The past six months have been a windfall for eHealth’s shareholders. The company’s stock price has jumped 133%, hitting $10.04 per share. This run-up might have investors contemplating their next move.

Is now the time to buy eHealth, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

We’re glad investors have benefited from the price increase, but we're sitting this one out for now. Here are three reasons why EHTH doesn't excite us and a stock we'd rather own.

Why Do We Think eHealth Will Underperform?

Aiming to address a high-stakes and often confusing decision, eHealth (NASDAQ: EHTH) guides consumers through health insurance enrollment and related topics.

1. Estimated Membership Hit a Plateau

As an online marketplace, eHealth generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

eHealth struggled to engage its audience over the last two years as its estimated membership were flat at 1.16 million. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If eHealth wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

2. Customer Spending Decreases, Engagement Falling?

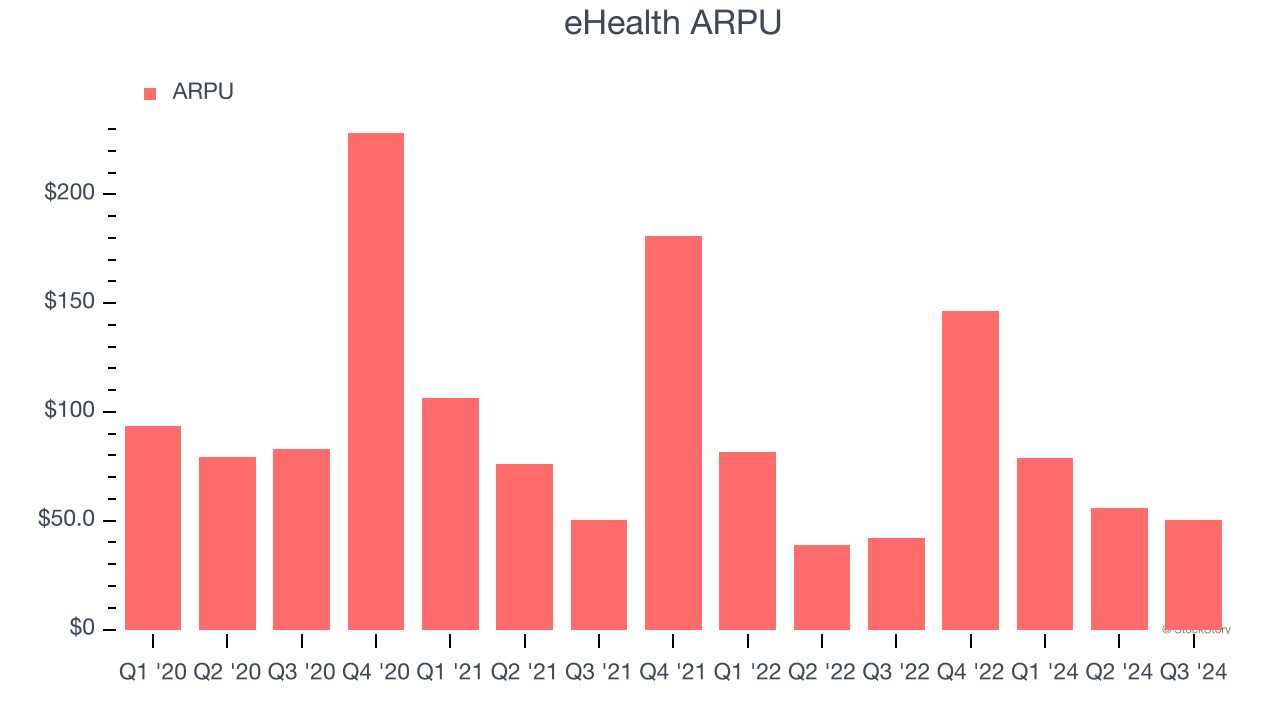

Average revenue per user (ARPU) is a critical metric to track for online marketplace businesses like eHealth because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and eHealth’s take rate, or "cut", on each order.

eHealth’s ARPU fell over the last two years, averaging 18.9% annual declines. This raises questions about its ability to engage users and signals its platform’s value is eroding.

3. EPS Trending Down

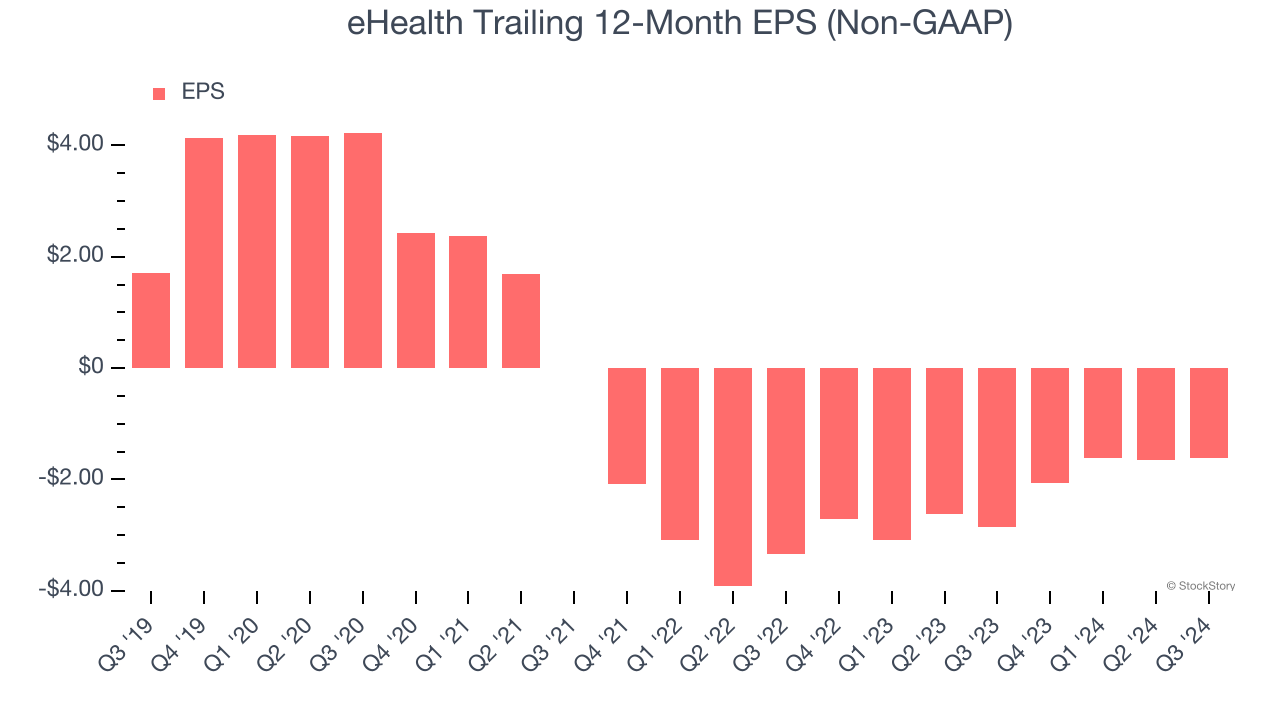

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for eHealth, its EPS declined by more than its revenue over the last three years, dropping 456% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

eHealth doesn’t pass our quality test. After the recent rally, the stock trades at 4× forward EV-to-EBITDA (or $10.04 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. We’d recommend looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Would Buy Instead of eHealth

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.