As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the health insurance providers industry, including Elevance Health (NYSE: ELV) and its peers.

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

The 12 health insurance providers stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was 1.1% below.

In light of this news, share prices of the companies have held steady as they are up 1.9% on average since the latest earnings results.

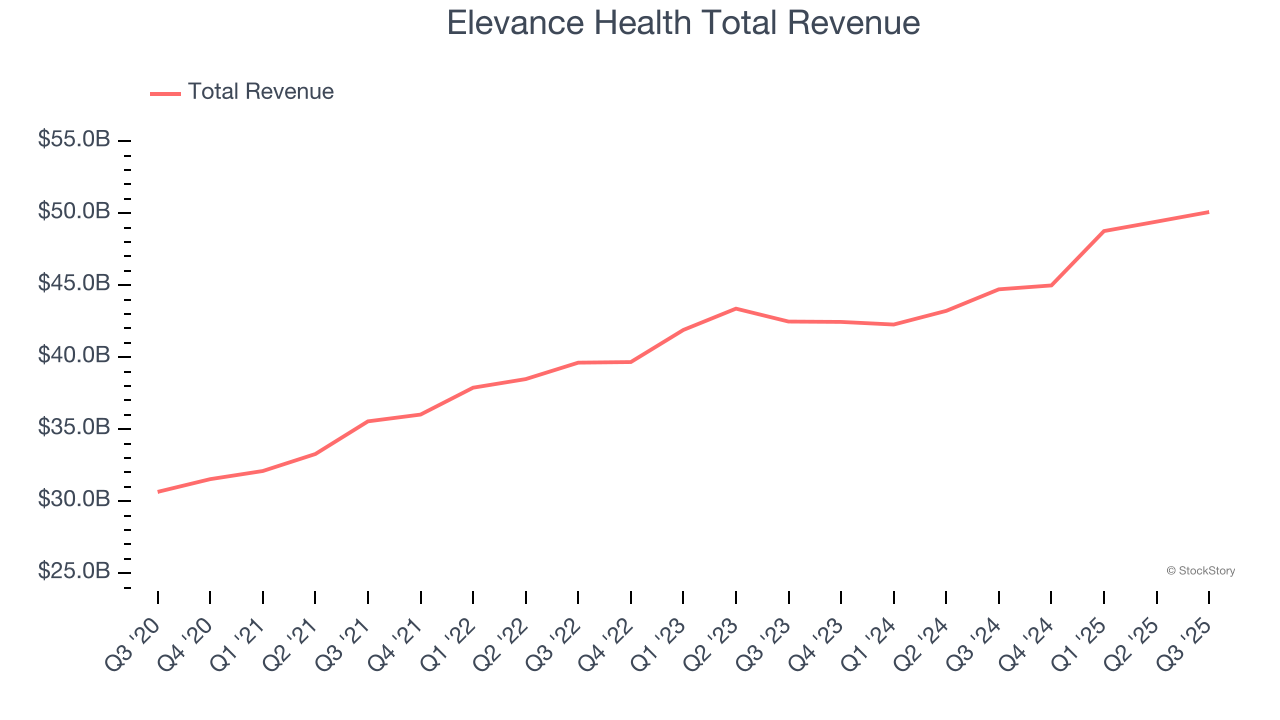

Elevance Health (NYSE: ELV)

Formerly known as Anthem until its 2022 rebranding, Elevance Health (NYSE: ELV) is one of America's largest health insurers, serving approximately 47 million medical members through its network-based managed care plans.

Elevance Health reported revenues of $50.09 billion, up 12% year on year. This print exceeded analysts’ expectations by 1.2%. Overall, it was a strong quarter for the company with a beat of analysts’ EPS estimates and a narrow beat of analysts’ revenue estimates.

"Our third quarter results were in line with expectations and reflect disciplined execution across Elevance Health. In a dynamic healthcare environment, we’re focused on advancing affordability and elevating the member experience through our growing value-based care partnerships and AI-enabled digital solutions that simplify access and improve outcomes. As we plan for 2026, we remain disciplined in managing what we can control – positioning our businesses for long-term, sustainable growth and value creation for all stakeholders.”

Interestingly, the stock is up 1.7% since reporting and currently trades at $360.

