Diversified industrial manufacturing company Worthington (NYSE: WOR) met Wall Street’s revenue expectations in Q4 CY2024, but sales fell by 74.8% year on year to $274 million. Its non-GAAP profit of $0.60 per share was 15.4% above analysts’ consensus estimates.

Is now the time to buy Worthington? Find out by accessing our full research report, it’s free.

Worthington (WOR) Q4 CY2024 Highlights:

- Revenue: $274 million vs analyst estimates of $273.8 million (in line, 74.8% year-on-year decline due to the divesture of its Sustainable Energy Solutions segment)

- Adjusted EPS: $0.60 vs analyst estimates of $0.52 (15.4% beat)

- Adjusted EBITDA: $56.21 million vs analyst estimates of $52.6 million (6.9% beat, 20.5% margin)

- Operating Margin: 1.3%

- Free Cash Flow Margin: 12.4%, up from 9.4% in the same quarter last year

- Market Capitalization: $1.92 billion

“We delivered solid financial results for the quarter despite mild but persistent macro headwinds, achieving year over year and sequential growth in adjusted EBITDA and adjusted EPS,” said Worthington Enterprises President and CEO Joe Hayek.

Company Overview

Founded by a steel salesman, Worthington (NYSE: WOR) specializes in steel processing, pressure cylinders, and engineered cabs for commercial markets.

Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Sales Growth

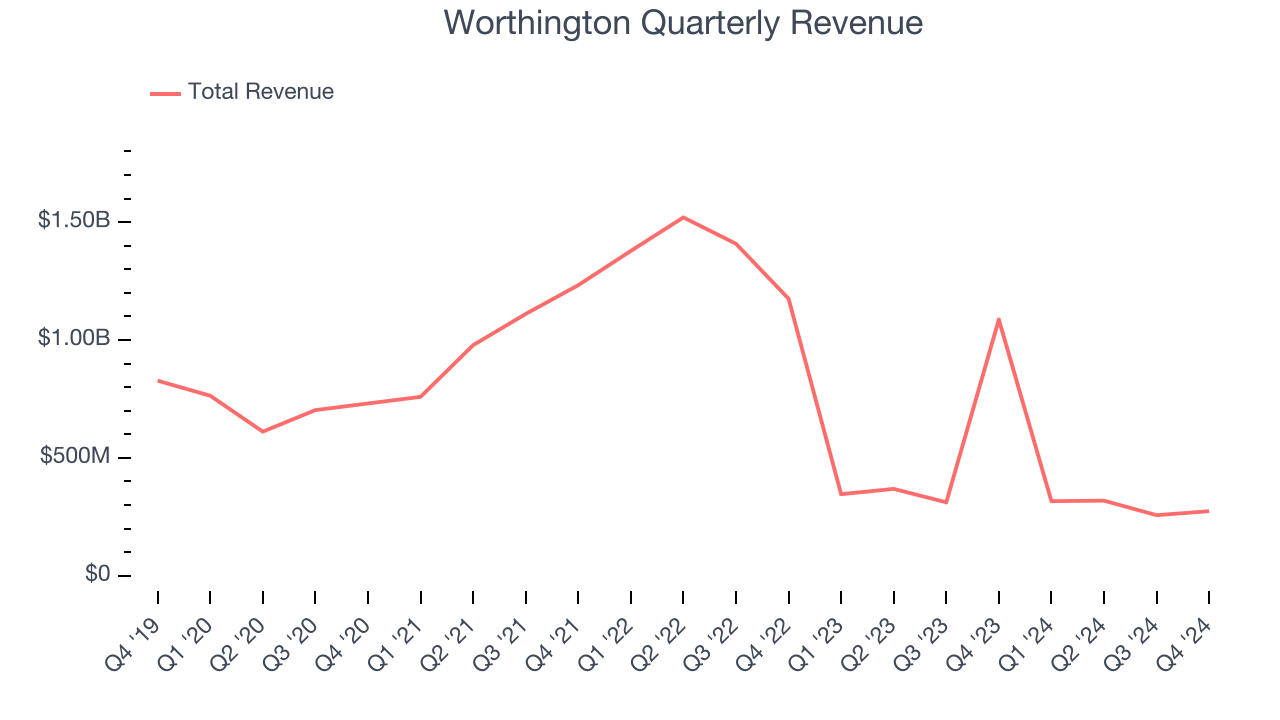

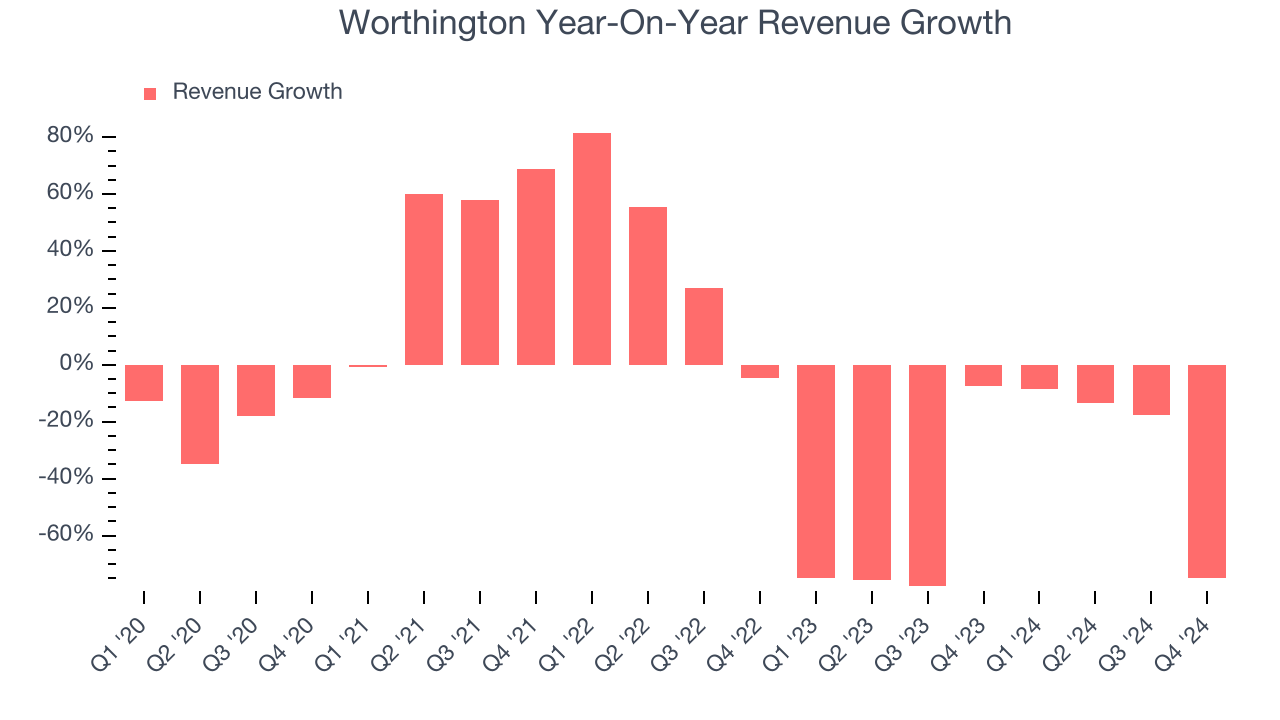

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Worthington’s demand was weak and its revenue declined by 19.7% per year. This was below our standards and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Worthington’s recent history shows its demand has stayed suppressed as its revenue has declined by 53.9% annually over the last two years. Worthington isn’t alone in its struggles as the Engineered Components and Systems industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

Worthington also breaks out the revenue for its most important segments, Consumer Products and Building Products, which are 42.6% and 57.4% of revenue. Over the last two years, Worthington’s Consumer Products revenue (cylinders, torches, balloon kits, tools) averaged 14.5% year-on-year declines. On the other hand, its Building Products revenue (refrigerant, cylinders, tanks) averaged 2.1% growth.

This quarter, Worthington reported a rather uninspiring 74.8% year-on-year revenue decline to $274 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to decline by 1% over the next 12 months. Although this projection is better than its two-year trend, it's tough to feel optimistic about a company facing demand difficulties.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

