Clothing and footwear retailer Boot Barn (NYSE: BOOT) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 16.9% year on year to $608.2 million. The company expects next quarter’s revenue to be around $455.5 million, close to analysts’ estimates. Its GAAP profit of $2.43 per share was 0.8% above analysts’ consensus estimates.

Is now the time to buy Boot Barn? Find out by accessing our full research report, it’s free.

Boot Barn (BOOT) Q4 CY2024 Highlights:

- Revenue: $608.2 million vs analyst estimates of $608.2 million (16.9% year-on-year growth, in line)

- EPS (GAAP): $2.43 vs analyst estimates of $2.41 (0.8% beat)

- Revenue Guidance for Q1 CY2025 is $455.5 million at the midpoint, roughly in line with what analysts were expecting

- EPS Guidance for Q1 CY2025 is $1.22 million at the midpoint, below expectations of $1,25

- EPS guidance for the full year is $5.86 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 16.4%, up from 14.4% in the same quarter last year

- Free Cash Flow Margin: 18.8%, up from 13.1% in the same quarter last year

- Locations: 438 at quarter end, up from 382 in the same quarter last year

- Same-Store Sales rose 8.6% year on year (-9.7% in the same quarter last year)

- Market Capitalization: $5.29 billion

John Hazen, Interim Chief Executive Officer, commented, “I want to thank the entire Boot Barn team for their excellent execution and dedication during a busy holiday season, which resulted in strong third quarter results and earnings per diluted share above the high-end of our guidance range. The strength we saw in the business was once again driven by broad-based growth across all major merchandise categories, channels and geographies, resulting in a consolidated same store sales increase of 8.6%. We also grew total sales 16.9% compared to the prior-year period, driven in part by the 13 new stores we opened in the third quarter and the 39 new stores we have opened year-to-date through our third fiscal quarter. In addition to strong sales, we continued to maintain our full-price selling model, resulting in merchandise margin expansion of 130 basis points. As we enter our fourth fiscal quarter, we feel very good about the overall tone of the business and the future growth potential of the brand.”

Company Overview

With a strong store presence in Texas, California, Florida, and Oklahoma, Boot Barn (NYSE: BOOT) is a western-inspired apparel and footwear retailer.

Footwear Retailer

Footwear sales–like their apparel counterparts–are driven by seasons, trends, and innovation more so than absolute need and similarly face the bigger-picture secular trend of e-commerce penetration. Footwear plays a part in societal belonging, personal expression, and occasion, and retailers selling shoes recognize this. Therefore, they aim to balance selection, competitive prices, and the latest trends to attract consumers. Unlike their apparel counterparts, footwear retailers most sell popular third-party brands (as opposed to their own exclusive brands), which could mean less exclusivity of product but more nimbleness to pivot to what’s hot.

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Boot Barn is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage. On the other hand, it can grow faster because it’s working from a smaller revenue base and has more white space to build new stores.

