Aerospace and defense company Cadre (NYSE: CDRE) missed Wall Street’s revenue expectations in Q3 CY2025, but sales rose 42.5% year on year to $155.9 million. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $627 million at the midpoint. Its GAAP profit of $0.27 per share was in line with analysts’ consensus estimates.

Is now the time to buy Cadre? Find out by accessing our full research report, it’s free for active Edge members.

Cadre (CDRE) Q3 CY2025 Highlights:

- Revenue: $155.9 million vs analyst estimates of $160.2 million (42.5% year-on-year growth, 2.7% miss)

- EPS (GAAP): $0.27 vs analyst estimates of $0.26 (in line)

- Adjusted EBITDA: $29.82 million vs analyst estimates of $27.66 million (19.1% margin, 7.8% beat)

- The company reconfirmed its revenue guidance for the full year of $627 million at the midpoint

- EBITDA guidance for the full year is $114 million at the midpoint, in line with analyst expectations

- Operating Margin: 12%, up from 5% in the same quarter last year

- Free Cash Flow was $21.63 million, up from -$6.23 million in the same quarter last year

- Market Capitalization: $1.73 billion

“We are pleased to report another quarter of strong performance, driven by Cadre’s industry leading brands and favorable trends across our law enforcement, first responder, military, and nuclear end-markets,” said Warren Kanders, CEO and Chairman.

Company Overview

Originally known as Safariland, Cadre (NYSE: CDRE) specializes in manufacturing and distributing safety and survivability equipment for first responders.

