Nvidia (NVDA) shares surged into focus Tuesday on reports that China would allow its tech companies to use Nvidia’s H200 chips for specific purposes. One of these use cases was reportedly university research or development labs, according to sources that spoke with The Information on condition of anonymity on Jan. 13.

However, reports Wednesday morning contradict that good news. According to customs agents, H200 chips are “not permitted” to enter China.

Nvidia stock is down 2% as of this writing.

Significance of China News for Nvidia Stock

The partial approval was seen as significant for the Nasdaq-listed firm as it would add to its already-lofty earnings and revenue estimates.

In November, the company based out of Santa Clara, California, said its top line will grow a whopping 65% year-over-year in the fourth quarter (Q4), excluding any meaningful revenue from China.

And given that Asia’s largest economy once accounted for about one-fifth of Nvidia’s total revenue, even partial recovery could materially accelerate its sales growth in 2026.

Therefore, the follow-up reports that H200 chips are not in fact permitted, has removed this optimism over enhanced financials for Nvidia.

Bernstein Reiterates Bullish View on NVDA Shares

Earlier this week, Bernstein’s senior analyst Stacy Rasgon maintained Nvidia shares as “top pick” for 2026, saying “AI spending currently shows no signs of slowing.”

Rasgon sees NVDA hitting $275 within the next 12 months, indicating potential upside of another 50% from here.

Speaking recently with CNBC, he even dubbed the AI stock “inexpensive” given the giant’s margin remains sustainably above 70%.

From a technical perspective as well, Nvidia sits decisively above its longer-term moving average (200-day) currently, indicating its broader uptrend remains intact.

Nvidia Remains a Wall Street Favorite

Other Wall Street analysts also agree with Rasgon’s constructive view on NVDA shares.

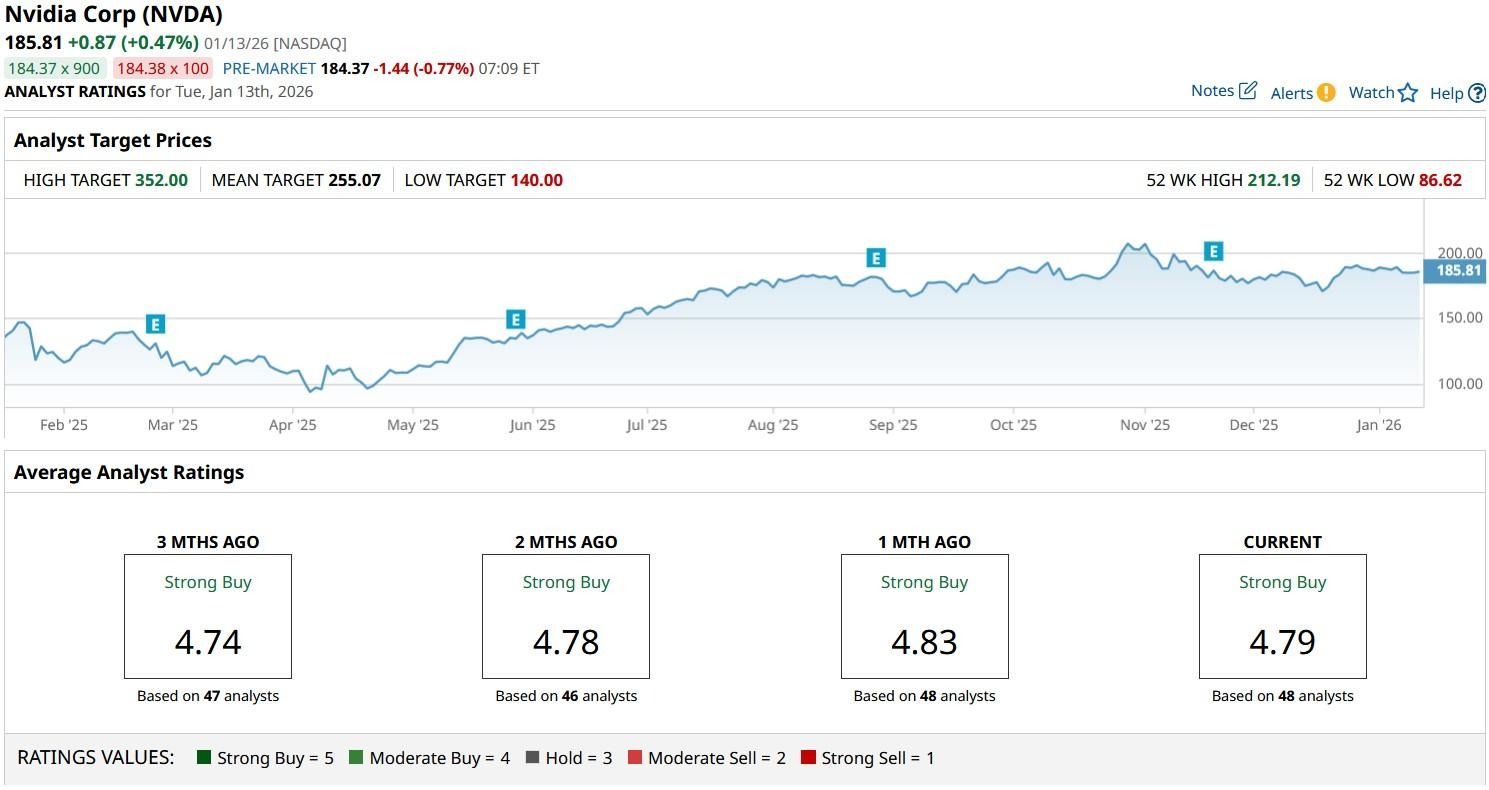

According to Barchart, the consensus rating on Nvidia stock remains at “Strong Buy” currently, with the mean target of about $255 signaling potential upside of roughly 40% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Google vs. Apple: Which Magnificent 7 Stock is a Better Buy Right Now?

- Should You Buy or Sell Nvidia Stock Amid China’s H200 Whiplash?

- Morgan Stanley Just Upgraded This 1 Lesser-Known Tech Stock. Should You Buy Shares Now?

- China Just Banned Broadcom’s Cybersecurity Solutions. What Does That Mean for AVGO Stock?