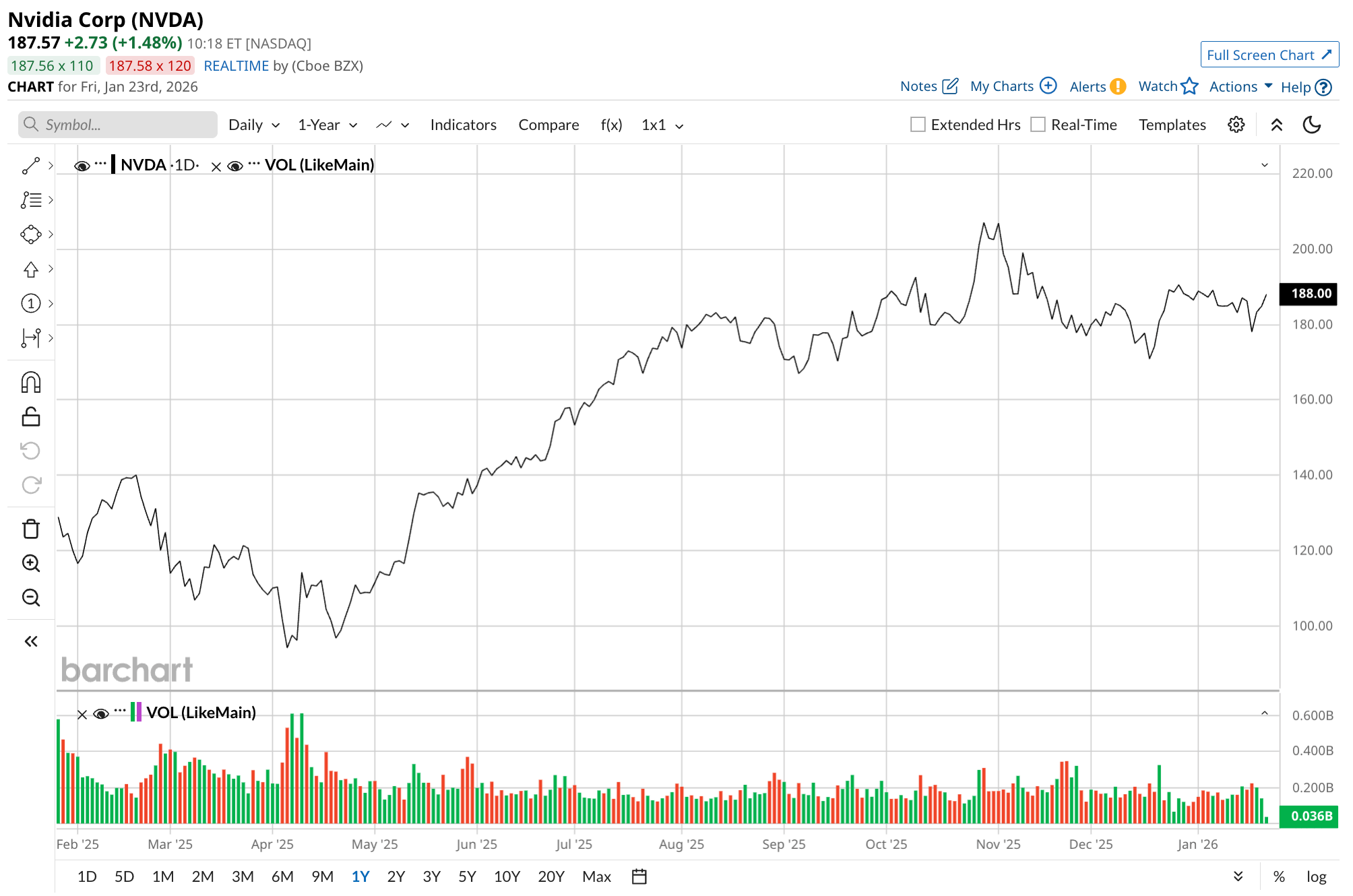

Nvidia (NVDA) stock has largely traded sideways since August, hovering in the $180 range amid investor concerns over the company sustaining its explosive growth trajectory, persistent chip shortages, and the significant loss of access to the lucrative Chinese market due to escalating U.S.-China trade tensions. These factors have weighed on sentiment, limiting upward momentum despite the company's artificial intelligence (AI) dominance.

