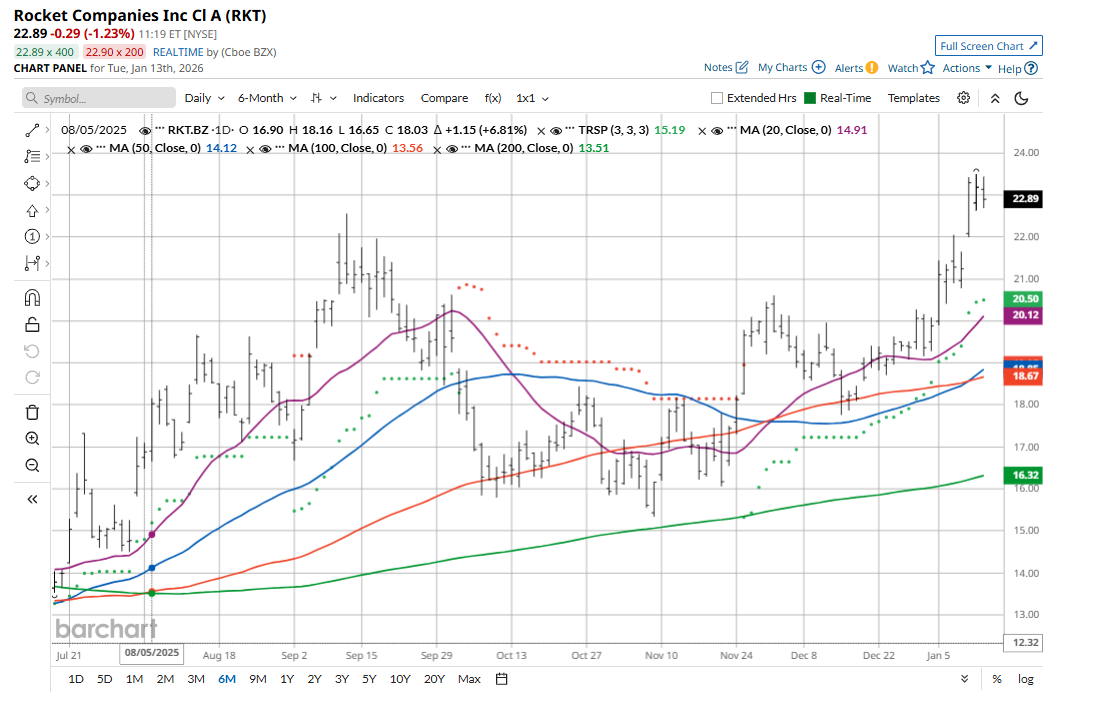

- Rocket Companies (RKT) is trading at new three-year highs.

- Shares are up more than 125% over the past year, and 25% in just the last month.

- RKT maintains a 100% “Buy” opinion from Barchart.

- The stock has benefitted from President Donald Trump’s plan to purchase $200 billion in mortgage bonds to boost home affordability.

Today’s Featured Stock

Valued at $49 billion, Rocket Companies (RKT) is a holding company behind many popular personal finance brands like Rocket Mortgage, Rocket Loans, and Rocket Homes.

Earlier in January, President Donald Trump posted on Truth Social that he had instructed Freddie Mac (FMCC) and Fannie Mae (FNMA) to purchase $200 billion in mortgage bonds. This is part of a plan to lower mortgage rates and monthly payments, and ultimately, make homebuying more affordable.

Since then, Rocket shares have gone “to the moon” as investors bet that it and other mortgage lenders will benefit from lower-rate environments. The expectation is that lower rates would spark increased home purchases and greater loan activity.

What I’m Watching

I found today’s Chart of the Day by using Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals; superior current momentum in both strength and direction; and a Trend Seeker “buy” signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. RKT checks those boxes. Since the Trend Seeker signaled a new “Buy” on Nov. 26, the stock has gained 17.43%.

Barchart Technical Indicators for Rocket Companies

Editor’s Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. These technical indicators form the Barchart Opinion on a particular stock.

Rocket Companies scored a new three-year high of $23.50 on Jan. 12.

- AGI has a Weighted Alpha of +110.76.

- Alamos Gold has a 100% “Buy” opinion from Barchart.

- The stock gained 125.49% over the past year.

- AGI has its Trend Seeker “Buy” signal intact.

- The stock recently traded at $23.18 with a 50-day moving average of $18.71.

- Rocket Companies made 9 new highs and gained 23.89% in the last month.

- Relative Strength Index (RSI) is at 76.43.

- There’s a technical support level around $22.71.

Don’t Forget the Fundamentals

- $49 billion market capitalization.

- 32.35x forward price-earnings ratio.

Analyst and Investor Sentiment on Rocket Companies

- The analysts tracked by Barchart rate Rocket Companies a “Moderate Buy” with price targets ranging between $17 and $25.

- Short interest is high at 28.05% of the float.

The Bottom Line on Rocket Companies

Rocket Companies, along with other companies in the mortgage lending business, have enjoyed time in the spotlight so far in January. Freddie Mac and Fannie Mae are set to “execute” on the $200 billion mortgage bond purchases, and Trump says he plans to tackle housing affordability more broadly.

Another positive for RKT is that its stock was already trending higher in 2025 thanks to Federal Reserve interest rate cuts and new AI features.

The story here is compelling, but investors should proceed with caution given the high short interest.

Additional disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance.

On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Mizuho Says This 1 Lesser-Known Chip Stock Is a Top Buy for 2026

- Citi Is Betting on Another ‘Supercycle’ in Palantir Stock. Should You Buy PLTR Here?

- Palmer Luckey Warns China’s ‘Most Powerful Weapon’ Isn’t a ‘Missile or Drone, It’s Their Ability to Control People’s Minds Through the Media’

- Analysts Say Capital One Stock Is a ‘Strong Buy.’ Did Trump Just Change That?