J. M. Smucker has been treading water for the past six months, recording a small return of 3.7% while holding steady at $99.40. The stock also fell short of the S&P 500’s 13.6% gain during that period.

Is there a buying opportunity in J. M. Smucker, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Do We Think J. M. Smucker Will Underperform?

We're cautious about J. M. Smucker. Here are three reasons you should be careful with SJM and a stock we'd rather own.

1. Slow Organic Growth Suggests Waning Demand In Core Business

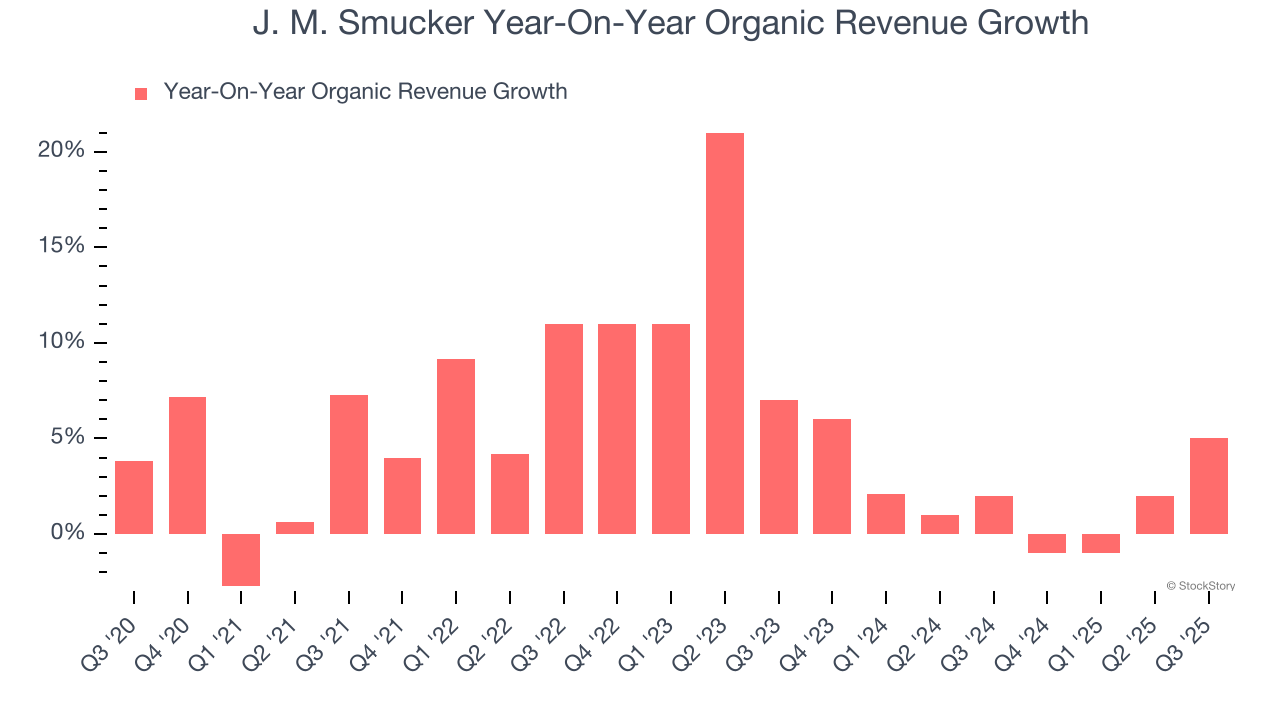

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for J. M. Smucker’s products has been stable over the last eight quarters but fell behind the broader sector. On average, the company has posted feeble year-on-year organic revenue growth of 2%.

