Growth investors have plenty of world-class options to choose from. Whether it's groundbreaking technologies like autonomous vehicles, machine learning, blockchain, virtual reality, or artificial intelligence, one thing is for certain: the future is now.

The ability for investors to put some capital to work in the technologies of tomorrow is exciting, and in many respects, this period of time is like no other. Most investors (be they growth-oriented or not) understand the AI revolution is absolutely powering the U.S. economy right now. Powering this growth are high-performance computing chips provided by the likes of Nvidia (NVDA), Advanced Micro Devices (AMD), and others.

That said, there are other overlooked chip stocks worth considering heading into earnings. Let's dive into what Citi analyst Atif Malik thinks are the best opportunities in the market right now.

Don't Go Mainstream With Your Semiconductor Holdings

Malik and a number of other market experts have touted the idea that there's a very broad and impressive rising tide raising all boats in the semi space. Accordingly, companies like Nvidia, AMD, and really the entire competitive set look investable here. Much of that has to do with low inventory and surging data center, AI, and general-purpose server demand.

What's interesting is that Malik highlighted NXP Semiconductors (NXPI) as one of his top ideas. Malik specifically noted that NXP is one of his most attractive ideas in this space, with a key focus on the company's valuation.

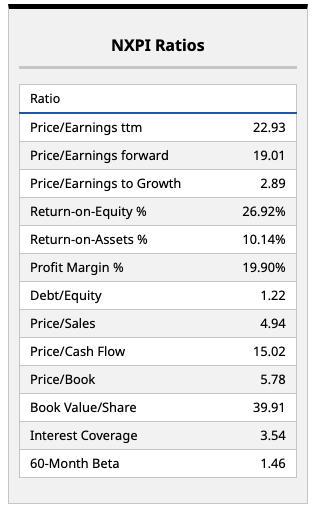

Looking at NXP's statistics above, I do think Malik and the other Citi analysts covering this name are onto something. With a forward price-earnings ratio under 20 times, that's a valuation that most investors can get behind. Despite being powered by extremely robust underlying structural growth trends (the AI revolution), NXPI stock is one that's trading at a discount to the broader market. That's tricky to find in this space and is encouraging on many fronts.

Now, there is some rationale to this low multiple on a relative basis. NXP currently has a profit margin under 20%, which stands in stark contrast to a number of other chipmakers with margins in the 50% range or higher. That said, if pricing power improves broadly across the board (which Malik and others appear to indicate is possible or even likely), then this company's valuation is even more attractive.

What I like most about NXP is the company's free cash flow yield, at more than 6% (trading at just 15 times cash flow). That's another metric that's very challenging to beat in the semiconductor space, and a clear reason why investors may rightly salivate at this name.

What Do Other Wall Street Analysts Think

The current consensus price target on NXPI stock sits at $263.53 per share, providing around 11% upside from current levels if this target is hit over the course of the next year or so.

That's not bad for any stock and would provide investors with meaningful upside in addition to the aforementioned free cash flow yield the company can use to reinvest in its core business.

I'm of the view that NXP's recent rally could signify future analyst upgrades, with this current price target simply failing to keep up with the company's impressive share price appreciation seen of late. For those in the same boat, this is a top pick I think is worth considering at this point.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart