With a market cap of around $20.7 billion, SBA Communications Corporation (SBAC) is a Florida-based wireless infrastructure company that owns and operates a portfolio of communication towers and related sites. The company provides tower space and services to wireless carriers, enabling reliable mobile connectivity across the United States, Latin America, and Canada.

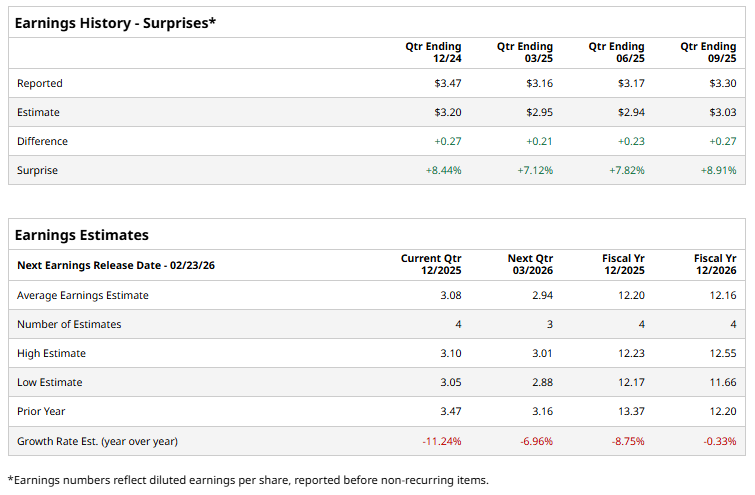

SBAC is scheduled to report its Q4 earnings soon. Ahead of the event, analysts expect the company to report an AFFO of $3.08 per share, down 11.2% from $3.47 per share in the same quarter of the previous year. The company has surpassed Wall Street's bottom-line estimates in the past four quarters.

For fiscal 2025, analysts expect SBAC to report an AFFO of $12.20 per share, down 8.8% from $13.37 in fiscal 2024.

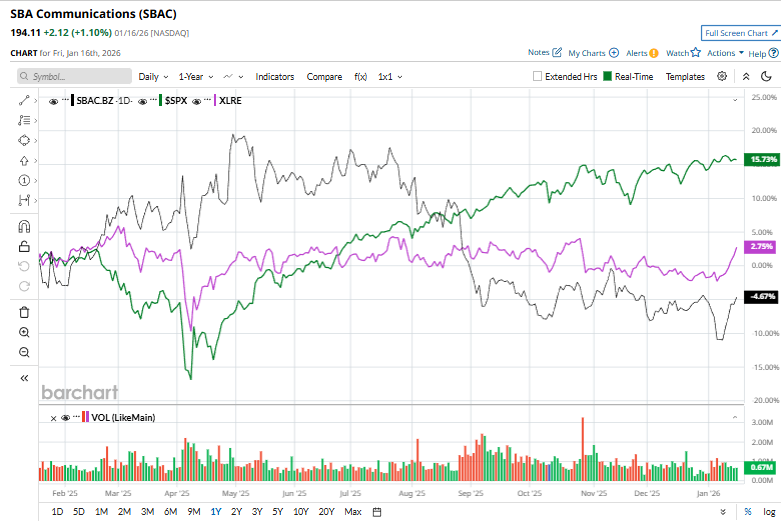

Over the past 52 weeks, SBAC stock has struggled, with its stock declining 4.9%, underperforming the Real Estate Select Sector SPDR Fund’s (XLRE) 2.7% rise and the S&P 500 Index’s ($SPX) 16.9% return during the same time frame.

Over the past year, SBA Communications has lagged the broader market primarily because investor sentiment toward tower REITs has weakened amid higher interest rates, which have raised financing costs and compressed valuations for capital-intensive infrastructure businesses. Slower incremental benefits from the 5G buildout and a more measured pace of new lease activity have also tempered growth expectations, hampering its price momentum.

Wall Street analysts are cautiously optimistic about SBAC’s stock, with an overall "Moderate Buy" rating. Among 20 analysts covering the stock, eight recommend "Strong Buy," one suggests a “Moderate Buy,” and 11 suggest a “Hold.” The average analyst price target of $229.78 implies an upswing potential of 18.4% from the prevailing price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart