American Express Ranks Highest in Personal Loan Customer Satisfaction for Third Consecutive Year

In a volatile economic environment in which customer satisfaction with most lending products such as mortgages and automotive loans is surging, overall customer satisfaction with personal loans is largely flat. According to the J.D. Power 2025 U.S. Consumer Lending Satisfaction Study,SM released today, this stagnant performance highlights the industry’s failure to move beyond basic transactions to address the unique and changing needs of today’s personal loan customers—many of whom have seen their financial health deteriorate considerably during the past year.1

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250515039654/en/

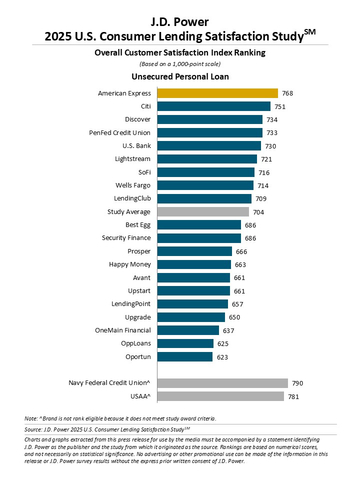

J.D. Power 2025 U.S. Consumer Lending Satisfaction Study

“The primary purpose of a consumer loan is to be a financial management tool, to help solve challenges customers are having with revolving credit card debt or unforeseen expenses,” said Bruce Gehrke, senior director of wealth and lending intelligence at J.D. Power. “So, when we see that customer satisfaction with these products is stagnating at a time when the financial health of the average customer is declining sharply, it raises questions about whether or not consumer loans are really hitting the mark for what customers need right now.”

Following are some key findings of the 2025 study:

- Satisfaction flat as financial health deteriorates: Overall customer satisfaction with personal loans is 704 (on a 1,000-point scale), up 2 points from the 2024 study. Meanwhile, just 25% of personal loan customers are classified as financially healthy this year, down from 27% in 2024 and 33% in 2023. During that same period, the percentage of customers identified as financially vulnerable has increased to 47%, up from 45% in 2024 and 40% in 2023.

- Data security is critical for delivering high satisfaction: On average, overall customer trust scores 203 points higher when personal loan customers perceive that their lender has a secure lending process that protects their personal information.

- Proactive fee communication reduces problems: Of personal loan customers who experienced a problem, 28% cited an unexpected fee, making it the most commonly cited problem. When fee information is disclosed after the loan approval, the incidence of unexpected fees surges to 43%. Similarly, overall satisfaction scores are highest (753) when fees are disclosed prior to an application and lowest (701) when they are disclosed after approval.

Study Ranking

American Express ranks highest among personal loan lenders in overall customer satisfaction for a third consecutive year, with a score of 768. Citi (751) ranks second and Discover (734) ranks third.

The U.S. Consumer Lending Satisfaction Study measures overall customer satisfaction based on performance in seven core dimensions on a poor-to-perfect rating scale. Individual dimensions measured are (in order of importance): loan met borrowing needs; level of trust; experience obtaining loan; makes it easy to do business with; people; digital channels; and kept informed about loan. The study is based on responses from 5,802 personal loan customers and was fielded from March 2024 through March 2025.

For more information about the U.S. Consumer Lending Satisfaction Study, visit https://www.jdpower.com/business/consumer-lending-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2025048.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business. The J.D. Power auto-shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

_______________________ |

1 J.D. Power measures the financial health of any consumer as a metric combining their spending/savings ratio, creditworthiness, and safety net items like insurance coverage. Consumers are placed on a continuum from healthy to vulnerable. |

View source version on businesswire.com: https://www.businesswire.com/news/home/20250515039654/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com