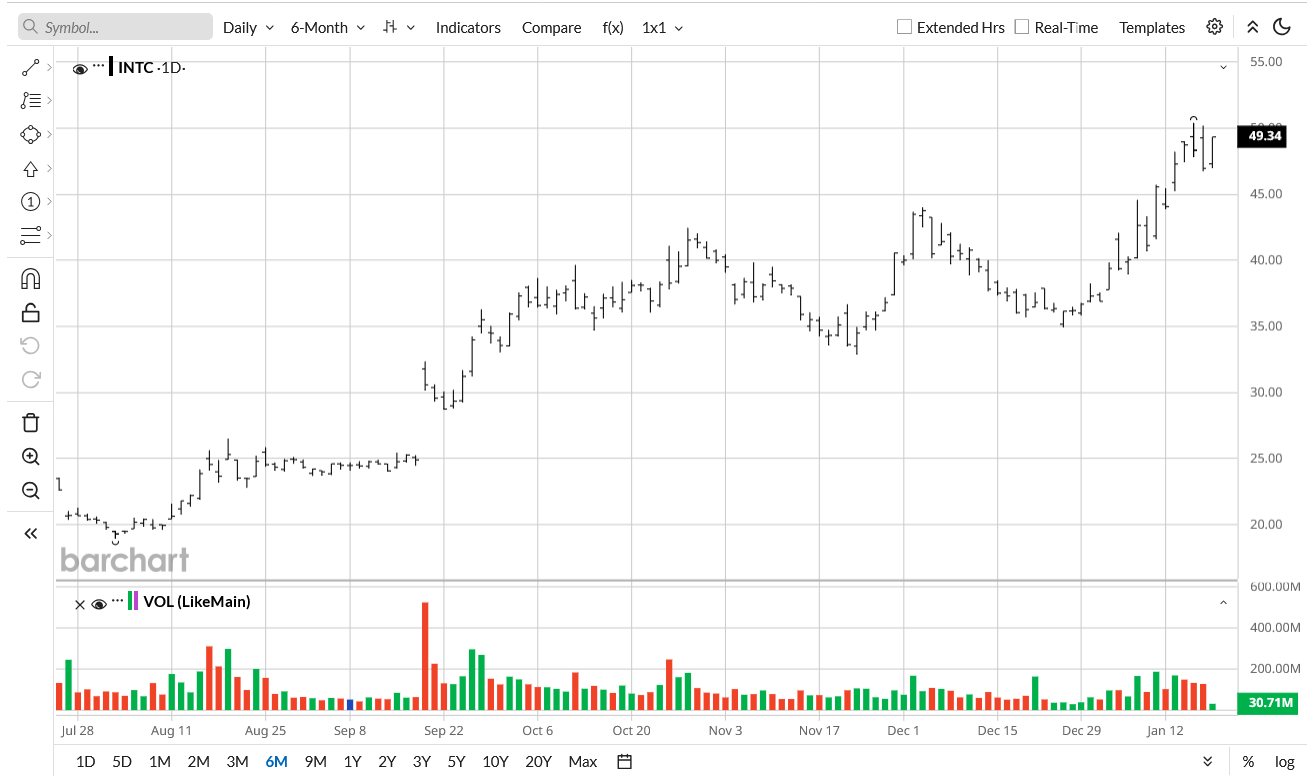

Analysts have been weighing in ahead of Intel's (INTC) much-awaited earnings on Jan. 22. The company has had to prove itself after an explosive rally since September 2025, sparked by successive wins with Nvidia (NVDA), SoftBank (SFTBY), and the U.S. government. Intel's CEO has been successful in courting several big-name AI companies and President Donald Trump himself, but whether he can hold the momentum is the real question.

INTC stock is up 30% year-to-date (YTD) already. Its Q4 earnings are expected to make or break the ongoing rally. UBS analysts believe the stock is a buy due to improving fundamentals. According to the firm, supply is “tight,” but there's still upside bias as PC and server demand remains strong. It is still a mixed quarter, but they believe Intel is improving quickly enough that it will end up ahead of where it is today.

UBS analyst Timothy Arcuri said, “If INTC guides 2026 revenue (unlikely), we would see low single digits as a reasonable (if not conservative) bar but expect some broader commentary on gross margin (drop-through 40-60%, UBS [estimate] full year ~38%), gross/net capex (UBS [estimate] ~$19B/~$12B or both up slightly Y/Y), and opex $16B (in-line w/ prior guide).”

