While headlines often focus on the same big players, some companies are quietly delivering strong growth, solid profits, and long-term competitive advantages. These two tech companies in particular are benefiting from powerful trends like artificial intelligence (AI) and positioning themselves for outsized gains, even before the market fully notices.

Which AI stocks should investors pay attention to as the market chases hype? Let's take a closer look.

AI Stock #1: Vertiv

Valued at $65.3 billion, Vertiv (VRT) is a critical supplier of power, cooling, and monitoring systems that protect servers and IT equipment, especially in large, high-density data centers used for cloud computing and AI. Vertiv’s third-quarter performance contributed to the optimism surrounding VRT stock last year. VRT is up 34% over the past 52 weeks, outperforming the S&P 500 Index's ($SPX) gain of 17%. VRT stock has also risen 9% so far this year.

In the third quarter, organic sales climbed to $2.6 billion, representing nearly 30% year-over-year (YOY) growth. The Americas led the way, with growth of more than 40%, while APAC (Asia-Pacific) also saw strong improvements. Although EMEA (Europe, the Middle East and Africa) remains soft, management anticipates improvement as AI-related investments increase later in 2026.

Vertiv reported a book-to-bill ratio of 1.4 times and a $9.5 billion backlog. These numbers indicate an unusually strong revenue forecast for 2026. Adjusted EPS rose by 63% YOY to $1.24. Beyond near-term growth, Vertiv is aggressively strengthening its long-term competitive position. The company is expanding its offerings in thermal control, high-density racks, power distribution, and advanced services, all of which are becoming increasingly important as AI workloads become more power-intensive. To keep ahead of future GPU generations, Vertiv intends to boost R&D spending by more than 20% by 2026.

A critical component of this plan is close collaboration with Nvidia (NVDA). Vertiv is developing an 800-volt DC power portfolio to complement Nvidia's upcoming Rubin Ultra platform, positioning itself as a preferred partner for next-generation AI data centers. Despite significant investment, Vertiv earned $462 million in free cash flow during the quarter and ended with $1.4 billion in cash and equivalents, displaying the financial strength that supports its expansion plans.

Looking ahead, management expects the momentum to continue. Vertiv expects approximately 20% organic sales growth and a 27% increase in EPS in Q4. Full-year earnings are expected to be $4.10 per share, up around 44% YOY, with organic revenues increasing by 27% to $10.2 billion. Free cash flow is expected to be $1.5 billion for the year.

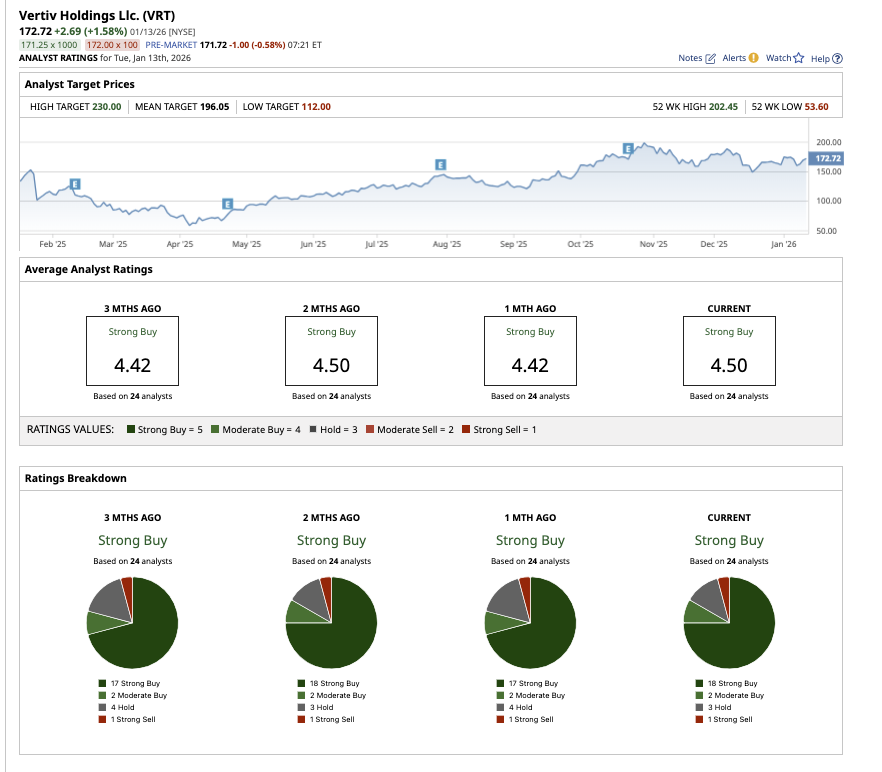

Analysts' trust in Vertiv has also grown in the last three months, with more than 20 upward revisions to both earnings and revenue estimates. Analysts expect 45% earnings growth in 2025, followed by another 29% in 2026, bolstering the case that Vertiv is more than just a short-term AI investment. Vertiv provides an appealing combination of growth, profitability, and strategic positioning for investors interested in long-term AI infrastructure development. This optimism reflects in Vertiv’s forward price-to-earnings (P/E) multiple of 32 times. While the premium valuation suggests high expectations are already priced in, some investors may see opportunities during pullbacks as a way to gain exposure to this outstanding AI stock.

On Wall Street, VRT stock holds an overall rating of “Strong Buy." Of the 24 analysts covering the stock, 18 rate it as a "Strong Buy," two call it a "Moderate Buy," three recommend a “Hold,” and one has a “Strong Sell" rating. The stock's average target price of $196.05 suggests potential upside of 12% from current levels, while the highest price estimate of $230 indicates a possible 31% rally over the next 12 months.