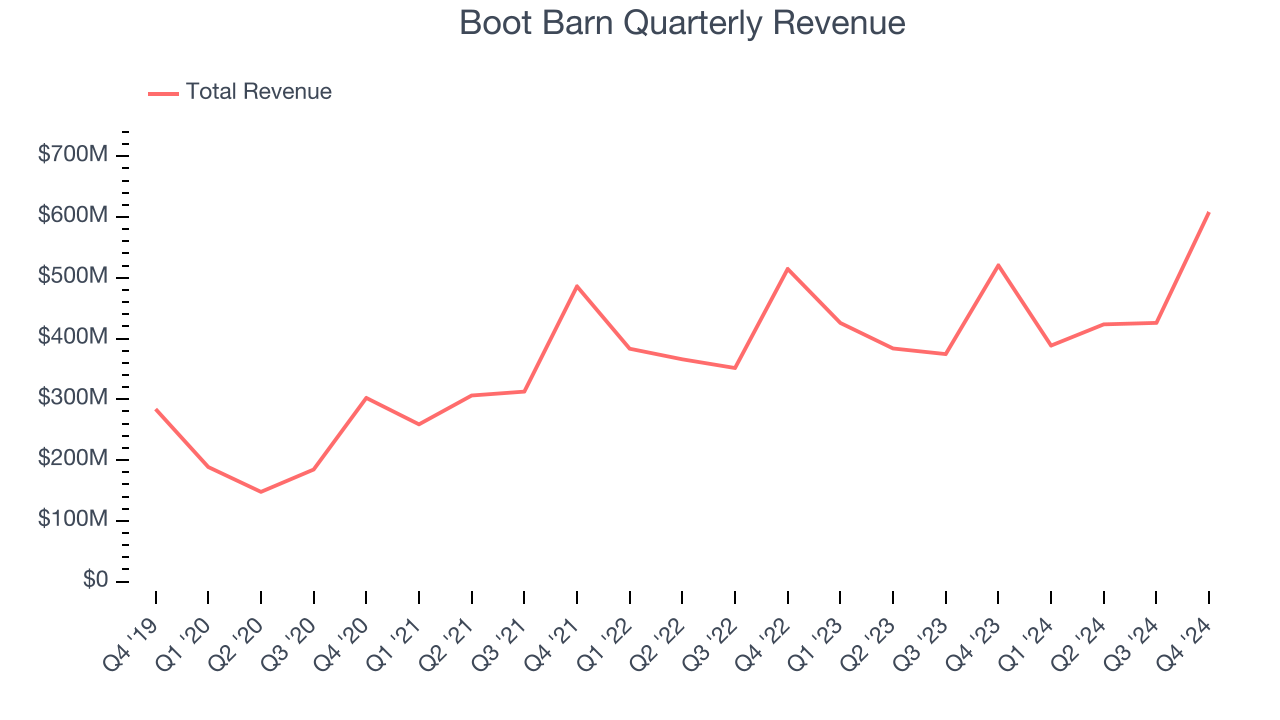

As you can see below, Boot Barn’s 16.8% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was impressive as it opened new stores and expanded its reach.

This quarter, Boot Barn’s year-on-year revenue growth was 16.9%, and its $608.2 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 17.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 15% over the next 12 months, a slight deceleration versus the last five years. Still, this projection is commendable and indicates the market sees success for its products.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Store Performance

