Achieving risk-free passive income from the stock market is the dream of investors. Unfortunately, nothing in the stock market are risk-free. However, if you are willing to have a cap on your downside in exchange for a cap on the upside, there is a multi-leg options strategy worth considering called the iron condor. This strategy can be applied to stocks with options in any stock sector.

This strategy requires basic options and knowledge of spreads. The iron condor is a multi-leg options strategy that utilizes credit spreads at the top and bottom of a trading range. It works best in a sideways to low volatility market.

Market neutral strategy

An iron condor is a market-neutral rather than a directional options strategy. This means you don't need to pick a direction to make income; instead, you have to identify a trading range that the stock will most likely stay within. This involves using technical analysis and trying to identify patterns, trends, and ranges. You also want to be sure not to trade iron condors during volatile events like earnings reports since you want the stock to stay trading within a price range.

The mechanics of an iron condor

The strategy is called iron condor because the shape of the profit/loss graph appears like a large bird with wings, with the body representing the maximum profit and wings representing the losses. An iron condor is generally comprised of 2 out of the money (OTM) credit spreads. A credit spread involves 2 trades, selling an option and buying an option at different strike prices while both having the same expiration. An iron condor is comprised of 4 total trades.

Identify the trading range.

The first step is to identify a trading range. It can be in a daily, weekly, or monthly trading range. A wider price range envelope will require a wider time frame chart.

