The Singapore-based Seagate Technology Holdings plc (STX) builds the backbone of the digital economy. With a market cap of approximately $92.9 billion, the company designs and manufactures hard disk drives, solid-state drives, hybrid drives, and storage subsystems. It also delivers scalable edge-to-cloud platforms that power data centers, cloud providers, enterprises, and equipment manufacturers worldwide.

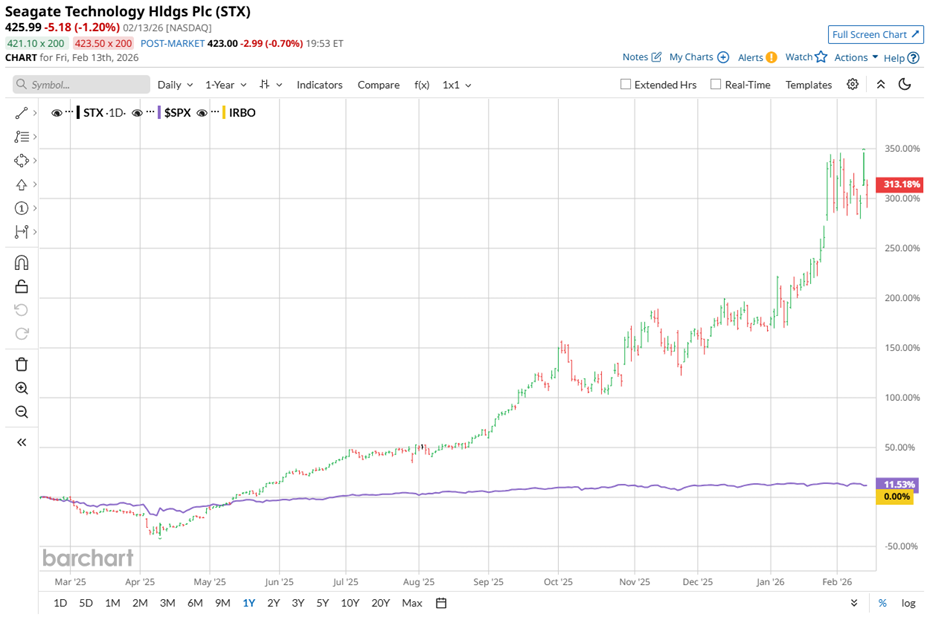

Over the past 52 weeks, Seagate’s shares have surged 319.8%, significantly outperforming the S&P 500 Index ($SPX), which gained 11.8% during the same period. Year-to-date (YTD), the stock has jumped 54.7%, while the broader index experienced a marginal pullback.

Seagate’s strength becomes even more pronounced when compared to its thematic peer benchmark. The iShares Future AI & Tech ETF (IRBO) has declined 1.5% over the past 52 weeks and has fallen 8.7% in 2026. In contrast, Seagate has delivered exceptional gains across both time frames.

On Jan. 28, STX stock leapt another 19.1% intraday after Seagate reported its Q2 fiscal 2026 results. Revenue climbed 21.5% year over year to $2.83 billion, beating the $2.75 billion analyst estimate. Adjusted EPS grew 53.2% from the year-ago value to $3.11, surpassing the Street’s forecast of $2.84.

As artificial intelligence (AI) applications accelerate data creation and expand their economic value, modern data centers require storage solutions that balance performance and cost efficiency at an exabyte scale. In here, Seagate Technology is advancing an areal-density-driven roadmap to meet evolving storage demands and sustain long-term value creation.

That being said, for Q3 fiscal 2026, Seagate's management expects revenue of $2.90 billion, plus or minus $100 million, and non-GAAP diluted EPS of $3.40, plus or minus $0.20, signaling continued operational momentum.

Looking ahead to fiscal year 2026, which ends in June, analysts project diluted EPS of $11.76, representing 62% year-over-year growth. Importantly, Seagate has exceeded consensus EPS estimates in each of the past four quarters, establishing a consistent pattern of earnings outperformance.