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

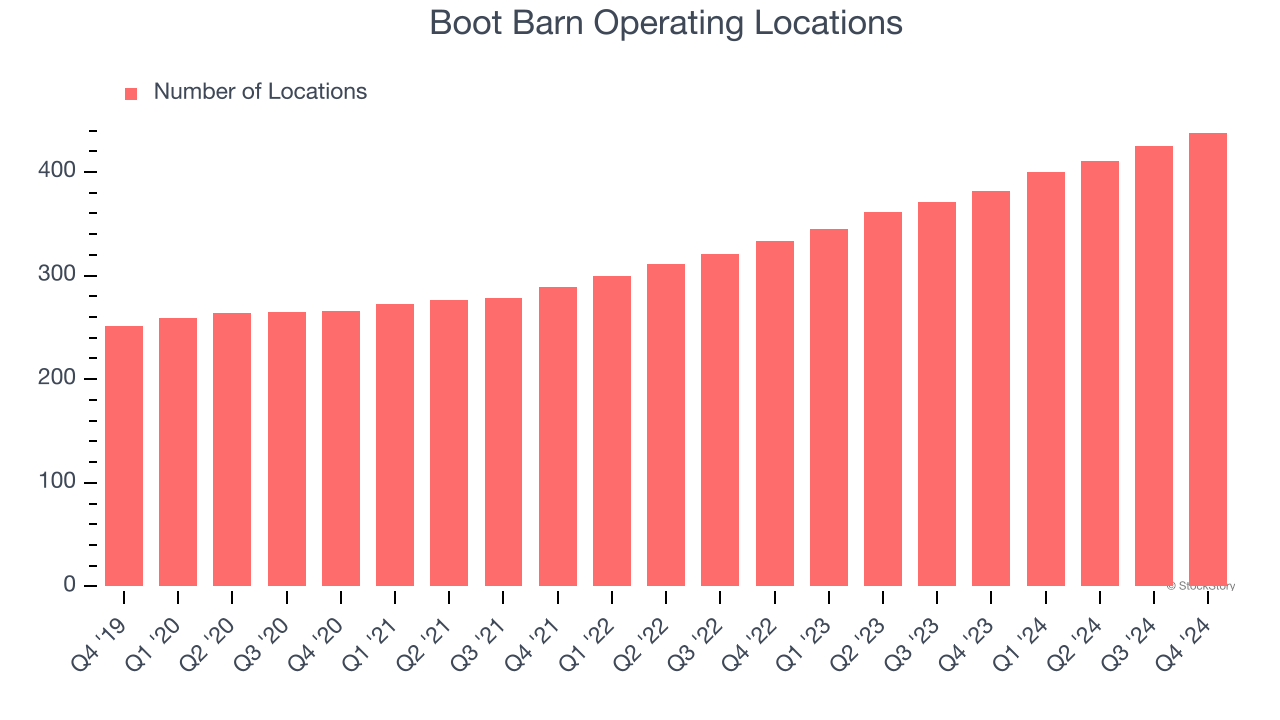

Boot Barn operated 438 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years, averaging 15% annual growth, much faster than the broader consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

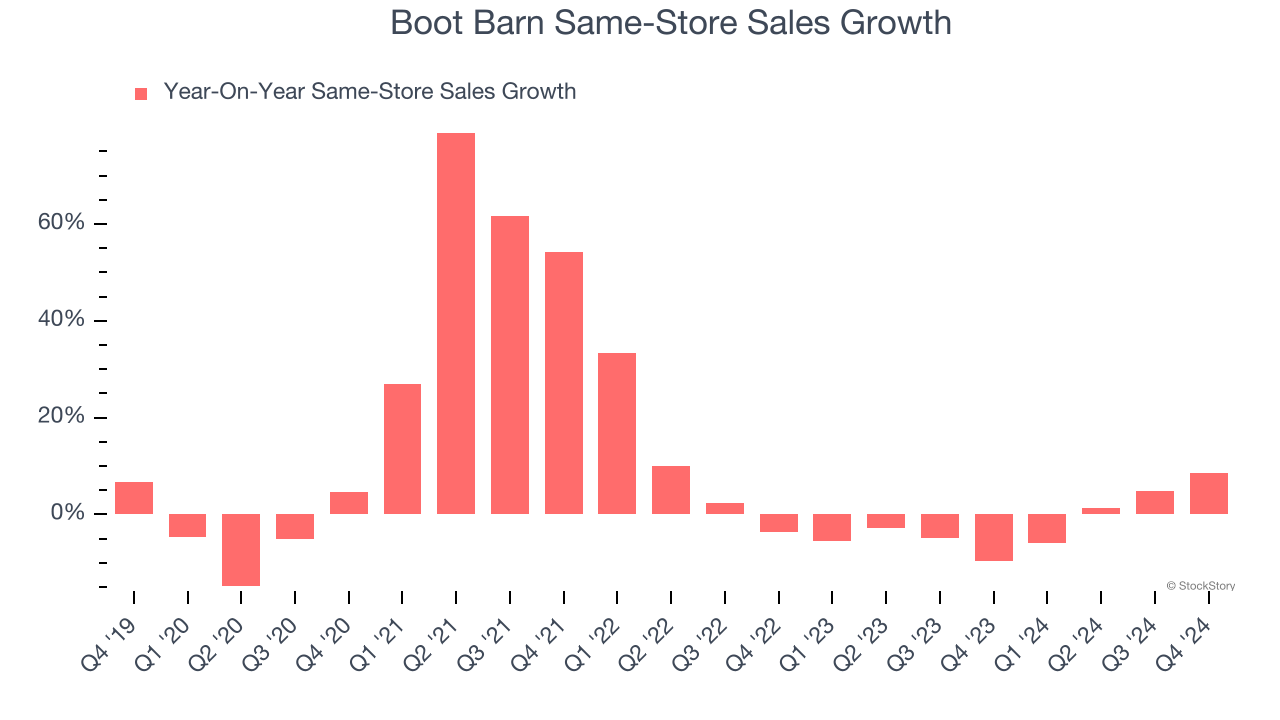

Boot Barn’s demand has been shrinking over the last two years as its same-store sales have averaged 1.7% annual declines. This performance is concerning - it shows Boot Barn artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

In the latest quarter, Boot Barn’s same-store sales rose 8.6% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Boot Barn’s Q4 Results

We struggled to find many resounding positives in these results. Same-store sales was in line, leading to in-line revenue. Looking ahead, revenue guidance for next quarter was in line, but EPS guidance was below Wall Street's estimates. Overall, this quarter could have been better. The stock traded down 6.2% to $163.80 immediately following the results.

Is Boot Barn an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.