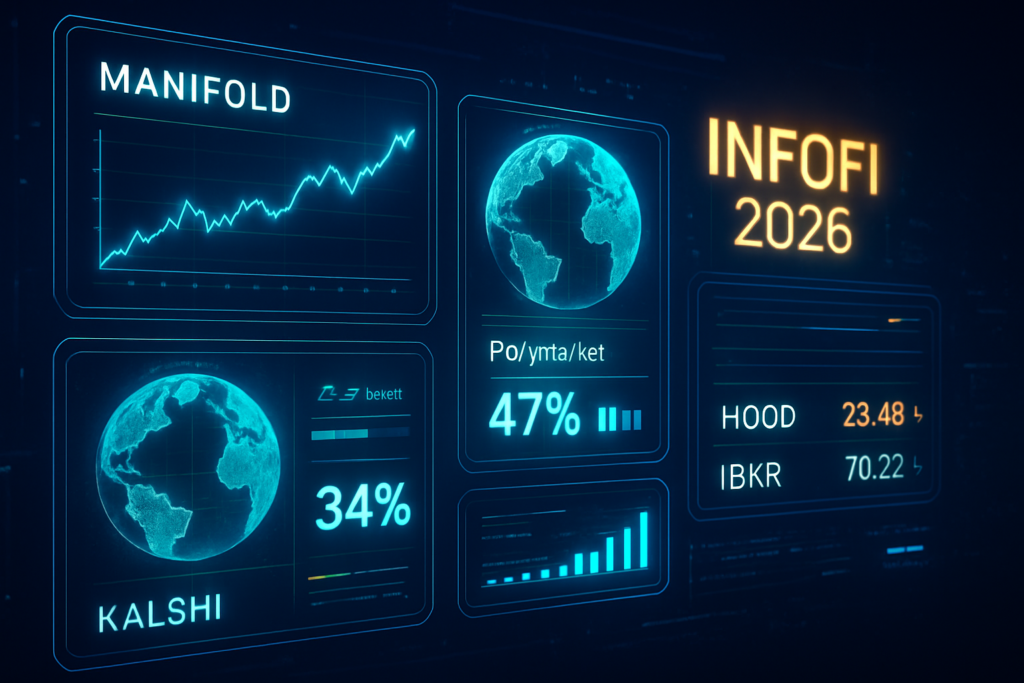

As of January 27, 2026, the prediction market industry is no longer a fringe hobby for statistics nerds or a seasonal interest for election cycles; it has evolved into a multi-billion dollar pillar of the global financial system known as "InfoFi" (Information Finance). On Manifold Markets, the industry's self-appointed "meta-layer," traders are currently obsessed with a high-stakes question: who will win the "Great Prediction War" of 2026?

With total industry volume reaching a staggering $13 billion per month in late 2025, meta-markets on Manifold are currently pricing a 47% probability that Polymarket will maintain its crown as the volume leader through the end of the year. However, the regulated giants are closing in. Interest in these meta-markets has skyrocketed as institutional liquidity from firms like Susquehanna International Group and Jane Street begins to treat event contracts not as "bets," but as sophisticated hedging tools for geopolitical and macroeconomic risk.

The Market: What's Being Predicted

The primary battleground for industry observers is the Manifold market titled "Top 1 Prediction Market by Volume in 2026." This contract tracks the total notional volume across the major players: Polymarket, Kalshi, and the rapidly ascending ForecastEx, owned by Interactive Brokers (NASDAQ: IBKR).

As of today, the odds stand at:

- Polymarket (47%): The crypto-native giant continues to lead, fueled by its role as the global "truth engine" for international events.

- Kalshi (34%): Despite facilitating over $43 billion in trades in 2025, Kalshi’s odds have softened following a recent regulatory speed bump in Massachusetts regarding sports contracts.

- ForecastEx (12%): A dark horse that recently surpassed $1 billion in cumulative notional volume, drawing in traditional finance (TradFi) users through the existing IBKR ecosystem.

- Robinhood (7%): Following its high-profile joint venture with Susquehanna, Robinhood (NASDAQ: HOOD) has become the fastest-growing retail entrant, though its 2026 volume is still playing catch-up.