Revenue Growth

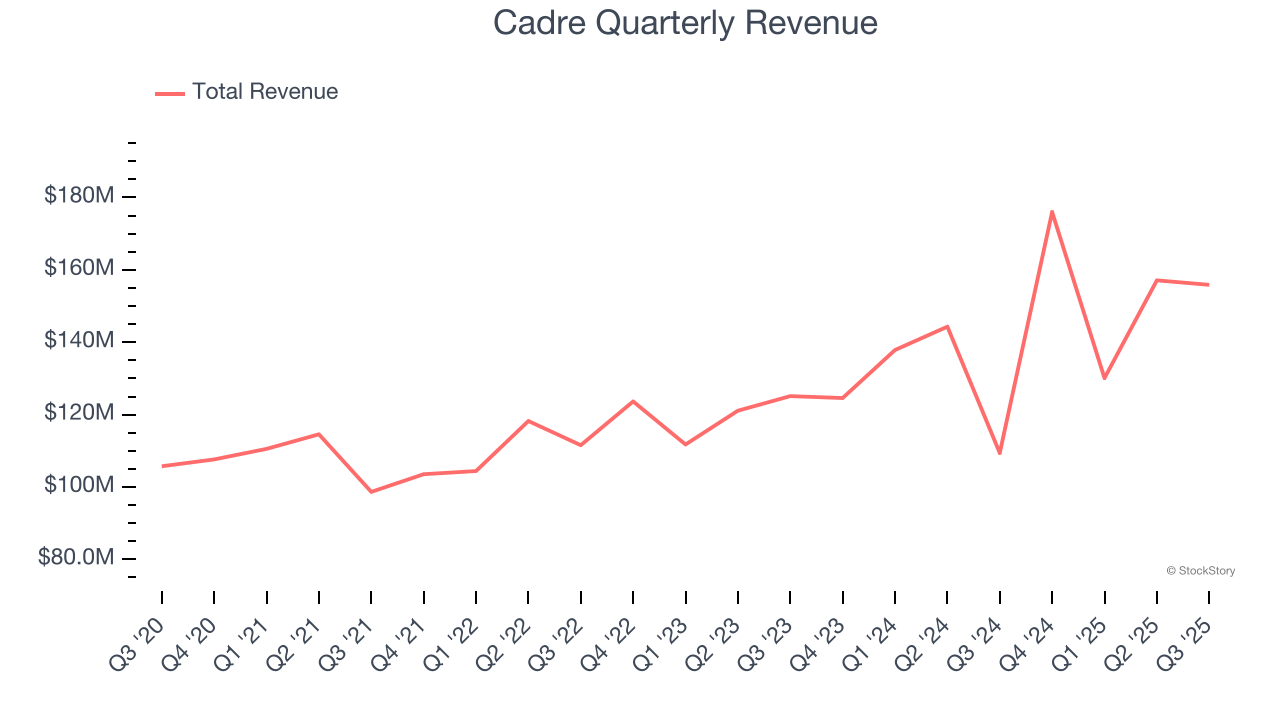

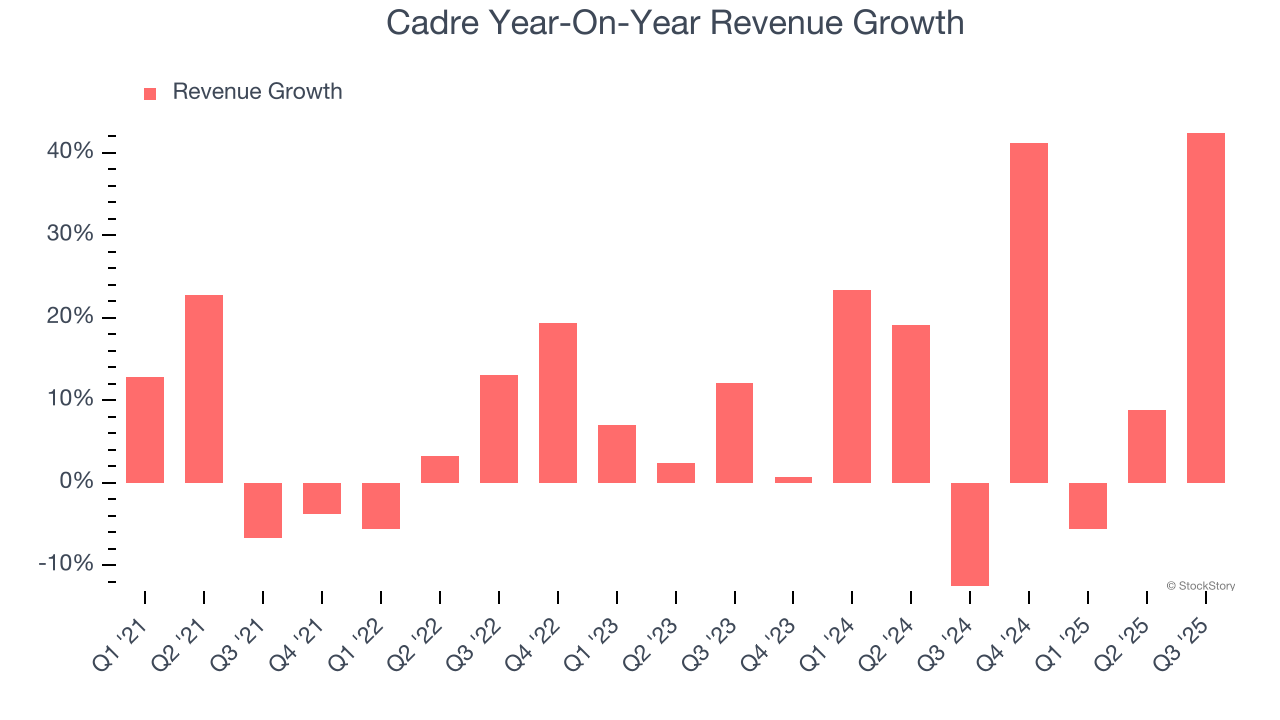

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Cadre’s sales grew at a decent 8.3% compounded annual growth rate over the last five years. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Cadre’s annualized revenue growth of 13.4% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