However, recent developments signal a potential shift: Beijing has given major tech firms the go-ahead to prepare orders for Nvidia's advanced chips, in turn giving the chipmaker the green light to resume sales in China. With this barrier lifting, this could reignite demand, bolster revenues, and pad profits. Should investors brace for NVDA stock to resume its upward march, potentially breaking free from its current range-bound trading and targeting new highs?

About Nvidia Stock

Headquartered in Santa Clara, California, Nvidia has emerged as the face of AI, pioneering graphics processing units (GPUs) that power everything from data centers to autonomous vehicles. Its chips are integral to AI training and inference, making it a cornerstone of the tech revolution. However, global trade tensions, particularly U.S. export restrictions on advanced semiconductors to China, severed a key revenue stream — China once accounted for about 20% of Nvidia's sales — leading to stagnation as growth fears mounted.

So far this year, NVDA stock is up by less than 1%, just behind the S&P 500's ($SPX) roughly 1% gain. This follows a volatile 2025 where shares rose about 38% in the first half of the year but went nowhere in the back half.

Valuation-wise, NVDA trades at a trailing price-to-earnings (P/E) ratio of 48 times, below its 10-year historical average but aligned with the semiconductor industry's current average of 41 to 50 times. The forward P/E of 41.7 times suggests strong expected earnings growth, while the price-to-sales (P/S) ratio of 34.4 well exceeds the industry average, reflecting premium pricing for Nvidia's AI leadership.

Compared to historical norms, the stock appears fairly valued, not overly inflated given projected 51% earnings growth this fiscal year, although risks like competition could pressure multiples if growth slows.

China Reopens Its Doors to Nvidia

Although the U.S. and China had previously eased some restrictions allowing Nvidia chips back into the country, Beijing's aggressive push for domestic tech self-sufficiency effectively stalled meaningful sales. Chinese regulators encouraged — or mandated — local tech giants to prioritize homegrown alternatives from companies like Huawei and Cambricon, sidelining foreign suppliers like Nvidia. This informal barrier created a de facto ban, exacerbating Nvidia's challenges amid broader trade frictions.

For instance, Alibaba (BABA) had expressed interest in purchasing up to 200,000 of Nvidia's H200 AI chips, a last-generation accelerator crucial for large-scale AI models, but without explicit government authorization, the deal couldn't proceed. This hesitation contributed to Nvidia's revenue headwinds, with the company reporting slower data center growth in regions affected by export curbs.

Now, in a pivotal shift, Chinese officials have signaled approval for major firms to prepare H200 orders, granting in-principle permission while conditioning imports on concurrent purchases of domestic chips, though specifics on quantities remain vague. This development prioritizes hyperscalers like Alibaba and Tencent (TCEHY), who are ramping up billions in AI infrastructure investments. ByteDance, the parent of TikTok, is also among those cleared, potentially unlocking a massive order pipeline.

For Nvidia, this reopens a channel that could dramatically boost sales and profits, especially as H200 demand surges globally. Analysts estimate China could represent billions in deferred revenue, helping offset any domestic chip mandates. With local manufacturers ramping production, competition remains, but Nvidia's technological edge in AI positions it to recapture high-end market share.

What Do Analysts Expect for Nvidia Stock?

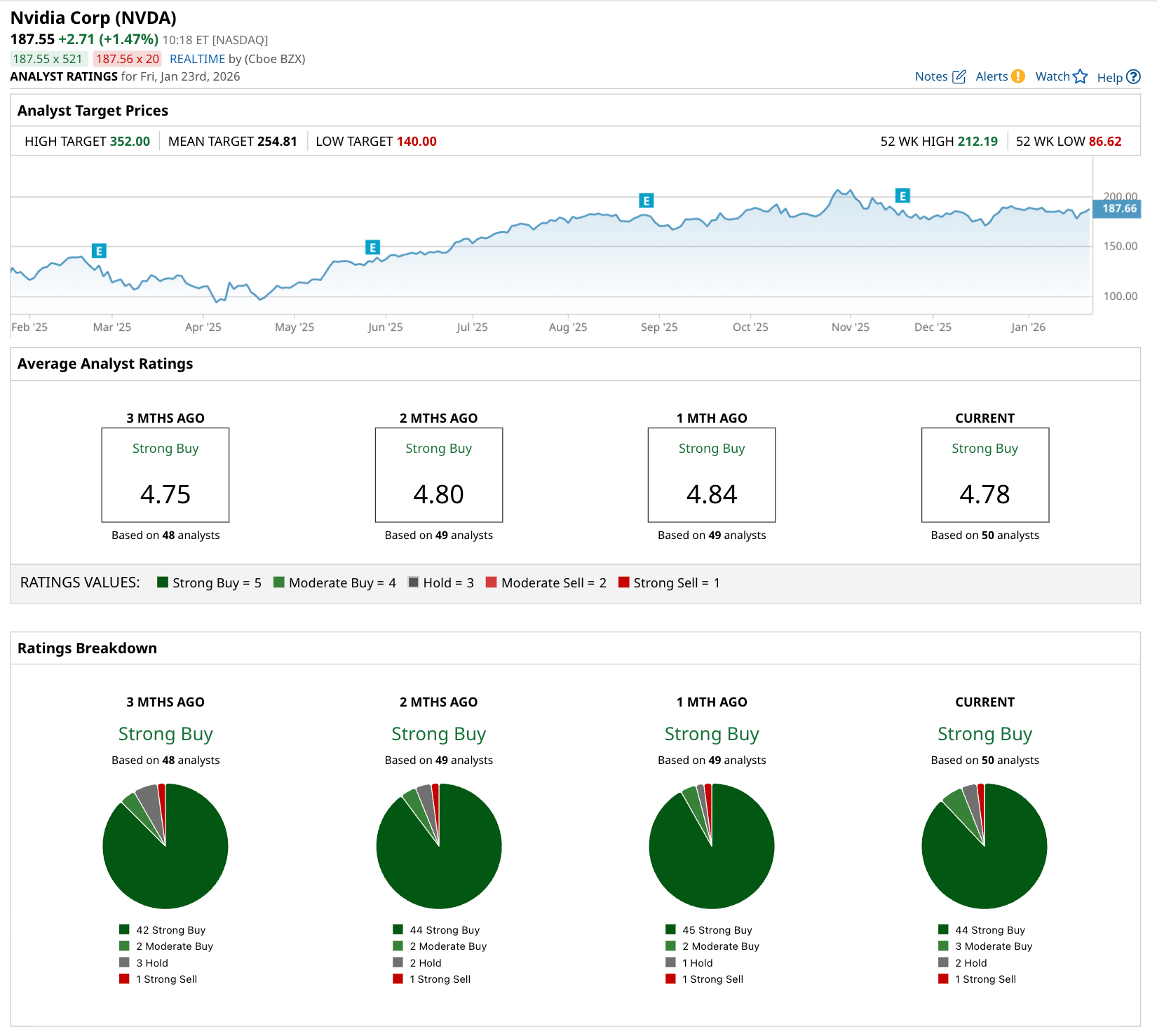

Analysts maintain a bullish stance on NVDA stock, with a consensus "Strong Buy" rating from 50 analysts, breaking down to 44 “Strong Buy” ratings, three “Moderate Buy” ratings, two “Hold” ratings, and one "Strong Sell."

This optimistic view has held steady, with no notable changes in recent months. Instead, sentiment has firmed as AI demand visibility improves and China access revives. The mean price target as tracked by Barchart is $254.81, representing potential upside of 36%.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Jefferies Has 5 Reasons You Should Buy the Dip in META Stock

- Wall Street Sours on Intel After Q4 Earnings. Should You Buy the Dip or Stay Far, Far Away?

- A Storm Is Brewing: How To Manage Risk and Weather Financial Turbulence in 2026

- Lemonade Will Insure Tesla’s Self-Driving Cars. Does That Make LMND a Robotaxi Stock to Buy?