Wrapping up Q3 earnings, we look at the numbers and key takeaways for the pharmaceuticals stocks, including Jazz Pharmaceuticals (NASDAQ: JAZZ) and its peers.

The pharmaceuticals sector develops, manufactures, and distributes drugs, benefiting from diversified portfolios of branded and generic medications. Looking ahead, growth will be driven by innovations in precision medicine, such as genetic therapies and advanced biologics, and the increasing use of AI to speed and increase the efficiency of drug discovery. These could specifically magnify the advantages of the most scaled players. Conversely, the sector faces considerable headwinds from intense, bipartisan political pressure on drug pricing, scrutiny of patent practices, and growing competition from biosimilars. These could specifically stymie the growth of smaller companies or ones facing patent expirations on key drugs.

The 16 pharmaceuticals stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.9% while next quarter’s revenue guidance was in line.

Luckily, pharmaceuticals stocks have performed well with share prices up 12.1% on average since the latest earnings results.

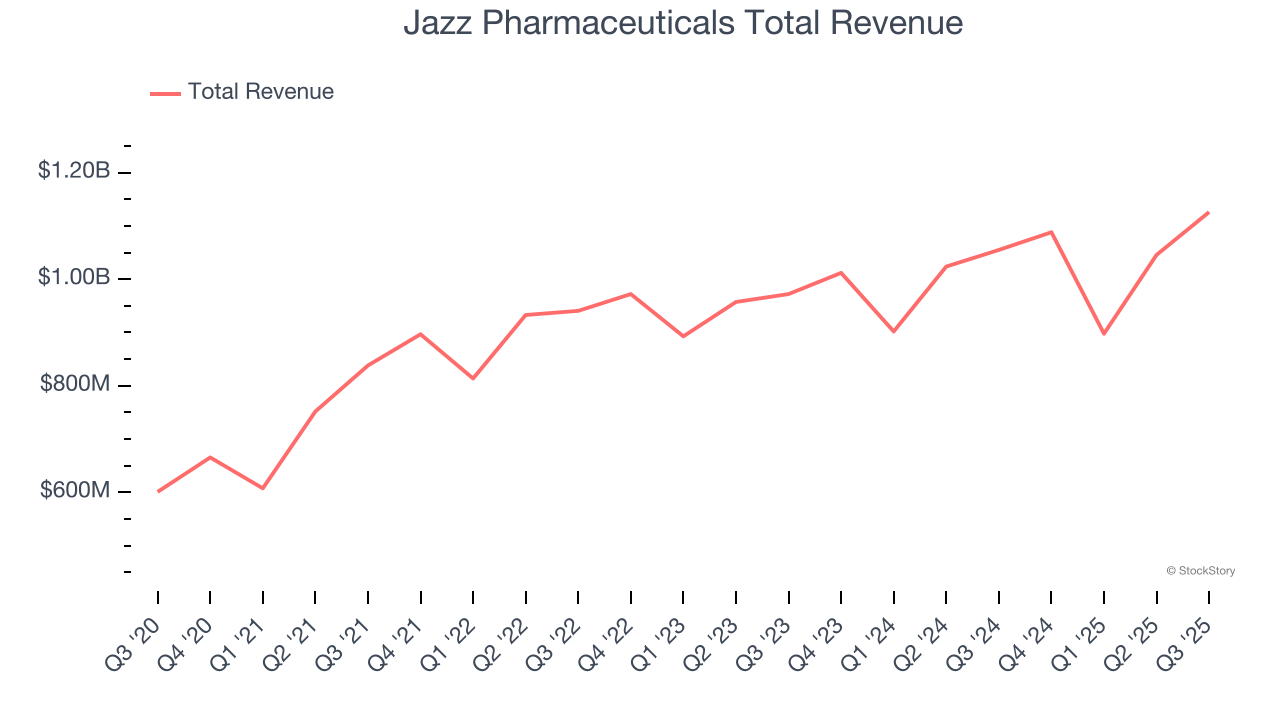

Jazz Pharmaceuticals (NASDAQ: JAZZ)

Originally founded in 2003 and now headquartered in Ireland following a 2012 tax inversion merger, Jazz Pharmaceuticals (NASDAQGS:JAZZ) develops and markets medicines for sleep disorders, epilepsy, and cancer, with a focus on treatments for patients with limited therapeutic options.

Jazz Pharmaceuticals reported revenues of $1.13 billion, up 6.7% year on year. This print exceeded analysts’ expectations by 1.1%. Overall, it was a very strong quarter for the company with a beat of analysts’ EPS estimates and a solid beat of analysts’ full-year EPS guidance estimates.

Interestingly, the stock is up 24.3% since reporting and currently trades at $170.53.

Is now the time to buy Jazz Pharmaceuticals? Access our full analysis of the earnings results here, it’s free for active Edge members.