Trading on these markets is characterized by high liquidity and a unique "insider" feel, as many participants are employees of these very platforms or professional market makers who provide the liquidity for the industry.

Why Traders Are Betting

The volatility in these meta-markets is being driven by three primary factors: regulatory arbitrage, the "InfoFi" narrative, and institutional product integration. Traders are currently reacting to a January 2026 preliminary injunction in Massachusetts that temporary banned "event contracts related to sports" on regulated exchanges. Since nearly 90% of Kalshi's record-breaking 2025 volume was derived from sports-adjacent markets, the "No" side of their dominance contract saw a massive 15% spike in volume this week.

Meanwhile, the concept of Information Finance (InfoFi)—the idea that prediction markets are the most efficient way to price the probability of truth—is moving from theory to reality. Projects like Intuition, which launched its mainnet in late 2025, have convinced Manifold traders that the industry's growth is "non-linear." There is currently a 53% probability on Manifold that a major bank CEO, such as Jamie Dimon of JPMorgan Chase & Co. (NYSE: JPM), will publicly endorse prediction markets as a legitimate asset class before the end of Q3 2026.

Finally, the entry of Coinbase (NASDAQ: COIN) into the space via its acquisition of The Clearing Company has signaled to traders that the infrastructure for a $10 trillion annual volume rate—the "bull case" for 2026—is finally being built.

Broader Context and Implications

This meta-forecasting trend reveals a fundamental shift in how the public views information. In 2024, prediction markets were used to "fact-check" polls; in 2026, they are being used to price the very future of the platforms themselves. This represents the ultimate "skin in the game" for an industry built on the premise that financial incentives lead to better forecasting.

The regulatory implications are particularly significant. A dominant market on Manifold currently gives an 81% chance that federal preemption will eventually protect Designated Contract Markets (DCMs) from varying state-level bans. If this "Yes" outcome triggers, it would effectively create a unified national market for event contracts in the U.S., similar to the equity markets.

Historically, Manifold's meta-markets have been eerily accurate. In late 2024, Manifold traders correctly predicted the exact quarter that Kalshi would achieve its first $1 billion month, months before it happened. The current betting activity suggests that 2026 will be the year where regulated (Kalshi, IBKR) and decentralized (Polymarket) volumes finally begin to converge as the legal "grey areas" evaporate.

What to Watch Next

The most immediate catalyst for these markets is the resolution of the "Public Integrity in Financial Prediction Markets Act" (H.R. 7004), currently making its way through Congress. If passed, it would formalize the rules around insider trading on event contracts—a move that sounds restrictive but is actually viewed as "bullish" by traders because it provides the legal framework necessary for pension funds and insurance companies to enter the market.

Key dates to monitor include:

- February 15, 2026: The deadline for the CFTC to respond to the Massachusetts injunction, which will likely decide Kalshi’s volume trajectory for the first half of the year.

- Q2 2026 Earnings: Watch for Robinhood (NASDAQ: HOOD) to report its first full quarter of "Event Derivatives" revenue, which many expect will surprise to the upside.

Traders should also keep an eye on the "Social-to-Market" pipeline. There is an active market on whether a major social media platform like X (formerly Twitter) or Reddit will integrate native prediction market widgets, a move that would likely push the "InfoFi" adoption probability toward 90%.

Bottom Line

The meta-markets on Manifold suggest that the prediction market industry is entering its "scaling phase." While Polymarket remains the volume king due to its global reach and crypto integration, the institutional weight behind ForecastEx and the retail power of Robinhood make the 2026 volume lead a closer race than most realize.

The rise of InfoFi represents a paradigm shift where information is no longer just consumed—it is priced, traded, and verified through financial incentives. Whether the industry hits the predicted $10 trillion annual volume target by the end of 2026 remains to be seen, but the "smart money" on Manifold is betting that the search for truth has finally found its business model.

In 2026, we aren't just predicting the news; we are betting on the machines that predict the news.

This article is for informational purposes only and does not constitute financial or betting advice. Prediction market participation may be subject to legal restrictions in your jurisdiction.

PredictStreet focuses on covering the latest developments in prediction markets.

Visit the PredictStreet website at https://www.predictstreet.ai/.