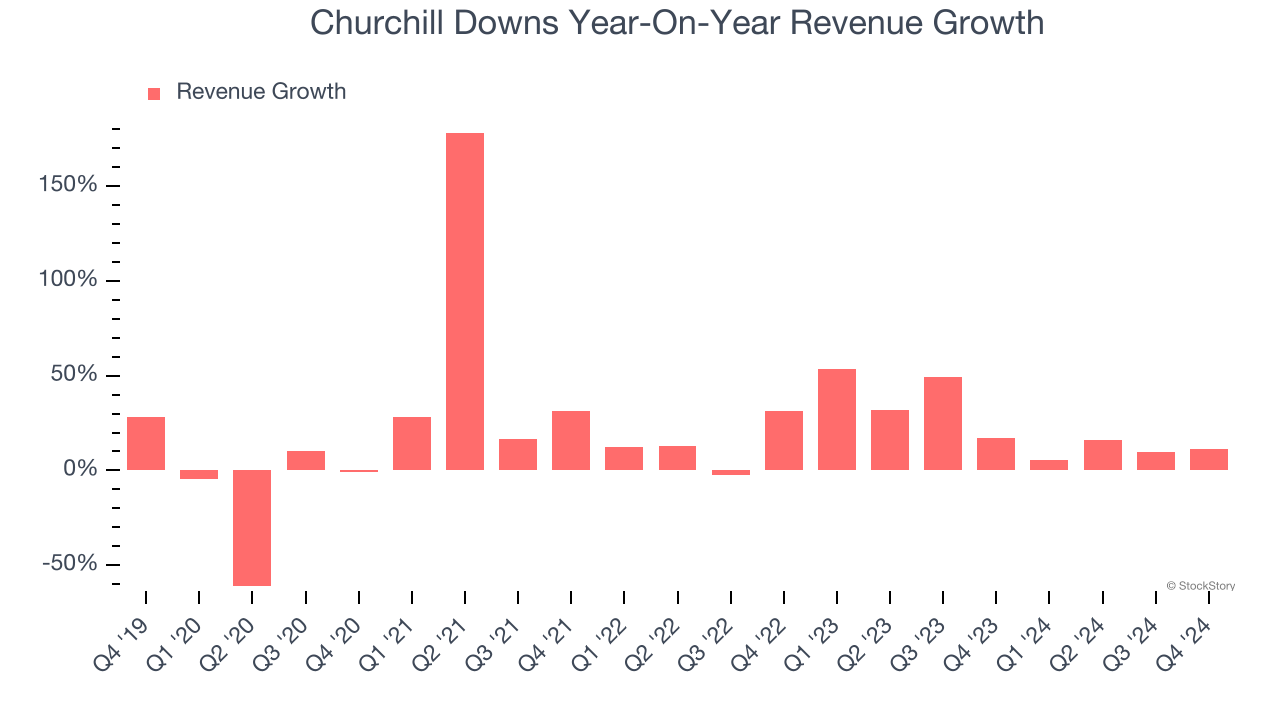

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Churchill Downs grew its sales at a decent 15.5% compounded annual growth rate. Its growth was slightly above the average consumer discretionary company and shows its offerings resonate with customers.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Churchill Downs’s annualized revenue growth of 22.9% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

We can better understand the company’s revenue dynamics by analyzing its three most important segments: Horse Racing, Gaming, and TwinSpires, which are 44.1%, 41.3%, and 17.3% of revenue. Over the last two years, Churchill Downs’s revenues in all three segments increased. Its Horse Racing revenue (live and historical) averaged year-on-year growth of 54.2% while its Gaming (casino games) and TwinSpires (horse racing subsidiary) revenues averaged 18.3% and 4.8%.

This quarter, Churchill Downs reported year-on-year revenue growth of 11.2%, and its $624.2 million of revenue exceeded Wall Street’s estimates by 0.9%.