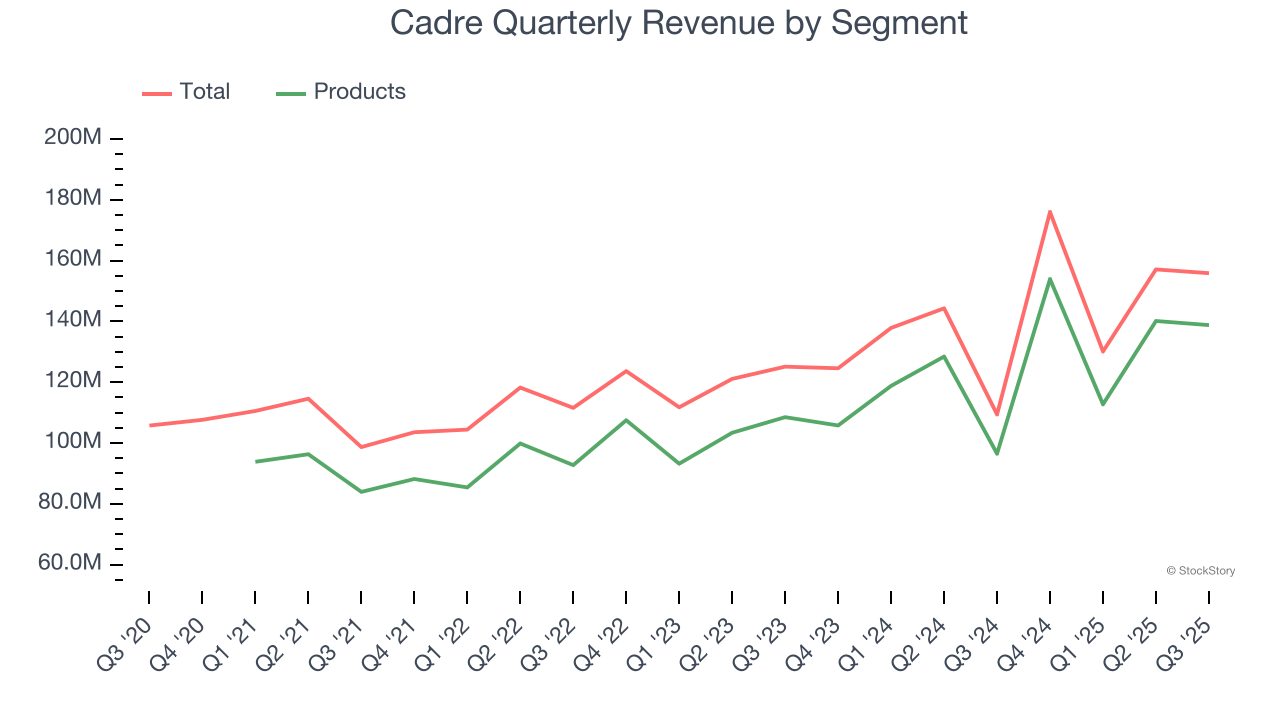

We can better understand the company’s revenue dynamics by analyzing its most important segment, Products. Over the last two years, Cadre’s Products revenue (body armor, corrections tools, sensors) averaged 16.6% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, Cadre achieved a magnificent 42.5% year-on-year revenue growth rate, but its $155.9 million of revenue fell short of Wall Street’s lofty estimates.

Looking ahead, sell-side analysts expect revenue to grow 8.5% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above average for the sector and implies the market sees some success for its newer products and services.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