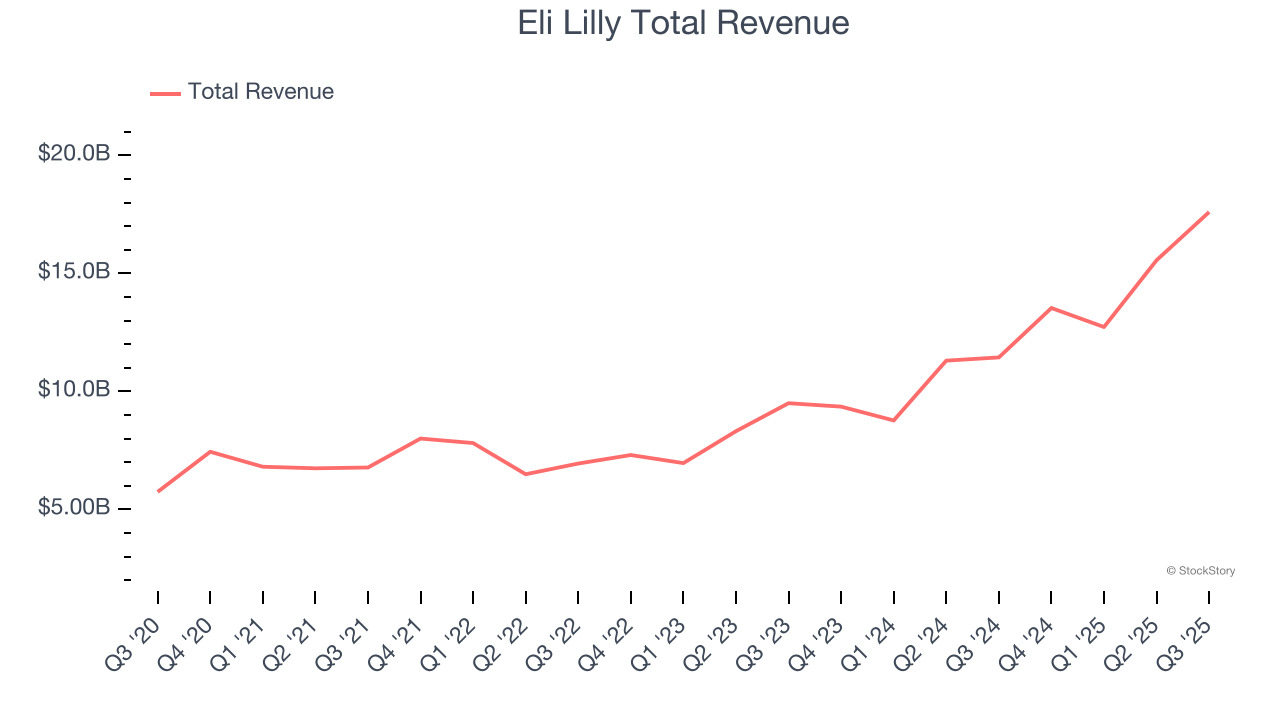

Best Q3: Eli Lilly (NYSE: LLY)

Founded in 1876 by a Civil War veteran and pharmacist frustrated with the poor quality of medicines, Eli Lilly (NYSE: LLY) discovers, develops, and manufactures pharmaceutical products for conditions including diabetes, obesity, cancer, immunological disorders, and neurological diseases.

Eli Lilly reported revenues of $17.6 billion, up 53.9% year on year, outperforming analysts’ expectations by 9.7%. The business had a stunning quarter with a solid beat of analysts’ revenue estimates and full-year revenue guidance exceeding analysts’ expectations.

Eli Lilly scored the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 32.7% since reporting. It currently trades at $1,077.

Is now the time to buy Eli Lilly? Access our full analysis of the earnings results here, it’s free for active Edge members.

Corcept (NASDAQ: CORT)

Focusing on the powerful stress hormone that affects everything from metabolism to immune function, Corcept Therapeutics (NASDAQ: CORT) develops and markets medications that modulate cortisol to treat endocrine disorders, cancer, and neurological diseases.

Corcept reported revenues of $207.6 million, up 13.7% year on year, falling short of analysts’ expectations by 4%. It was a softer quarter as it posted full-year revenue guidance missing analysts’ expectations significantly and a significant miss of analysts’ revenue estimates.

Corcept delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 16% since the results and currently trades at $82.51.

Read our full analysis of Corcept’s results here.

ANI Pharmaceuticals (NASDAQ: ANIP)

With a diverse portfolio of 116 pharmaceutical products and a growing rare disease platform, ANI Pharmaceuticals (NASDAQ: ANIP) develops, manufactures, and markets branded and generic prescription pharmaceuticals, with a focus on rare disease treatments.

ANI Pharmaceuticals reported revenues of $227.8 million, up 53.6% year on year. This print surpassed analysts’ expectations by 6.4%. It was a very strong quarter as it also logged an impressive beat of analysts’ revenue estimates and a beat of analysts’ EPS estimates.

The stock is down 8.6% since reporting and currently trades at $82.49.

Read our full, actionable report on ANI Pharmaceuticals here, it’s free for active Edge members.

Merck (NYSE: MRK)

With roots dating back to 1891 and a portfolio that includes the blockbuster cancer immunotherapy Keytruda, Merck (NYSE: MRK) develops and sells prescription medicines, vaccines, and animal health products across oncology, infectious diseases, cardiovascular, and other therapeutic areas.

Merck reported revenues of $17.28 billion, up 3.7% year on year. This number beat analysts’ expectations by 1.8%. Overall, it was a strong quarter as it also produced an impressive beat of analysts’ constant currency revenue estimates and a beat of analysts’ EPS estimates.

The stock is up 23.5% since reporting and currently trades at $106.92.

Read our full, actionable report on Merck here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.