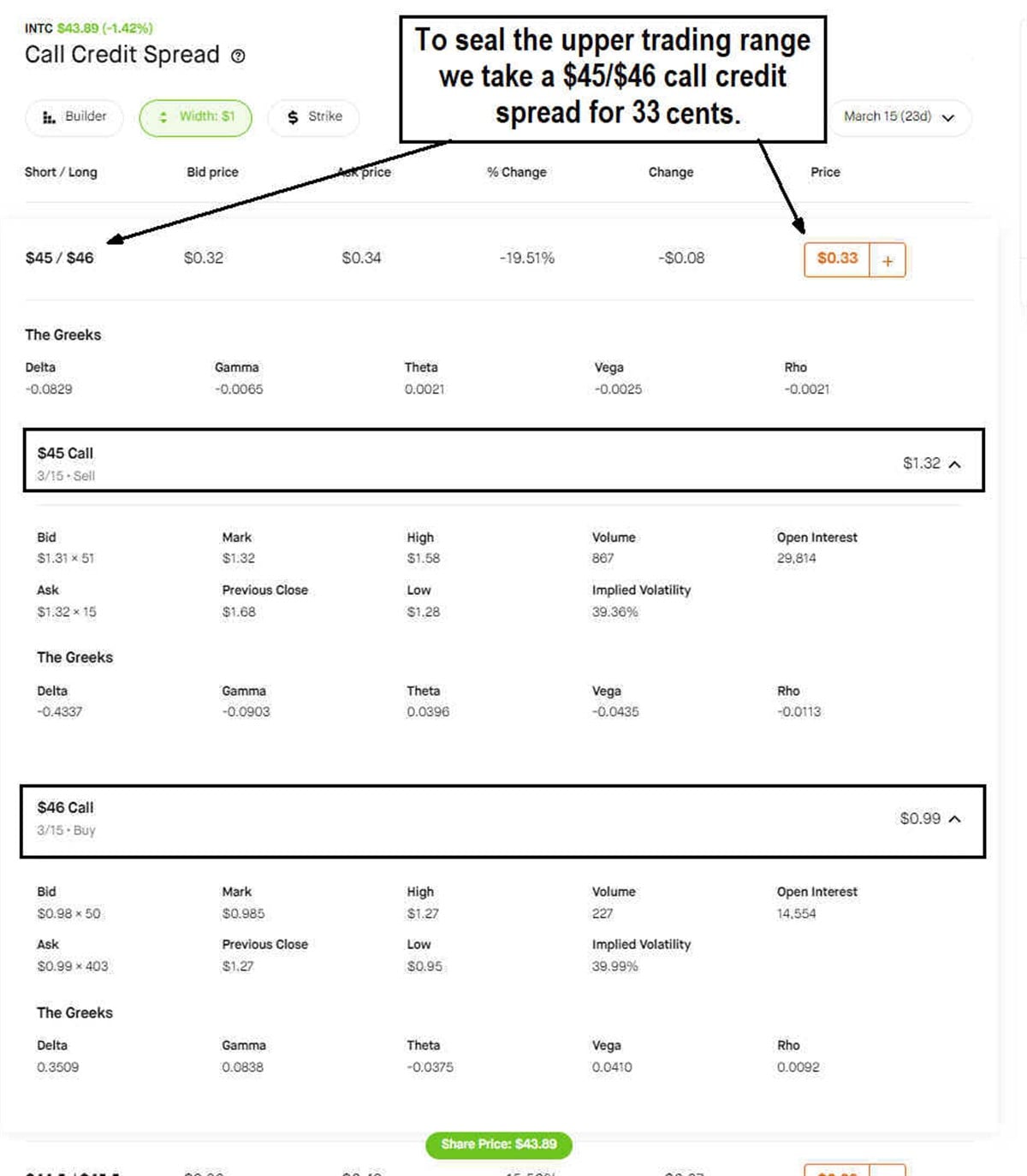

Let’s use Intel Co. (NASDAQ: INTC) on the daily candlestick chart. INTC is trading around $43.94 on Feb. 21, 2023. INTC recently dumped on its earnings report, causing it to chop around in a trading range; It has been trading under the $45 level with a daily 50-period moving average (MA) resistance at $45.76. This represents the gap between the resistance level and the daily 50-period MA. We collect 33 cents.