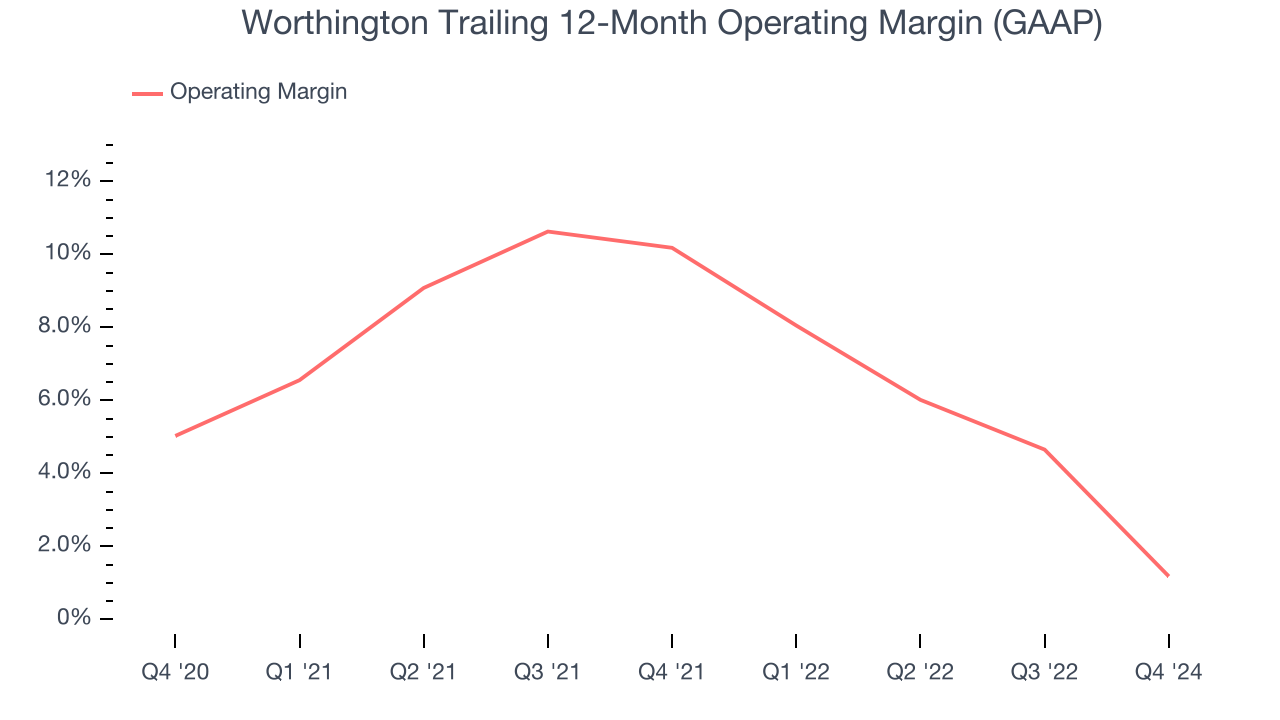

Worthington was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.7% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Worthington’s operating margin decreased by 3.8 percentage points over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers.