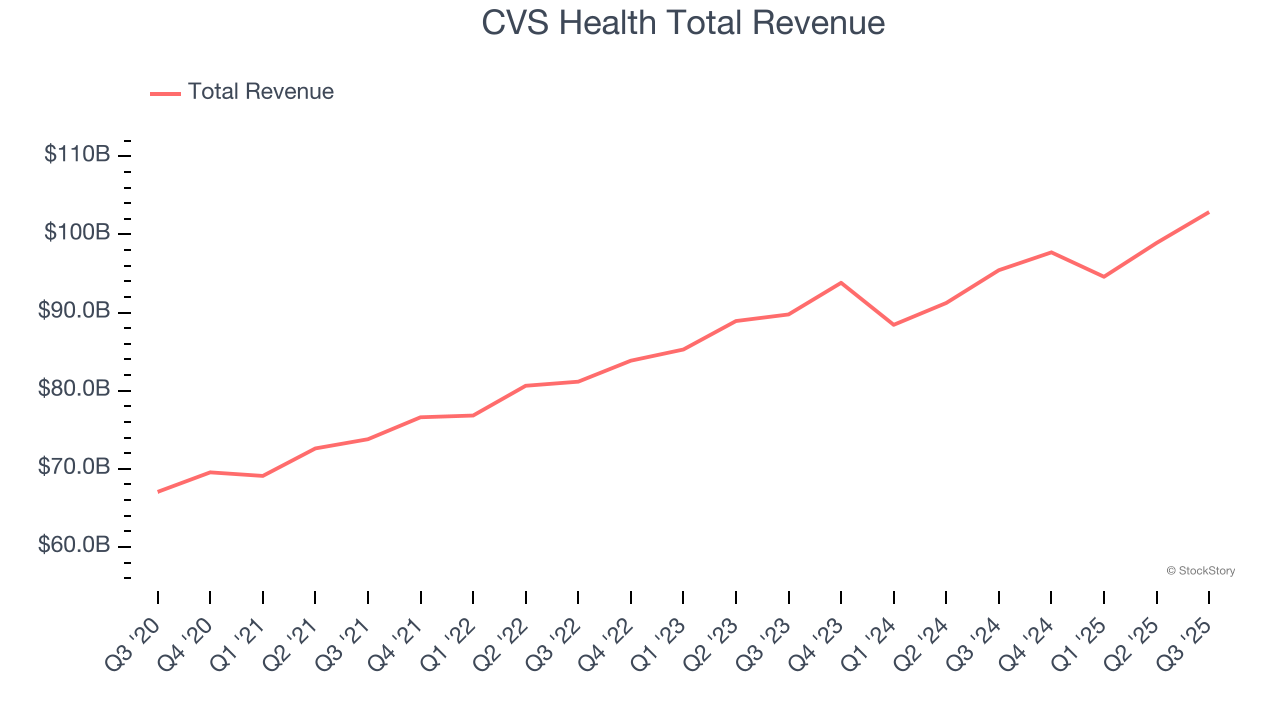

Best Q3: CVS Health (NYSE: CVS)

With over 9,000 retail pharmacy locations serving as neighborhood health destinations across America, CVS Health (NYSE: CVS) operates retail pharmacies, provides pharmacy benefit management services, and offers health insurance through its Aetna subsidiary.

CVS Health reported revenues of $102.9 billion, up 7.8% year on year, outperforming analysts’ expectations by 4.1%. The business had an exceptional quarter with a solid beat of analysts’ same-store sales and revenue estimates.

The market seems unhappy with the results as the stock is down 2.9% since reporting. It currently trades at $79.79.

Is now the time to buy CVS Health? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Molina Healthcare (NYSE: MOH)

Founded in 1980 as a provider for underserved communities in Southern California, Molina Healthcare (NYSE: MOH) provides managed healthcare services primarily to low-income individuals through Medicaid, Medicare, and Marketplace insurance programs across 21 states.

Molina Healthcare reported revenues of $11.48 billion, up 11% year on year, exceeding analysts’ expectations by 4.6%. Still, it was a slower quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates.

Molina Healthcare delivered the weakest full-year guidance update in the group. The company lost 118,000 customers and ended up with a total of 5.63 million. As expected, the stock is down 13.6% since the results and currently trades at $168.08.

Read our full analysis of Molina Healthcare’s results here.

Cigna (NYSE: CI)

With roots dating back to 1792 and serving millions of customers across the globe, The Cigna Group (NYSE: CI) provides healthcare services through its Evernorth Health Services and Cigna Healthcare segments, offering pharmacy benefits, specialty care, and medical plans.

Cigna reported revenues of $69.57 billion, up 9.2% year on year. This print beat analysts’ expectations by 3.1%. Zooming out, it was a satisfactory quarter as it also produced an impressive beat of analysts’ revenue estimates but full-year EPS guidance in line with analysts’ estimates.

The company lost 3,000 customers and ended up with a total of 16.35 million. The stock is down 7.3% since reporting and currently trades at $277.36.

Read our full, actionable report on Cigna here, it’s free for active Edge members.

UnitedHealth (NYSE: UNH)

With over 100 million people served across its various businesses and a workforce of more than 400,000, UnitedHealth Group (NYSE: UNH) operates a health insurance business and Optum, a healthcare services division that provides everything from pharmacy benefits to primary care.

UnitedHealth reported revenues of $113.2 billion, up 12.2% year on year. This number was in line with analysts’ expectations. Taking a step back, it was a mixed quarter as it also logged a narrow beat of analysts’ customer base estimates but revenue in line with analysts’ estimates.

The company kept the number of customers flat at a total of 54.08 million. The stock is down 7% since reporting and currently trades at $339.75.

Read our full, actionable report on UnitedHealth here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.