AI Stock #2: Palantir Technologies

Palantir Technologies (PLTR) develops advanced data analytics and AI software used by governments and enterprises to make critical decisions. Its platforms — Foundry, Gotham, and the Artificial Intelligence Platform (AIP) — are designed to integrate massive, complex data sets and convert them into actionable intelligence. In the past 52 weeks, PLTR stock has soared surged 164%, outperforming even the market’s most dominant tech leaders.

With a market cap exceeding $420 billion, Palantir is no longer an under-the-radar name. However, its growth story may still be unfolding. In the third quarter, Palantir’s total revenue climbed 63% YOY to $1.18 billion, driven in large part by its government segment. Government revenue grew 52% YOY and 14% sequentially, with U.S. government sales reaching $486 million. This growth reflects both expansion within existing defense and intelligence programs and new contracts tied to rising demand for AI-enabled decision-making tools. This momentum helped drive record total contract value bookings of $2.8 billion, up 151% YOY. Q3 included hundreds of large deals, highlighting the scale at which customers are committing to the company's platforms.

Despite its strength in public-sector contracts, Palantir has long faced criticism for relying too heavily on government spending cycles. Management has responded by aggressively scaling its commercial business, which has worked in the firm’s favor. The U.S. commercial segment emerged as Palantir’s fastest-growing division, with revenue soaring 121% YOY and 29% sequentially. The net dollar retention rate of 134% further highlights how existing customers are deepening their relationships with Palantir's platforms.

What separates Palantir from many high-growth software peers is its ability to grow rapidly while maintaining exceptional profitability. In Q3, the company posted an adjusted gross margin of 84% and net income of $476 million, representing roughly 40% of revenue. Adjusted EPS reached $0.21. Palantir surpassed $2 billion in trailing 12-month adjusted free cash flow for the first time. With $6.4 billion in cash and short-term securities and an active share repurchase program, the company has ample financial flexibility to invest in growth while returning capital to shareholders.

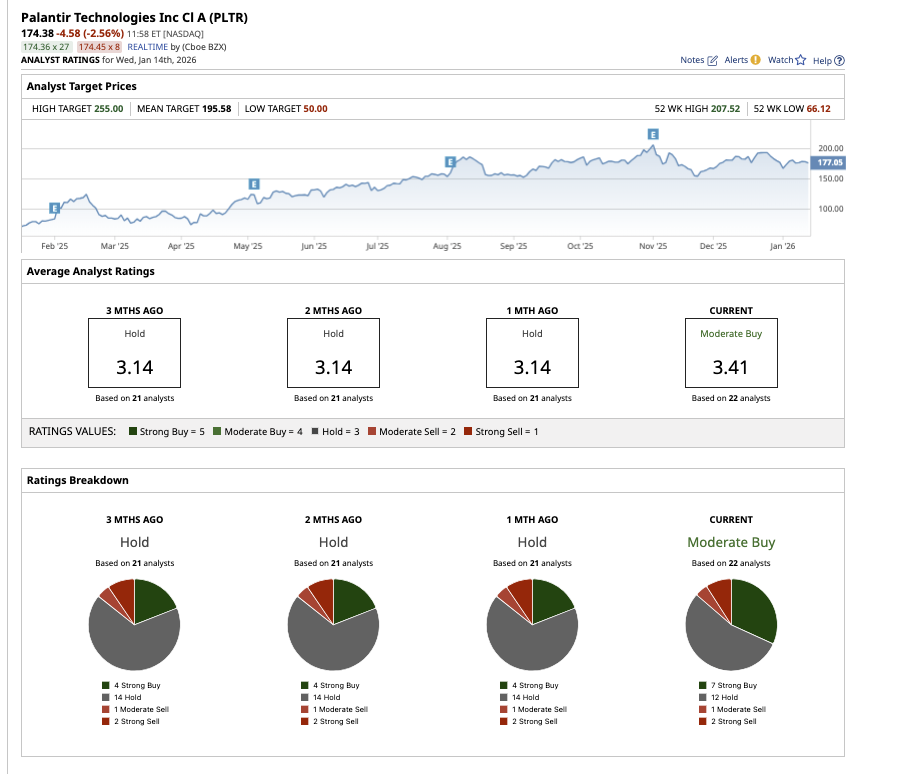

Analysts expect revenue growth of 54% in 2025, alongside a 77% increase in earnings. Revenue and earnings are further expected to increase by 42% and 39% in 2026. However, trading at roughly 225 times forward earnings, Palantir is overvalued, highlighting that investors are already pricing in long-term AI dominance.

Despite this outlook, Wall Street rates PLTR stock as a consensus “Moderate Buy", up from a “Hold” rating one month ago. Among the 22 analysts covering PLTR stock, seven rate it a “Strong Buy,” 12 have a “Hold” rating, one analyst has a “Moderate Sell,” and two provide a “Strong Sell" rating. The average target price of $195.58 suggests that shares can climb 9% over current levels. Meanwhile, the Street-high estimate of $255 implies potential upside of 42% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Trump-Linked Penny Stock Just Regained Nasdaq Compliance. Should You Buy It for 2026?

- Cathie Wood Is Buying Up Roblox Stock. What Is the Bull Case for RBLX in 2026?

- Intel Stock Just Got a New Street-High Price Target. Should You Buy INTC Here?

- Unusual Options Activity: 3 Multi-Leg Trades to Watch — SHOP, SBUX, and PINS