2. Shrinking Operating Margin

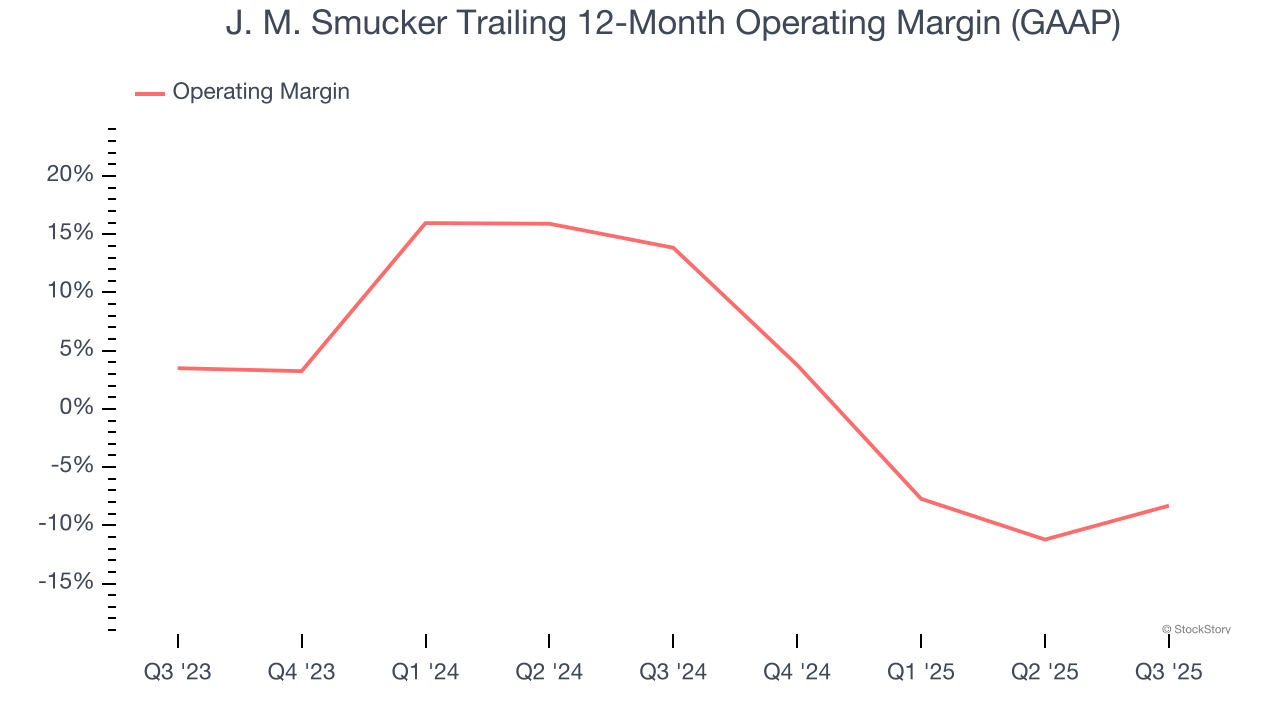

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Looking at the trend in its profitability, J. M. Smucker’s operating margin decreased by 22.2 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. J. M. Smucker’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its operating margin for the trailing 12 months was negative 8.3%.

3. Previous Growth Initiatives Haven’t Impressed

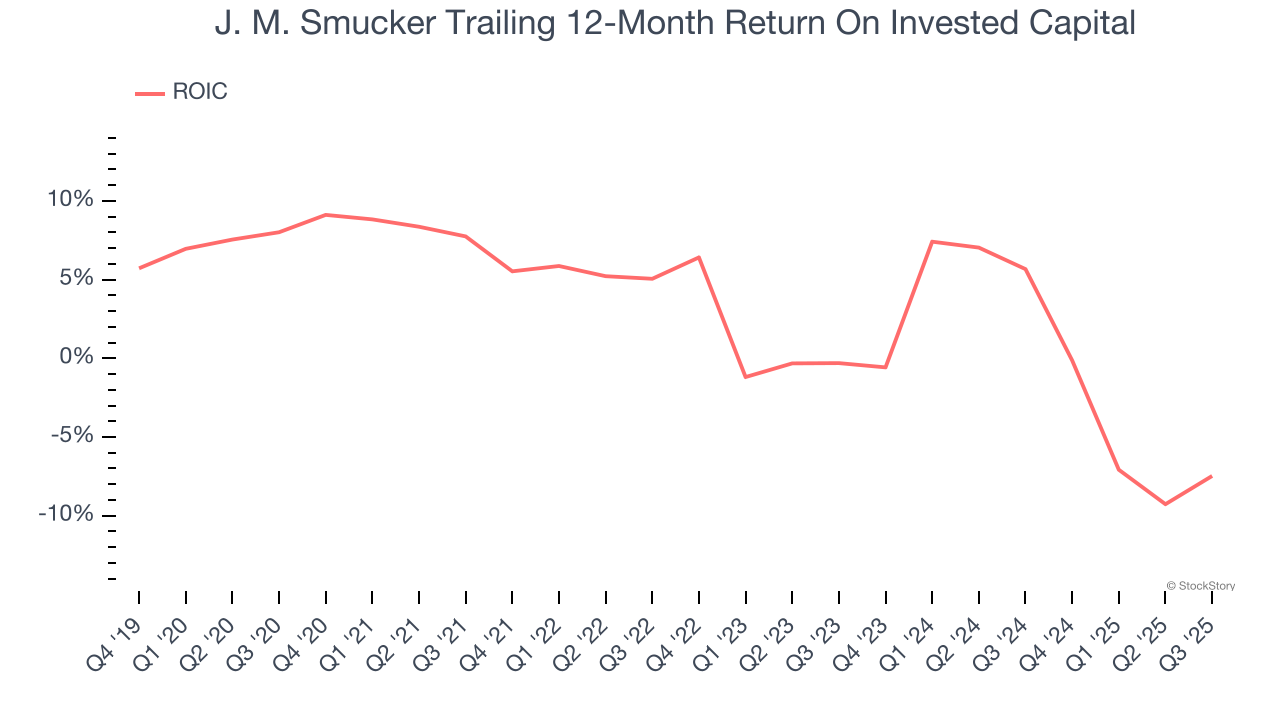

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

J. M. Smucker historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.1%, lower than the typical cost of capital (how much it costs to raise money) for consumer staples companies.

Final Judgment

We see the value of companies helping consumers, but in the case of J. M. Smucker, we’re out. With its shares underperforming the market lately, the stock trades at 10.2× forward P/E (or $99.40 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are more exciting stocks to buy at the moment. Let us point you toward one of our top software and edge computing picks.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.