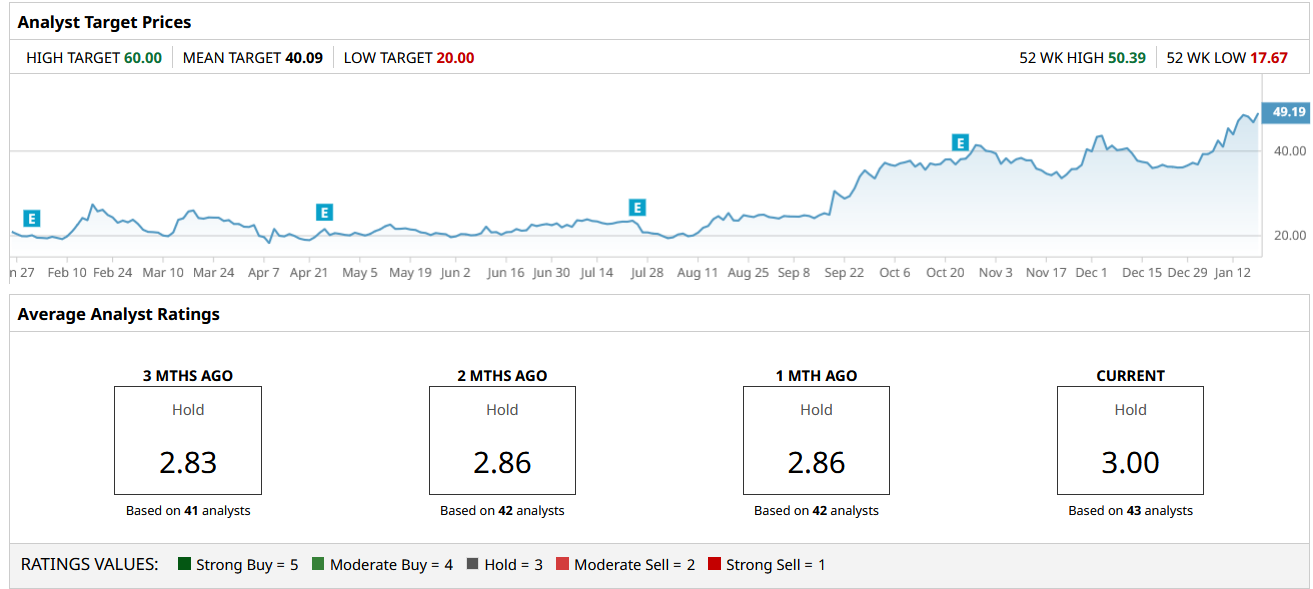

Arcuri increased his price target from $40 to $49.

What to Expect

In Q3, Intel reported $13.65 billion in revenue, up 2.78%. The market broadly believes that the company will report $13.38 billion in revenue for Q4, a 6.2% decline year-over-year (YoY). This will put the full-year sales count at $52.55 billion, a 1% decline YoY. For EPS, analysts expect Q4 EPS to be at $0.08, a 37% decline YoY.

Growth is very anemic compared to most other chipmakers, but Intel is expected to mount a recovery starting in 2026, with revenue recovering by 2.7% and an EPS recovery of 76.3%. Sales growth is expected to improve progressively thereafter.

If sales growth turns out to be positive and the EPS contraction isn't as bad as expected, the stock can surge. If there's one thing Intel has been consistent in doing, it is disappointing Wall Street. There haven't been any concrete signs of a true recovery from Intel. Q4 being better than expected will thus be the signal that may spark a rally and take INTC stock to new highs above $70.

Will Intel Disappoint Again?

Intel's new contracts will add plenty of demand. Whether these deals are going to convert into revenue this quickly is to be seen on earnings day. The analyst in question is more on the optimistic side, but he does have a “Hold” rating on the stock.

I do believe that Intel's Q4 earnings figures will look a bit precarious. It explicitly noted Q4 guidance excludes Altera after the majority stake sale, which can mechanically reduce reported revenue versus prior periods and complicate “growth” comparisons.

You should also keep in mind that all those deals won't convert into revenue this fast. For instance, the government funding is not “revenue” and is just funding Intel will use to build out its infrastructure before it can start selling products. The drawback is that it can end up making earnings look even worse before a rebound.

I would thus not bet on a surprise from Intel in Q4.

Why You Should Still Buy INTC Stock

Intel has roared back in the past few months, but the rally has legs, as the company now has money. At its helm is one of the most experienced CEOs in the industry. The turnaround so far has been remarkable and even eclipsed what the bulls had expected before he joined the company.

Most analysts are still behind Arcuri's price target due to the uncertainty surrounding Intel.

I believe $40 can end up being a floor price if Q4 goes well. I don't doubt that the next few quarters will be rough, but Intel is slowly but surely moving towards stabilization. If you're in it for the long run, buying now is worth it. Even if the stock does take a dip after a potential Q4 disappointment, it's another opportunity to back up the truck while it's cheap.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart