Since June 2025, Ares has been in a holding pattern, posting a small return of 1.7% while floating around $170.19. The stock also fell short of the S&P 500’s 13.6% gain during that period.

Given the weaker price action, is now a good time to buy ARES? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free for active Edge members.

Why Is Ares a Good Business?

With roots in the leveraged finance group of Apollo Management, Ares Management (NYSE: ARES) is an alternative investment firm that manages private equity, credit, real estate, and infrastructure assets for institutional and high-net-worth clients.

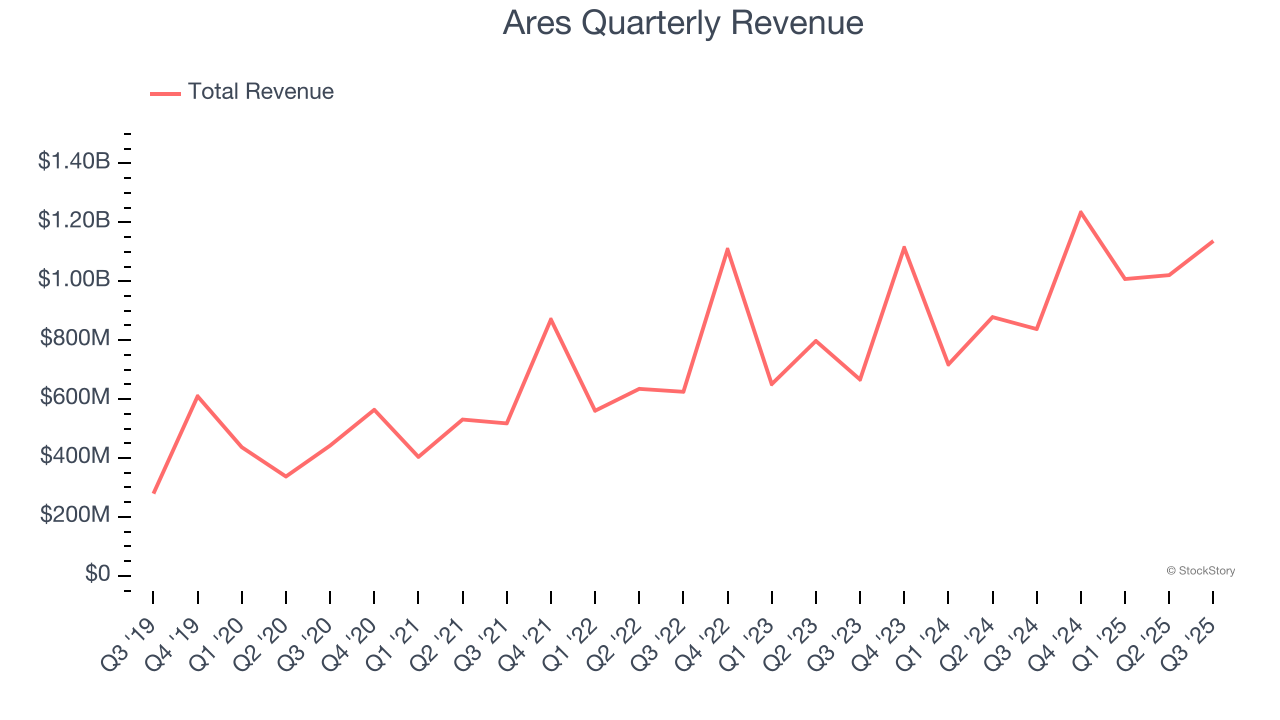

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

Luckily, Ares’s revenue grew at an excellent 19.2% compounded annual growth rate over the last five years. Its growth surpassed the average financials company and shows its offerings resonate with customers.

2. Fee-Related Earnings Jumped Higher

Revenue trends matter, but the durability of profits is what separates winners from losers. For asset managers, fee-related earnings strip away the noise of performance fees and investment income to reveal the core profitability of their fee-based business model. This represents the steady, predictable earnings that investors can count on.

Ares’s annual fee-related earnings growth over the last five years was 33.6%, an elite result.

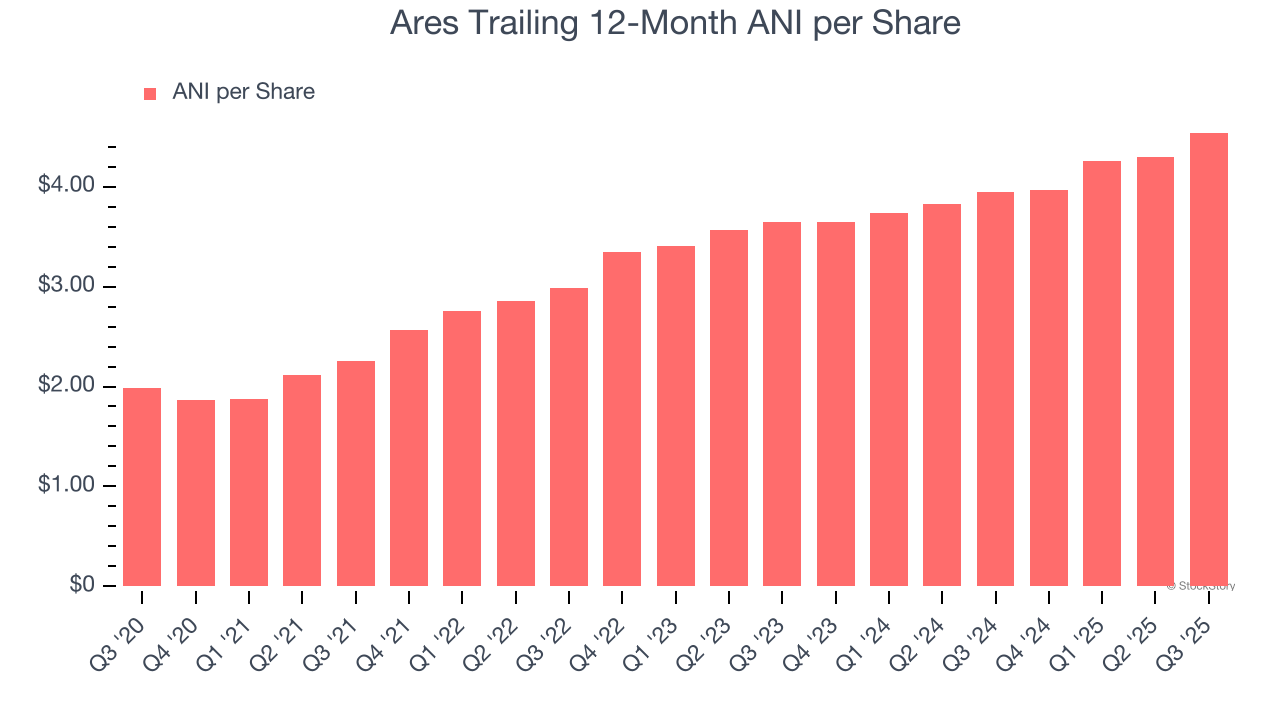

3. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Ares’s remarkable 17.9% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Final Judgment

These are just a few reasons Ares is a high-quality business worth owning. With its shares trailing the market in recent months, the stock trades at 28.7× forward P/E (or $170.19 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free for active Edge members.

Stocks We Like Even More Than Ares

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.