Corn (ZCH26), soybean (ZSH26), and winter wheat (KEH26) (ZWH26) futures markets saw decent price recoveries on Friday, Jan. 16, including technically bullish weekly high closes, following an early week gut-punch in the form of bearish USDA supply and demand data.

King Corn Needs to Stabilize

Despite decent price gains in March corn last Friday, for the week the market was still down 21 cents. “King Corn” will need to show more strength this week for bulls to regain confidence and to suggest a price bottom is in place. If “King Corn” stabilizes, other grain markets will also have better chances to begin their own price uptrends.

Last week’s USDA’s production figures included both record harvested acres of 91.3 million and a record average yield of 186.5 bushels per acre. U.S. corn producers may also be looking toward the 2026-27 crop year that could present another year of hefty U.S. corn acres planted.

Strong export demand for U.S. corn continues to surface. USDA last Friday reported daily U.S. corn sales of 120,000 MT of corn to Japan and 298,000 MT to unknown destinations during 2025-26. Demand continues to be the bright spot for corn, as U.S. export business sits at unprecedented levels along with domestic ethanol production.

Focus is starting to shift toward Brazil’s second-crop corn (safrinha) plantings. Corn and soybean traders are closely watching weather conditions in South American growing regions. There are some dry areas in southern Argentina, but no major problems in that country or in Brazil.

The late-March planting intentions report from USDA will be one of the biggest data points of the year for the grain markets.

Sickly Soybean Meal Market Dragging Down Soybean Futures

March soybean futures closed down 4 3/4 cents last week from the week prior. March soybean meal (ZMH26) futures last Friday fell to a nearly three-month low and on the week were down $13.70. Soybean futures bulls had a decent week, given the bigger losses in corn, and recovered from Monday’s solid losses. Soybean oil (ZLH26) saw a very good trading week on hopes for better demand for biofuels. However, soybean meal was a laggard, and that’s a bearish omen for soybeans in the near term. The existing price downtrend in soybean meal needs to be broken to provide the soybean market a chance to sustain a price uptrend. Soybean meal price history does show that when meal prices are below $300.99, the market is a value-buying opportunity.

China continues to purchase U.S. soybeans, advancing closer to the 12 million metric ton figure agreed upon in last fall’s trade truce. However, U.S. saber rattling and U.S. coziness with Taiwan are upsetting to China. The soybean and entire grain futures markets complex needs the U.S.-China trade truce to hold up for the markets to have a better chance of sustaining price uptrends in the coming months.