In Q4, Worthington generated an operating profit margin of 1.3%,

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

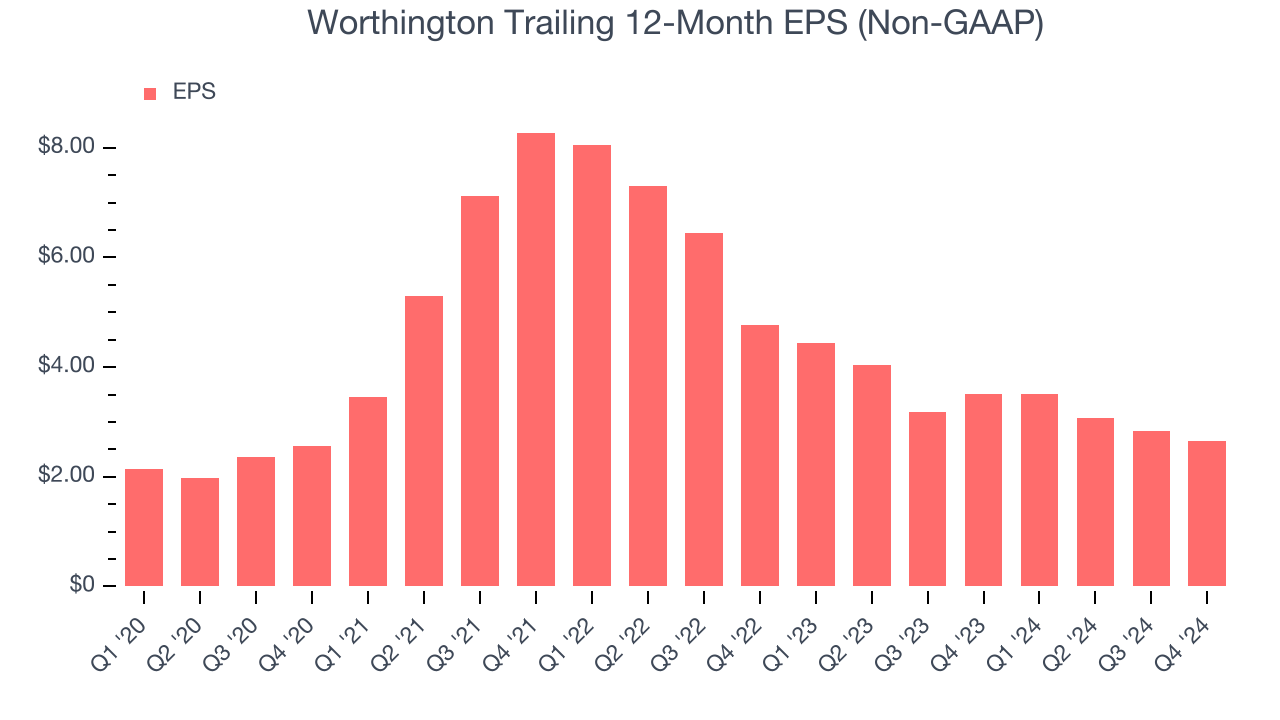

Worthington’s EPS grew at a weak 2% compounded annual growth rate over the last five years. This performance was better than its 19.7% annualized revenue declines but doesn’t tell us much about its business quality because its operating margin didn’t expand.

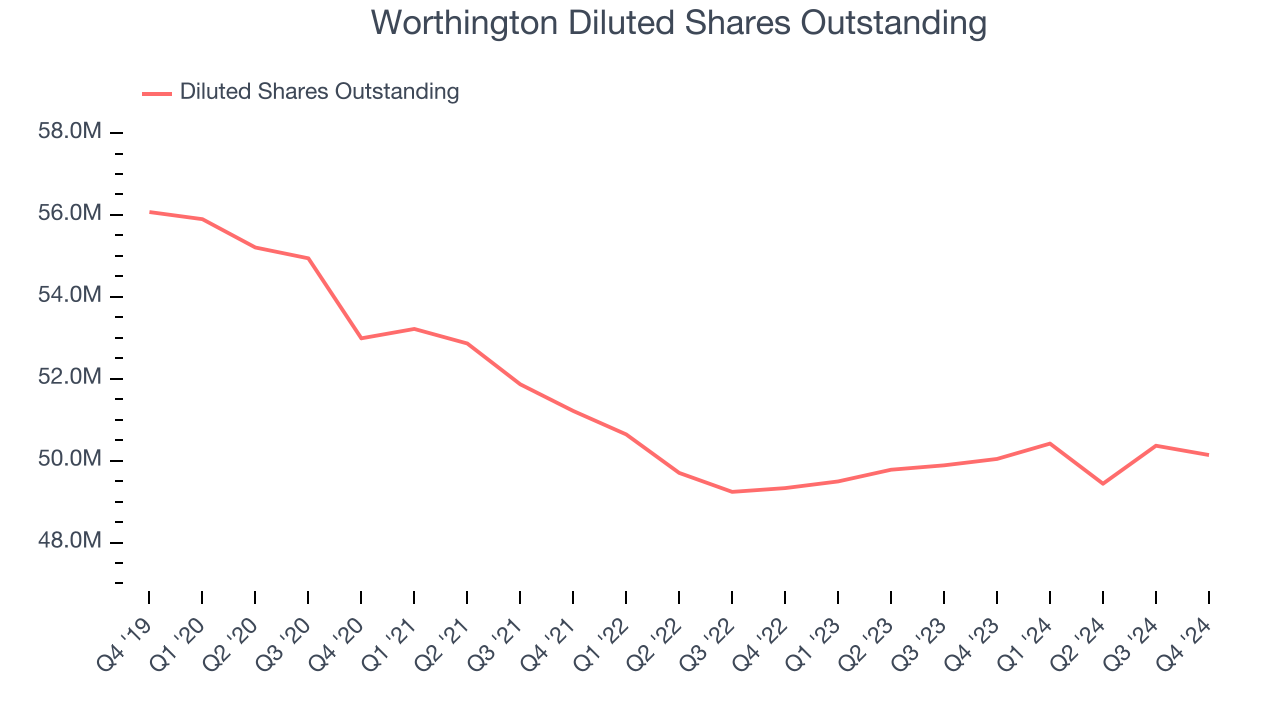

Diving into the nuances of Worthington’s earnings can give us a better understanding of its performance. A five-year view shows that Worthington has repurchased its stock, shrinking its share count by 10.6%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Worthington, its two-year annual EPS declines of 25.4% show it’s continued to underperform. These results were bad no matter how you slice the data.In Q4, Worthington reported EPS at $0.60, down from $0.78 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Worthington’s Q4 Results

We enjoyed seeing Worthington exceed analysts’ EPS and EBITDA expectations this quarter. Zooming out, we think this quarter featured some important positives. The stock traded up 16.9% to $44.55 immediately following the results.

Worthington put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.