With a market cap of $167.2 billion, AT&T Inc. (T) is a global telecommunications and technology company offering wireless, broadband, fiber, and managed services to consumers, businesses, and government customers under well-known brands such as AT&T, Cricket, and AT&T Fiber. Operating through its Communications and Latin America segments, the company provides mobile and internet services across the U.S. and Mexico.

Shares of the Dallas, Texas-based company have underperformed the broader market over the past 52 weeks. The stock has risen 3.2% over this time frame, while the broader S&P 500 Index ($SPX) has returned 13.9%. In addition, shares of AT&T are down 5.6% on a YTD basis, compared to SPX’s 1.5% gain.

Moreover, the telecom giant stock has lagged behind the State Street Communication Services Select Sector SPDR ETF’s (XLC) 17.3% surge over the past 52 weeks.

AT&T shares fell 1.9% after the company posted Q3 2025 on Oct. 22 as investors reacted to flat adjusted EPS of $0.54 despite strong subscriber additions. Concerns also rose over ongoing structural pressures, including a 7.8% decline in Business Wireline revenue and increased operating costs tied to higher equipment sales, legal settlements of ~$0.4 billion, and rising depreciation from network upgrades.

For the fiscal year that ended in December 2025, analysts expect AT&T's adjusted EPS to decline 8.9% year-over-year to $2.06. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

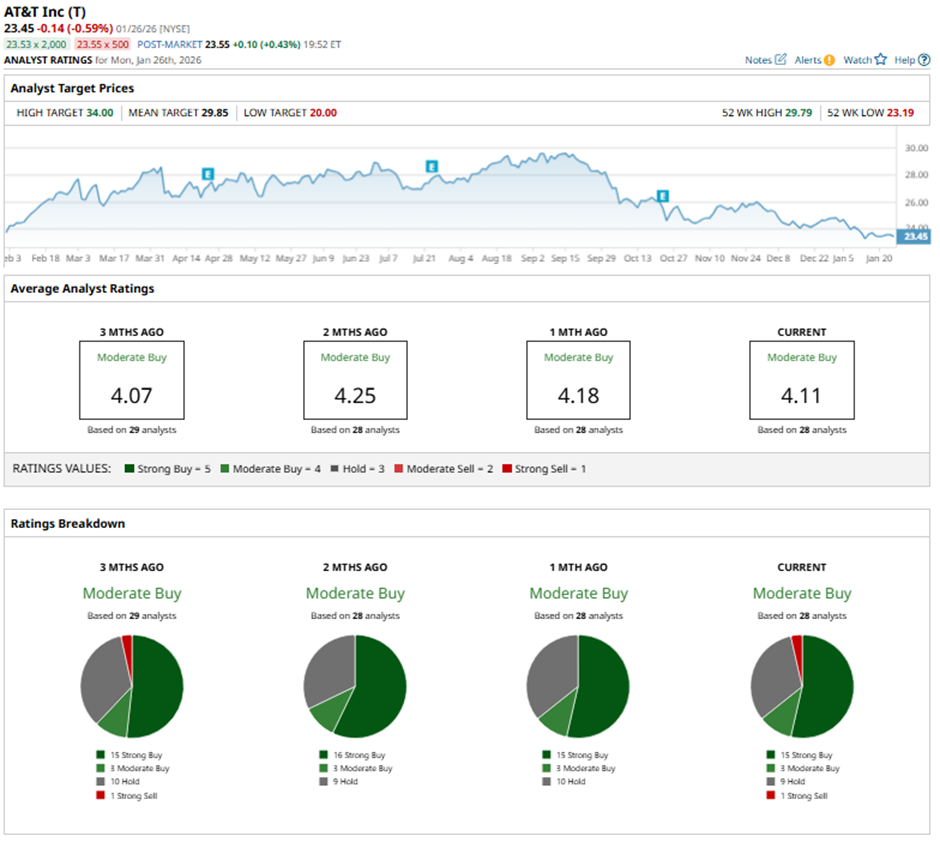

Among the 28 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 15 “Strong Buy” ratings, three “Moderate Buys,” nine “Holds,” and one “Strong Sell.”

On Jan. 26, Wells Fargo cut its price target on AT&T to $27 while maintaining an “Overweight” rating.

The mean price target of $29.85, representing a premium of 27.3% to AT&T's current price. The Street-high price target of $34 suggests a nearly 45% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Microsoft Reports Q2 Earnings Jan. 28. Is MSFT Stock a Buy Before Then?

- As IonQ Snaps Up SkyWater Technology for $1.8B, Should You Buy the Quantum Computing Stock Here?

- What's Next for Sandisk Stock After a 1,000% Rally?

- USAR Stock Is Solidly in Overbought Territory as Trump Invests in USA Rare Earth. Can You Still Chase the Rally Here?