Domino's Pizza, Inc. (DPZ) is a Michigan-based multinational pizza restaurant company and one of the largest and most recognized names in global quick-service food. Valued at a market cap of $13.5 billion, Domino’s has grown into the world’s largest pizza delivery and carry-out chain, operating tens of thousands of stores across more than 90 countries. It is expected to announce its fiscal Q4 earnings for 2025 before the market opens on Tuesday, Oct. 14.

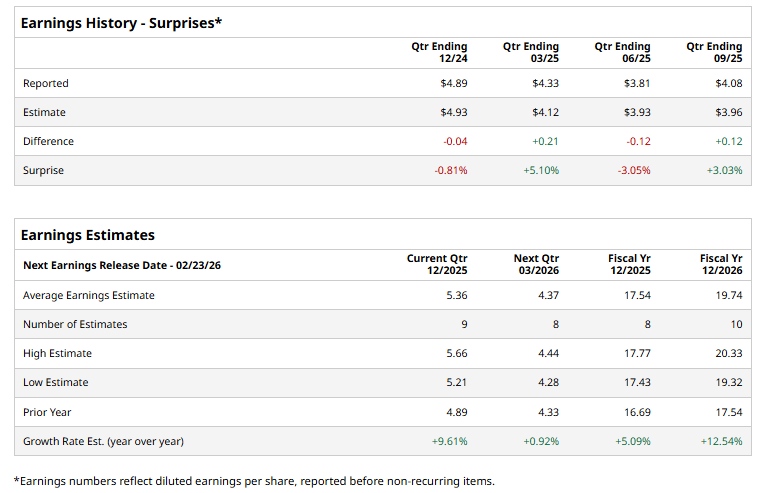

Ahead of this event, analysts expect this pizza company to report a profit of $5.36 per share, up 9.6% from $4.89 per share in the year-ago quarter. The company has topped Wall Street’s earnings estimates in two of the last four quarters, while missing on two other occasions.

For fiscal 2025, analysts expect DPZ to report a profit of $17.54 per share, representing a 5.1% increase from $16.69 per share in fiscal 2024. Furthermore, its EPS is expected to grow 12.5% year over year to $19.74 in fiscal 2026.

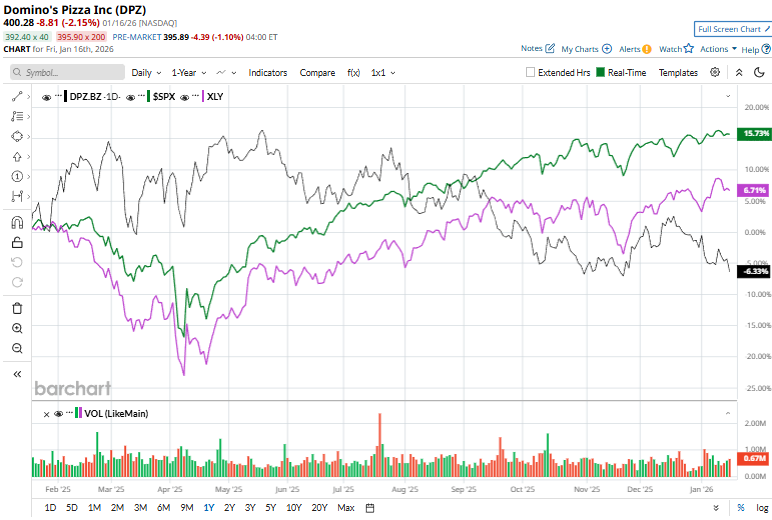

Shares of DPZ have dropped 4.5% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 16.9% uptick and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 8.2% return over the same time frame.

On Jan. 5, Domino’s Pizza fell more than 3% after TD Cowen downgraded the stock from “Buy” to “Hold,” noting that the company faces tougher growth dynamics ahead amid softer same-store sales trends, rising input costs for franchisees, and increasing competition in the delivery and quick-service pizza market.

Wall Street analysts are moderately optimistic about DPZ’s stock, with a "Moderate Buy" rating overall. Among 29 analysts covering the stock, 15 recommend "Strong Buy," one indicates a "Moderate Buy," 11 suggest "Hold,” and two advise “Strong Sell” ratings. The mean price target for DPZ is $495.72, indicating a 23.8% potential upside from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart