Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Ollie's (NASDAQ: OLLI) and its peers.

Discount retailers understand that many shoppers love a good deal, and they focus on providing excellent value to shoppers by selling general merchandise at major discounts. They can do this because of unique purchasing, procurement, and pricing strategies that involve scouring the market for trendy goods or buying excess inventory from manufacturers and other retailers. They then turn around and sell these snacks, paper towels, toys, clothes, and myriad other products at highly enticing prices. Despite the unique draw and lure of discounts, these discount retailers must also contend with the secular headwinds of online shopping and challenged retail foot traffic in places like suburban strip malls.

The 5 discount retailer stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was 0.8% below.

Thankfully, share prices of the companies have been resilient as they are up 5.1% on average since the latest earnings results.

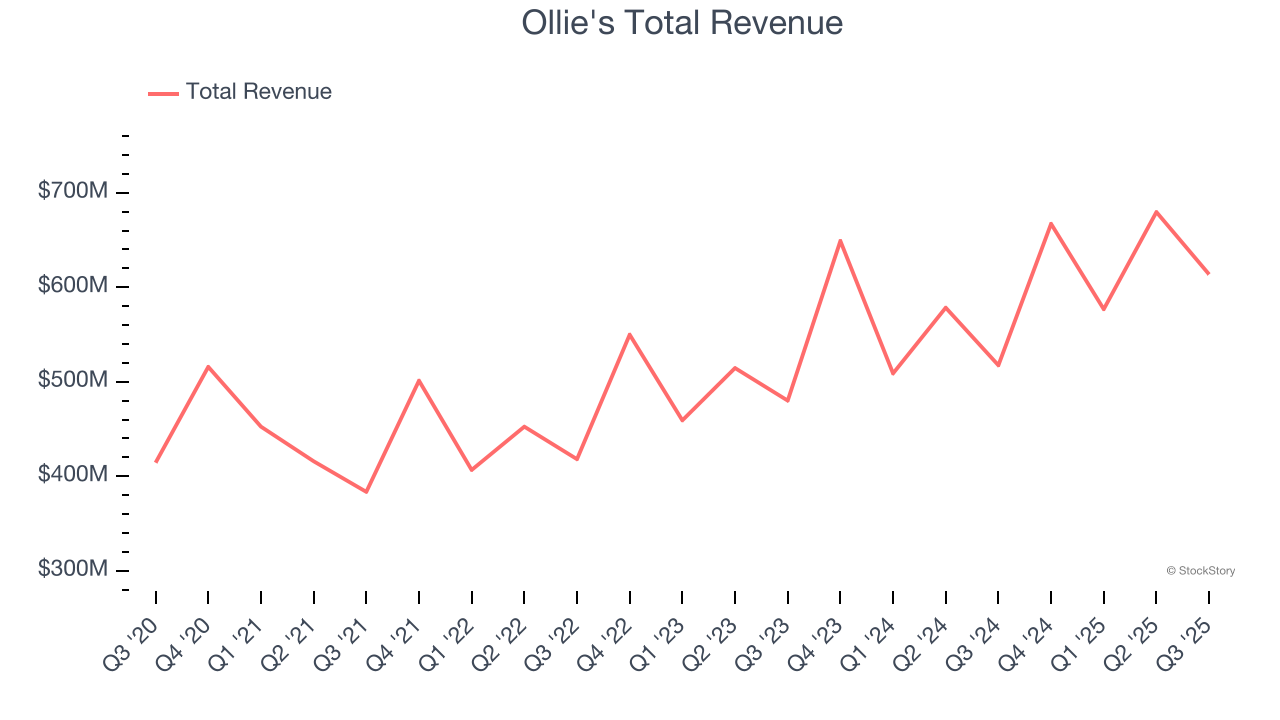

Weakest Q3: Ollie's (NASDAQ: OLLI)

Often located in suburban or semi-rural shopping centers, Ollie’s Bargain Outlet (NASDAQ: OLLI) is a discount retailer that acquires excess inventory then sells at meaningful discounts.

Ollie's reported revenues of $613.6 million, up 18.6% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a narrow beat of analysts’ EBITDA estimates but revenue in line with analysts’ estimates.

“Thanks to the extraordinary execution of our team, we delivered another strong performance in the third quarter. We opened a record number of stores, continued to accelerate membership growth of our Ollie’s Army loyalty program, widened our price gaps to the fancy stores, and delivered industry-leading sales growth, all while driving significant improvement on the bottom-line,” said Eric van der Valk, President and Chief Executive Officer.

Ollie's achieved the highest full-year guidance raise of the whole group. Still, the market seems discontent with the results. The stock is down 14.6% since reporting and currently trades at $108.82.

Is now the time to buy Ollie's? Access our full analysis of the earnings results here, it’s free for active Edge members.