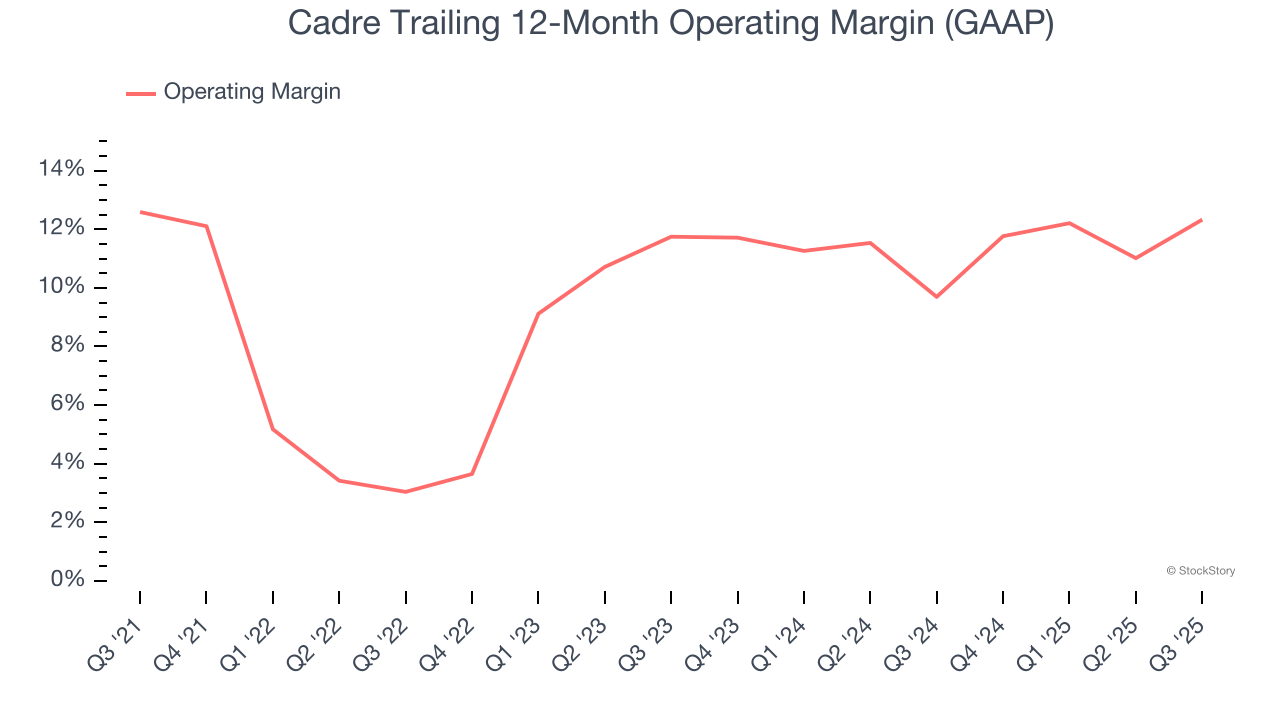

Cadre’s operating margin has been trending up over the last 12 months and averaged 10.1% over the last five years. Its solid profitability for an industrials business shows it’s an efficient company that manages its expenses effectively.

Looking at the trend in its profitability, Cadre’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Cadre generated an operating margin profit margin of 12%, up 7 percentage points year on year. This increase was a welcome development and shows it was more efficient.

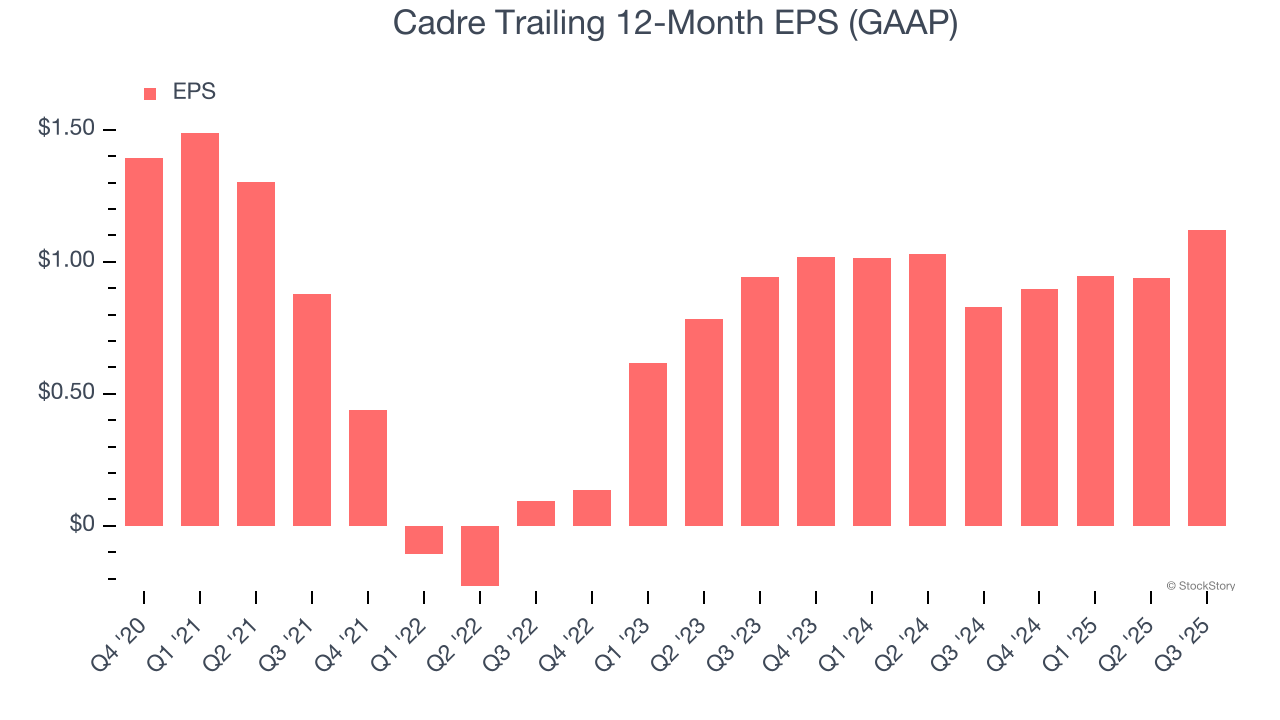

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

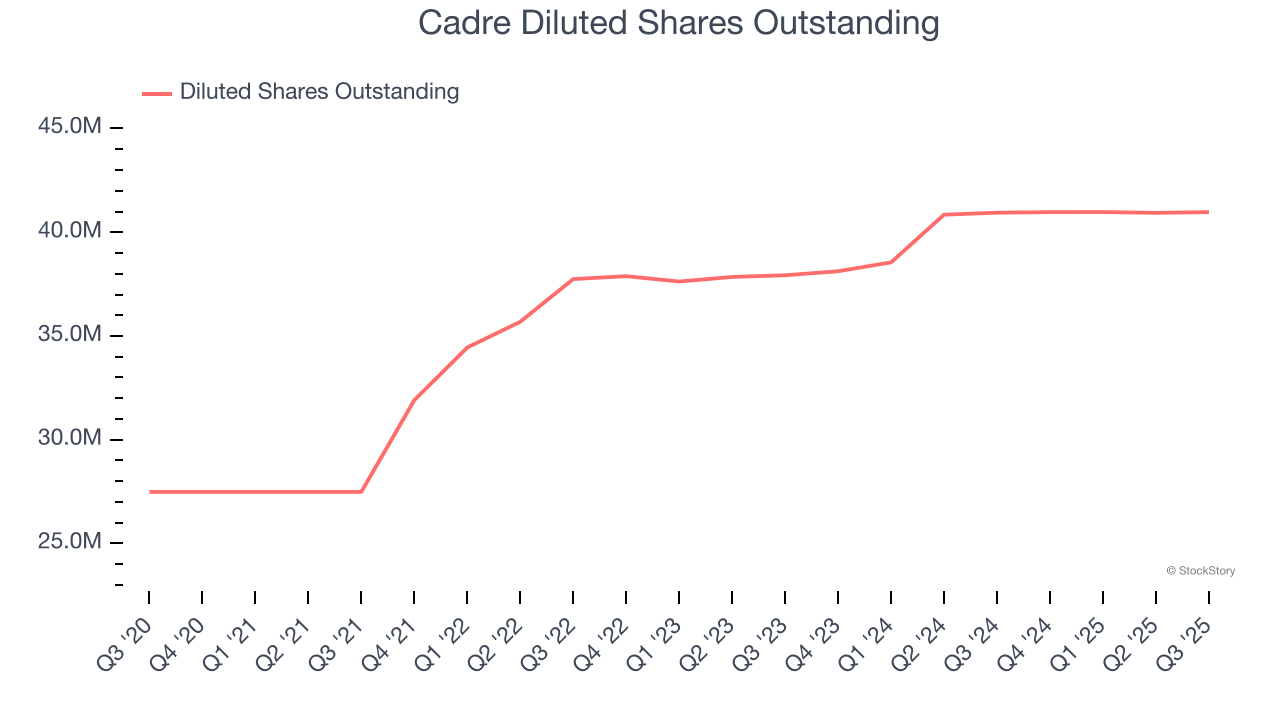

Cadre’s flat EPS over the last five years was below its 8.3% annualized revenue growth. However, its operating margin didn’t change during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

We can take a deeper look into Cadre’s earnings to better understand the drivers of its performance. Cadre recently raised equity capital, and in the process, grew its share count by 49.1% over the last five years. This has resulted in muted earnings per share growth but doesn’t tell us as much about its future. We prefer to look at operating and free cash flow margins in these situations.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Cadre, its two-year annual EPS growth of 9% was higher than its five-year trend. Accelerating earnings growth is almost always an encouraging data point.

In Q3, Cadre reported EPS of $0.27, up from $0.09 in the same quarter last year. This print beat analysts’ estimates by 3.3%. Over the next 12 months, Wall Street expects Cadre’s full-year EPS of $1.12 to grow 27.1%.

Key Takeaways from Cadre’s Q3 Results

We were impressed by how significantly Cadre blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS was in line with Wall Street’s estimates. On the other hand, its Products revenue missed and its revenue fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock remained flat at $42.29 immediately after reporting.

Big picture, is Cadre a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.