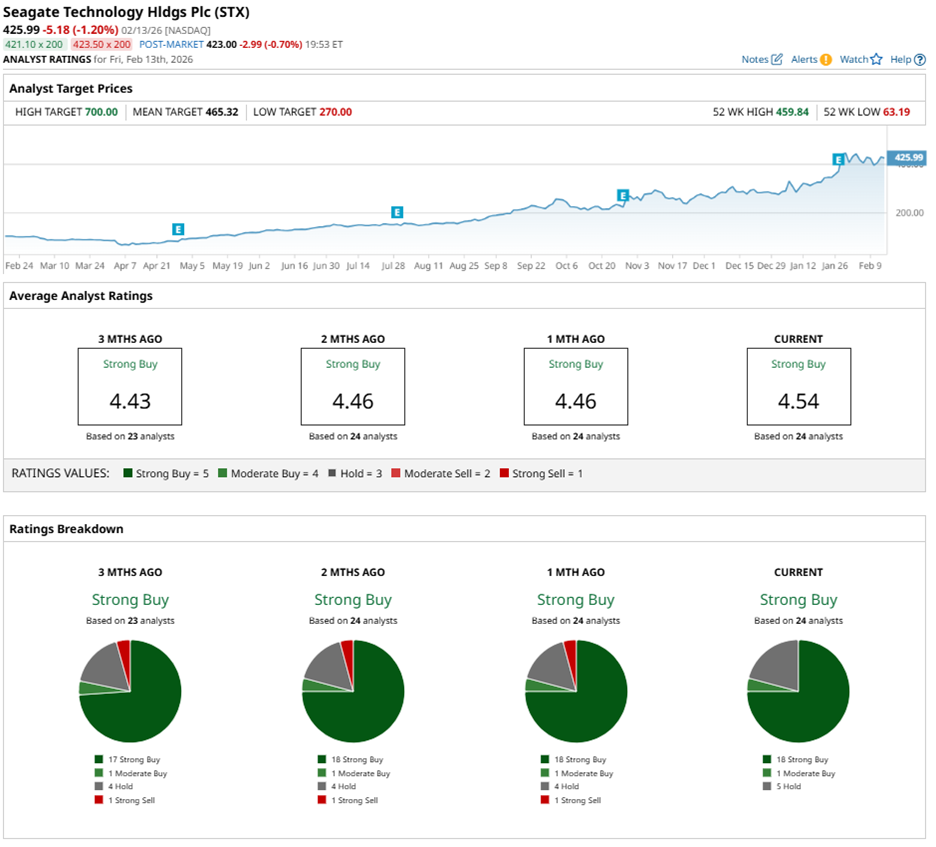

Wall Street maintains a distinctly favorable view, assigning STX stock an overall “Strong Buy” rating. Of the 24 analysts covering the stock, 18 assign a “Strong Buy” rating, one recommends “Moderate Buy,” and five advise “Hold.”

Importantly, the distribution has improved from three months ago, when 17 analysts carried “Strong Buy” ratings.

On Feb. 6, Citigroup Inc. (C) reaffirmed its “Buy” rating on STX stock and raised its price target from $460 to $480. The firm highlighted a durable demand environment, emphasizing that enterprise customers are expanding data center capacity to accommodate growing AI workloads.

Price targets further underscore expectations for continued appreciation. The average price target of $465.32 represents potential upside of 9.2%. Meanwhile, the Street-high target of $700 suggests a gain of 64.3% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Markets Don’t Bottom On Fear. They Bottom When Forced Sellers Are Done

- AI Disruption Fear, FOMS and Other Key Things to Watch this Week

- Warren Buffett Says Only Buy Stocks You’re Comfortable Holding For Ten Years, Otherwise Don’t Bother Even ‘Owning it for Ten Minutes’

- Is AMD Stock a Buy? Why Wall Street Sees 40% Upside From Here.