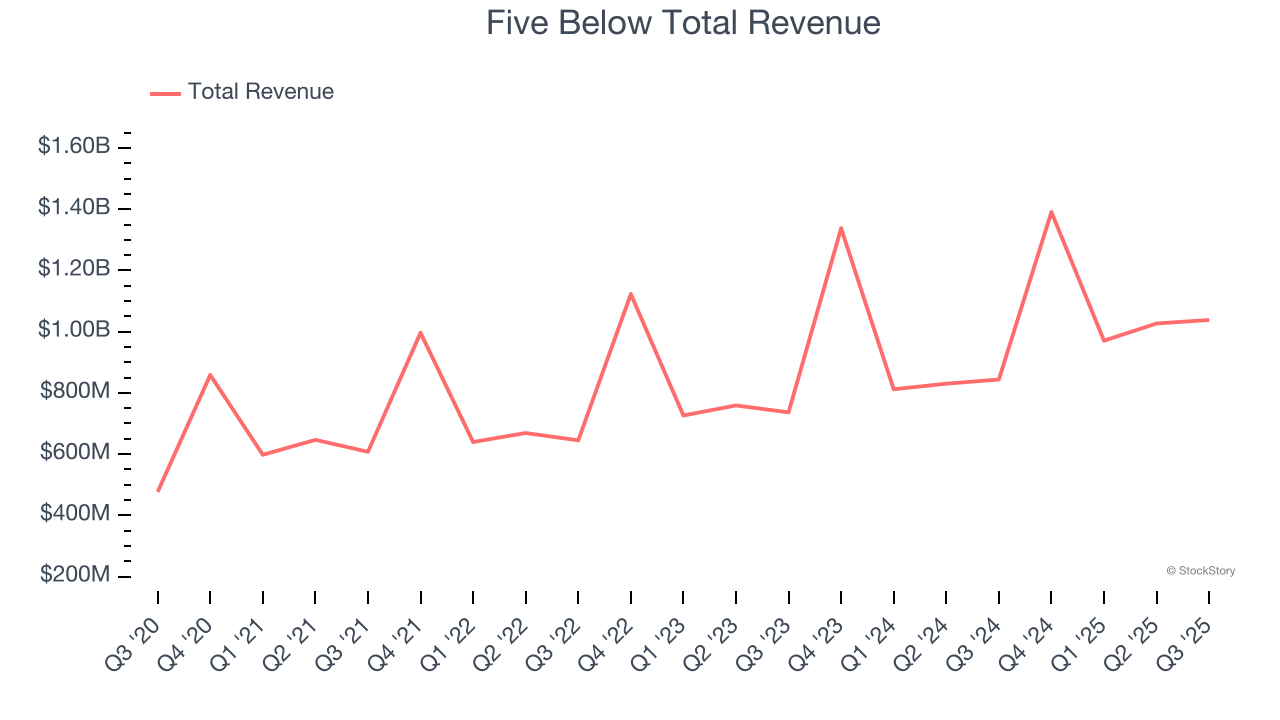

Best Q3: Five Below (NASDAQ: FIVE)

Often facilitating a treasure hunt shopping experience, Five Below (NASDAQ: FIVE) is an American discount retailer that sells a variety of products from mobile phone cases to candy to sports equipment for largely $5 or less.

Five Below reported revenues of $1.04 billion, up 23.1% year on year, outperforming analysts’ expectations by 6.3%. The business had a stunning quarter with EPS guidance for next quarter exceeding analysts’ expectations and a beat of analysts’ EPS estimates.

Five Below pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 14.6% since reporting. It currently trades at $188.50.

Is now the time to buy Five Below? Access our full analysis of the earnings results here, it’s free for active Edge members.

Burlington (NYSE: BURL)

Founded in 1972 as a discount coat and outerwear retailer, Burlington Stores (NYSE: BURL) is now an off-price retailer that has broadened into general apparel, footwear, and home goods.

Burlington reported revenues of $2.71 billion, up 7.1% year on year, in line with analysts’ expectations. Still, it was a satisfactory quarter as it posted a solid beat of analysts’ EBITDA estimates.

Burlington delivered the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is flat since the results and currently trades at $284.

Read our full analysis of Burlington’s results here.

Ross Stores (NASDAQ: ROST)

Selling excess inventory or overstocked items from other retailers, Ross Stores (NASDAQ: ROST) is an off-price concept that sells apparel and other goods at prices much lower than department stores.

Ross Stores reported revenues of $5.60 billion, up 10.4% year on year. This print surpassed analysts’ expectations by 2.6%. It was a very strong quarter as it also put up a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ revenue estimates.

The stock is up 12.5% since reporting and currently trades at $180.59.

Read our full, actionable report on Ross Stores here, it’s free for active Edge members.

TJX (NYSE: TJX)

Initially based on a strategy of buying excess inventory from manufacturers or other retailers, TJX (NYSE: TJX) is an off-price retailer that sells brand-name apparel and other goods at prices much lower than department stores.

TJX reported revenues of $15.12 billion, up 7.5% year on year. This result topped analysts’ expectations by 1.5%. Overall, it was a strong quarter as it also logged a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ gross margin estimates.

The stock is up 6.8% since reporting and currently trades at $155.47.

Read our full, actionable report on TJX here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.