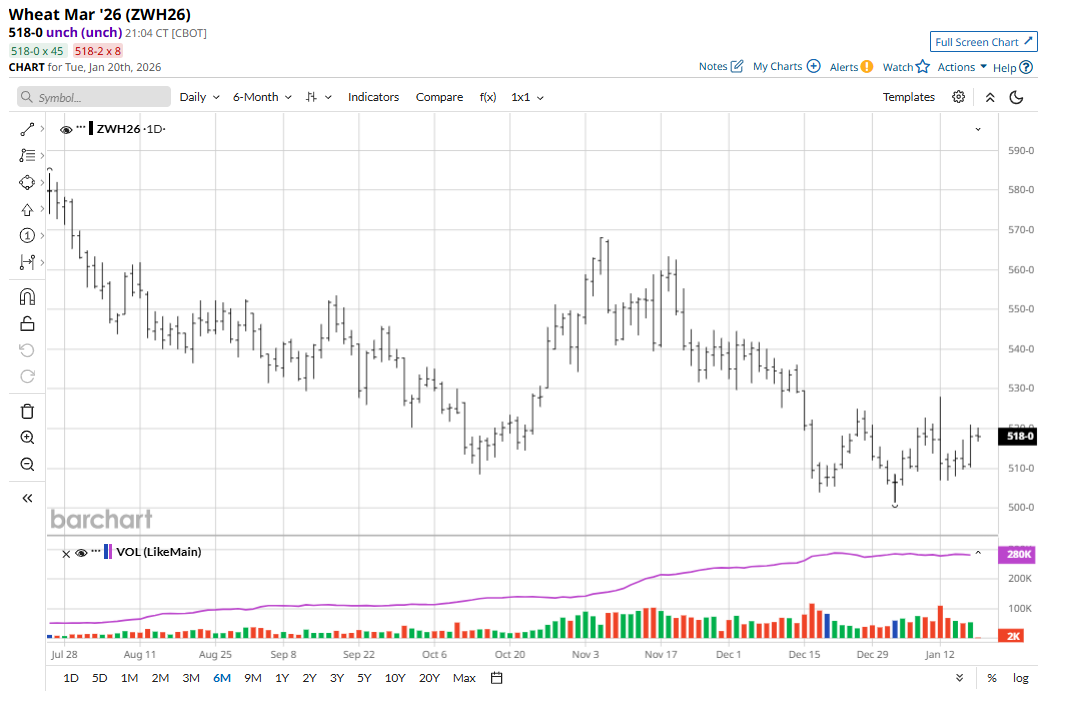

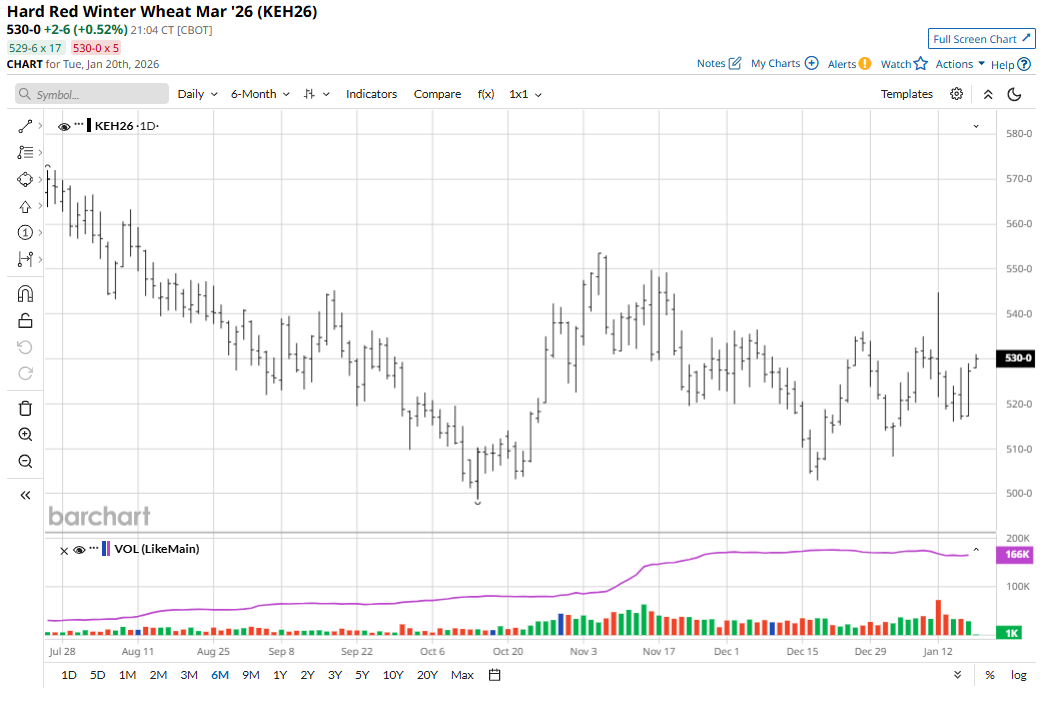

Winter Wheat Markets Continue to Grind Sideways

March soft red winter wheat futures were up 3/4 cents on the week. March hard red winter futures lost 3 cents last week.

The winter wheat futures markets continue to chop in a sideways trading range at lower levels. Bulls are hoping this is “basing” action that will soon kick off a price uptrend. There is very strong longer-term technical support at the $5.00 level in SRW and HRW that could be a price floor in those markets.

Winter wheat traders are monitoring colder temperatures in the central U.S. and Plains states, which should add some winter hardiness to the crops. Single-digit low temperatures and no snow should not be a major problem for crops in the north. Weather watchers also said bitter cold in western Russia and northeastern Europe will have no negative impacts on winter crops because of significant snow cover in most of the regions.

Hefty global supplies and mostly favorable weather conditions around the world wheat regions have kept wheat futures prices squelched. It’s likely the wheat futures markets will be significantly influenced by what the corn futures market does during the next several weeks.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart