Adding to the clamor of the banking industry against the Trump administration's proposed cap of 10% interest on credit card debt for one year, Citigroup (C) CEO Jane Fraser has harked back to the era of former President Jimmy Carter to remind the present regime that this move has failed earlier. At Davos, where the who's who of world and corporate leaders have descended, Fraser remarked, “I think there's a very keen understanding that this would have the opposite impact of what the actual intent would be, and there are better ways to go about it.”

Straying off course by highlighting that affordability remains an issue in the country, Fraser, however, said that capping interest rates on credit card debt would hurt credit access and negatively impact the purchasing power of the general public. Pointing towards a similar move in the Carter administration, the Harvard alumna said, "Within two months, it was completely reversed."

Why The Cap And Why Are The Banks Opposing It?

The proposed 10% cap on credit card interest rates is designed as a populist cost-of-living intervention. Credit card APRs (annual percentage rates) in the U.S. currently average 20%-25%, and for subprime borrowers can exceed 30%. In a high-inflation, high-rate environment, revolving credit has become one of the most visible financial pressure points for households.

From a political standpoint, the cap allows policymakers to signal direct relief to consumers without expanding fiscal spending. It also reframes inflation pain as the result of “financial excess” by banks, rather than macro policy or government deficits. Trump has criticized the high rates, asking earlier, “They charge Americans interest rates of 28%, 30%, 31%, 32%. Whatever happened to usury?” Usury is the practice of charging interest on a loan at an excessively high or unfair rate.

Banks, however, have a deeper interest in combating this, as the revenue accretion from interest rates on credit card debt is a material amount, which has only gone up in the past years. According to the Seventh Biennial Report to Congress on the Consumer Credit Card Market issued by the CFPB, U.S. consumers were assessed a total of $160 billion in interest charges during 2024. This figure represents a staggering increase from the $105 billion in interest assessed in 2022, reflecting a 52.3% growth in the cost of revolving credit over a two-year window. The scale of this revenue generation is a direct result of three compounding variables: higher APRs, an expansion in the number of cardholders, and an increase in the average monthly balance held per cardholder.

Moreover, this is a high-margin source of revenue as well for the banks, as illuminated by the disparity between credit card yields and other forms of bank lending. As of the end of 2023 and continuing through 2024, the spread of credit card APRs over the Federal Funds Rate stood at approximately 18%, compared to only 2.25% for Commercial and Industrial (C&I) loans and 3% for mortgages. This "alpha" in credit card lending has allowed specialized credit card banks to report a return on assets (ROA) of 3.87% in 2024, nearly triple the 1.38% ROA reported for the broader banking sector.

For Citi in particular, the interest in the non-capping of interest rates on credit card debt is even more crucial. As the third-largest issuer of credit cards in the United States, Citigroup's credit card segments generated a combined $18.3 billion in revenue in 2025. Branded Cards, which include the flagship Citi-branded proprietary cards and co-branded partnerships like American Airlines (AAL) and Costco (COST), accounted for $11.64 billion. Retail Services, which manages private-label and co-brand credit card programs for major retail partners, contributed $6.62 billion. When analyzed as a percentage of Citigroup's $81.1 billion total yearly revenue, these segments represented about 24.6% of the firm's entire top-line results in 2025, up from 18.3% in 2020.

Specifically in terms of interest, interest-earning balances in the Branded Cards segment grew 4% year-over-year (YoY) in 2025. This concentration on interest-earning balances is a strategic pivot designed to capture higher yields as funding costs for the broader bank began to stabilize. Unsurprisingly, a cap would put a dent in this rapidly growing and high-margin business for Citi.

Citi's Tough Q4

Uneasiness around the capping of interest rates on credit card debt also stems from the company's disappointing results for the latest quarter, with Q4 2025 seeing the reporting of a miss on both the revenue and earnings fronts. Revenues increased by just 2% from the previous year to $19.9 billion, missing the consensus estimate by more than half a billion dollars. EPS declined by 11.2% in the same period to $1.19 per share. Notably, not only did this miss the consensus estimate of $1.65 per share, but this was the first bottom-line miss from the financial services major in more than two years.

Return on average tangible common equity, a key metric to assess the profitability of banks, also corrected by 100 basis points to 5.1%. However, average deposits and loan balances improved at an impressive rate, rising by 8% and 7% on a YoY basis to $1.42 trillion and $737 billion, respectively. Tangible book value per share also improved to $97.06 per share from $89.34 per share in the year-ago period.

Additionally, with a market cap of $201.83 billion, C stock is up 41% over the past year, offering a dividend yield of 2.03%. This is higher than the sector median of 1.30%.

However, despite the sharp run-up, Citi's stock continues to trade at levels comparable to the sector medians. Its forward P/E and P/B are at 11.05 and 0.94, while the sector medians are at 11.36 and 1.24, respectively.

Analyst Opinion on C Stock

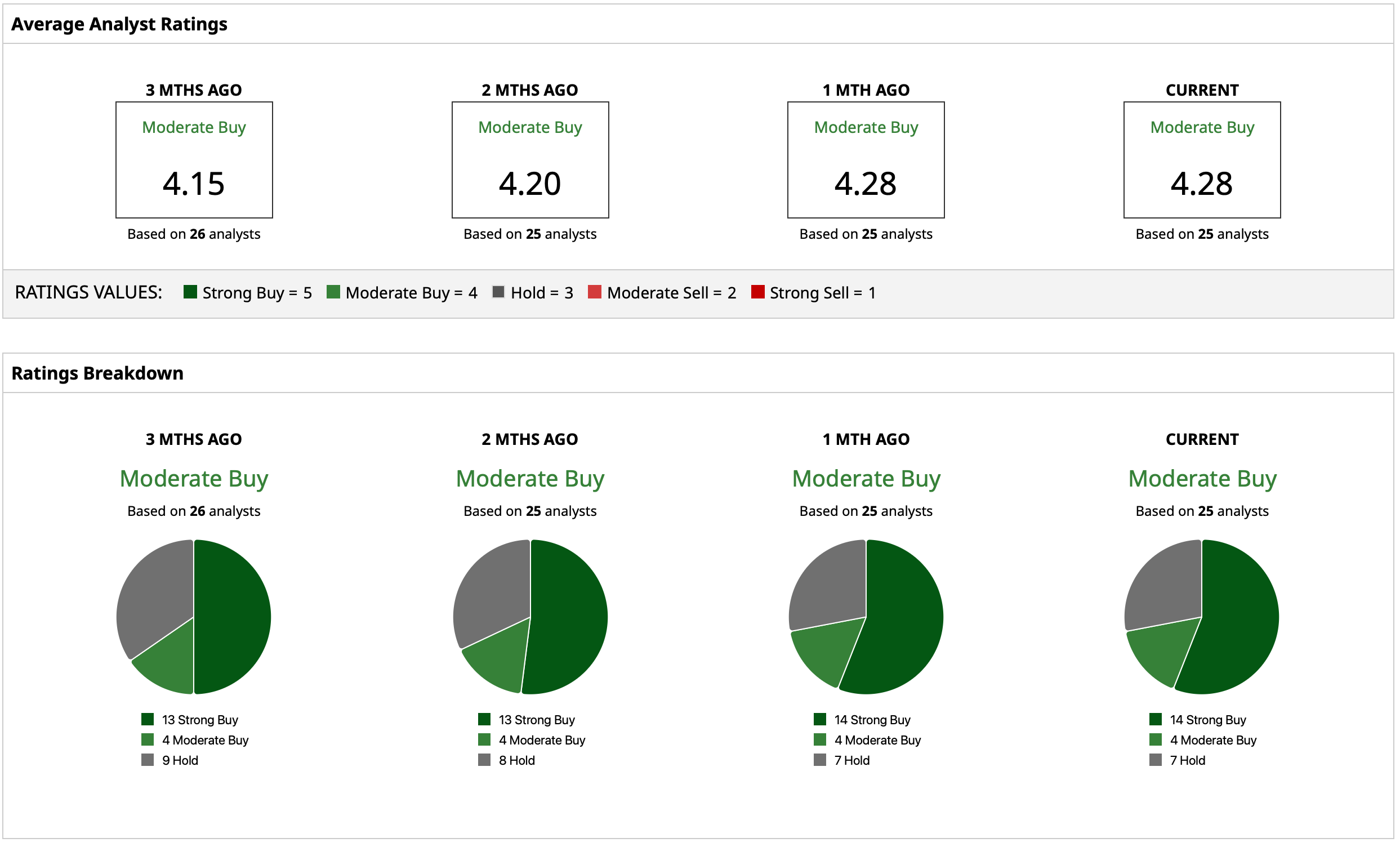

Overall, analysts have deemed C stock as a “Moderate Buy,” with a mean target price of $131.46, which denotes an upside potential of about 14% from current levels. Out of 25 analysts covering the stock, 14 have a “Strong Buy” rating, four have a “Moderate Buy” rating, and seven have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Three Hot Options Plays, Each with Its Own Twist

- How This Options Expert Screens for High-Probability Spread Trades, Step-by-Step

- Calling Back to Jimmy Carter, Citigroup’s CEO Says Credit Card Rate Caps Would ‘Not Be Good’ for the U.S. Economy

- ‘Yes or No AI’: 93% of DuckDuckGo Users Overwhelmingly Reject AI, So What Does This Mean for the Future of Nvidia, Alphabet, and Other AI Stocks?