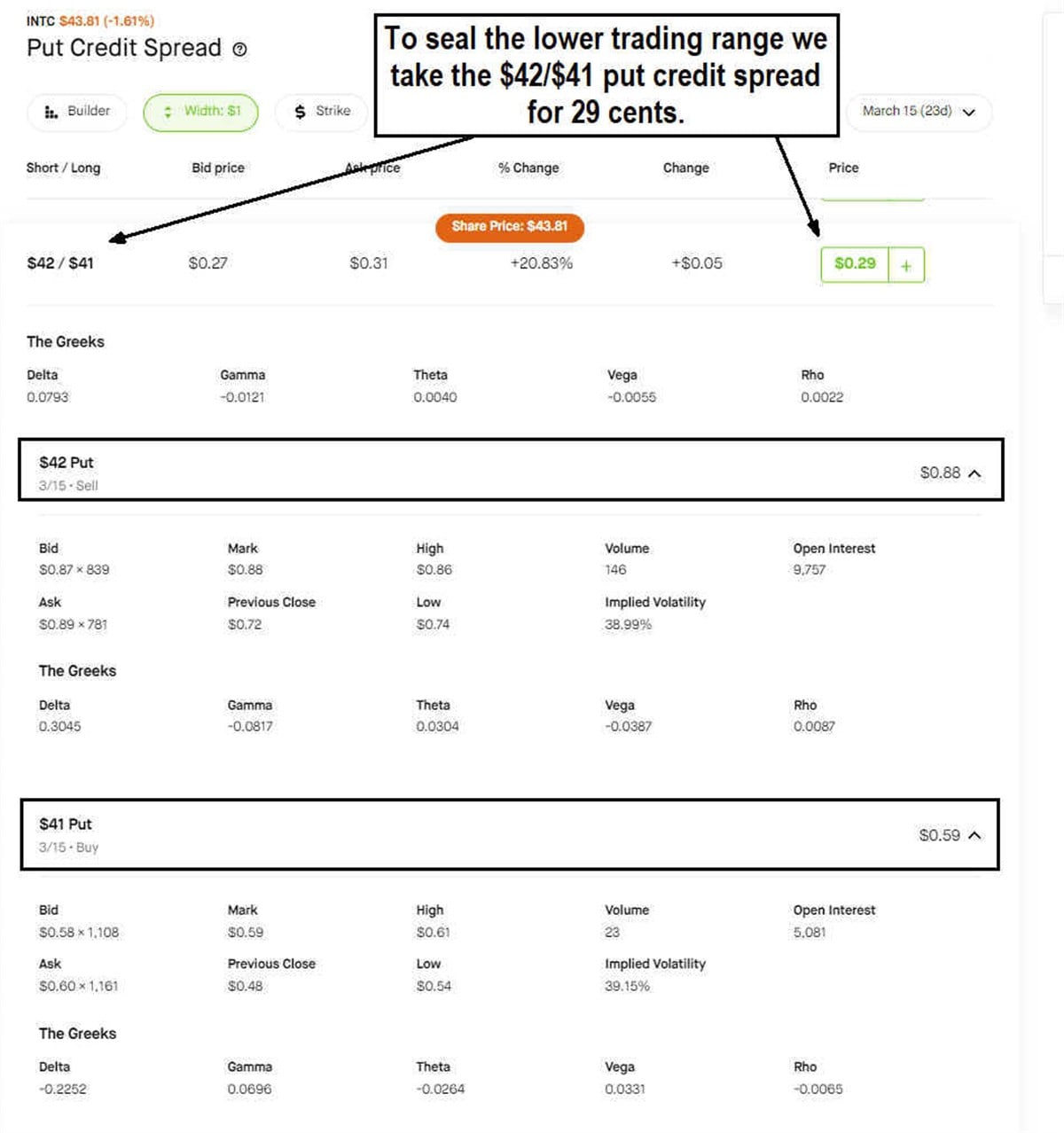

The lower range level is around $42.00, with lower support of around $41.05 prior to the swing low. The daily relative strength index (RSI) is stalled around the 50-band. Based on the charts, we can use the $45 upper and $42 lower range. We collect 29 cents. The total spread premiums we collect on the iron condor is 62 cents or $67.

Placing the trades

Using the $45 and $42 range envelopes, we can start putting on the credit spreads on both sides.

For the $45 upper range, we can look for the $45/$46 call credit spread expiring 23 days from now on March 15, 2024. Unlike debt spreads, where we have to buy the spread, credit spreads actually pay us to place the trade. The $45/$46 credit spread pays us 33 cents. We are selling the $45 call at $1.32 and buying the $46 call at 99 cents. The difference is the spread of 33 cents, which we what we get a credit for.

For the $42 lower range envelope, we can look for the $42/$41 put credit spreads. We would be selling the $42 put for 88 cents and buying the $41 put for 59 cents, which has a spread of 29 cents. After executing both credit spread trades, the iron condor strategy is executed. INTC would need to close within the $45 and $42 envelope to garner the maximum profit of 62 cents.

Possible outcomes

Upon expiration, if INTC closes between $42 and $45, then the profit is the 62-cent premium received from the two credit spreads. The $45/$46 call credit spread, which we received 33 cents, would expire worthless since INTC closed under $45. The put credit spread, which we received 29 cents, would expire worthless since INTC close above $42.

IF INTC closes above $46, then we would keep the premium on the $42/$41 put credit spread of 29 cents. We would lose $1 on the $45/$46 call credit spread for a net loss of 71 cents.

IF INTC closes below $41, then we would keep the premium on the $45/$46 call credit spread of 33 cents. We lose $1 on the $42/$41 put credit spread for a net loss of 67 cents.

Managing the trade

If you're a seasoned trader, you can monitor the iron condor and make adjustments or close out the trade when it looks like one side of the envelope is set up to be pierced. The longer the underlying stock stays within the envelopes, the more profitable it can be just from Theta erosion.

Iron Condors can be actively managed since the maximum losses can be more than the maximum profit. The maximum profit is the premiums received on the credit spreads. Max losses cost the amount of the spread between the strikes minus the premium received for the spread. We will delve deeper into the trading spreads, including credit spreads, in the upcoming options articles.