With a market cap of $306.9 billion, Chevron Corporation (CVX) is a global energy and chemicals company operating through its Upstream and Downstream segments. Its operations span the exploration, production, and transportation of oil and gas, refining and marketing petroleum products, and manufacturing chemicals, plastics, and renewable fuels.

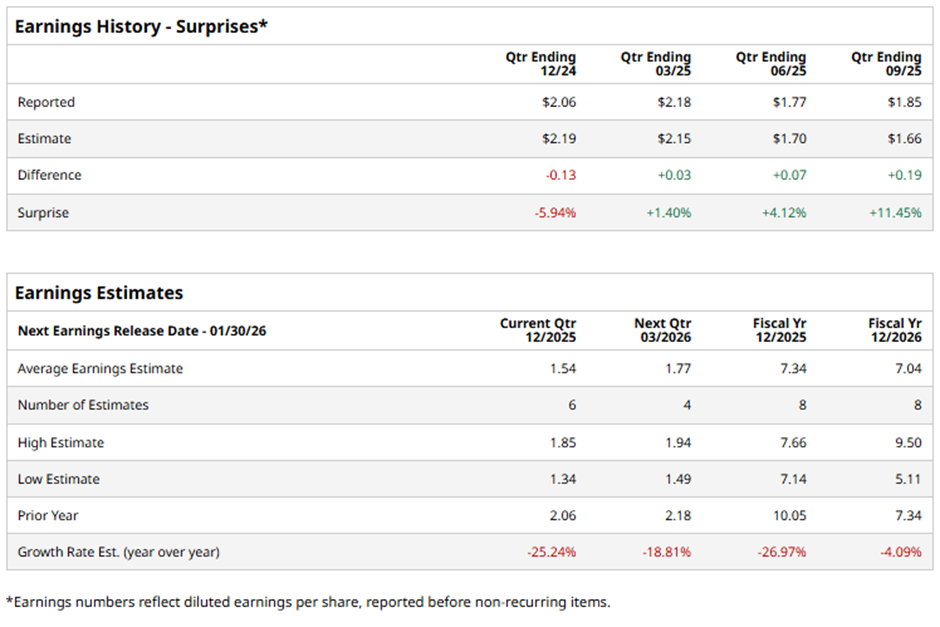

The Houston, Texas-based company is slated to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts expect the oil company to report an adjusted EPS of $1.54, a 25.2% dip from $2.06 in the year-ago quarter. It has exceeded Wall Street's earnings expectations in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts forecast Chevron to report adjusted EPS of $7.34, marking a decline of nearly 27% from $10.05 in fiscal 2024.

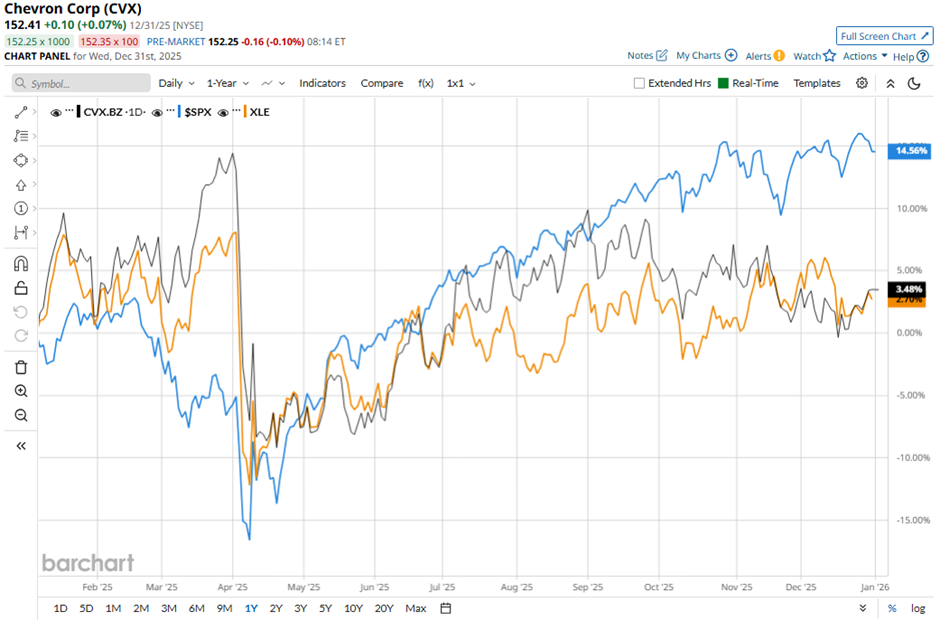

Shares of Chevron have gained 6.5% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 16.4% gain. However, the stock has slightly outpaced the State Street Energy Select Sector SPDR ETF's (XLE) 5.8% return over the same period.

Shares of Chevron rose 2.7% on Oct. 31 after the company reported Q3 2025 adjusted EPS of $1.85, beating the consensus estimate, driven by record upstream production of 4,086 MBOE/d. Investors were encouraged by strong U.S. output, which rose 27.1% year-over-year to 2,040 MBOE/d, and robust downstream profits of $1.1 billion, reflecting higher product sales margins.

Analysts' consensus view on CVX stock remains cautiously optimistic, with a "Moderate Buy" rating overall. Out of 26 analysts covering the stock, 13 recommend a "Strong Buy," three "Moderate Buys," nine give a "Hold" rating, and one has a "Strong Sell." The average analyst price target for Chevron is $169.59, suggesting a potential upside of 11.3% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As MicroStrategy Buys $109 Million of Bitcoin, Should You Buy MSTR Stock?

- Wall Street’s Radial Framework Potentially Exposes a Mispriced Opportunity in Ambarella (AMBA) Stock Options

- A $1 Billion Catalyst Just Hit Coupang. How Should You Play CPNG Stock Here?

- Alphabet Soars — Is GOOGL Stock Still a Buy for 2026?