Specialty insurance company Markel Group (NYSE: MKL) met Wall Street’s revenue expectations in Q3 CY2025, but sales fell by 14.7% year on year to $3.93 billion.

Is now the time to buy Markel Group? Find out by accessing our full research report, it’s free for active Edge members.

Markel Group (MKL) Q3 CY2025 Highlights:

- Net Premiums Earned: $2.13 billion vs analyst estimates of $2.08 billion (flat year on year, 2.3% beat)

- Revenue: $3.93 billion vs analyst estimates of $3.92 billion (14.7% year-on-year decline, in line)

- Combined Ratio: 93% vs analyst estimates of 95.4% (240 basis point beat)

- Market Capitalization: $23.25 billion

"I'm very pleased with our overall results and the progress we've made as a company this year," said Tom Gayner, Chief Executive Officer.

Company Overview

Often referred to as a "mini Berkshire Hathaway" for its three-engine business model of insurance, investments, and wholly-owned businesses, Markel Group (NYSE: MKL) is a specialty insurance company that underwrites complex risks, manages investment portfolios, and owns a diverse collection of operating businesses.

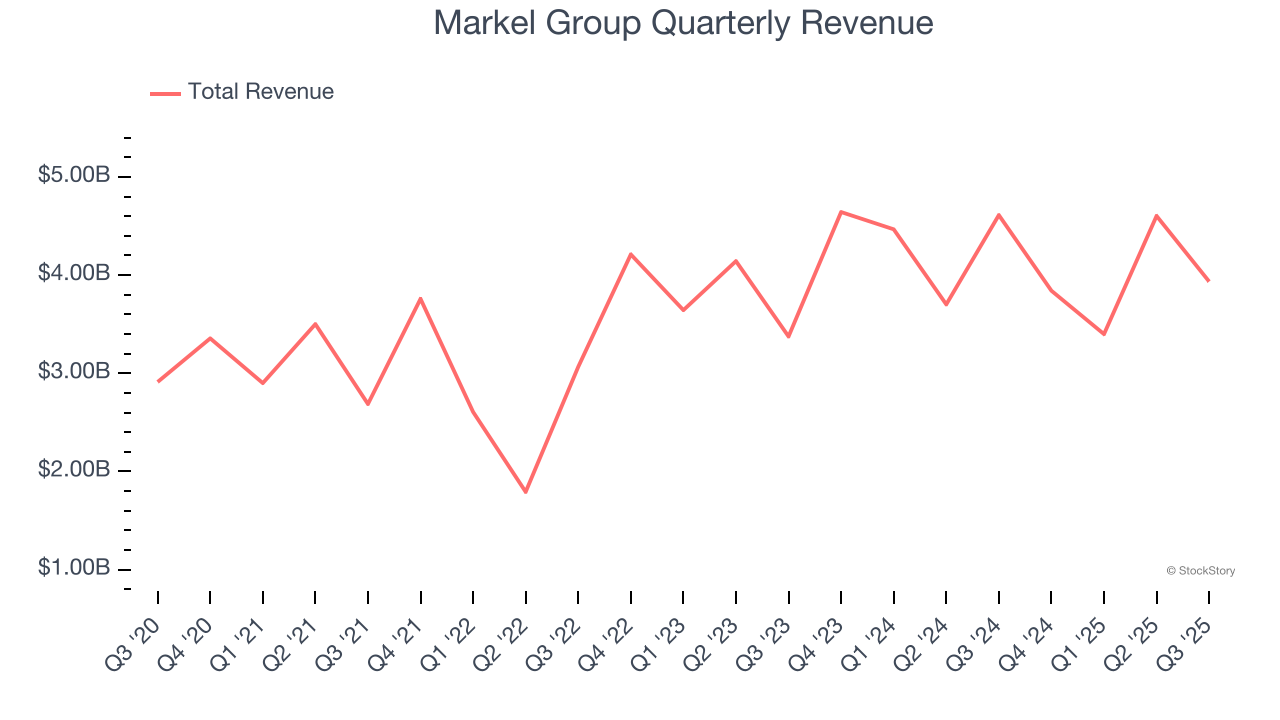

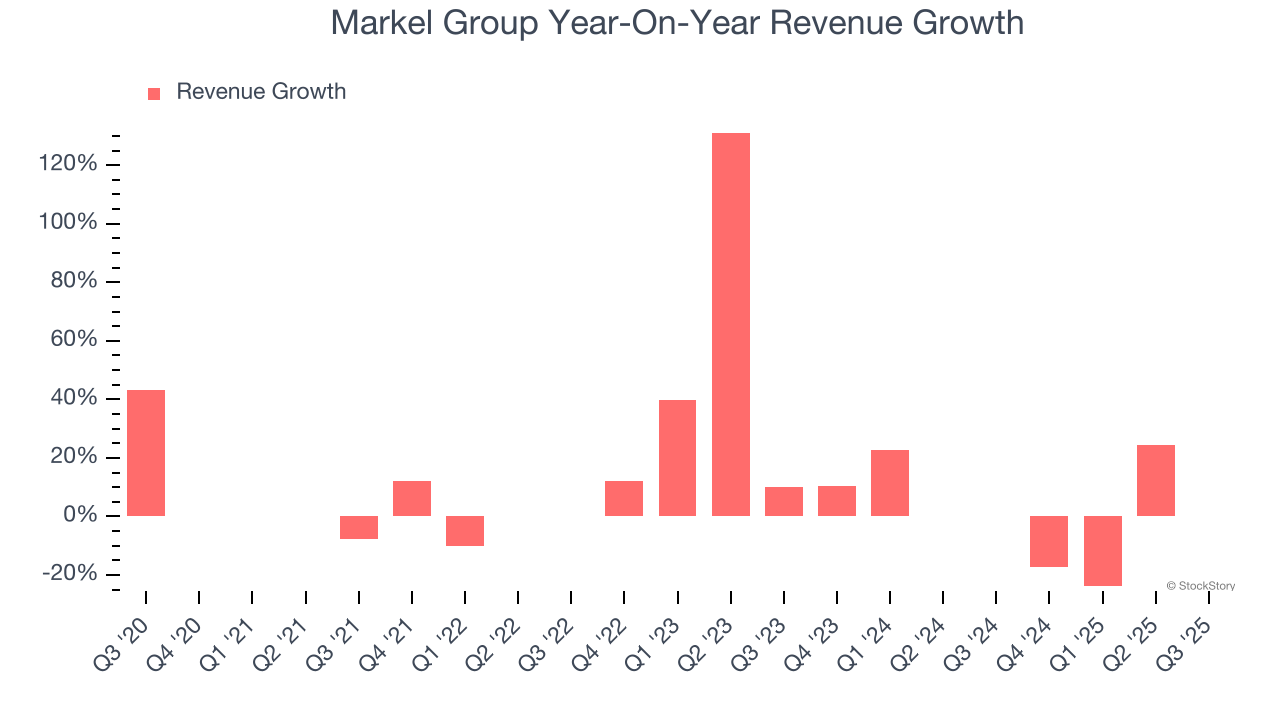

Revenue Growth

Insurance companies generate revenue three ways. The first is the core insurance business itself, represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected but not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from policy administration, annuities, and other value-added services. Regrettably, Markel Group’s revenue grew at a mediocre 7.5% compounded annual growth rate over the last five years. This fell short of our benchmark for the insurance sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Markel Group’s recent performance shows its demand has slowed as its annualized revenue growth of 1.3% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Markel Group reported a rather uninspiring 14.7% year-on-year revenue decline to $3.93 billion of revenue, in line with Wall Street’s estimates.

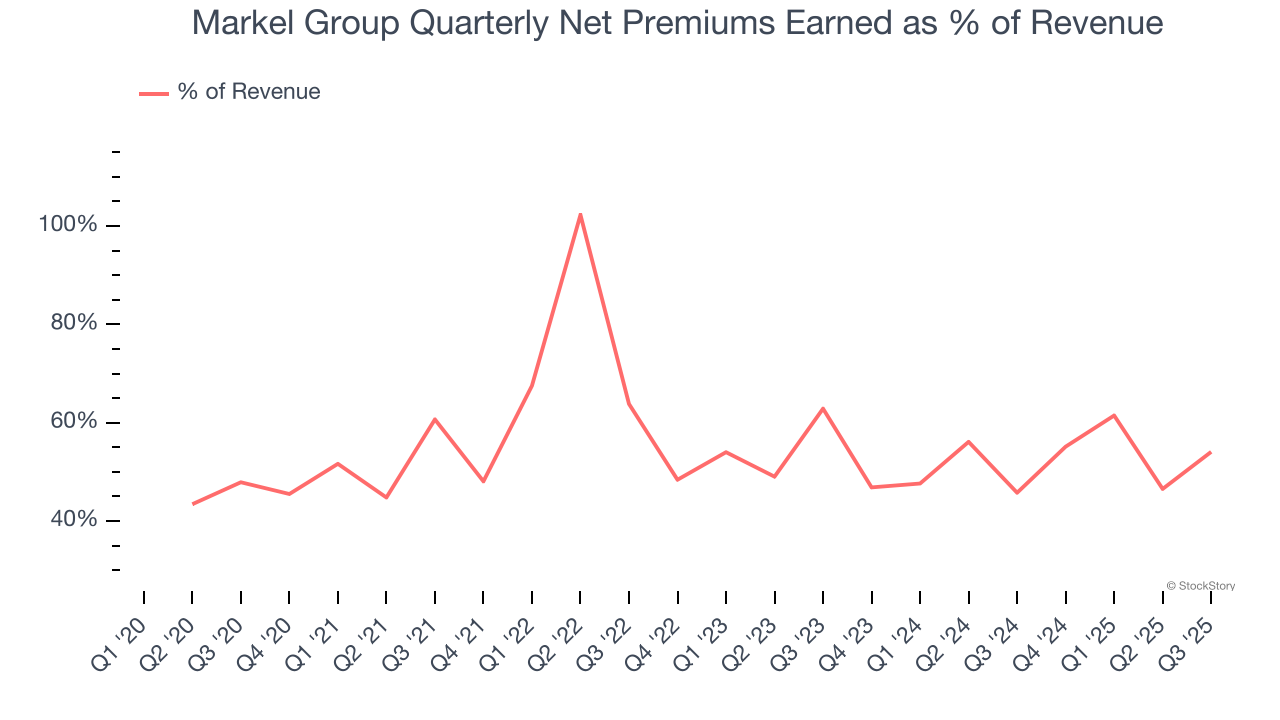

Net premiums earned made up 53.6% of the company’s total revenue during the last five years, meaning Markel Group’s growth drivers strike a balance between insurance and non-insurance activities.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.Markets consistently prioritize net premiums earned growth over investment and fee income, recognizing its superior quality as a core indicator of the company’s underwriting success and market penetration.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

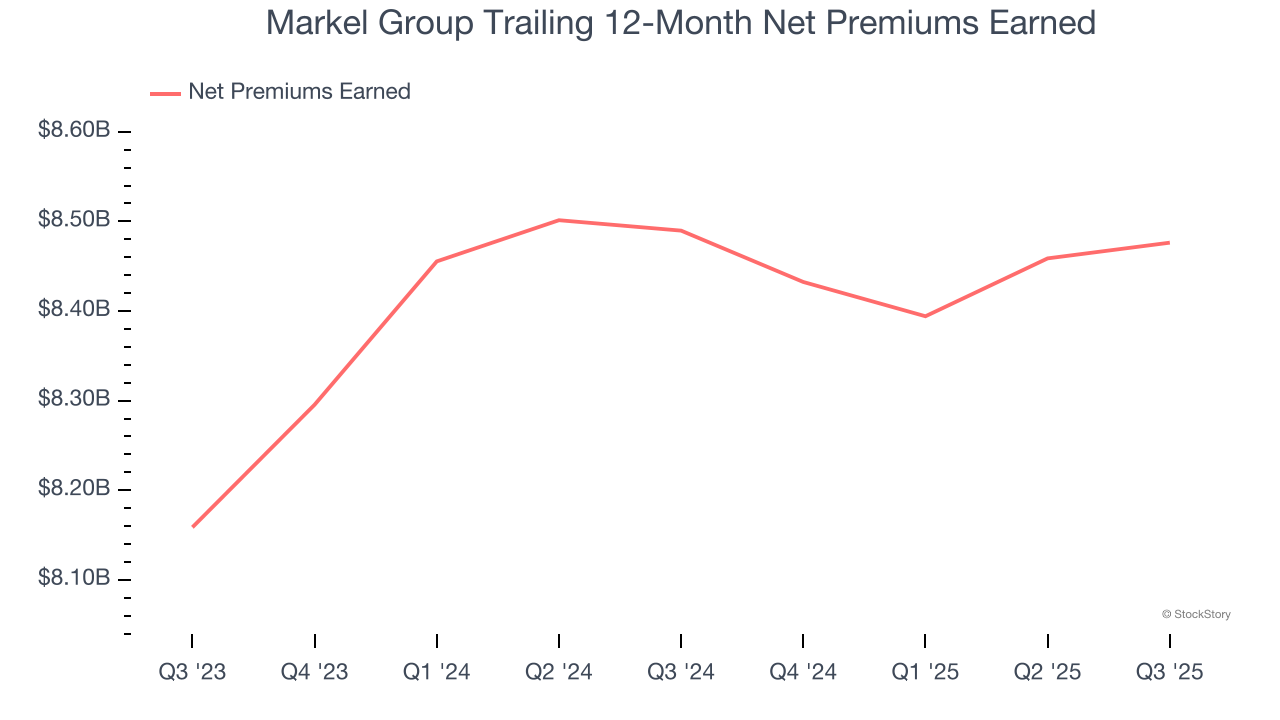

Net Premiums Earned

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore gross premiums less what’s ceded to reinsurers as a risk mitigation and transfer strategy.

Markel Group’s net premiums earned has grown at a 9.3% annualized rate over the last five years, slightly better than the broader insurance industry and faster than its total revenue.

When analyzing Markel Group’s net premiums earned over the last two years, we can see that growth decelerated to 1.9% annually. This performance was similar to its total revenue.

In Q3, Markel Group produced $2.13 billion of net premiums earned, flat year on year. But this was still enough to top Wall Street Consensus estimates by 2.3%.

Key Takeaways from Markel Group’s Q3 Results

We enjoyed seeing Markel Group beat analysts’ net premiums earned expectations this quarter. We were also happy its revenue was in line with Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 2% to $1,863 immediately following the results.

Sure, Markel Group had a solid quarter, but if we look at the bigger picture, is this stock a buy? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.