Looking ahead, sell-side analysts expect revenue to grow 9.1% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

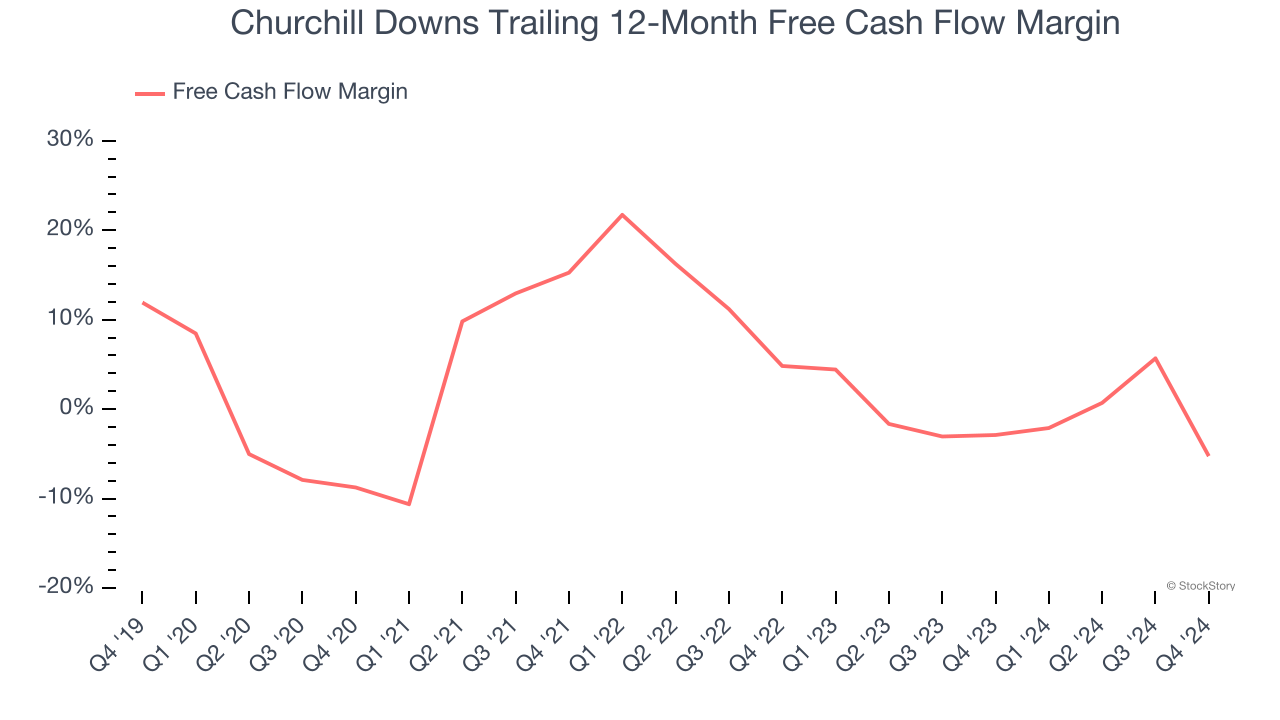

Over the last two years, Churchill Downs’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 4.1%, meaning it lit $4.13 of cash on fire for every $100 in revenue. This is a stark contrast from its operating margin, and its investments in working capital/capital expenditures are the primary culprit.

Churchill Downs burned through $367 million of cash in Q4, equivalent to a negative 58.8% margin. The company’s cash burn increased from $71.9 million of lost cash in the same quarter last year.

Looking forward, analysts predict Churchill Downs will generate cash on a full-year basis. Their consensus estimates imply its free cash flow margin of negative 5.2% for the last 12 months will increase to positive 14.3%, giving it more money to invest.

Key Takeaways from Churchill Downs’s Q4 Results

It was encouraging to see Churchill Downs narrowly top analysts’ revenue expectations this quarter due to outperformance in its TwinSpires segment. We were also glad its EBITDA beat. On the other hand, its EPS missed Wall Street's estimates. Overall, this was a mixed quarter. The stock remained flat at $118.75 immediately after reporting.

Is Churchill Downs an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.